March 2024

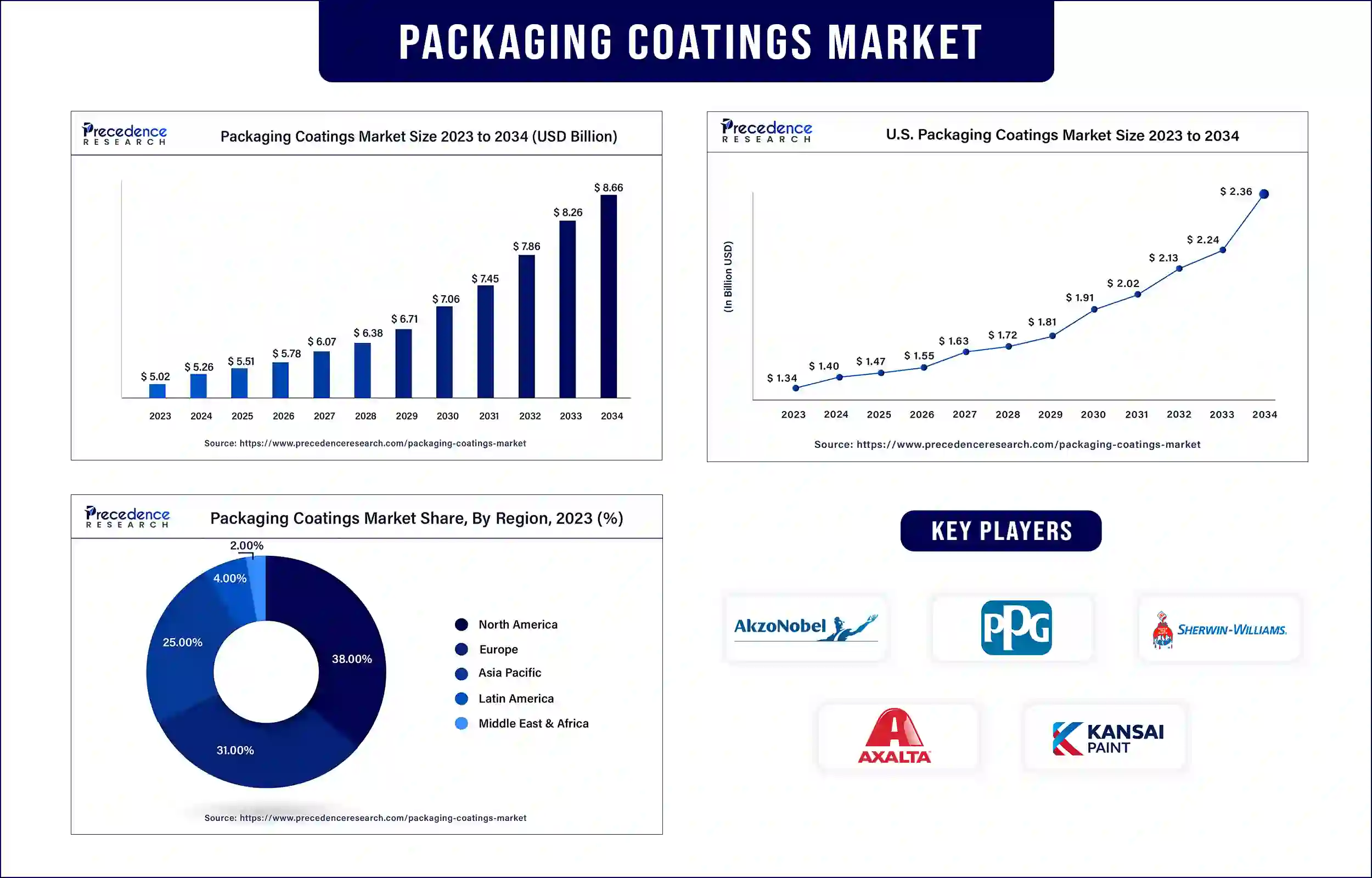

The global packaging coatings market surpassed USD 5.02 billion in 2023 and is projected to be worth around USD 8.26 billion by 2033, poised to grow at a CAGR of 5.1% during the forecast period. The rising demand for flexible packaging is driving the packaging coatings market. These coatings enhance resistance properties, durability, and adhesions of packaging. Thus, they are in high demand in various industries, such as food & beverages.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.precedenceresearch.com/checkout/3444

Packaging coatings play a significant role in several industries, such as e-commerce and food & beverages. The increasing trend of online shopping significantly boosts the packaging coatings market. Several companies are now inclining toward producing sustainable products due to the rising concern about environmental issues. Various types of packaging coatings include paperboard coatings, corrugated coatings, luxury coatings, and specialty coatings. Packaging coatings play an important role in maintaining product safety, which is the key reason most companies prefer high-quality packaging coatings. Some of the key market players, including Akzo Nobel NV, Kansai Paint, and Axalta Coating Systems, are constantly innovating to enhance product quality, thereby boosting the growth of the market.

Rising demand for personalized and digital packaging drives the packaging coatings market

There is a high demand for personalized coatings. Packaging is categorized as primary packaging, secondary packaging, and tertiary packaging. Foil, bag, bottle, and jar packaging are primary packaging, large shipping boxes are secondary packaging, and forklifts and pallet jacks are tertiary packaging. The rapid expansion of the coating industry is encouraging various companies to invest in it to advance the industry.

The demand for quality packaging coatings is also increasing in the healthcare and electronics industries. Many companies are developing new technologies to make significant changes in the coating industry as per the market requirements.

Market players need to follow several guidelines while producing coatings for various industries, which hinder the packaging coatings market. Due to these stringent regulations, products are usually rejected, which causes a major loss to the market players and restricts the market’s development.

Recent Development by KHS India

| Company Name | KHS India |

| Headquarters | Ahmedabad, Gujarat, India |

| Development | In March 2023, KHS India, a manufacturer of filling and packaging systems for the food and non-food sectors, introduced plasma coating technology to pack beverages in PET bottles. |

Recent Development by Solvay

| Company Name | Solvay |

| Headquarters | Brussels, Belgium |

| Development | In October 2023, Solvay, a multinational chemical company, released Diofan Ultra736, a polyvinylidene chloride (PVDC) coating solution with an ultra-high water vapor barrier. |

The market in Asia Pacific is projected to grow at the fastest rate during the forecast period due to the rising urbanization in developing countries, such as China, India, and Japan. The rising trend of customized coatings and canned food culture encourages market players to develop coatings with bio-based formulations. Thus, many market players are making efforts to produce enhanced coatings.

North America dominated the market in 2023 due to the rising usage of canned food by the working people. As the number of working people in America increases, the earning potential also increases, ultimately encouraging people to use canned stored food. According to a survey, approximately 98% of U.S. households consume canned fruits and vegetables. Due to the high amount of canned food usage, the food administration has also made some strict rules and regulations that coating companies need to follow. Many American companies are using bio-based formulations to produce coatings for the food and pharmaceutical industries due to the rising usage of environmentally friendly products.

Technological advancements and reliability over canned food boost the packaging coatings market

Technological progressions in packaging coatings create immense opportunities in the market. Smart coatings integrating nanotechnology and sensors enhance the barrier properties and durability of coatings. Smart coatings, along with real-time pointers, deliver improved superior control, mainly in the pharmaceutical and food sectors. Antimicrobial coatings increase product security by preventing microorganism development. At the same time an important move in the direction of sustainability is observed, nurturing the expansion of bio-based, environmentally friendly, and recyclable coatings.

This kind of progress is mainly due to the rising awareness about environmental conditions among people. Thus, technological advancements significantly boost the packaging coatings market during the forecast period 2024 to 2033.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 5.26 Billion |

| Market Revenue by 2033 | USD 8.26 Billion |

| CAGR | 5.1% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segmentation

By Application

By Type

By End User

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3444

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

March 2024

July 2024

January 2025

May 2024