July 2024

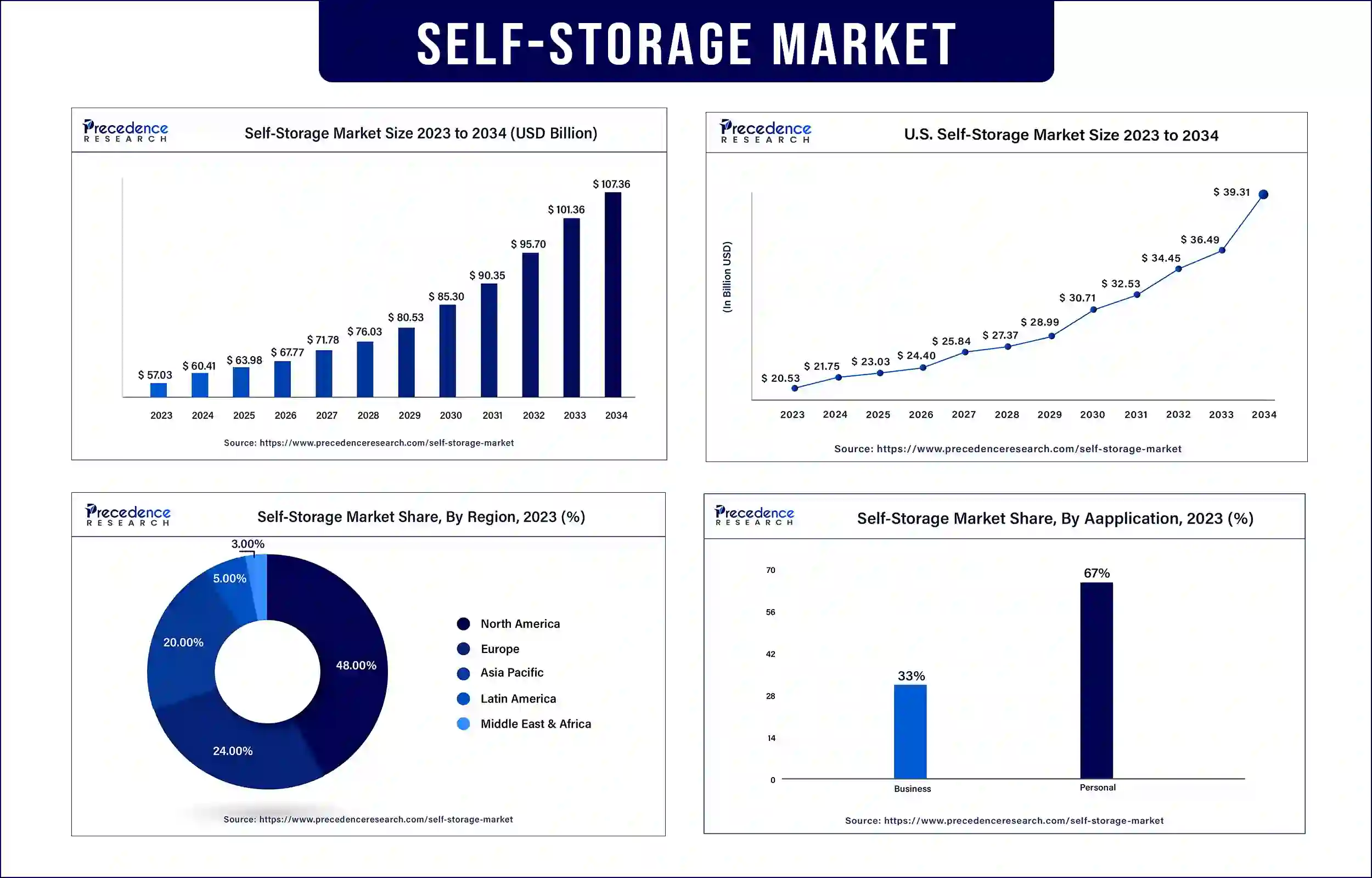

The global self-storage market was exhibited at USD 1.30 billion in 2023 and is projected to attain around USD 2.57 billion by 2033, poised to grow at a CAGR of 7.04% during the forecast period.

The self-storage is an ever-increasing area of growth, since it instils confidence in both individuals and commercial clients regarding their equipment or personal belongings storage. For example, a self-storage company may offer different alternatives depending on what consumers need such as one-room storage, warehouse for keeping raw materials etc. these include aspects like urbanization, economic growth and rise in disposable income.

That provision of its culture backdrop extent albeit housing since both a container space configuration affordable and depositories who are typically thought to be outsider. A close examination reveals that it has become big business drawing people into renting garages below houses where they store former furniture among other things till grandchildren come back after their studies abroad until someone repaints it across the neighbouring condo or apartment manager does away with it for somebody else. Urbanization, economic development, and disposable income increases are among these determinants.

Increasing urbanization drives the market

In urban areas, higher population density often means little living space for individuals, prompting creation of a self-storage market. As cities grow larger and more populated, the need for space becomes more acute. With all the goods that need to be accommodated, crowded urban centers have very limited accommodation facilities or working spaces. Hence this makes self-storage a good option when space is lacking. Self-storage markets are needed for extra and unsuitable items that cannot be stored at home or in workplaces. This means that the need for storage areas will only keep on increasing as urbanization, population density and also lifestyle patterns change. Therefore, those who offer self-storage services should understand these drivers so as to respond to their client’s needs.

Recent Developments

| Company Name | SmartStop self-storage |

| Headquarters | Lader Ranch, California |

| Recent Developments | In April 2024, SmartStop Self-Storage announced the acquisition of a self-storage facility. |

| Company Name | Storage Giant |

| Headquarters Newport | Wales, United KIngdom |

| Recent Developments | In November 2022, Storage Giant announced the launch of a new high-security storage facility. |

The North America, has positioned itself as the largest and most dominant self-storage market in the world and is observed to sustain the position in the upcoming years. The sector has evolved because the density of populations in main city centers is high, and there are several employees who have to store goods temporarily. Some of the major cities that have experienced an extraordinary exploitation of market facilities include New York, Los Angeles, Chicago and Miami among others for meeting high demand in congested areas. They are also centres of immigration where a high percentage of the population is made of migrant and expatriate population , thus requiring frequent short and long term storage services. The availability of some of the largest real estate companies and specialized self-storage REITs has thus been the key driver of scale and sophistication in services offered. Services include basic small self-storage units to climate controlled drive up units, with extra security features.

Integration of Emerging Consumer Requirements

A growing population and being cramped up means that there is always need for additional space to store multiple materials. Operators can then focus on certain segments of customers such as college students or business entities. New facilities with provision for high tech facilities that most young age customers may fancy may influence established structures. Commercial real estate development companies with whom the company gets into partnerships can help it buy good stands. Thus, further consolidation of the regional operators would stay feasible to realize the economies of scale.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 60.41 Billion |

| Market Revenue by 2033 | USD 101.36 Billion |

| CAGR | 5.91% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Segment

By Type

By End-Use

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/4928

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

July 2024

January 2024

April 2024

July 2024