December 2024

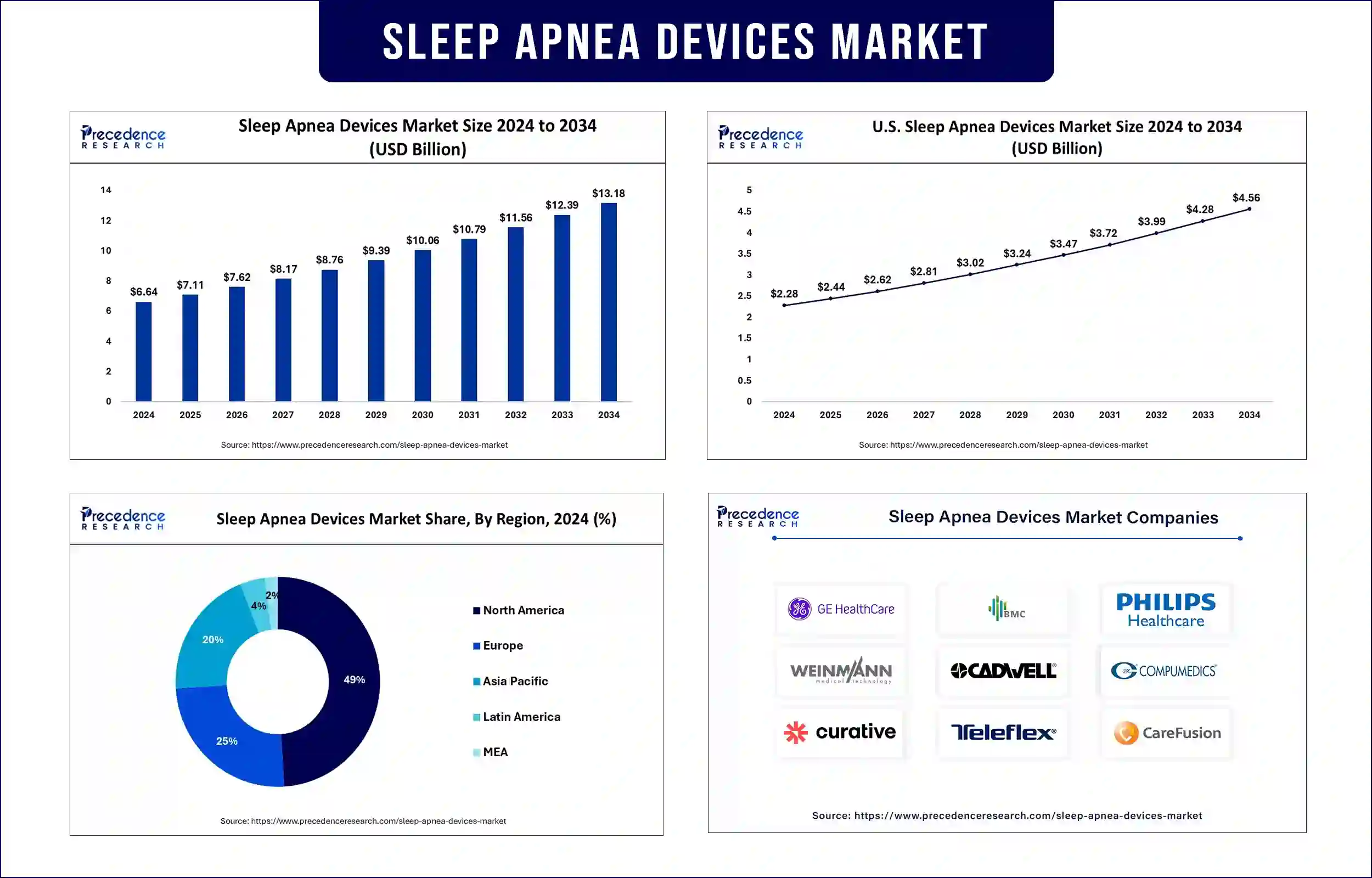

The global sleep apnea devices market revenue reached USD 6.64 billion in 2024 and is predicted to attain around USD 12.39 billion by 2033 with a CAGR of 7%. The global sleep apnea devices market is experiencing significant growth, driven by the increasing prevalence of sleep disorders, rising awareness of sleep-related health issues, and advancements in diagnostic and therapeutic technologies.

The sleep apnea devices market encompasses diagnostic and therapeutic solutions designed to manage sleep-disordered breathing effectively. Two diagnostic categories include polysomnography (PSG) systems and home sleep apnea tests (HSATs). The therapeutic devices are made up of continuous positive airway pressure (CPAP) machines alongside bilevel positive airway pressure (BiPAP) systems and auto-adjusting positive airway pressure (APAP) systems. Patient adherence and treatment results improve through recent advancements in artificial intelligence (AI) linked with cloud-based monitoring platforms. Developing innovations demonstrate how advanced technologies are being integrated into sleep apnea management, as they enhance both early diagnosis capabilities and personalized treatment approaches while improving patient health results.

The rising popularity of public health initiatives with sleep health awareness campaigns helps people understand sleep apnea effects along with its prolonged medical implications. The American Academy of Sleep Medicine (AASM) supports better screening and prompt diagnosis of patients. According to the AASM, obstructive sleep apnea (OSA) means at least five interruptions in breathing or reduced breathing episodes per hour that result in excessive daytime fatigue or present with at least 15 documented hypopnea-apnea events regardless of reported symptoms. The importance of detecting sleep apnea at an early stage becomes evident through recent developments, as does the requirement of complete management strategies for its treatment.

The modern manufacturing industry produces smart continuous positive airway pressure (CPAP) machines with artificial intelligence (AI)-based algorithms that automatically regulate pressure levels by monitoring user breathing patterns in real time. Recent technological developments result in improved comfort as well as better therapy follow-up for patients. Through its cMAP software, NovaResp utilizes AI to supply adjusted air pressures at lower levels which results in better adherence on conventional CPAP devices in 2024. These advanced smart CPAP machines enable healthcare providers to monitor patient data through remote cloud-based systems and make necessary setting changes to customize optimal therapy plans. Sleep apnea treatment has seen a major advancement through these developments, which now creates customized therapy options that cause less disruption to patients.

The growing preference for at-home diagnosis is driving the adoption of HSATs, which offer a convenient and cost-effective alternative to in-lab sleep studies. Regulatory approvals and insurance coverage expansions are further supporting this trend. Patients perform sleep evaluations through HSATs from their home settings, as they no longer need to undergo tests at medical facilities. Home sleep apnea tests receive insurance coverage from multiple health plans since insurers recognize their combination of effectiveness and affordability. Modern sleep medicine shows a progressive shift toward making advanced healthcare accessible to patients within their homes.

The integration of telehealth solutions in sleep apnea management is enabling real-time patient monitoring, remote consultations, and data-driven therapy adjustments. These advancements improve accessibility to care and enhance treatment outcomes. The new developments offer better patient access to healthcare services and lead to superior medical results. The invention of smart pajamas with fabric sensors enables at-home tracking of sleep disorders by wirelessly transferring data to smartphones through their fabric-based sensors. Telehomecare services under telehealth enable the treatment of sleep apnea through patient education while offering support to manage chronic conditions more effectively as healthcare visits become less necessary. Technology development leads to better sleep apnea treatment that provides personalized and efficient care.

Regional Anaylsis

North America dominated the sleep apnea devices market in 2024 and is expected to maintain its leading position supported by high awareness levels, the presence of key market players, and favorable reimbursement policies for sleep disorder treatments. Eli Lilly received U.S. Food and Drug Administration (FDA) authorization for Zepbound (tirzepatide) as the initial medicine for obstructive sleep apnea (OSA) treatment for adults with obesity in December of 2024. CardiacSense gained FDA clearance in 2023 for its CSF-3 wearable watch to track vital signs continuously, including heart rate and oxygen saturation, which improves sleep disorder early identification and management. Furthermore, the strong healthcare infrastructure in North America and emerging medical technology place this region in the lead competitors for sleep apnea solutions.

Asia Pacific is projected to experience the fastest growth in the sleep apnea devices market, supported by rising healthcare investments, growing urbanization, and an increasing burden of undiagnosed sleep apnea cases. Countries like China, India, and Japan are expanding their diagnostic and therapeutic infrastructure to address the growing demand. The rise in Japan's senior citizen population leads to more sleep disorders, which require advanced sleep apnea management technology investments. The sleep apnea devices market in the region exhibits promising development potential because of these emerging trends.

Governments throughout Asia Pacific establish public awareness initiatives and enhance medical coverage to increase access to diagnosis and treatment services for residents. The National Health Commission in China focuses on early identification and treatment of sleep troubles by expanding its primary healthcare system. Through its health insurance policy, Ayushman Bharat promotes affordable access to sleep apnea diagnosis and treatment in India. The initiatives quicken sleep apnea device adoption and reduce the difference between numerous disease cases and scarce medical diagnoses.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 6.64 Billion |

| Market Revenue by 2033 | USD 12.39 Billion |

| CAGR | 7% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

By Product Type

By End-User

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/sample/1053

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025