December 2024

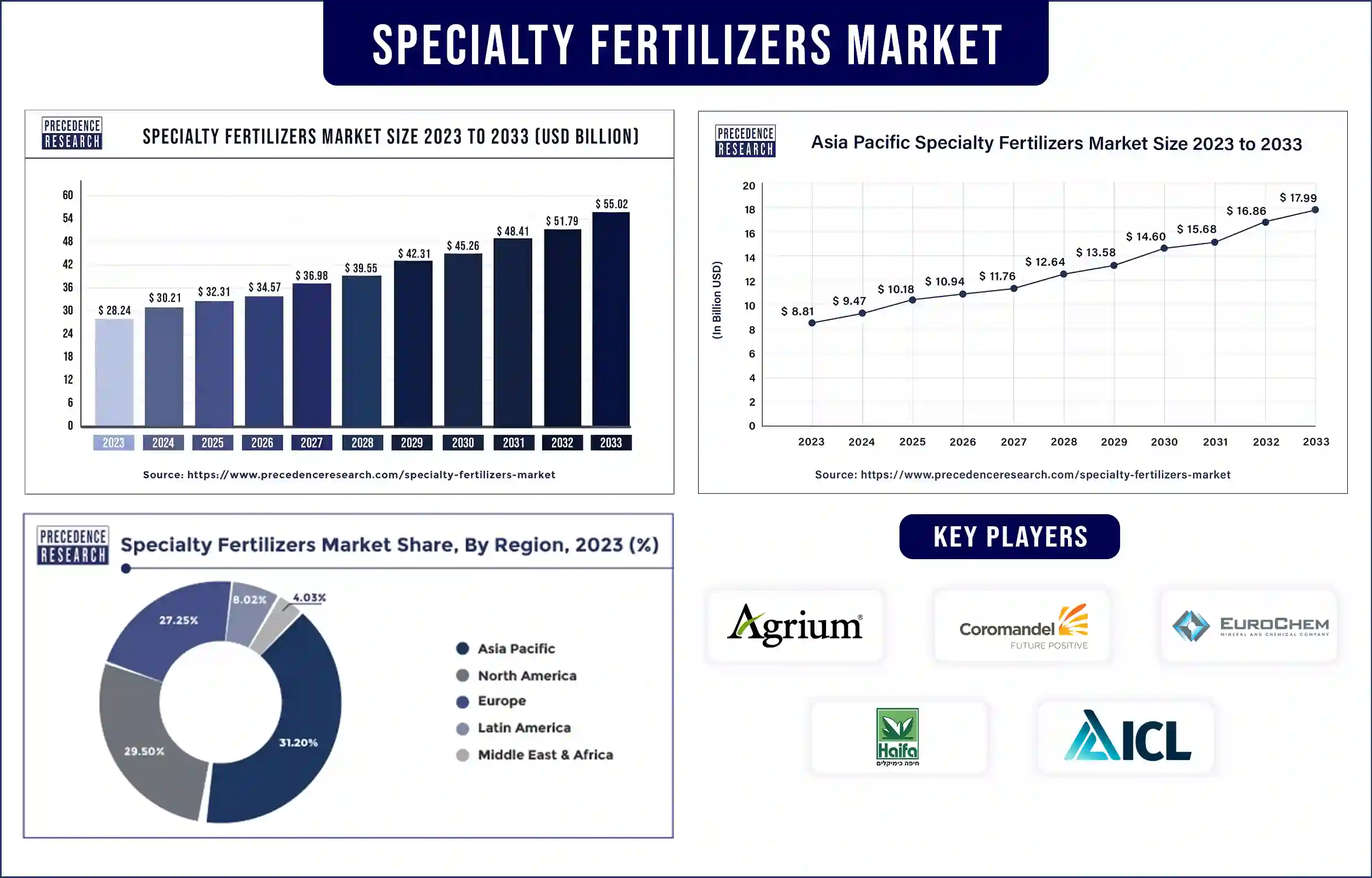

The global specialty fertilizers market revenue was valued at USD 28.24 billion in 2023 and is poised to grow from USD 30.21 billion in 2024 to USD 55.02 billion by 2033, at a CAGR of 6.89% during the forecast period 2024 – 2033. The increasing demand and utilization of specialty fertilizers are estimated to drive the growth of the specialty fertilizers market.

The specialty fertilizers market manufactures fertilizers used to meet soil needs and deliver nutrients for specific crops in an efficient and targeted manner compared to conventional chemicals and fertilizers. These specialty fertilizers are applied extensively in high-value crops, such as ornamental plants, fruits, and crops, to optimize crop quality and yield and customize soil conditions.

The increasing focus on sustainable agriculture practices, rising demand for high-yield crops, and rapid population growth are expected to boost market growth. In addition, continuous advancements in fertilizer technologies, the increasing use of slow-release and controlled-release fertilizers, and the increasing effectiveness and ease of application of dry specialty fertilizers are further expected to accelerate the growth of the specialty fertilizers market during the forecast period.

Increasing demand for high-quality crops and focus on precision agriculture to enhance market growth.

Specialty fertilizers that can improve nutritional value, quality, and crop production are becoming more and more essential as consumer demand is growing and the world’s population for premium agricultural products rises. In addition, by using precision agriculture techniques, specialty fertilizers are designed to offer specific nutrients based on soil characteristics and crop requirements. It also helps to reduce waste and increase productivity.

The demand for specialty fertilizers is enhanced by the implementation of precision agriculture techniques, such as digital farming technologies, variable rate application, and soil testing. Furthermore, farmers now have more specialty fertilizers with the help of technological developments such as enhanced efficiency fertilizers, micro-nutrient-enriched formulations, and controlled release. These driving factors are anticipated to drive the growth of the specialty fertilizers market.

However, the complexity of management and application of specialty fertilizers may restrain the market growth. Particular management strategies and application methods may be needed to improve the effectiveness of specialty fertilizers. Guaranteeing proper application integration, timing, and rates with other agronomic practices can be very tough, especially for those with insufficient access to expanded services. Farmers require sufficient assistance and training. These factors may create challenges and may hinder the growth of the specialty fertilizers market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 30.21 Billion |

| Market Revenue by 2033 | USD 55.02 Billion |

| Market CAGR | 6.89% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Innovation in Specialty Fertilizers by EuroChem

Recent Innovation in Specialty Fertilizers by ICL

Read Also: Green Fertilizers Market Size

Asia Pacific dominated the specialty fertilizers market in 2023 and is expected to grow fastest during the forecast period. The increasing incidence of sulfur and zinc deficiency, increasing demand for specialized fertilizers to improve production effectiveness to the rapidly growing population, and the increasing investment in cutting fertilizers that reduce environmental effects and maximize nutrient uptake simulated by government programs to improve food security and support sustainability are expected to enhance the growth of the specialty fertilizers market in the region. China, India, Japan, and South Korea are the leading countries in the market. China is the fastest leading country and has an enhanced need for innovative nutrient sources used in specific plant and soil conditions to improve special responses that optimize plant productivity and growth.

North America held the second-largest market share in the specialty fertilizers market. North America is the most developed region due to the presence of countries with favorable agriculture strategies, early adoption of specialty fertilizers, and high gross domestic product. The enhanced emphasis on sustainable agriculture and increasing adoption of precision farming techniques are further driving the growth of the market in the region. The U.S. and Canada are the major countries in North America.

Improvements and technological developments

Improvements in specialty fertilizer technology include the adoption of better application devices such as strip tillage equipment, streamer nozzles, Y-drops, and variable rate applicators. This equipment helps with the placement and timing of fertilizer to reduce environmental losses. New specialty technology provided by NACHURS can offer some of the equipment essential to unlock nutrient uptake challenges.

A specialty fertility program based on fertility standardized recommendations and soil sampling was developed over the years. New specialty fertilizer technology is focused on utilizing the utilization and efficiency rate of fertilizer rather than simply increasing the nutrient level of the soil. These major factors are expected to drive the growth of the specialty fertilizers market in the coming years.

Market Segmentation

By Type

By Form

By Application Method

By Crop Type

Buy this Research Report@ https://www.precedenceresearch.com/checkout/2839

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308

December 2024

January 2025

April 2025

March 2025