December 2024

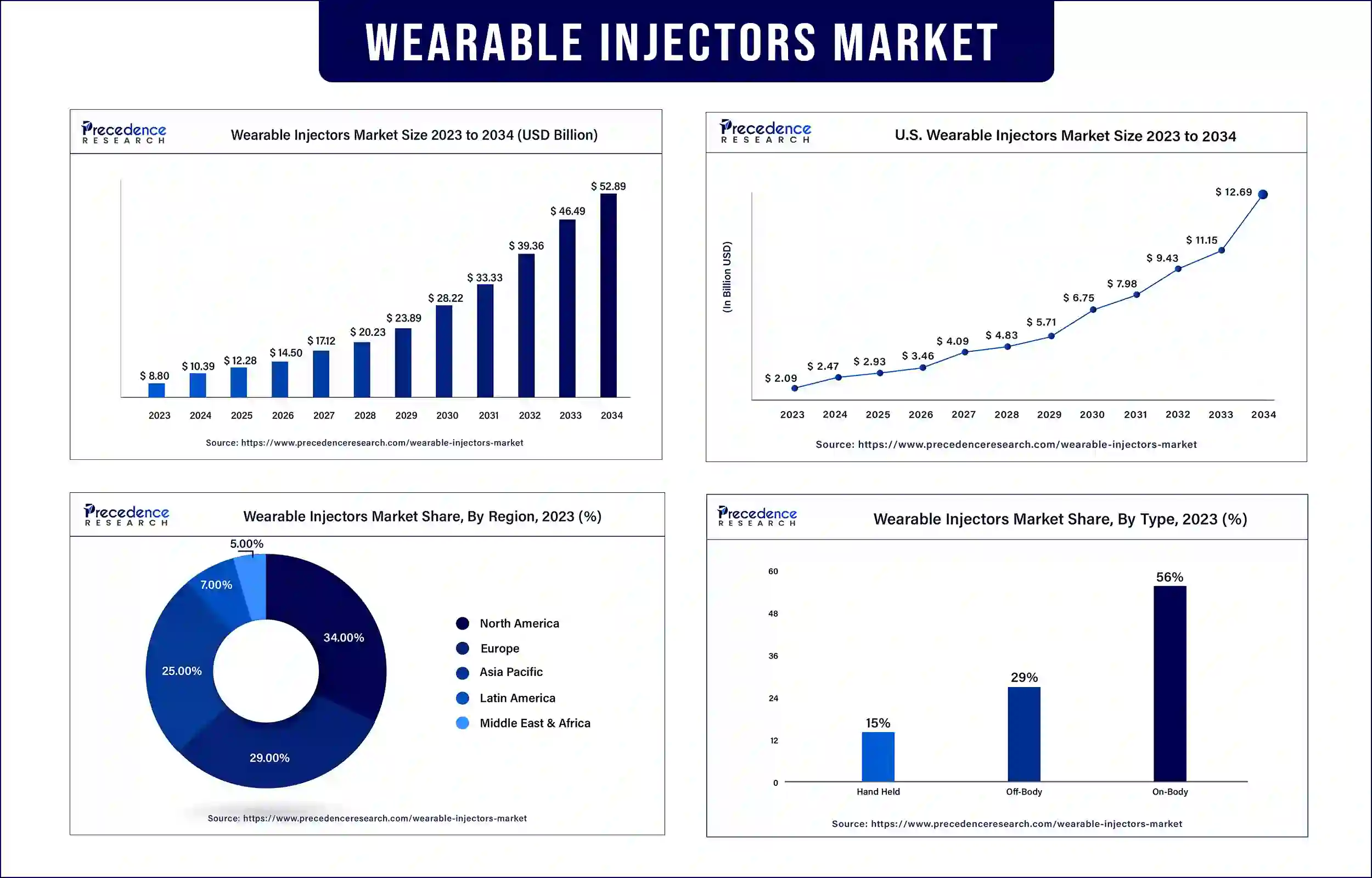

The global wearable injectors market revenue was USD 10.39 billion in 2024 and is projected to reach around USD 46.49 billion by 2033, expanding at a CAGR of 17.67% throughout the projection period 2024 to 2033. The market is experiencing substantial growth due to increasing emphasis on preventing care, growing awareness of health and wellness, and rising demand for personalized health guidance. The rising number of individuals seeking proactive health management, coupled with the need for personalized support and motivation, is driving the market.

Wearable injectors are worn on the body when the drug is given over a pre-programmed period lasting seconds or hours. A wearable injector is a single-use system that is removed from the body upon complete injection of the dose and can be conveniently disposed of. It helps to reduce total healthcare costs compared to home administration of IV infusion drugs. It also allows patients to self-inject without medical supervision.

The market is expanding rapidly due to the growing demand for convenient drug delivery methods, advancements in medical technology, and the increasing prevalence of chronic diseases. The rising number of patients who require long-term medication, coupled with the need for improved adherence and patient comfort, is driving the market growth.

The rising geriatric population significantly contributes to the wearable injectors market growth. In addition, growing concerns over needle stick injuries positively influence market growth. The increasing need to reduce healthcare expenditures catalyzes market growth. Apart from this, the growing demand for home-based treatment creates a positive outlook for the market.

Based on type, the on-body segment dominated the market with the largest share in 2023. This is due to the increasing demand for on-body wearable injectors, as they are convenient to wear on the skin and are water resistant. They offer various benefits such as reduced healthcare costs, lifecycle management, dosage frequency changes, and refrigerated drug automated warming. On the other hand, the off-body segment is expected to expand at a notable CAGR in the coming years. These injectors reduce problems such as skin sensitivity, adhesive fitting issues, and painful removal. Rising investments in producing off-body injectors further boost the segment.

On the basis of application, the oncology segment accounted for the largest share of the market in 2023. This is due to the increasing cases of cancer across the globe. Cancer patients often require medications every hour to manage symptoms. The rising demand for self-administration of medication among cancer patients contributed to the segment’s dominance. On the other hand, the autoimmune diseases segment is expected to expand at the fastest CAGR during the forecast period. This is due to the increasing instances of diabetes worldwide.

Based on end-user, the homecare segment led the market with the largest share in 2023. This is due to the increasing awareness about self-care and self-injection. In addition, the increasing preference for home-based care to reduce frequent hospital visits bolstered the segment.

Increasing prevalence of chronic diseases: The Increasing prevalence of chronic diseases worldwide boosts the market growth. The treatment for chronic diseases requires medication. A person can effectively get medications using a wearable injector at home. In line with this, the rising incidence of lifestyle-related disorders positively influences global market growth. Furthermore, favorable reimbursement policies create a positive outlook for the market. The treatment of chronic diseases requires daily or weekly dosages. Due to their high demand, the market players focus on manufacturing and developing wearable injectors.

Introduction of smart features: Due to the increasing demand for advanced wearable injectors, market players focus on manufacturing and developing wearable injectors with smart features. Rapid technological advancements in medical devices offer lucrative opportunities in the market. Moreover, market players are heavily investing in innovative technologies to develop cutting-edge wearable injectors.

North America dominated the wearable injectors market in 2023 and is expected to maintain its dominance in the coming years. This is due to the growing incidence of chronic diseases and lifestyle-related diseases. The improved healthcare infrastructure significantly contributes to market growth across the region. On the other hand, Asia Pacific is expected to witness fastest growth in the market in the coming years. This is due to favorable government initiatives for advancing healthcare infrastructure. Factors such as the increasing geriatric population, rising healthcare expenditure, increasing prevalence of chronic diseases, and the growing adoption of advanced medical technologies positively influence the market.

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 10.39 Billion |

| Market Revenue by 2033 | USD 46.49 Billion |

| CAGR | 17.67% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2023 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segments Covered in the Report

By Type

By Application

By End User

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/1402

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344

December 2024

January 2025

April 2025

January 2025