February 2025

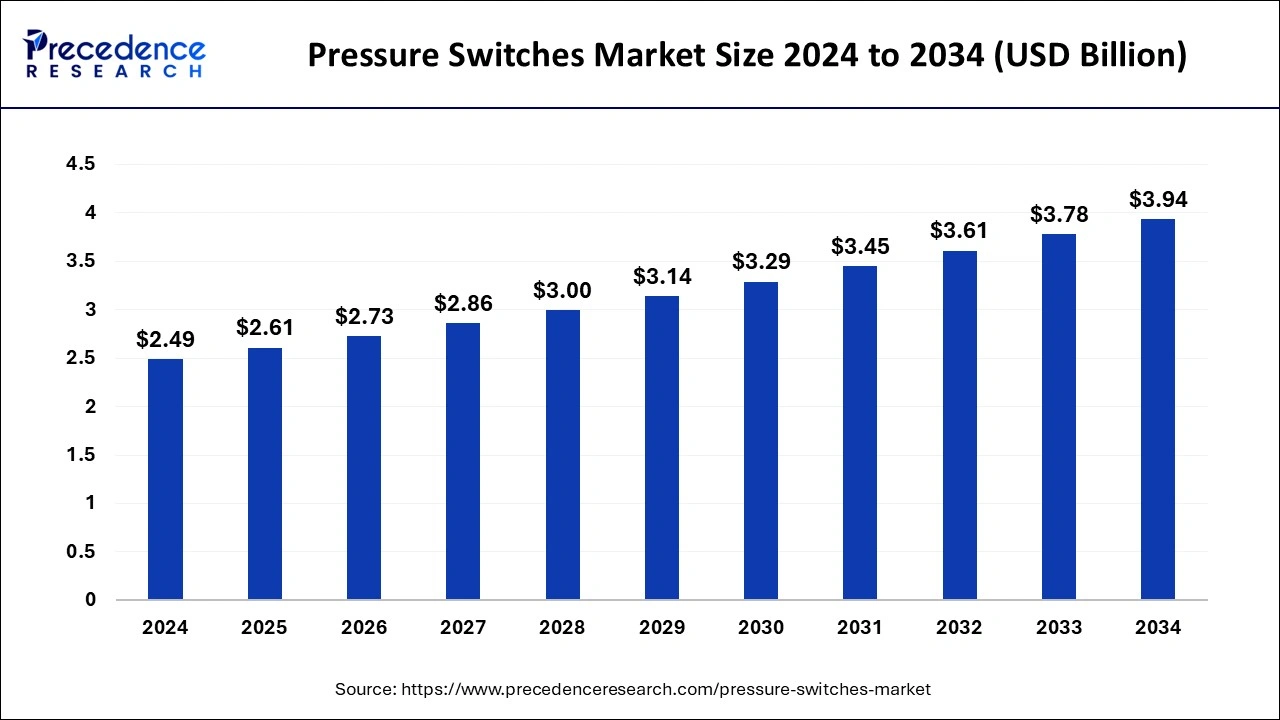

The global pressure switches market size is estimated at USD 2.61 billion in 2025 and is predicted to reach around USD 3.94 billion by 2034, accelerating at a CAGR of 4.70% from 2025 to 2034. The Asia Pacific pressure switches market size surpassed USD 1.12 billion in 2025 and is expanding at a CAGR of 4.86% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The pressure switches market size was estimated at USD 2.49 billion in 2024 and is predicted to hit around USD 3.94 billion by 2034 with a CAGR of 4.70% from 2025 to 2034. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop pressure switches, which is estimated to drive the global pressure switches market over the forecast period.

Artificial intelligence algorithms can analyze data from pressure switches to predict potential failures before they occur. This helps industries reduce downtime, improve maintenance schedules, and extend the lifespan of equipment, thereby increasing the reliability of pressure switches. AI-driven systems can process vast amounts of data from pressure switches in real time, improving the accuracy of pressure monitoring and control. This leads to more efficient operations and better decision-making in industrial processes.

Integrating artificial intelligence with pressure switches allows for the development of smart, autonomous systems that can self-adjust based on real-time pressure data. This reduces the need for manual intervention, increases efficiency, and supports the growing trend of industrial automation. AI can provide deep insights by analyzing historical and real-time pressure data. This helps industries optimize their processes, identify patterns, and make informed decisions to enhance productivity and minimize costs. AI enables remote monitoring of pressure switches, allowing operators to track performance, receive alerts, and make adjustments from anywhere. This is especially beneficial for industries with distributed operations or those in remote locations.

Artificial intelligence allows pressure switches to adapt to specific industrial environments and conditions by learning from operational data. This leads to more customized solutions that meet the unique needs of different industries. Artificial intelligence can optimize the operation of pressure switches to reduce energy consumption. By continuously analyzing and adjusting pressure levels, AI helps industries achieve more sustainable operations, aligning with environmental regulations and cost-saving goals. Artificial intelligence, when integrated with the Internet of Things, enables pressure switches to be part of a connected ecosystem. This facilitates seamless communication between devices, enhances data sharing, and supports the broader adoption of Industry 4.0 technologies.

Artificial intelligence can enhance safety by providing real-time monitoring and instant alerts for abnormal pressure conditions. This helps industries comply with safety standards and reduces the risk of accidents and equipment damage.

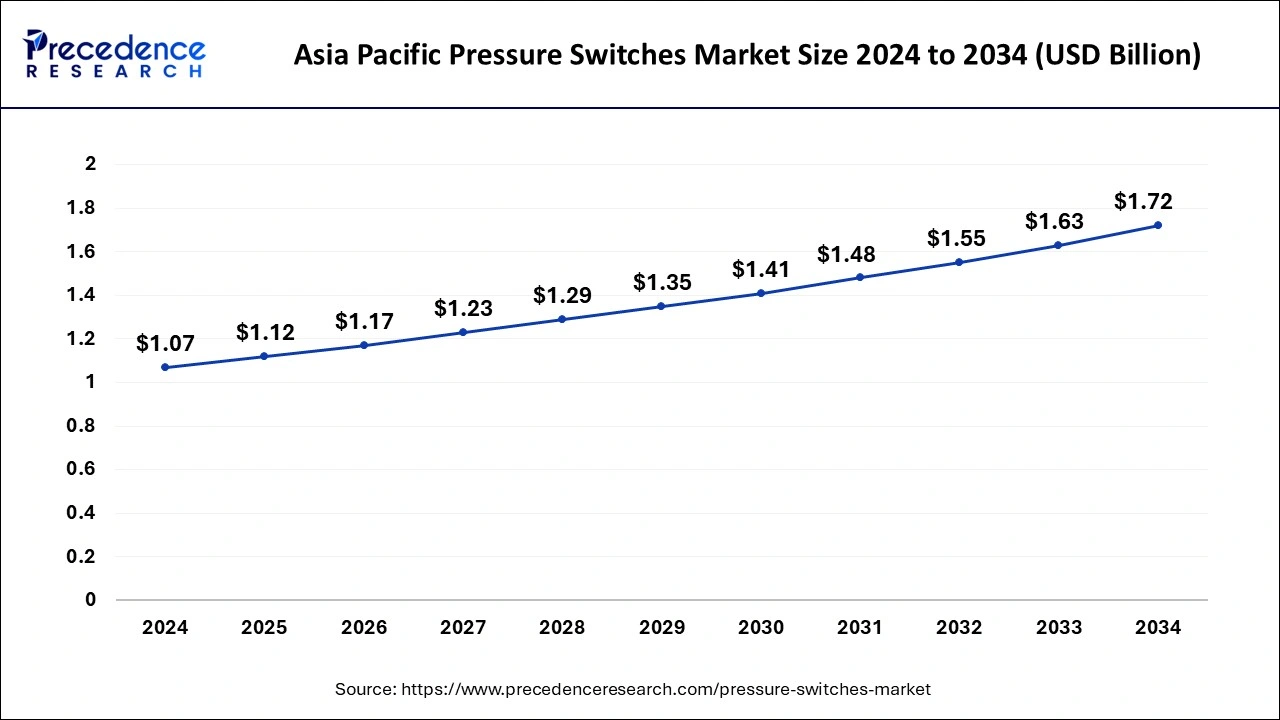

The Asia Pacific pressure switches market size was valued at USD 1.07 billion in 2024 and is anticipated to reach around USD 1.72 billion by 2034, poised to grow at a CAGR of 4.86% from 2025 to 2034.

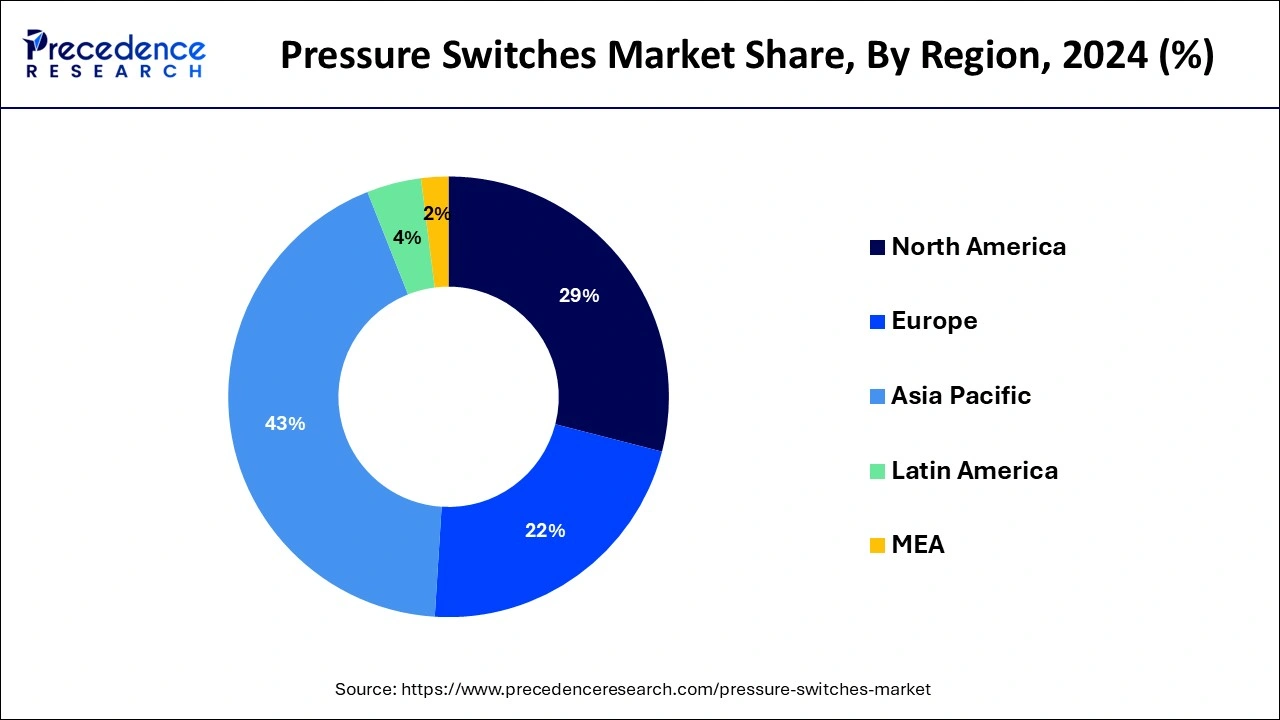

Asia Pacific held the largest share of the pressure switches market in 2024. The growth of the region is attributed to the presence of prominent market players, increasing electricity demand, rising progress of industrialization, growing demand for water pumps and electrical gas compressors, rapid adoption of advanced technology, robust growth of the manufacturing industry, increasing investment by major companies, and rising focus on renewable energy for energy efficiency. Moreover, the increasing use of automation in industrial infrastructure has led to the reduction of human error, boosted productivity, and reduced manufacturing cost and time, which in turn accelerates the expansion of the pressure switches market in the coming years.

In the region, developing countries such as China, India, and Japan are the major contributors to the market. The increasing investments in process and manufacturing industries, as well as the expansion of industrial activity in these countries, create a significant growth in demand for pressure switches. Japan and China are technologically advanced producers of electronics products. Furthermore, private companies and governments in the Asia-Pacific region have witnessed a substantial increase in renewable energy investment. Pressure switches are widely being used in solar and wind power-producing facilities due to the global shift to more sustainable energy sources. Key players in the region are emphasizing enhancing their product offerings through various strategic approaches.

The pressure switches market offers control equipment that arew extensively used to monitor and control fluid pressure in a system. It can be an electronic or mechanical device that employs an electrical contact whenever a liquid pressure reaches a certain threshold or set point. These switches make an electrical contact on either pressure rise or fall from a specific pressure level. Pressure-based switches are crucial components in several industries, and the pressure switches market has grown significantly due to its multiple applications that ensure the efficiency, safety, and proper functioning of equipment.

Pressure switches are available in a wide range of residential and industrial applications, such as pumps, HVAC systems, furnaces, and many others. The pressure point that mainly activates the switch is broadly known as the set point and the pressure threshold that works to deactivate the switch is known as the cut-out point. In addition, pressure switches are used in process control systems to maintain steady pneumatic or mechanical pressure properly.

| Report Coverage | Details |

| Market Size in 2025 | USD 2.61 Billion |

| Market Size by 2034 | USD 3.94 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.70% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Pressure Range, By Application, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing applications of pressure switch

The increasing number of applications of pressure switches is expected to boost the growth of the pressure switches market. Pressure switches are extensively used for various domestic and commercial applications. HVAC, air pumps, gas cylinders, and others use air compressor pressure switches to control and monitor the system air pressure. For residential, commercial, and industrial applications, well pump pressure switches are utilized to bring water from the well and also ensure auto-regulate water flow.

Vacuum pressure switches are used to measure the vacuum or any negative pressure in the system. They are widely found in boilers, air compressors, electric heaters, transmission systems, and others. Furnace pressure switches can be operated as safety instruments, as they detect negative pressure in several applications. For instance, if there is low air pressure during the furnace start-up, they shut down the furnace. Medical equipment like oxygen delivery systems uses pressure switches to monitor the incoming gas pressure. Such supportive factors are contributing to the market's growth during the forecast period.

High cost

The high cost associated with pressure switches is anticipated to hamper the market's growth. The pressure switches are expensive, which may discourage small end-user industries due to budget constraints, which may impact the revenue of the market and likely restrict expansion of the global pressure switches market.

Increasing demand for automation

The increasing demand for automation is projected to offer a lucrative opportunity for the growth of the pressure switches market during the forecast period. The increase in industrial activity makes use of automation, which enhances productivity, reduces human error, and significantly lowers operational costs. In industries, these switches are used for equipment control, including plastic molding injection, press machines, welding machines, and others. Additionally, the robust growth of manufacturing and processing industries requires advanced equipment, which is expected to spur the demand for pressure switches in the coming years.

India has become an attractive location for multinationals across a wide range of industries. India's manufacturing sector is experiencing a substantial rise in investments, which boosts the nation's economic landscape. A report published by Colliers indicates India's manufacturing market will reach USD 1 trillion by 2025-26, with Gujarat becoming India's manufacturing powerhouse, followed by Maharashtra, then Tamil Nadu.

The solid-state segment held a significant share of the pressure switches market in 2024; the segment is observed to grow in the coming years. Solid-state pressure switches offer various benefits over electromechanical switches, such as high accuracy, long-term stability, capability to handle a wide range of system pressures, broad frequency response, and high resistance to shock and vibration. Solid state switches are no-moving part devices and offer several benefits that make them suitable for medical, mobile, off-highway, and industrial applications. Solid-state pressure switches may also have one to four or more switch points, digital displays, and analog and digital outputs. Thereby driving the segment's growth.

The electromechanical segment is observed to grow at a significant rate during the forecast period. Electromechanical pressure switches comprise a sensing component and an electrical snap-action switch. These switches follow the traditional-style mechanical switches that are composed of moving parts. Various types of transducers, such as the diaphragm and the Bourdon type, are used to operate the switch mechanically. Diaphragm switches use the metal diaphragm to operate the switch, whereas Bourdon switches use a bourdon tube to operate the switch. These switches are capable of switching to higher currents and are not voltage-dependent.

The below 100 Bar segment held the dominating share of the pressure switches market and is expected to sustain the position throughout the forecast period due to its increasing use in the automotive and transportation sectors. Below 100 Bar pressure switches are used in engine and transmission oils systems, HVAC systems, hydraulic braking systems, pneumatic equipment, and generators.

By pressure range, the 100-400 bar segment is projected to grow at the highest CAGR in the market. Switches in this pressure range are gaining popularity due to various industrial and construction applications, including compressors, process equipment, and hydraulic systems. The growing adoption of high-pressure hydraulic systems in agriculture and manufacturing is set to drive growth in the segment. Advances in technology, energy efficiency, and production process optimization in these industries are set to lead to substantial growth in the coming years.

The HVAC segment held the dominating share of the pressure switches market in 2024. The HVAC industry has experienced the maximum use of pressure switches owing to the rising consumption in emerging nations. Pressure switches in HVAC equipment serve for safety purposes and better maintenance. The air pressure switches in the HVAC equipment assist in detecting minimum and maximum set points. Equipment such as compressors, fans, air conditioners, pumps, and many others use pressure switches to control and monitor these devices.

By application, the safety & alarm system segment will gain a significant share of the market over the studied period of 2025 to 2034. The segment is set to grow in the coming years due to growing safety and security concerns, as well as advances in sensor technology. The growth of the smart home market is also expected to lead to significant expansion in the segment.

The automotive & transportation segment held the largest share of the pressure switches market in 2024. Pressure switches play a crucial role in the automotive & transportation sector. Pressure switches, monitors, and control systems for multiple applications such as marine, railway, and roadways. These switches are widely used for engine oil monitoring and transmissions & power steering. Hydraulic switches are utilized for controlling the air bellows within trucks. In railways, pressure switches are used for brakes, air suspension, shoe gear, compressor control, and others. Therefore, the rising use of these switches for major applications in the automotive & transportation sectors also increases investments and is projected to boost the demand for pressure switches.

The process and manufacturing industry segment is observed to grow at a notable rate during the forecast period. The process and manufacturing industry relies heavily on automation to streamline operations, increase efficiency, and ensure consistent product quality. Pressure switches play a crucial role in automated systems by monitoring and controlling pressure levels in various industrial processes, such as hydraulic systems, pneumatic systems, and manufacturing equipment. Pressure switches are integral components of process control systems used in industries such as oil and gas, chemical processing, water treatment, and food and beverage manufacturing. These switches monitor pressure variations in pipelines, tanks, vessels, and machinery, enabling precise control of process parameters and ensuring optimal performance and product quality.

By Type

By Pressure Range

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

March 2025

October 2024

September 2023