December 2024

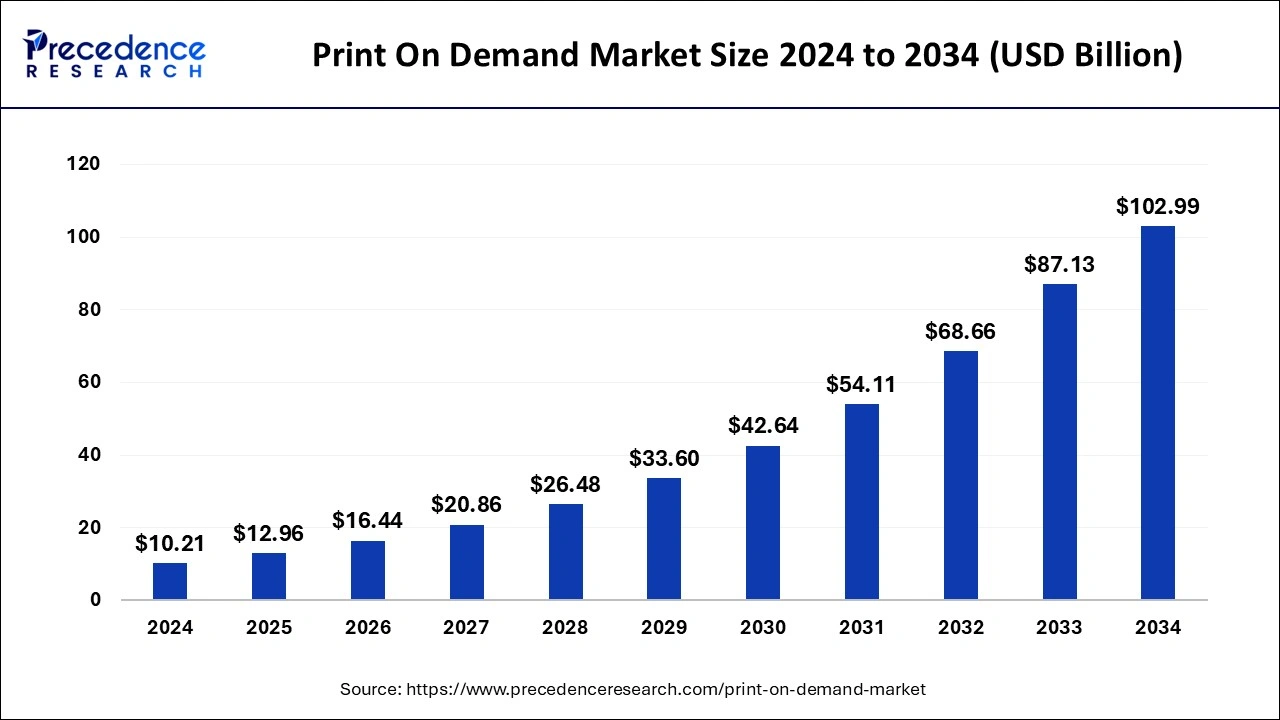

The global print on demand market size is valued at USD 12.96 billion in 2025 and is forecasted to attain around USD 102.99 billion by 2034, accelerating at a CAGR of 26% from 2025 to 2034. The North America print on demand market size surpassed USD 3.68 billion in 2024 and is expanding at a CAGR of 26.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global print on demand market size was accounted for USD 10.21 billion in 2024, and is expected to reach around USD 102.99 billion by 2034, expanding at a CAGR of 26% from 2025 to 2034. The print on demand market is experiencing significant growth due to the rapid expansion of e-commerce businesses and the rising demand for customized products.

The print on demand market is witnessing a transformative wave due to AI integration. AI helps print on demand platforms to offer consumers various personalized printing options. Advanced AI technologies allow consumers to identify and correct errors in real time and carefully analyze vast datasets. This enhances overall efficiency and minimizes waste. AI technologies boost production, reducing human errors, and streamlining order processing. In addition, AI-enabled tools lower costs by accurately predicting material needs and improving the manufacturing process. To generate tailor-made product recommendations and analyze customer data, AI enables advanced data analysis techniques. AI also automates the design process by generating unique layouts and graphics based on user input.

The U.S. print-on-demand market size was estimated at USD 2.53 billion in 2024 and is predicted to be worth around USD 26.95 billion by 2034, at a CAGR of 26.69% from 2025 to 2034.

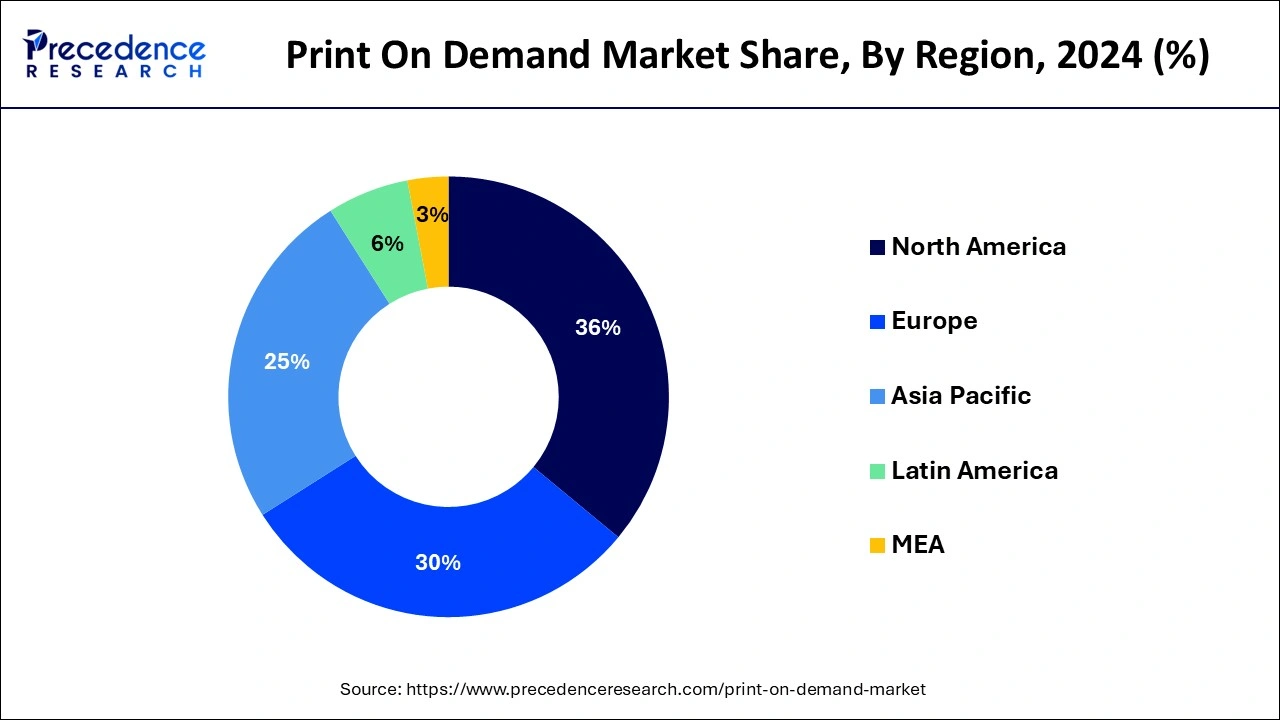

In 2024, North America ruled the market, and it is predicted that it will continue to do so throughout the forecast era. The market is expanding due to elements like technological infrastructure, steady currencies, and the availability of factories for print-on-demand goods. For instance, the headquarters of some of the biggest print-on-demand businesses, including Printful, Inc., Printify, Inc., and Zazzle Inc. A number of non-North American businesses, including Australia's Redbubble Ltd. and Norway's Gelato, have distribution facilities in the area.

Over the forecast timeframe, Asia Pacific is anticipated to have the greatest CAGR of 28%. The expansion can be ascribed to the presence of significant market participants. The main development factors for the regional market are increasing smartphone usage and internet penetration, as well as a sizable number of online shoppers. The regional market is anticipated to expand as a result of technological developments and the existence of numerous sizable textile factories.

The print-on-demand market refers to a business model where products such as books, apparel, and other goods are only printed when an order is received, rather than being produced in bulk and stored in a warehouse. This approach allows for a more efficient and cost-effective supply chain, as well as reduced waste and environmental impact. The print-on-demand market has grown rapidly in recent years due to advancements in technology and increasing demand for personalized and unique products. This market includes various players, including online retailers, publishers, and self-publishing authors. The print-on-demand market is expected to continue to grow in the coming years, with the rise of e-commerce and increasing consumer demand for customized products.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.96 Billion |

| Market Size by 2034 | USD 102.99 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 26% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Platform, By Software, and By Product |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Systems that print on demand give users printing options

Sales of goods in the home décor product area have grown as a result of people working from home and residing in their houses. This aspect is anticipated to be a key factor in the growth of the market for print-on-demand services. Platforms for print-on-demand offer customers publishing options that are tailored to their needs. Artists and retailers who run print-on-demand businesses and want to sell their creations online can link their current online shop or start a new one, depending on the platform. The end-to-end delivery service will be completed by the service providers printing the customers' purchases and shipping the merchandise to the customers.

E-commerce Growth

The demand for print-on-demand services is being driven by the explosive development of e-commerce platforms. Online markets offer businesses and people a practical and effective way to sell customized goods without the need for inventory control or an initial investment in manufacturing tools. In addition, the increasing presence of a number of e-commerce platforms provides easy access to a wide network of print-on-demand suppliers in customers’ preferred locations. This in turn drives the demand for print-on-demand products. Furthermore, such platforms are offering discounts, coupons, and premium enterprise plans for a wide variety of print-on-demand products, which augments the growth of the e-commerce industry and POD market.

Such e-commerce platforms also advertise and adopt unique strategies to attract website visitors. They also provide information about starting a POD business at a very low cost. Moreover, the customization option provided by them allows customers easily get the product they desire. Extensive variety of products including apparel, accessories, and housewares which in turn creates the demand and thrives the growth of this market.

Lack of artists' and makers' power and transparency

The print-on-demand market has enabled artists and makers to bring their creative works to a wider audience without the need for costly inventory and distribution systems. However, one of the challenges faced by artists and makers in this market is the lack of power and transparency they have in the production process and pricing structure. Many print-on-demand platforms offer limited options for customization and control over the production process, leaving artists and makers with little say in the final product.

Additionally, the pricing structure on these platforms can be opaque, with unclear commission rates and fees, making it difficult for creators to accurately value their work and determine their profits. As a result, some artists and makers have turned to alternative print-on-demand platforms or even self-hosted e-commerce sites to gain greater control and transparency in the production and pricing of their creative works. However, this can come with its own set of challenges, such as increased marketing and customer acquisition costs.

Increasing smartphone adoption and increasing internet penetration

The demand for print-on-demand services is rising as a result of consumer preferences for original goods and fashionable clothing, as well as rising internet and smartphone utilization. One of many elements supporting the sector's development is the rise in online shopping sales. Govid-19's limitations increased internet purchasing, which in turn increased the demand for products that were printed on demand.

The increasing adoption of smartphones and increasing internet penetration have contributed to the growth of the print-on-demand market. With more people having access to the internet and using their smartphones to shop online, the demand for print-on-demand products has increased. This is because print-on-demand services typically offer a convenient and affordable way for customers to order personalized or custom-made products, such as t-shirts, phone cases, and other merchandise.

Moreover, the rise of social media platforms has also played a significant role in the growth of the print-on-demand market. Social media has become a powerful marketing tool for print-on-demand services, as it allows them to reach a larger audience and promote their products directly to consumers. Additionally, social media platforms like Instagram and Facebook provide an avenue for creators and designers to showcase their work and connect with potential customers.

The print-on-demand market has been divided into two segments - software and service categories based on technology. Over the projection term, the service sector is expected to have the greatest CAGR, at 28.7%. This is explained by the rise in the number of service providers who give end-to-end fulfillment and drop shipment. The service providers additionally provide marketing and branding services, such as bespoke packaging, and artistic services, such as photos and graphic design. Print-on-demand retailers and creators can take advantage of these services' ease and variety.

The software sector had the biggest revenue share in 2024, and it is anticipated that it will continue to dominate for the duration of the forecast term. Software platforms offer solutions for designing, publishing, and printing books, magazines, and other printed materials. These platforms include tools for formatting, layout, and cover design, as well as e-commerce capabilities to sell printed materials directly to consumers. Service platforms, on the other hand, provide end-to-end solutions for printing and delivering printed materials to customers. These services can include printing, binding, and shipping, as well as e-commerce capabilities to sell printed materials on behalf of content creators.

The integrated category had the biggest revenue share in 2023, and it is anticipated that it will continue to dominate for the duration of the projection period. It will expand at a CAGR of 24% over the course of the projection term. This is due to the elevated visibility and acceptance of combined software. The segment is growing as a result of the availability of numerous third-party e-commerce sites and the simplicity of linking to them. The demand for integrated solutions is also being fueled by advantages like flexibility, increased processing capacity, and cost-effectiveness.

Over the projection period, the stand-alone category is anticipated to expand at the maximum CAGR of 26.9% and hold onto its leadership position. Leading providers of print-on-demand services like the Australian Redbubble Group and the American Zazzle Inc. are independent companies. The standalone site functions like a marketplace where designers or merchants can make products and sell them there. The vendors benefit because they are saved from having to focus on technical specifics.

The category for home decor is anticipated to have the greatest CAGR, at 28%. The increase in remote working since the pandemic can be ascribed to the fact that more people are remaining at home and trying to make their living spaces more comfortable. The expanding selection of goods in the house and living area, including mats, cushions, posters, and others, is offering consumers more choices and boosting sales.

The biggest revenue share was contributed by the apparel sector in 2024, and it is anticipated that this will continue throughout the projection period. This can be ascribed to the growing trend toward fashion apparel, the quick uptake of internet shopping in the fashion industry, and the younger generation's desire for customized and distinctive goods.

By Platform

By Software

By Product

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

December 2024