January 2025

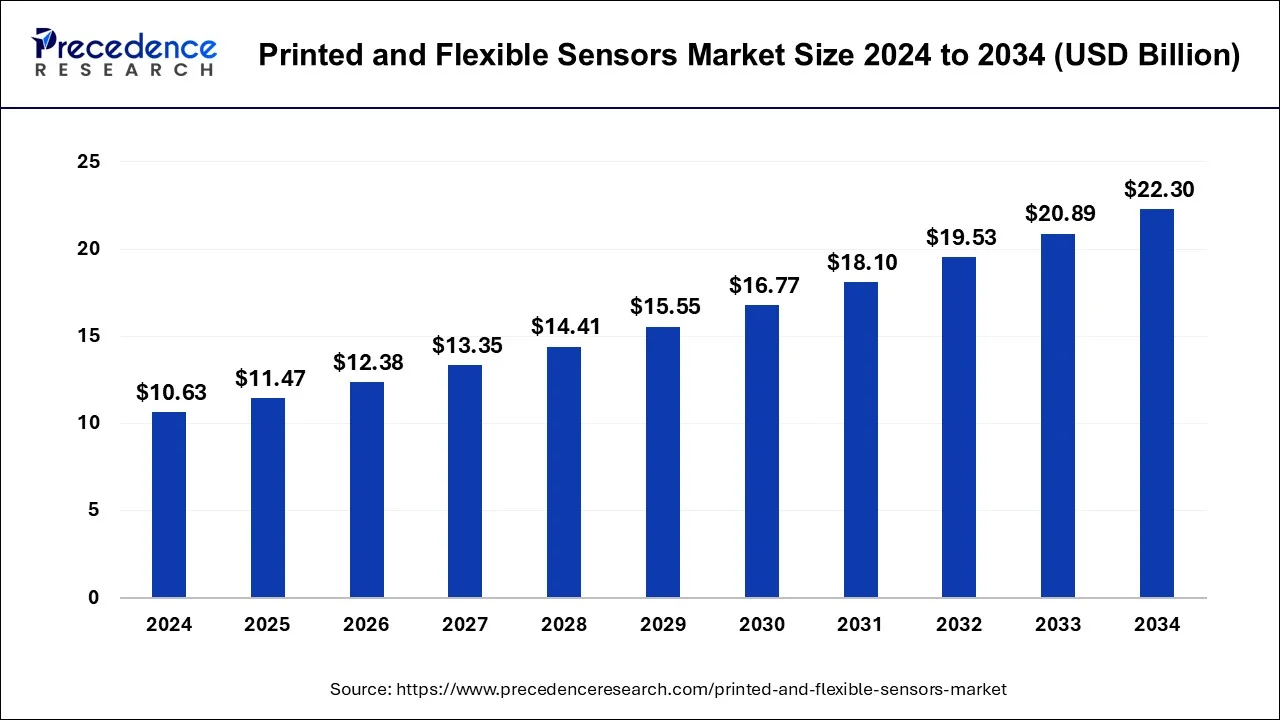

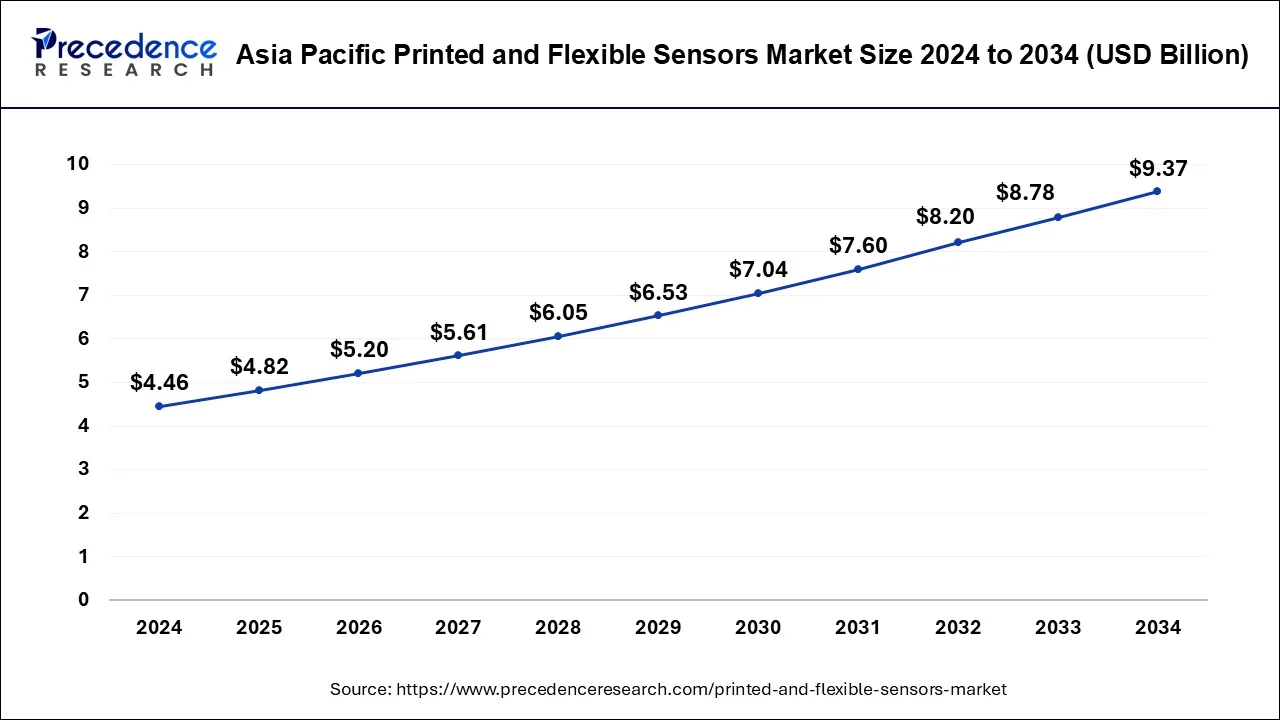

The global printed and flexible sensors market size is calculated at USD 11.47 billion in 2025 and is forecasted to reach around USD 22.30 billion by 2034, accelerating at a CAGR of 7.69% from 2025 to 2034. The Asia Pacific printed and flexible sensors market size accounted for USD 4.82 billion in 2025 and is expanding at a CAGR of 7.71% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global printed and flexible sensors market size was USD 10.63 billion in 2024, estimated at USD 11.47 billion in 2025, and is anticipated to reach around USD 22.30 billion by 2034, expanding at a CAGR of 7.69% from 2025 to 2034.

The Asia Pacific printed and flexible sensors market size was valued at USD 4.46 billion in 2024 and is expected to reach USD 9.37 billion by 2034, growing at a CAGR of 7.71% from 2025 to 2034.

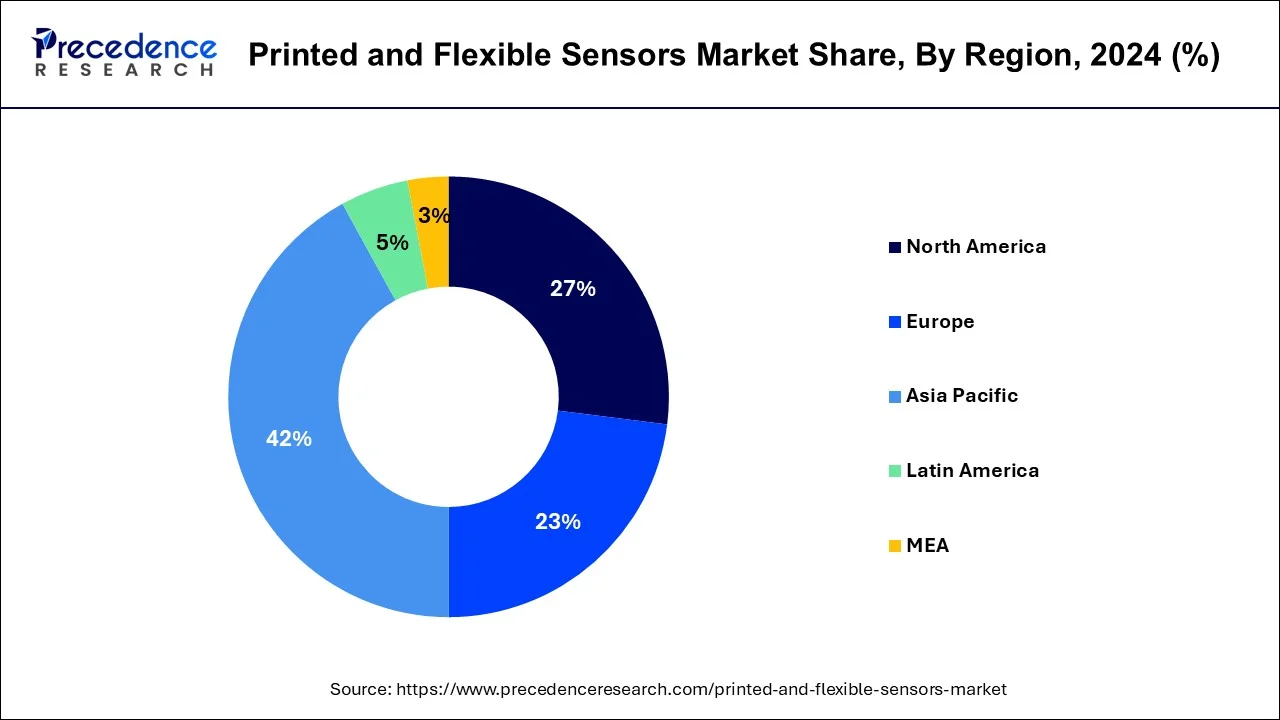

In 2024, Asia Pacific dominated the global and flexible sensors market holding 42% of the market share. This dominance is due to the presence of key market players. Moreover, the ongoing technological advancements and countries such as China, Japan, and South Korea provide opportunities for the manufacturers on a long-term basis in the region. Additionally, the rising adoption of printed electronics technology in consumer electronics, automotive, and medical, and growing small and medium-sized electronic businesses in the region is driving the growth of the market.

Increasing demand for consumer electronics across the globe is estimated to be the key factor that drives the demand for flexible and printed sensors. Technological advancements and developments in electronic devices seem to upend consumer preference and demand over the upcoming period.

Flexible electronics is one of such technologies that widely influence the gaming and entertainment industry owing to their multi-dimensional properties that include lightweight, portability, and ruggedness. Further, flexible electronics provide the ability to roll, curve, conform, flex, and enable a new intuitive user interface. In addition to its advanced features, an amalgamation of flexible electronics with wearable technology is likely to open new interfaces in the industry of flexible electronics. Hence, various technology disruptions in the field of consumer electronics are expected to significantly impact the market growth of printed and flexible sensors in the coming years.

Apart from consumer electronics, remarkable advancements in automotive electronic products are likely to impel the market growth for flexible and printed sensors. Increasing demand for advanced safety features along with driver assistance systems is estimated to surge the demand for sensors in an automobile that further propel the growth of flexible and printed electronics in the industry.

However, high cost compared to rigid sensors coupled with a high risk of damage while handling is the major factor of concern that hamper the growth of flexible and printed sensors over the upcoming years. Nonetheless, the rising penetration of the Internet of Things (IoT) and artificial intelligence in electronic products are likely to open alluring opportunities for the market players, thereby augmenting the market growth.

| Report Highlights | Details |

| Market Size in 2024 | USD 10.63 Billion |

| Market Size in 2025 | USD 11.47 Billion |

| Market Size by 2034 | USD 22.30 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.69% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Biosensor occupied the major value share in the year 2024 mainly because of escalating demand for glucose test strips that is largely used in diabetes monitoring. Diabetes has become one of the most common diseases across the globe. Its alarming rate of rise has forced the government to adopt several measures to control the disease. According to the International Diabetes Federation (IDF), around 424.9 Million people across the globe were suffering from diabetes in 2017 and the number is expected to surge to 628.6 Million by 2045, a 48% rise in the total patients of with diabetes. Hence, home therapeutic devices for continuously monitoring diabetes are a common trend in developed as well as developing countries, thereby triggering the demand for biosensors.

Apart from this, image sensors accounted to contribute significant value to the printed and flexible sensor market. The growth of the segment is major because of significant technological advancements in image sensing technology to cater to the rising need across various industries such as consumer electronics and automotive. For example, image sensors are widely used in the automotive industry for rear imaging cameras, dashcams, driver assistance systems, and many more. Whereas, in consumer electronics, it is largely used in smartphones and various electronic products that implement AI and IoT for their feature enhancement.

Medical accounted for the largest market share in the printed and flexible sensor application segment in 2024. This is attributed to the significant demand for biosensors across various medical devices, particularly in diabetes monitoring devices. Further, it is also used significantly for the diagnosis of infectious diseases. Apart from all this, the rising prevalence of chronic disease has surged the need for effective monitoring devices to diagnose the problem at its easy stage and cure them.

Key Companies & Market Share Insights

The global printed and flexible sensors market is highly competitive and opportunistic for the new startup players as well as we-established manufacturers. The rapid change in consumer preference along with the fast-moving technological development across various industries has created a remarkable opportunity for the market players to grab a maximum foothold in the market. In addition, product diversity and reliability is the major parameter that is required to improve the company’s market position. In the wake of the same, the industry participants invest prominently in new product development and advancement.

This research study comprises a complete assessment of the market by means of far-reaching qualitative and quantitative perceptions, and predictions regarding the market. This report delivers a classification of the marketplace into impending and niche sectors. Further, this research study calculates the market size and its development drift at global, regional, and country from 2025 to 2034. This report contains a market breakdown and its revenue estimation by classifying it on the basis of printing technology, type, application, and region:

By Printing Technology

By Type

By Application

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

June 2024

December 2024

April 2023