March 2025

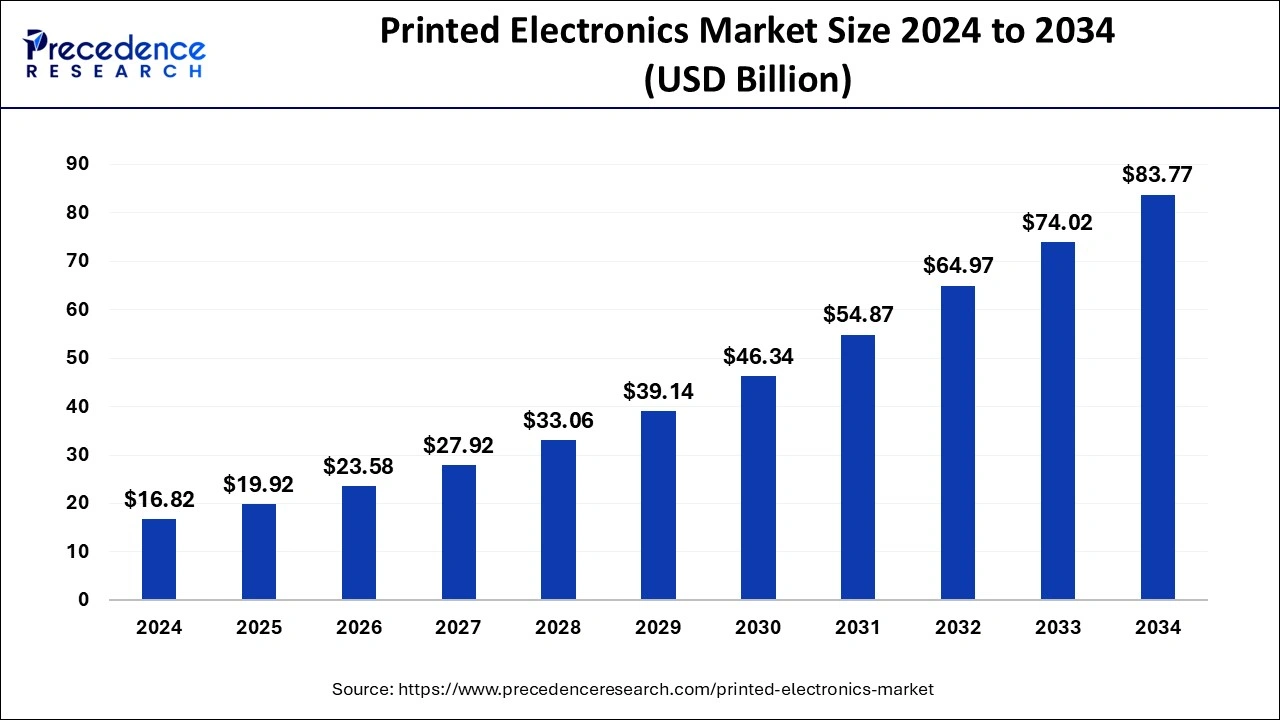

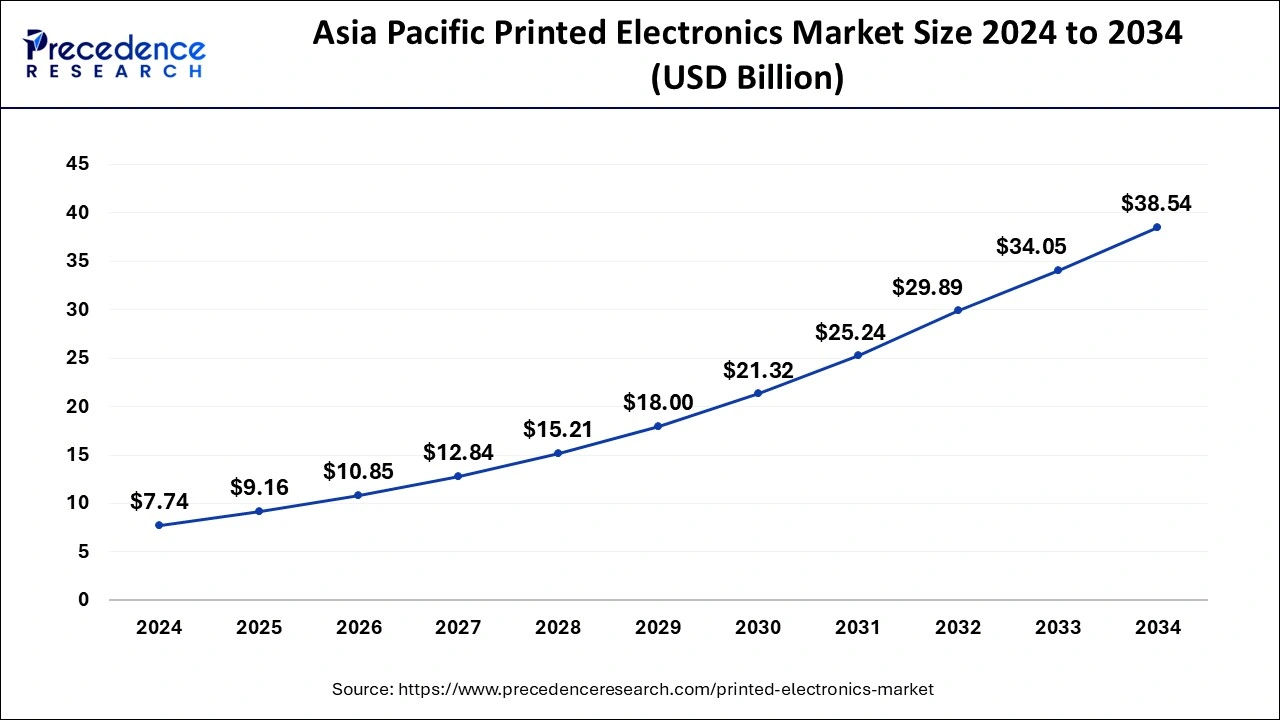

The global printed electronics market size estimated at USD 19.92 billion in 2025 and is anticipated to reach around USD 83.77 billion by 2034, expanding at a CAGR of 17.42% from 2025 to 2034. The Asia Pacific printed electronics market reached USD 9.16 billion in 2025 and is expanding at a CAGR of 18% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global printed electronics market size accounted for estimated at USD 16.82 billion in 2024 and is predicted to reach around USD 83.77 billion by 2034, growing at a CAGR of 17.42% from 2025 to 2034.

The Asia Pacific printed electronics market reached USD 7.74 billion in 2024 and expected to be worth around USD 38.54 billion by 2034, at a CAGR 18% between 2025 to 2034.

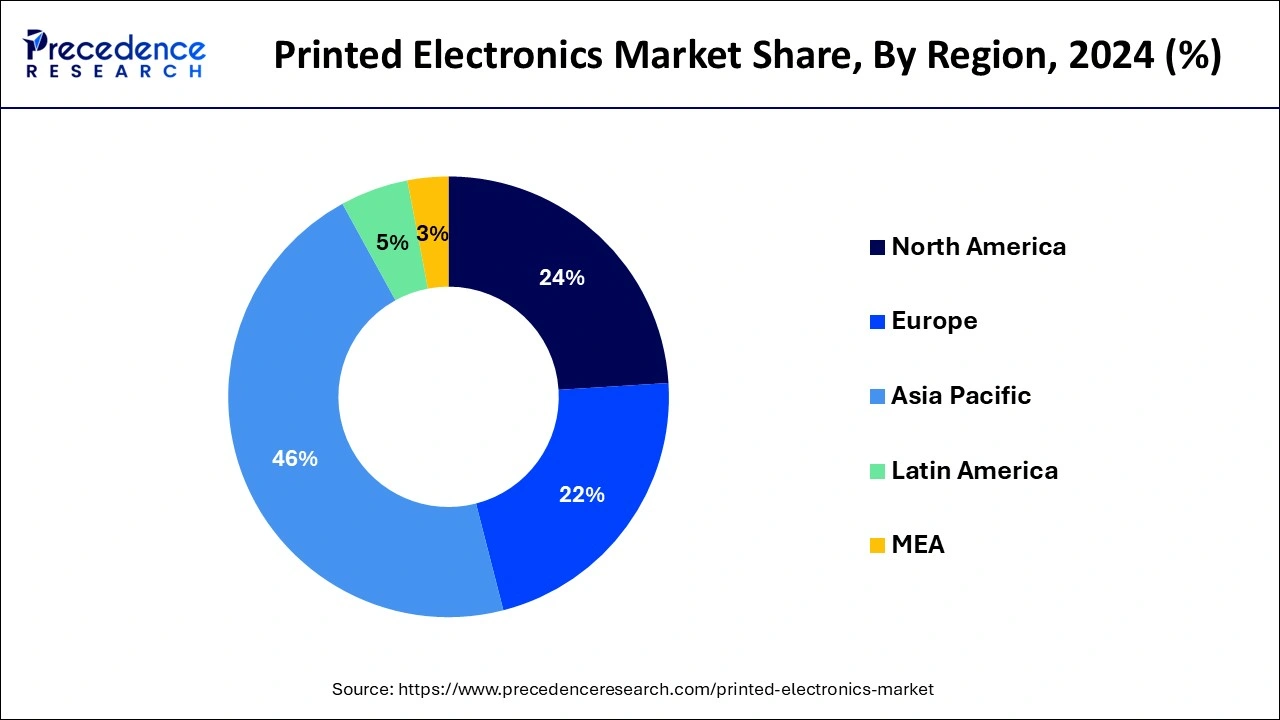

Asia Pacific is expected to account for the highest proportion of the global printed electronics market by 2024. During the projected period, the Asia Pacific market is anticipated to grow at the fastest CAGR. The Asia Pacific region is a major producer of electrical gadgets and components. The expansion of the printed electronics market in Asia Pacific can be due to increased investments in R&D activities connected to printed electronics in the region, as well as large-scale manufacture of electronic components. China, Japan, South Korea, and Australia are all key contributors to the Asia Pacific printed electronics market's expansion. The expansion of the printed electronics market in this area is being driven by factors such as the acceptance of novel technologies and the rising popularity of advanced consumer electronics.

Due to increased R&D investments and expanding acceptance of the technology in various industrial applications such as photovoltaic, lighting, and RFID devices, this technology is expected to gain momentum in the North American and European regions as well. Over the projection period, the regions are expected to rise steadily in terms of CAGR. For instance, On 28th September 2021, Molex, a global electronics leader and connectivity inventor, today announced the Molex Flex-to-Board RF mmWave Connector 5G25 series. This innovative Molex micro connector enables RF antenna module manufacturers and mobile device designers to optimize high-speed 5G components while reducing space constraints on increasingly packed printed circuit boards.

The growing use of IoT is opening up a slew of new growth prospects for printed electronics applications across the board. Furthermore, rising demand for improved OLED displays and printed RFID devices is paving the way for greater use of the technology due to its high efficiency, low power consumption, and low production cost.

Printed electronics has been a major research area, with an emphasis on ongoing improvements and improvisations to improve existing capabilities and explore new applications in a variety of disciplines. Several benchmarking advancements and technological developments have resulted from increased R&D investments by numerous groups, organizations, and corporations over the previous few decades. All these attributes are anticipated to fuel the market growth.

Consumer product makers, such as IoT devices, smartphones, display devices, and other communication devices, make up the majority of end-product manufacturers. Manufacturers incorporate technology into a variety of items based on customer demand and distribute them to distributors or retailers for sale. To get a foothold in expanding markets like Asia Pacific, major players in the sector are relying on mergers and acquisitions or distribution agreements.

| Report Coverage | Details |

| Market Size by 2034 | USD 83.77 Billion |

| Market Size in 2025 | USD 19.92 Billion |

| Market Size in 2024 | USD 16.82 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.42% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Technology, Device, End Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The printed electronics market is divided into ink and substrate. The inks material segment accounted for the largest portion of the market in 2024. Moreover, throughout the projection period, the category is expected to develop at a faster CAGR. One of the most important materials utilized in the production of printed electronics is ink. The rising need for sophisticated printing technologies, better quality conductive inks, and compact devices are estimated to contribute positively towards the market growth. Graphene ink, for example, is being developed to create low-cost, flexible, water-resistant, and highly conductive electrical circuits.

The screen-printing technology segment accounted for contributing the largest market share in 2024 and is expected to grow significantly during the forecast period. Screen printing is one of the world's oldest and most versatile printing methods. This printing process is used to create printed sensors and batteries, as well as posters, labels, signs boards, textiles, and electronic circuit boards.

Electrodes and electrical wires for LED panels, touch panels, and solar cells are printed via screen printing. In addition, the technology allows for the creation of huge graphics and the application of heavier inks to substrate surfaces. All these attributes drive the market growth. For instance, On 3rd March 2021, NovaCentrix announced a transparent security system based on inkjet printed material displays multiple touch point operation of a transparent capacitive type sensor. The device's active touch component uses high transmittance values, making it difficult for the human eye to discern where the sensing part is located and increasing the device's security level. The method can be used on both rigid (used in windows, exhibitions, and displays) and flexible glass substrates (used in door lockers, and other curved surfaces). The demonstrator employs both stiff and flexible non-organic and printed technology.

The display devices and photovoltaic devices accounted for the biggest market shares, and this dominance is expected to continue over the projection years because of its growing application in the burgeoning packaging business. The RFID device segment is also attracting a lot of attention around the world. Because of the precision, authenticity, dependability, and cost-effectiveness provided, printed electronics RFID devices are in high demand in the packaging industry. As a result, from 2023 to 2032, the RFID device segment is predicted to increase at a significant rate, with the highest CAGR.

The aerospace and defense segment is predicted to grow at the fastest rate. Because of their low weight, relative simplicity, and great reliability, printed electronics are widely used in the aerospace and defense industries, resulting in low maintenance requirements. Furthermore, the printing of electronic circuits on 3D surfaces allows market participants to produce aircraft wings, innovative materials for missiles, rockets, and other defense equipment.

By Material

By Technology

By Device

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

March 2025

June 2024

December 2024

April 2023