November 2024

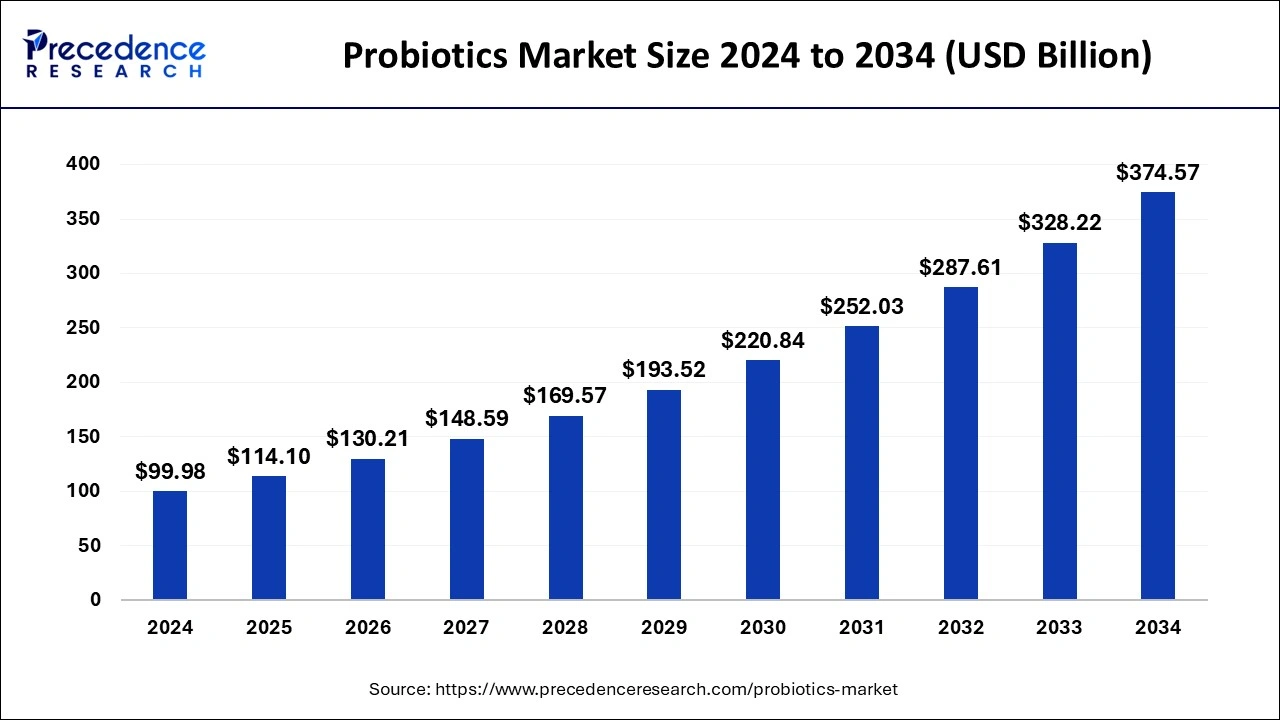

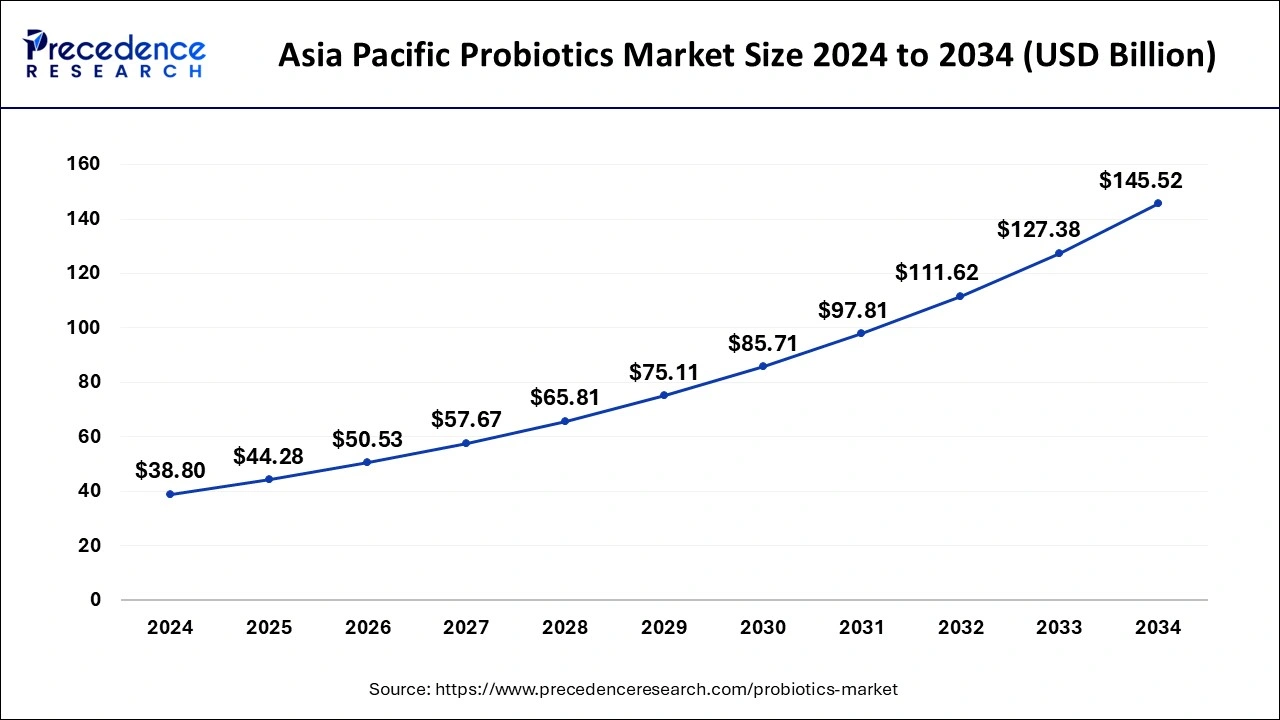

The global probiotics market size is calculated at USD 114.10 billion in 2025 and is forecasted to reach around USD 374.57 billion by 2034, accelerating at a CAGR of 14.12% from 2025 to 2034. The Asia Pacific probiotics market size surpassed USD 44.28 billion in 2025 and is expanding at a CAGR of 14.13% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global probiotics market size was estimated at USD 99.98 billion in 2024 and is anticipated to reach around USD 374.57 billion by 2034, expanding at a CAGR of 14.12% from 2025 to 2034.

The Asia Pacific probiotics market size was evaluated at USD 38.80 billion in 2024 and is predicted to be worth around USD 145.52 billion by 2034, rising at a CAGR of 14.13% from 2025 to 2034.

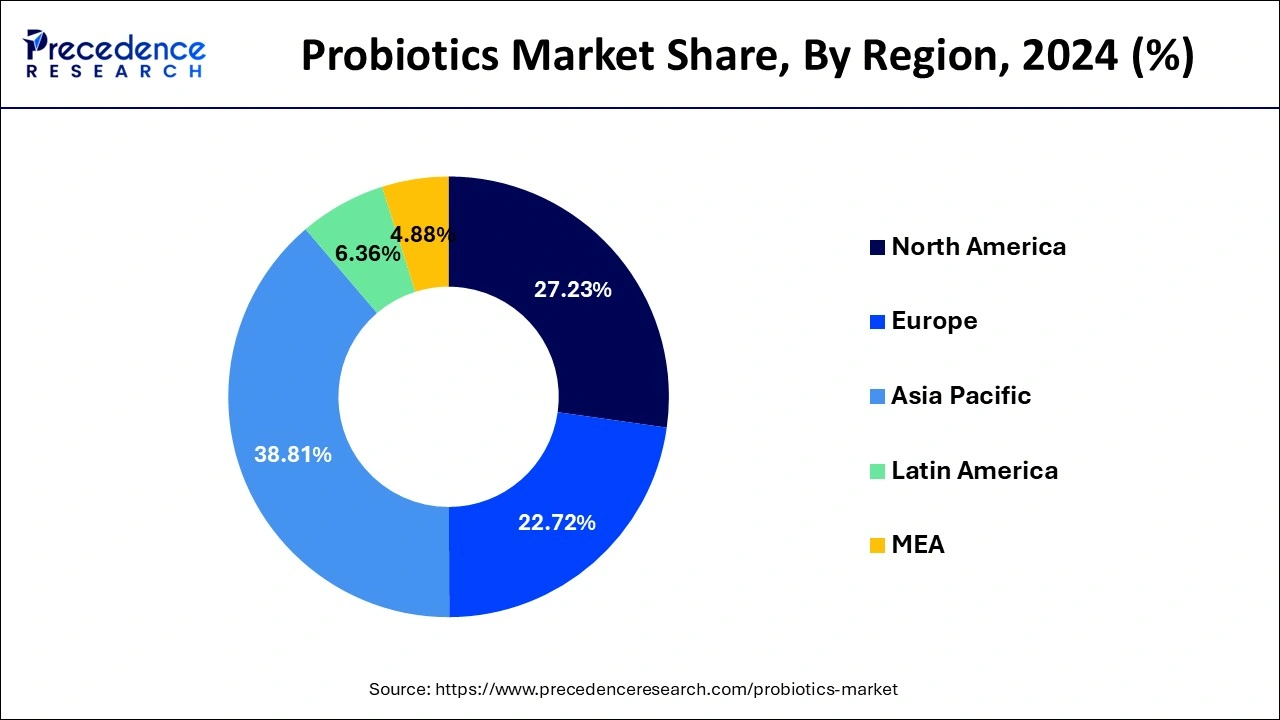

Asia pacific dominated the global market with the largest market share of 38.81% in 2024. The region is witnessing a substantial rise in consumer awareness due to competitive strategies opted by the global players. Strong demand from countries, similar to India, China, and Australia, is contributing to the overall market growth. The rising population, coupled with the rising disposable income and improvised standard of living, is a factor anticipated to cater to the regional market growth. During the previous years, owing to a deficiency of technology, the market was swamped with these products which lacked room temperature stability. Therefore, this problem of quality was addressed as a major challenge, and various companies introduced technologies, such as microencapsulation, which enhance the stability and life of the probiotic bacteria in the region.

North America region is likely to foresee considerable market growth during the forecast period. Also, continued manufacturer’s investments in the food & beverage and pharmaceutical industries are likely to contribute to the market growth of the region. In addition, the key players of the region are investing in R&D to launch new products to provide products to consumers of various age groups and different genders. Therefore, all these types of factors are expected to propel the probiotics market growth over the forthcoming time period.

The probiotics market deals with yeast and bacteria that help maintain a healthy microbial balance in the intestines of animals and humans. Probiotics promote the body’s digestive enzymes and juices and guarantee appropriate digestion. Probiotics are being utilized to treat neurological, digestive diseases and mental problems. They also remove infections in the body, protect lipids and proteins from oxidative damage, and enhance the immune system. In addition, the probiotic market is driven by various factors such as rising technological advancements in probiotics and increasing adoption of probiotics in food and beverages. As scientific research increases to highlight the gut microbiome’s crucial role in maintaining well-being, immune function, and digestive health, more people are identifying the value of incorporating probiotics into their daily routines.

| Report Coverage | Details |

| Market Size in 2024 | USD 99.98 Billion |

| Market Size in 2025 | USD 114.10 Billion |

| Market Size by 2034 | USD 374.57 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 14.12% |

| Base Year | 2024 |

| Largest Market | Asia Pacific |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, End Use, Distribution Channel, Function, Form, Ingredient, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The market is augmented by the growing consumer inclination towards preventative healthcare in confluence with the development of effective probiotic strains. Probiotics, when consumed in acceptable quantities, provide various benefits to the body, such as improved gut health and reduced intestinal inflammation. Probiotics play an essential part in preventative healthcare as they help the occurrence of diseases by strengthening the immune system. Therefore, rising consumer awareness regarding preventative healthcare is anticipated to boost the probiotics market growth over the forecast period.

High cost of probiotics

The rising cost of research and development for new probiotic strains will challenge the growth of the market. The high spending on-recruiting research equipment, huge investments in laboratories, sustained spending in research and innovation activities, and skilled individuals hinder market growth. Therefore, these factors restrain the growth of the probiotics market.

Replace pharmaceutical agents with probiotics

The increasing demand for probiotics encompasses customers shift for products with developed health advantages. Consumer expectations related to these products have grown, as evidence of probiotics’ positive impact on health continues to accumulate. This trend toward searching for cost-effective, natural, and safe alternatives to pharmaceuticals has improved the exploration of probiotics. To treat various human diseases, especially those affecting the gastrointestinal tract, clinical trials have demonstrated that probiotics have the potential. Incorporating probiotic-rich fermented dairy products into diets has shown assurance in meeting specific clinical diseases, such as lactose intolerance, Helicobacter pylori infection, cancer, allergic diseases, irritable bowel syndrome, inflammatory bowel disease, rotavirus-associated diarrhea, and antibiotic-associated diarrhea. These factors are expected to enhance the growth of the probiotics market.

Based on ingredient, the bacteria segment garnered the highest probiotics market share in 2024 due to surge in demand for bacteria derived probiotics food products. This is attributed to the growth in health issues that have encouraged market players to invest in R&D and launch new & innovative probiotics products.

Based on application, the food & beverages segment accounted largest revenue share of over 75% in 2024 due to the rising popularity of probiotic functional foods & potables among consumers. Growth in consumer awareness, faith in its efficacy, and safety are some of the factors driving the market of probiotics. The food & beverages segment is the largest market segment across the regions. Consumers are now taking a visionary approach towards preventing chronic conditions. China and Japan are the two dominant markets in the Asia Pacific, and the Japanese market is projected to reach its maturity level during the forecast period.

On the other hand, the animal feed segment is projected to record the fastest growth during the cast. The ban on synthetic antimicrobial growth promoters (AGP’s) in Europe is a factor driving the market. The motive behind the ban was to check the practice of using antibiotics, antimicrobials, and other medicines for promoting the growth of livestock in order to rise the production of meat, milk, and other products.

By Application

By End Use

By Distribution Channel

By Ingredient

By Function

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

May 2024