July 2024

Procurement Analytics Market (By Component: Solution, Services, By Deployment Mode: On Premise, Cloud; By Enterprise Size: Large Enterprises, SMEs; By Industry Vertical: BFSI, Manufacturing, Retail, IT and Telecom, Healthcare, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

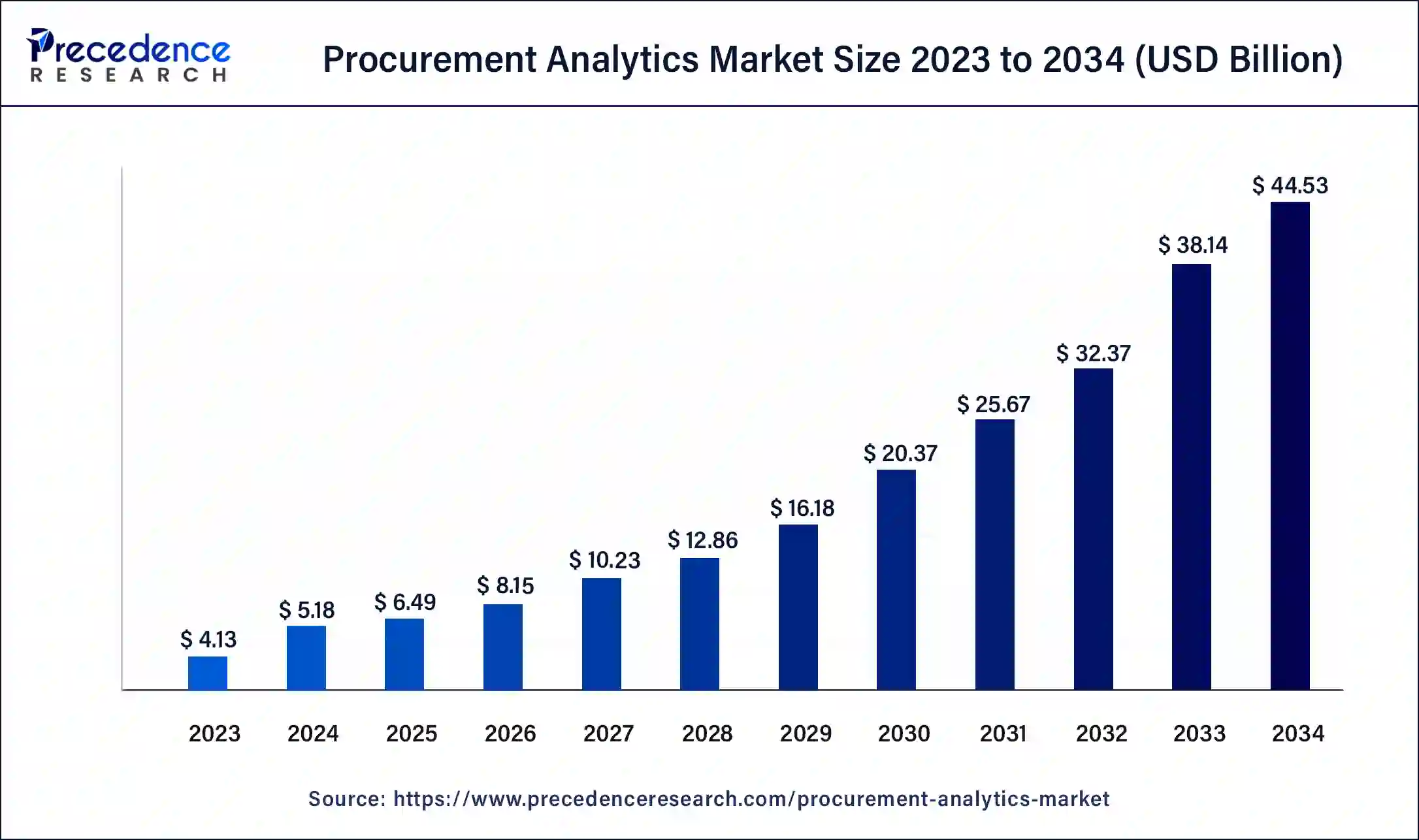

The global procurement analytics market size was USD 4.13 billion in 2023, calculated at USD 5.18 billion in 2024, and is expected to reach around USD 44.53 billion by 2034. The market is expanding at a solid CAGR of 24% over the forecast period 2024 to 2034.

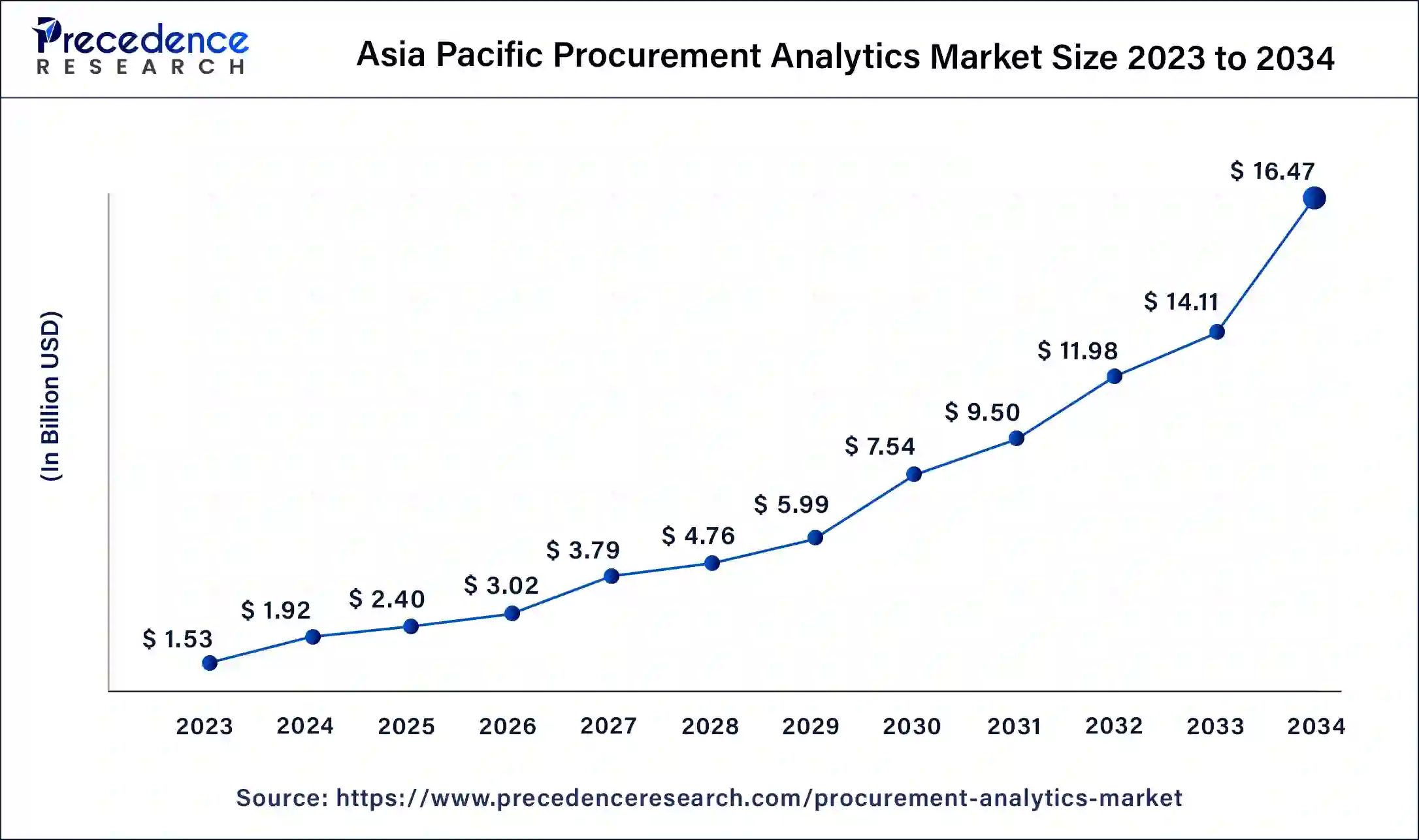

The Asia Pacific procurement analytics market size was estimated at USD 1.53 billion in 2023 and is predicted to be worth around USD 16.47 billion by 2034, at a CAGR of 24.2% from 2024 to 2034.

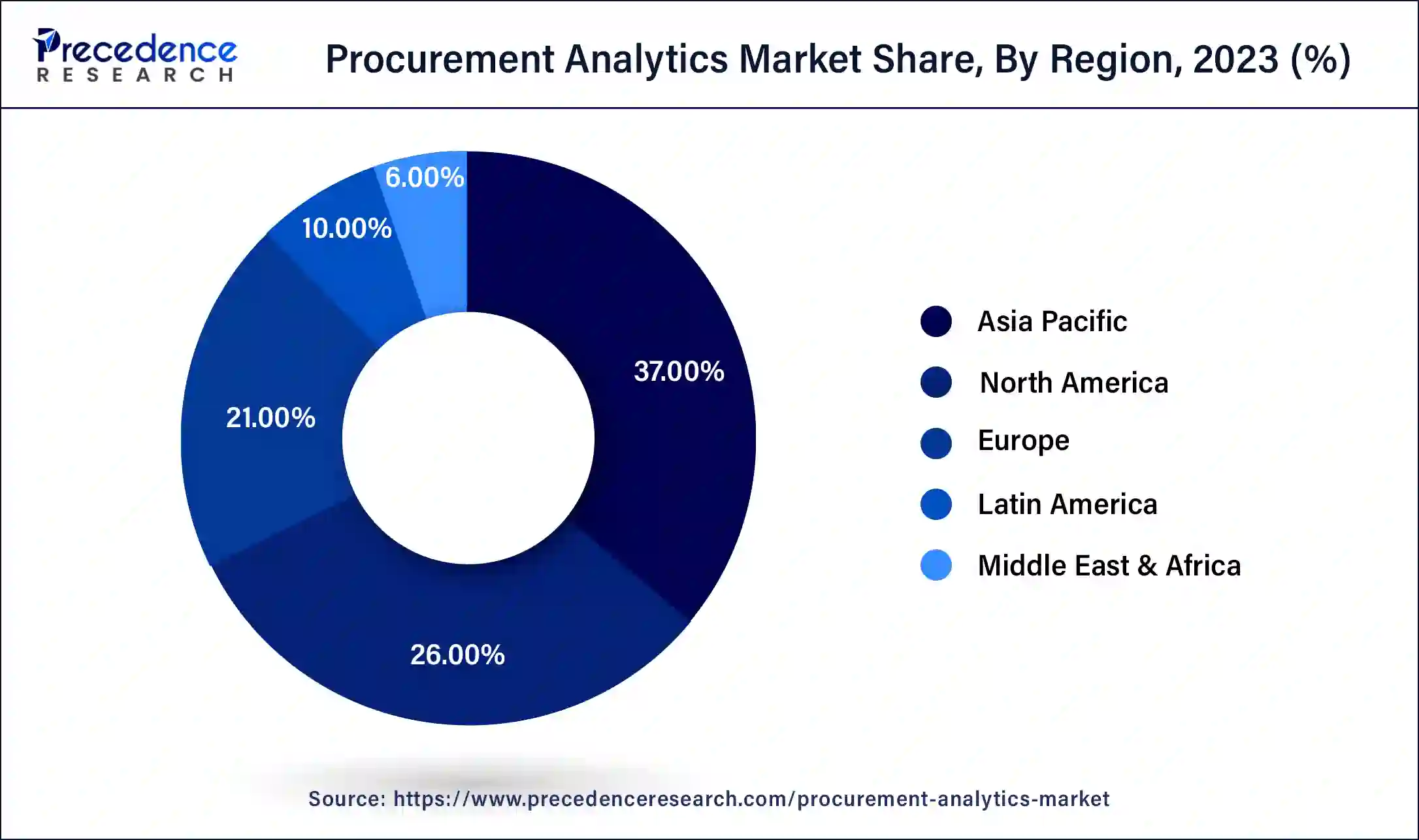

Asia-Pacific has held the largest revenue share of 37% in 2023. The dominance of Asia-Pacific in the procurement analytics market is attributed to its robust development, burgeoning industrial landscape, and widespread embrace of cutting-edge technologies. As businesses across Asia-Pacific prioritize operational streamlining, cost reduction, and more effective supply chain management, the adoption of procurement analytics solutions has witnessed substantial growth. The region's diverse industry landscape, coupled with a heightened awareness of the advantages offered by analytics in procurement, solidifies Asia-Pacific's substantial market presence in this sector.

North America is estimated to observe the fastest expansion. North America dominates the procurement analytics market due to its advanced technological infrastructure, high adoption of analytics solutions, and a mature procurement landscape. The region's businesses prioritize data-driven decision-making, boosting the demand for procurement analytics tools. Additionally, a strong presence of key market players, robust government initiatives, and a focus on innovation contribute to North America's significant share. The region's early adoption of advanced technologies and a conducive business environment position it as a major contributor to the growth and leadership in the procurement analytics market.

Procurement analytics is the smart use of data analysis and business intelligence to enhance how organizations buy goods and services. This involves digging into various data points such as supplier performance, pricing trends, and contract compliance. By applying analytics, companies can make better purchasing decisions, find ways to cut costs and reduce risks tied to procurement.

In simpler terms, procurement analytics is like having a data-driven compass for making smarter choices in the buying process. It helps organizations see where they can save money, negotiate better deals with suppliers, and overall, run their purchasing operations more smoothly. This kind of gives businesses a competitive edge by making sure they're always making well-informed decisions in the complex world of procurement.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 24% |

| Market Size in 2023 | USD 4.13 Billion |

| Market Size in 2024 | USD 5.18 Billion |

| Market Size by 2034 | USD 44.53 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Component, By Deployment Mode, By Enterprise Size, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Demand for real-time insights and digital transformation initiatives

The increasing demand for real-time insights and digital transformation initiatives is propelling the surge in market demand for procurement analytics. In today's fast-paced business environment, organizations require immediate access to data-driven insights to make informed decisions. The real-time capabilities of procurement analytics empower businesses to swiftly adapt to dynamic market conditions, optimize purchasing strategies, and mitigate risks promptly. Simultaneously, as companies embark on comprehensive digital transformation journeys, the integration of procurement analytics becomes a cornerstone.

The digitization of procurement processes enhances operational efficiency, automates manual tasks, and facilitates seamless collaboration across departments. Organizations are recognizing the strategic value of analytics in transforming procurement from a transactional function to a strategic business driver, fostering a heightened demand for advanced analytics solutions in the procurement sector. This intersection of real-time insights and digital transformation underscores the pivotal role of procurement analytics in modernizing and optimizing supply chain processes.

Data quality issues and integration challenges

Data quality issues and integration challenges present significant restraints to the market demand for procurement analytics. Firstly, data quality is paramount for effective analytics, and inaccuracies or inconsistencies in procurement data can lead to flawed insights and decision-making. Concerns over data reliability may deter organizations from fully embracing analytics solutions, impacting market demand. Secondly, integration challenges with existing systems, such as Enterprise Resource Planning (ERP) platforms, create barriers to seamless adoption.

The complexity of integrating analytics tools with diverse systems can result in disruptions to established workflows, posing a deterrent for organizations looking to implement procurement analytics. The fear of potential operational disruptions and the resources required for successful integration may lead some businesses to postpone or forego the adoption of these analytics solutions, constraining the overall market demand for procurement analytics. Overcoming these obstacles requires innovative solutions, industry-wide standards, and robust education to instill confidence in organizations regarding the reliability and compatibility of procurement analytics tools.

Rising demand for predictive analytics and increased emphasis on sustainability

The rising demand for predictive analytics is creating substantial opportunities in the procurement analytics market. Organizations increasingly recognize the value of solutions that can forecast market trends, anticipate demand fluctuations, and assess supplier performance. Predictive analytics enables proactive decision-making, allowing businesses to optimize procurement strategies, reduce risks, and gain a competitive advantage in dynamic market conditions.

Simultaneously, the increased emphasis on sustainability presents a unique opportunity for procurement analytics. Businesses are seeking solutions that can evaluate and optimize supplier sustainability practices, environmental impact, and social responsibility. Procurement analytics tools that integrate sustainability metrics into decision-making processes not only align with corporate responsibility goals but also cater to growing market demand for ethically and environmentally conscious procurement practices. Capitalizing on these trends positions procurement analytics providers to meet evolving business needs and contribute to a more sustainable and strategic approach to procurement.

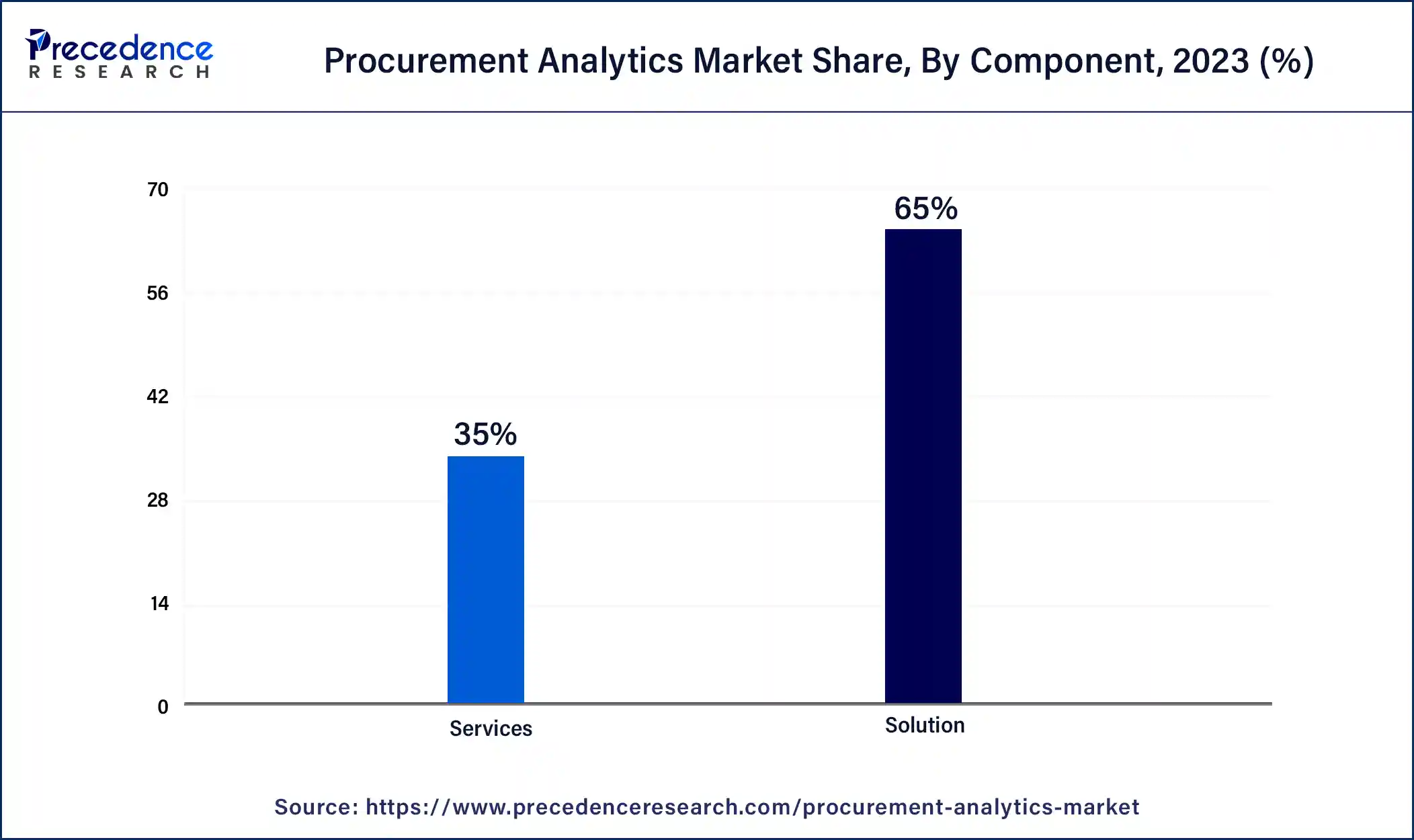

In 2023, the solution segment had the highest market share of 65% on the basis of the component. In the procurement analytics market, the solution segment involves software designed to improve procurement processes. These solutions include tools for data analytics, predictive modeling, and reporting. Trends in this sector focus on integrating advanced tech like AI, ensuring user-friendly interfaces for widespread use, and creating cloud-based solutions for scalability. As businesses increasingly value data-driven decision-making in procurement, the solution segment is adapting to provide more sophisticated and efficient analytics tools to meet growing demands.

The services segment is anticipated to expand at a significant CAGR of 28.2% during the projected period. In the procurement analytics market, the services segment encompasses consulting, implementation, and support services. Consulting services involve strategic guidance for optimizing procurement processes, while implementation services focus on integrating analytics solutions into existing systems. Support services ensure ongoing functionality and troubleshooting. Trends in this segment include a rising demand for specialized consulting to tailor solutions for diverse industries, a focus on seamless implementation to minimize disruptions, and a growing emphasis on ongoing support to maximize the long-term effectiveness of procurement analytics solutions.

According to the deployment mode, the on premise segment has held 61% revenue share in 2023. The on-premise segment in the procurement analytics market refers to solutions deployed locally within an organization's infrastructure. While cloud-based solutions gain popularity, on-premise deployments remain relevant for businesses with stringent security requirements or regulatory constraints. The on-premise trend in procurement analytics signifies a need for customized, controlled solutions, giving organizations direct oversight and ensuring data resides within their infrastructure. This trend caters to enterprises valuing data control and security, particularly prevalent in industries with strict compliance standards like finance, healthcare, and government.

The cloud segment is anticipated to expand fastest over the projected period. In the procurement analytics market, the cloud segment refers to the deployment of analytics solutions through cloud-based platforms. This approach offers organizations scalable, flexible, and cost-effective access to procurement analytics tools. A significant trend in this segment involves the increasing adoption of cloud-based solutions, driven by the need for accessibility, seamless updates, and enhanced collaboration. Cloud deployment allows businesses to leverage advanced analytics capabilities without the need for extensive infrastructure investments, aligning with the broader industry shift towards scalable and efficient cloud-based solutions in procurement analytics.

According to the enterprise size, the large enterprises' segment has held a 62% revenue share in 2023. In the procurement analytics market, large enterprises refer to organizations with extensive operations, significant procurement needs, and complex supply chains. The trend in this segment involves a heightened focus on leveraging advanced analytics to optimize sourcing strategies, enhance supplier relationships, and ensure cost efficiencies. Large enterprises are increasingly adopting sophisticated procurement analytics solutions to gain real-time insights, streamline processes, and mitigate risks, aligning with the broader trend of data-driven decision-making for comprehensive supply chain management.

The SMEs segment is anticipated to expand fastest over the projected period. Small and Medium Enterprises (SMEs) in the procurement analytics market generally encompass businesses with fewer than 500 employees. Despite budget limitations, SMEs are progressively integrating procurement analytics to improve cost efficiency, supplier collaborations, and decision-making. This trend involves the creation of accessible and affordable analytics solutions tailored to SME requirements, enabling them to utilize data-driven insights for strategic procurement choices. As technology evolves, SMEs are adopting analytics to maintain competitiveness and enhance operational efficiency in their procurement strategies.

According to the industry vertical, the manufacturing segment held a 25% revenue share in 2023. In the manufacturing segment, procurement analytics refers to the application of data-driven insights to enhance sourcing, supplier management, and operational efficiency. Trends in this sector include the increasing adoption of predictive analytics for demand forecasting, optimizing supplier relationships, and improving supply chain visibility.

Manufacturers are leveraging analytics to streamline procurement processes, negotiate favorable terms with suppliers, and mitigate risks. The integration of analytics tools with manufacturing processes enhances decision-making, contributing to overall operational excellence and competitiveness within the industry.

The healthcare segment is anticipated to expand fastest over the projected period. In the healthcare sector, procurement analytics involves leveraging data insights to optimize the sourcing and acquisition of medical supplies, equipment, and services. Trends in healthcare procurement analytics include the integration of predictive analytics for demand forecasting, ensuring timely availability of critical resources. Additionally, there is a growing emphasis on enhancing supplier relationships, improving compliance with healthcare regulations, and implementing analytics-driven cost-saving measures, all of which contribute to more efficient and resilient healthcare procurement processes.

In September 2021, Coupa Software unveiled a strategic collaboration with Japan Cloud, marking the inception of a joint venture named Coupa K.K. This partnership positions Coupa to efficiently cater to the increasing demand from Japanese enterprises seeking enhanced efficiency and flexibility through Business Spend Management solutions.

In a parallel development in April 2021, Oracle and SailGP, a premier sailing racing league globally, extended their successful Procurement Analytics platform in anticipation of the league's second season. This expansion underscores Oracle's commitment to providing advanced procurement solutions, contributing to the optimization of SailGP's operations as they navigate the complexities of their global sporting events.

Segments Covered in the Report

By Component

By Deployment Mode

By Enterprise Size

By Industry Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

August 2024

November 2024

November 2024