July 2024

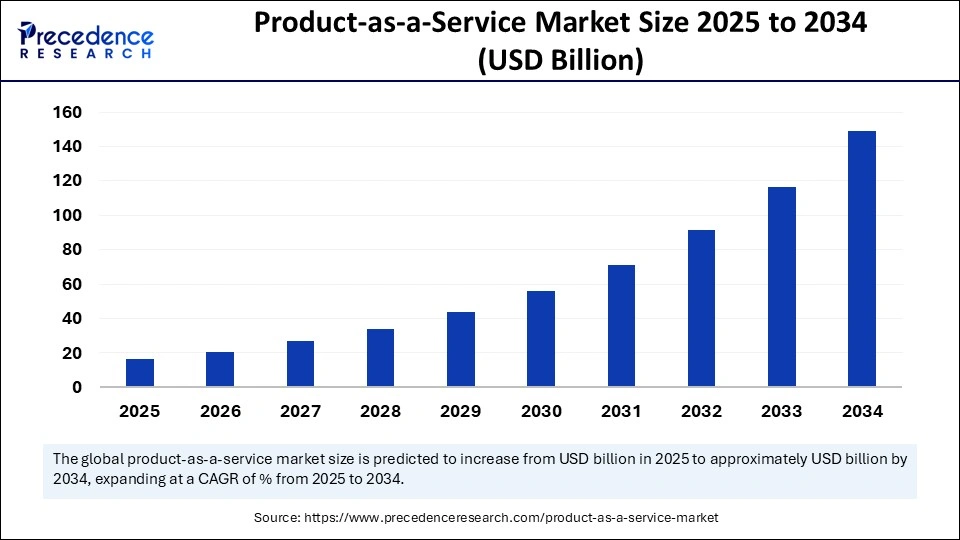

Product-as-a-service market lets customers use a product via subscription or pay-per-use, combining product access with service and support. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

Develops innovative products designed for long-term service, enhancing performance through data insights, remote monitoring, and predictive maintenance. The key factor driving market growth is rising consumer demand for cost-effective and flexible solutions. Also, the growing demand for customized solutions, coupled with the innovations in IoT and cloud computing, can fuel market growth further.

Artificial Intelligence plays a transformative role in the product-as-a-service market by optimizing rapid product development, enhancing customer experience, and efficient data-driven decision-making. Furthermore, AIaaS helps organizations access AI abilities without requiring robust in-house infrastructure or expertise, which makes it easier to combine AI into PaaS offerings. AI-driven chatbots and virtual assistants offer rapid customer support, improving overall customer satisfaction.

Product-as-a-service (PaaS) is the latest business approach where consumers utilize and access products through pay-per-use arrangements or subscriptions rather than directly purchasing them outright. Paas focuses on offering the benefits and outcomes of products, generally accompanied by services such as upgrades and maintenance. By retaining ownership and the product's lifespan, PaaS can optimize resource efficiency and sustainability.

| Report Coverage | Details |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Advancements incentives

PaaS models incentivize organizations to advance in product design and production. Products are created to be more rapidly upgraded, repaired, or adapted to shift consumer needs, boosting a culture of innovation and sustainability. In addition, PaaS models also involve sharing resources like shared vehicles, shared workspaces, or shared equipment. This trend facilitates collaboration, decreases the underutilization of assets, and optimizes overall resource efficiency.

Complex financial structure

Setting prices for PaaS component offerings can be challenging, as it requires a precise calculation of potential revenue volatility and total lifetime value. However, the flexible nature of PaaS can cause unpredictable revenue streams that need careful forecasting and cash flow management. Also, service firms may be required to develop new expertise and skills in customer acquisition and product marketing to effectively promote their PaaS offerings. Promote their PaaS offerings.

Raised customer engagement

By offering access to services and products rather than ownership, PaaS boosts closer consumer relationships and growth opportunities for ongoing support, customization, and personalized experiences. Furthermore, PaaS enables manufacturers to show the true value of their offerings by giving access to the advantages and outcomes they offer, other than just the physical product itself. PaaS provides a platform for manufacturers to create innovative revenue streams, like performance guarantees, selling product usage, or integrated services.

Asia Pacific held a notable product-as-a-service market share in 2024. The dominance of the region can be attributed to the increasing investments in cloud infrastructure by major market players, coupled with the ongoing adoption of innovative technologies in the region. Moreover, rising investment in digital infrastructure across emerging economies such as China and India is propelling the regional market expansion further.

In Asia Pacific, China led the product-as-a-service market owing to the surge in the middle-class population and the growing adoption of e-commerce services. PaaS solutions help organizations leverage these investments to facilitate transportation, warehousing, and distribution activities within the country.

North America, while carrying a significant share in the last decade, is expected to grow notably during the period studied. The growth of the region can be credited to the rising early deployment of PaaS-based software along with the growing investment in cloud services by major market players. Furthermore, major players such as Alphabet, Inc., IBM Corporation, Amazon Web Services, and Microsoft Corporation are investing heavily in cloud infrastructure.

In North America, the U.S. dominated the product-as-a-service market. The dominance of the region can be driven by major market players in the country continually finding ways to enhance operational efficiency and decrease costs in the supply chain operations. PaaS solutions provide opportunities to optimize processes and streamline resource utilization, impacting positive market growth.

Recent Developments

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

July 2024

December 2024

June 2024

November 2024