August 2024

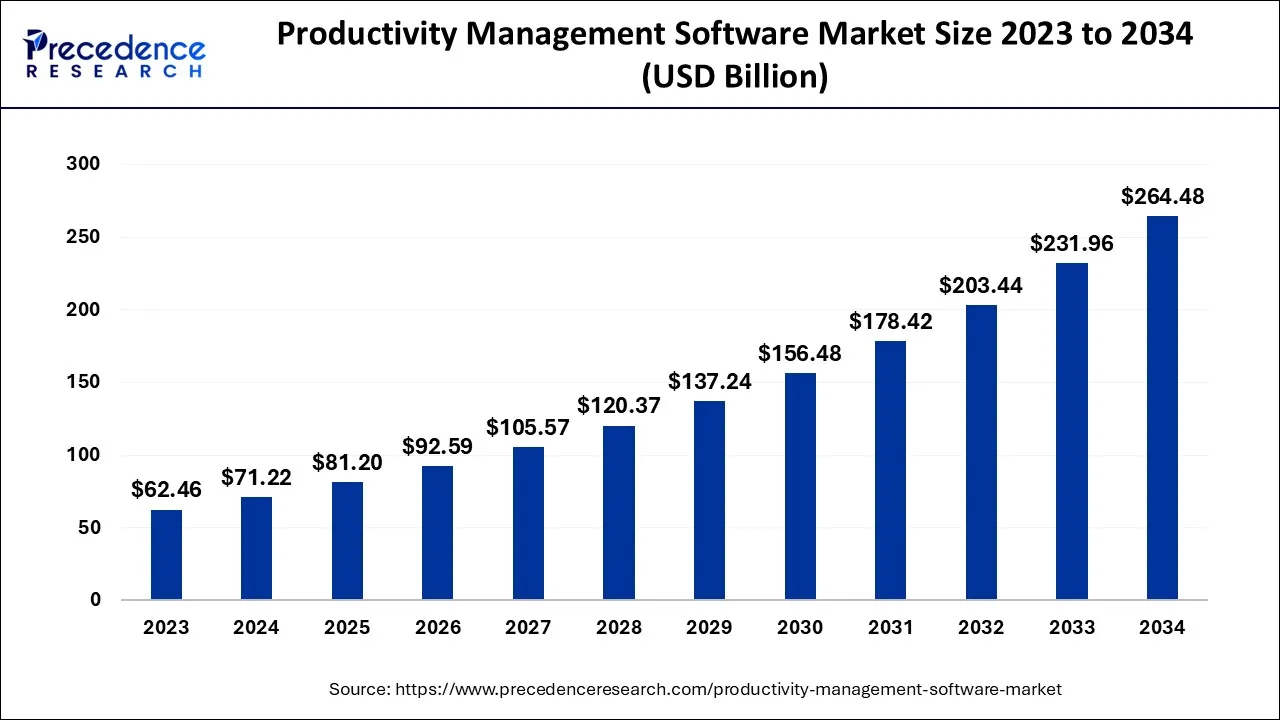

The global productivity management software market size accounted for USD 71.22 billion in 2024, grew to USD 81.20 billion in 2025 and is expected to be worth around USD 264.48 billion by 2034, registering a CAGR of 14.02% between 2024 and 2034. The North America productivity management software market size is calculated at USD 25.64 billion in 2024 and is estimated to grow at a CAGR of 14.18% during the forecast period.

The global productivity management software market size is calculated at USD 71.22 billion in 2024 and is projected to surpass around USD 264.48 billion by 2034, growing at a CAGR of 14.02% from 2024 to 2034. A group of applications known as productivity management software (PMS) tracks staff activity and gathers information for performance enhancement.

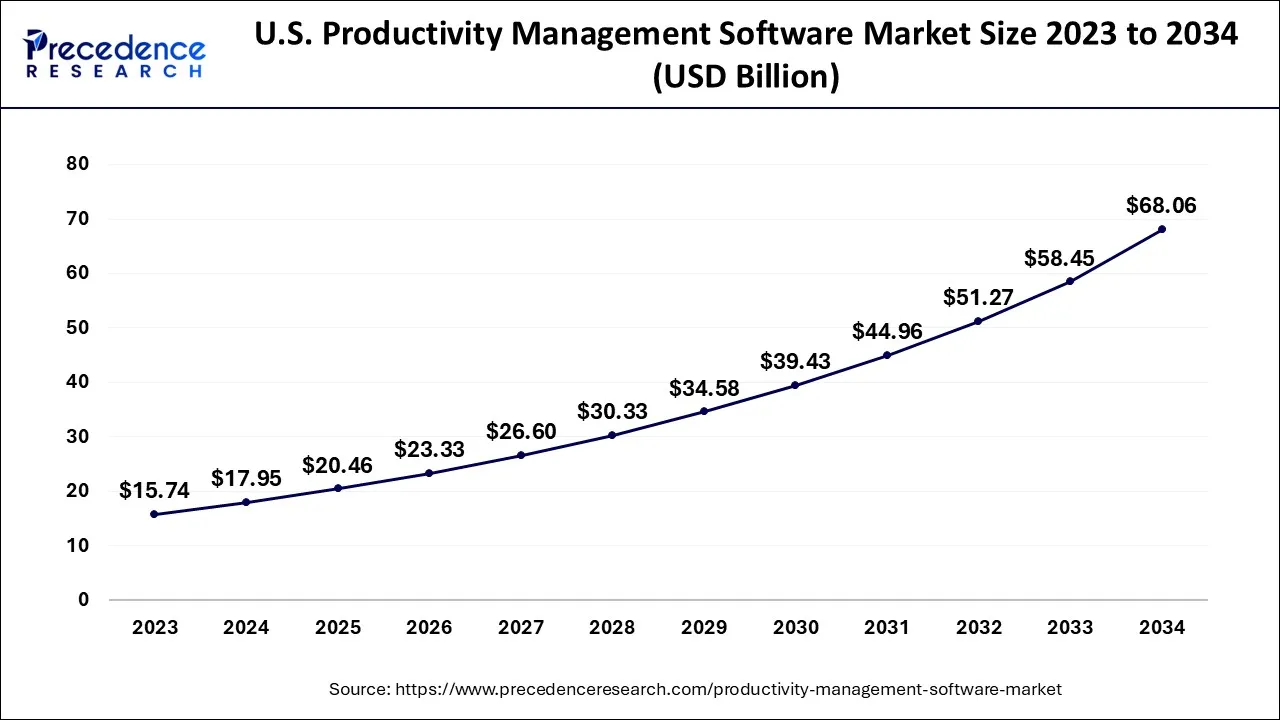

The U.S. productivity management software market size is exhibited at USD 17.95 billion in 2024 and is projected to be worth around USD 68.06 billion by 2034, growing at a CAGR of 14.26% from 2024 to 2034.

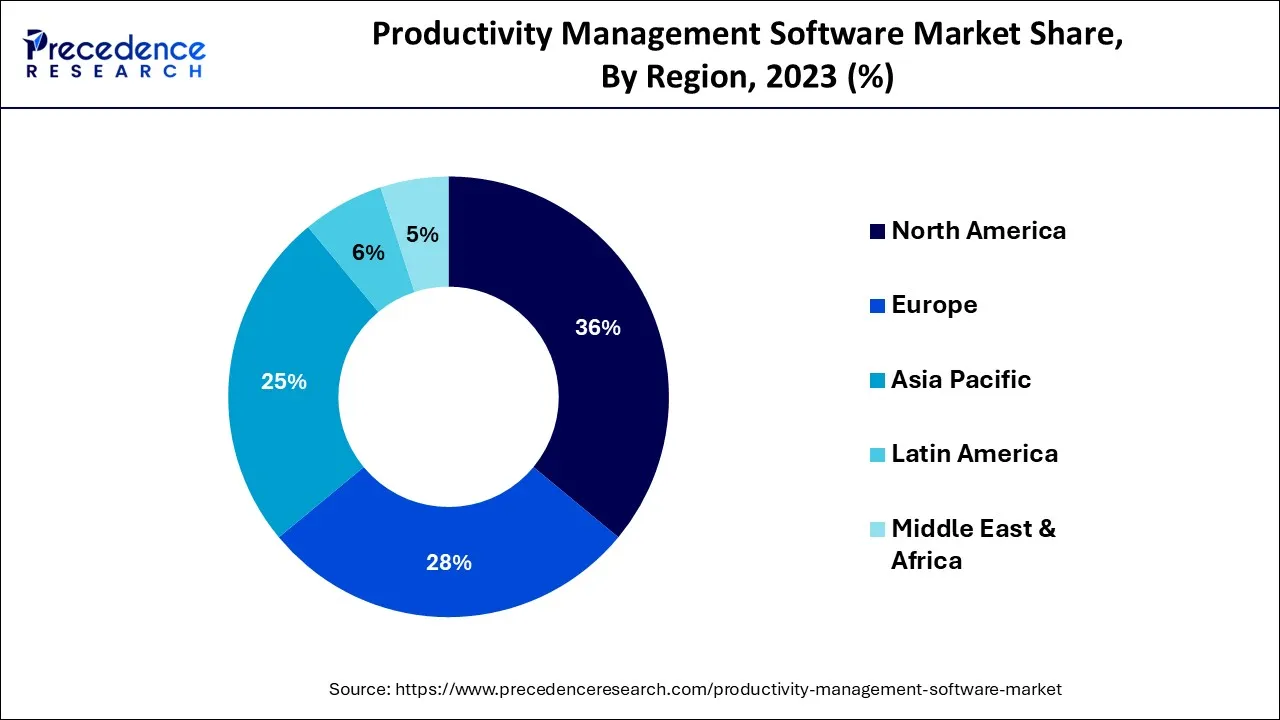

Due to the existence of significant businesses like Salesforce, Oracle, IBM Corporation, Microsoft Corporation, Adobe, and Google, North America had the biggest revenue share of about 36% in 2023 and is expected to continue to hold the dominant share throughout the forecast period. The growth is primarily ascribed to the increased use of PMS solutions to handle routine duties the high level of technological advancements, the presence of several leading market players, and the growing demand for automation, and optimization solutions in various industries and organizations' rapidly changing infrastructure. The industry would expand even more if AI and ML technologies were adopted more widely.

The productivity management software market in the Asia Pacific is anticipated to grow at the maximum CAGR of 15.50% between 2024 and 2034. Growth in the area is anticipated to be supported by emerging industry segments like healthcare, IT and telecom, BFSI, and others. Additionally, over the course of the projection period, the development of the regional market will be aided by the rising number of small and mid-size businesses in the regions.

The European region, including countries such as the United Kingdom, Germany, and France, is also a significant market for productivity management software, driven by the increasing focus on process optimization, cost savings, and efficiency gains. The Middle East and Africa region is also expected to witness growth in the productivity management software market, owing to the increasing adoption of technology, rising labor costs, and the growing demand for automation and optimization solutions in various industries.

The market is primarily being driven by the increasing need for businesses to handle duties and workflow in order to accelerate growth and the quickly expanding developments in machine learning (ML) and artificial intelligence (AI). Additionally, as workplace mobility, smartphones, and bring your own device (BYOD) become more widely used in business operations and as the mobile workforce grows, the demand for productivity management software will rise, driving the market's expansion.

Increasing efficiency also helps businesses beat out rivals on the market. Companies are more eager to cut running costs in order to make sizable earnings, and increased efficiency aids in the achievement of their profitability objectives. To enhance the working atmosphere and cut expenses, organizations are seeking to engage in technologically oriented solutions like productivity management software (PMS), which would provide them with centralized productivity management solutions.

The primary purpose of operational efficiency is to evaluate a company's profitability in relation to its running expenses. A company's or investment's activities are more effective the more lucrative it is. An examination of the economies of scale can also be gained from comparing output and organizational effectiveness. Organizations work to attain effective economies of scale in order to reduce per-unit expenses and increase per-unit profits. Performance improvement is a worry for executives and is the center of many technology projects and implementations.

Transparent business practices include effectiveness, small company sales, internal operations, sourcing, pricing, and business ethics. The operational effectiveness of the companies, for which employee productivity is a crucial factor, is also enhanced by increased business openness. Adopting technology-based options could assist businesses in resolving issues with organizational effectiveness and openness, resulting in higher financial returns. Hence, these variables could aid the development of the market in the forthcoming years.

| Report Coverage | Details |

| Market Size in 2024 | USD 71.22 Billion |

| Market Size by 2034 | USD 264.48 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 14.02% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Solution, Deployment, Enterprise Size, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Easy business evaluation and technological improvements

These contemporary methods and technologies have assisted businesses in increasing output. A company's effectiveness can be measured, which can be used to assess its success. The market is primarily being driven by the rising need for businesses to efficiently handle tasks and workflow, as well as the steadily improving machine learning (ML) and artificial intelligence (AI) technologies. The use of these apps is expanding along with the rate at which cell phones, laptops, and other technical devices are being adopted by people. Therefore, these elements working in concert are propelling this industry's market expansion.

Increasing adoption of cloud-based software solutions

The increasing adoption of cloud-based software solutions is driving the growth of the productivity management software market. The flexibility and scalability, cost savings, accessibility, automatic updates, and integration with other software are all factors contributing to the growth of the market. As more businesses adopt cloud-based productivity management software solutions, the market is likely to continue to experience significant growth and innovation. Cloud-based software solutions are highly flexible and scalable, making them an attractive option for businesses of all sizes.

These solutions can be customized to meet the specific needs of each business and can be easily scaled up or down as needed to accommodate changing needs. Cloud-based software solutions are typically less expensive than traditional on-premise software solutions, as they do not require businesses to purchase or maintain expensive hardware or IT infrastructure. This makes cloud-based solutions an attractive option for small and medium-sized businesses that may have limited budgets. These factors ultimately lead to the rising adoption of cloud-based software solutions which in turn expands the growth of the productivity management software market.

High expense and privacy issues

The expensive deployment costs of efficiency management software products limit market expansion. As interaction is required for the profits and losses to be clearly known, the business suffers from the absence of direct employee involvement. Employee privacy concerns are a major barrier to the market's expansion. Because this software tracks employee activities and productivity, there may be concerns about employee privacy and data protection.

This can be particularly concerning in industries that are highly regulated, such as healthcare or finance. To address these concerns, software providers need to ensure that their software is secure and complies with privacy regulations.

Resistance to change

Resistance to change is one of the primary challenges that the production management software market faces. This challenge arises because many businesses are accustomed to using traditional methods of tracking productivity and may be hesitant to adopt new technology and change their existing workflows. One of the reasons for this resistance to change is the fear of disrupting established processes. Businesses may be hesitant to switch to new software because they fear that it may cause delays, disrupt productivity, or lead to other negative outcomes. They may also worry about the costs associated with implementing new software, such as training costs or the cost of purchasing new hardware.

Using cloud computing techniques

Cloud-based technology is being adopted by businesses more frequently. An increasing number of companies are storing their apps and data in the cloud using management tools. Project management tools that are cloud-based make it simpler to plan, work on, watch over, and finish tasks. Project managers finish work using a network of tools accessible within the software instead of a standard whiteboard and sticky notes.

The implementation of productivity management software (PMS) differs by company and team. However, it is designed to make project management and deadline management more straightforward and more effective. Cloud-based productivity management systems are not only affordable but also low maintenance.

The desire for a work-from-home setting increased as a result of the pandemic epidemic. As work-from-home policies were accepted by more companies, online work administration became necessary, necessitating digitization. Thus, more people are using work management apps. Many businesses are using these strategies to cut costs in order to turn a profit, and the rise in output will enable them to meet their objectives. In the modern era, businesses are implementing technology-based methods to increase income. These elements present a chance for the market for efficiency management tools to expand.

In 2023, the market was led by the content management and teamwork sector, which brought in more than 36% of the total income. Workflow administration, file sharing, task and project management, and communication are just a few of the topics covered in this section. By removing the bottleneck in the feedback and review processes, the content management and collaboration software makes working together on business tasks faster and more approachable. By bringing communications, information, and context together in one location, the solution facilitates productivity and supports the segment's development.

During the projection period, the sector for artificial intelligence and predictive analytics is expected to have the greatest CAGR of over 15.0%. The section features software that makes use of machine learning, Intelligence, statistical algorithms, and data mining techniques. The business can use this software to convert data into forecast insights, increase organizational efficiency, and conduct an in-depth analysis of current data to find trends in past events. The increased use of several risk analytics solutions for risk detection and risk reduction strategies can be linked to the development of the artificial intelligence and predictive analytics market.

In 2023, the cloud-based PMS market category had the highest revenue share, exceeding 56%. This involves hosting the productivity management software on a cloud-based server, which users can access over the Internet. Cloud-based deployment is more cost-effective and requires less IT expertise. The increasing trend among companies toward digital transformation and accelerated client interaction, both of which reduce enterprise costs, is another factor influencing the uptake of cloud-based solutions.

In the upcoming years, the productivity management software market's on-premise implementation sector is anticipated to experience a substantial CAGR of 7%. The big businesses that use the on-premise implementation of productivity management software are responsible for a sizeable portion of the revenue share for this method of software distribution. On-premise solutions can be expensive initially, but they have the advantage of reduced operating expenses over the long run. Security issues with cloud implementation for businesses are another factor driving the segment's expansion.

In 2023, the Small and Medium-Sized Enterprises (SMEs) category accounted for more than 50.0% of total income. driving factors behind the growth of the productivity management software market in the small and medium-sized enterprises (SMEs) segment include, increasing adoption of cloud-based solutions, and growing awareness of the benefits of productivity management software solutions. Additionally, over the course of the forecast period, the demand for productivity management software is anticipated to rise as the number of big businesses in emerging and established countries increases.

Over the projection period, the SMEs sector is also expected to have the greatest CAGR of 18.5%. Productivity management software assists SMBs in reducing expenses, eliminating repetitive chores, prioritizing work, and enhancing teamwork. The expansion can be ascribed to the rise in Businesses in developing nations like China and India. Additionally, SMEs' growing need for efficient management software solutions to streamline processes and cut costs is anticipated to fuel market expansion.

Segments Covered in the Report:

By Solution

By Deployment

By Enterprise Size

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

April 2025

September 2024

November 2024