January 2025

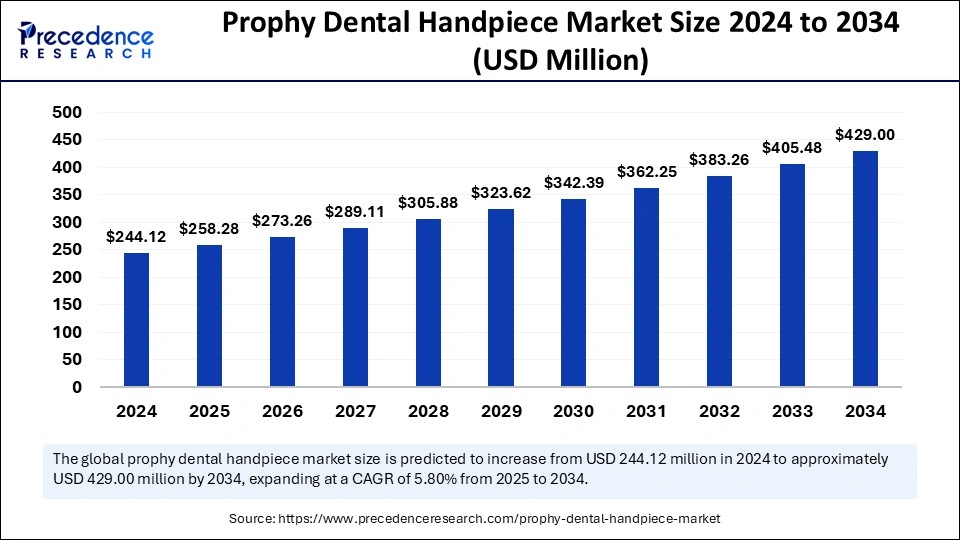

The global prophy dental handpiece market size is calculated at USD 258.28 million in 2025 and is forecasted to reach around USD 429 million by 2034, accelerating at a CAGR of 5.80% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global prophy dental handpiece market size accounted for USD 244.12 million in 2024 and is predicted to increase from USD 258.28 million in 2025 to approximately USD 429 million by 2034, expanding at a CAGR of 5.80% from 2025 to 2034. The prophy dental handpiece market is growing due to increasing demand for preventive dental care. Furthermore, technological advancements and growing dental tourism contribute to market growth.

Artificial intelligence is greatly revolutionizing the prophy dental handpiece market through improved efficiency, precision, and usability. AI-based algorithms can analyze the torque, speed, and vibration of handpieces in real time to optimize performance while minimizing hand fatigue. For instance, AI-enhanced handpieces like NSK iProphy and Bien-Air’s SMART series implement intelligent speed regulation to enable consistent performance. Predictive maintenance also plays an important role in assisting Easy to Service (E2S) products. Using AI technology, these products can track wear patterns, such as loss of torque or power, and predict when servicing will be needed before the motor fails.

AI is enabling personalized settings, allowing the handpieces to identify users' preferences that indicate exactly how much torque/speed settings they want a handpiece to run at for all the dentists who use that handpiece. Emerging technologies are focusing on AI-enabled diagnostics, with handpieces equipped with sensors that measure resistance encountered during polishing to determine enamel health status in real-time. These improvements will improve clinician efficiency, permit gentler, more precise procedures, and improve patient comfort.

The prophy dental handpiece market entails the sector that produces, distributes, and innovates handpieces designed for use in professional dental cleaning and polishing procedures. Such dental handpieces serve as important equipment for preventive dentistry as they are used to remove plaque, stains, and biofilm to enhance the oral health of patients. Dental professionals consistently utilize prophy handpieces during routine prophylaxis treatment, providing effective and comfortable dental cleaning and polishing for patients.

The prophy dental handpiece market is anticipated to grow steadily due to increasing demand for preventive care and advances in dental technology. Manufacturers are innovating lighter, more ergonomic and cordless prophy handpiece designs to improve ease of use and reduce operator fatigue. Features that involve autoclavable and disposable options are also seeing increased importance in addressing improved hygiene needs.

| Report Coverage | Details |

| Market Size by 2034 | USD 429 Million |

| Market Size in 2025 | USD 258.28 Million |

| Market Size in 2024 | USD 244.12 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.80% |

| Dominated Region | North America |

| Fastest Growing Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Power Supply, Usage, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising Prevalence of Dental Diseases

The rising prevalence of oral diseases is a key factor driving the growth of the prophy dental handpiece market. An increase in poor diet, sugar consumption, a lack of oral hygiene, and tobacco usage has worsened the endemic rise in periodontal disease, cavities, and tooth decay. According to a report published by the World Health Organization (WHO) in March 2025, approximately 3.7 billion people are affected by oral disease every year, with increased incidence rates observed recently (i.e., an increase of 50% in the last 30 years). New data indicates that global dental visits for preventative care have increased by 18% in 2024 as more and more people seek regular cleaning and prophylaxis treatments to avoid expensive dental treatments.

High Cost of Advanced Prophy Dental Handpieces

A major restraining factor of the prophy dental handpiece market is the high cost of advanced dental handpieces. New prophy handpieces, especially those powered by electric and/or air-driven technology, can be costly due to their highly engineered parts, ergonomic design, and durability. For instance, even high-end electric handpieces may range from USD 1,000 to USD 3,000 each, and the procurement of such an item is usually not in the budgets of small dental clinics, private practices, or emerging economies.

Moreover, substantial investment is required to repair and/or replace less durable parts of the handpiece, adding to the overall maintenance expense. This discourages dental professionals from spending on prophy dental handpieces. Furthermore, the availability of low-cost options limits the broader acceptance of modern electric handpieces, especially in developing economies.

Demand for Electric Prophy Handpieces

The rising preference for electric handpieces over air-driven options creates immense opportunities in the prophy dental handpiece market. Electric handpieces feature consistent torque, quieter, and more precision, enhancing patient comfort and dentist efficiency. Key players operating in the market are focusing on expanding their portfolio to meet varying consumer demands. In October 2023, NSK America introduced the Ti-Max Z2 Series of air turbine dental handpieces with "DYNAMIC POWER SYSTEM" rotor technology, which offers consistent and smooth power delivery along with decreased vibration and noise while generating increased cutting strength for the dentist. These developments align with the growing demand for dental products, supporting minimally invasive procedures and overall patient experience.

The contra-angle dental handpieces segment held the largest market share in 2024. This is mainly due to their versatility and the ability to provide high-precision restorative and prophylactic procedures. The contra-angle dental handpieces allow access to posterior teeth and maximize torque efficiency. They are a suitable alternative to both general practice and specialty practice. The high-speed variants of contra-angle handpieces offer the ability to remove plaque and polish and elevate the clinical outcome quickly. Due to continued engineering advances and advances in technology, contra-angle dental handpieces continue to be the standard of care in professional dental care.

The straight prophy dental handpieces segment is anticipated to grow at a remarkable CAGR in the coming years due to their ergonomic design and ease of use. Their lightweight construction reduces fatigue to the hand, making them the preferred choice among dental professionals. The increase in the desire for preventive dental care and the growing desire for polishing procedures in routine check-ups further boost the segment growth. Advancements in material compositions such as titanium and fiber-optic integration elevate the use, enhancing the performance of straight prophy dental handpieces.

The electric driven segment captured the largest share of the prophy handpiece market in 2024. Electric-driven handpieces are widely preferred for their constant power supply and efficiency compared to air-driven handpieces. Electric handpieces provide higher torque and are less noisy, making them suitable for extended procedures, unlike air-driven handpieces. Electric-driven handpieces have superior efficiencies and enhanced performance, increasing patient comfort. Thus, they are gaining popularity in large, high-end dental clinics and hospitals. Recent improvements in motors have solidified the electric-driven prophy dental handpieces position in the market.

The battery operation segment is expected to expand at a significant rate over the studied period. The segment growth can be attributed to the rising demand for portability and flexibility in dentistry. Battery-operated prophy handpieces are cordless, which makes them perfect for mobile dental practices, home dental care, or remote clinics. The increase in minimally invasive and patient-centered dentistry resulted in a greater adoption of the cordless battery-operated prophy handpiece. Additionally, advancements in lithium-ion batteries resulted in longer run times and faster charging, all of which contribute to their popularity in various dental clinic practices.

The reusage segment dominated the prophy dental handpiece market by capturing the largest share in 2024 due to their cost-effectiveness and durability. They are built for long-term use due to sterilization, making them the preferred choice for practices with lots of patients. Many dental clinics buy high-quality reusable handpieces because they provide better long-term returns than disposables. Recent advancements in technology and antimicrobial coatings are elevating the standard of hygiene of these handpieces. These factors support the continued use of reusable handpieces in the market.

The single-use segment is expected to expand at a rapid pace over the projected period, primarily because of growing concerns about potential cross-contamination and infection control. This has come into focus more since the pandemic because there has been a growing emphasis on strict sterilization processes and the use of disposable handpieces. Regulatory groups and other health organizations are encouraging the use of single-use devices to reduce hospital-acquired infections.

The dental clinics segment dominated the prophy dental handpieces market in 2024. This is due to the high volume of prophylactic procedures performed in dental clinics. As patients have become more aware of hygiene and oral health, the visits to dental clinics have increased in the last year. This encouraged dental clinics to continue to purchase the newest equipment to increase productivity and comfort for their patients. Private and multi-specialty dental clinics also utilize high-performance handpieces to improve workflow and decrease total time for procedures.

The ambulatory surgical centers segment is projected to grow at the fastest rate during the forecast period. The segment growth is mainly attributed to the rising shift toward an outpatient care model due to its cost-effectiveness and easy accessibility. ASCs typically provide care in a multidisciplinary center with advanced technology treatment with dental procedures as an alternative to hospital-based care. The rapid growth of ASCs, especially in developed countries, contributes to market growth.

North America’s Stronghold on the Prophy Dental Handpiece Market

North America dominated the market with the largest share in 2024. The market growth in the region is driven by established healthcare infrastructure and a focus on preventive care. The rising incidences of oral disease and increasing awareness of dental hygiene are boosting demand for newer dental tools. Electric-driven handpieces are gaining traction due to their precision, efficiency, and ability to streamline dental procedures. Dental practitioners are continuing to welcome technological refinements like ergonomic designs and noise reduction features. The presence of some of the leading dental equipment manufacturers in North America guarantees they continue to innovate and make high-quality prophy handpieces available.

The U.S. is a major contributor to the North American prophy dental handpiece market. This is mainly due to the increasing establishment of dental facilities as well as the number of dental professionals in practice. In addition, government measures to promote oral health awareness and encourage regular dental check-ups and prevention have further aided market growth. The development of a comprehensive network of dental clinics with an increased reliance on advanced equipment further supports the growth of the market.

Digital Advancements and Aging Populations to Propel European Prophy Dental Handpiece Market Growth

Europe is expected to witness the fastest growth in the coming years due to factors like increasing disposable incomes and a growing awareness of oral healthcare. In the first quarter of 2024, some countries, including Poland (10.2%), Portugal (6.7%), and Italy (3.4%), experienced a noticeable increase in real household income per capita and thereby had the ability to spend more on preventive and cosmetic dental treatments. A growing prevalence of periodontal disease, along with an aging population, has driven the demand for professional dental cleaning implements. Technological advances and the advent of cordless prophy handpieces have also improved the efficiency and ease of the treatment paradigm.

In the UK, the increasing popularity of cosmetic dentistry is one of the major driving forces within the market. The increase in the number of private dental clinics boosts the demand for high-end dental equipment. Moreover, social media trends, including beauty influencers, have contributed to the increased interest in tooth whitening and smile makeovers, leading to significant demand for high-end prophy handpieces. Government programs that promote oral hygiene, such as awareness campaigns/public programs and dental outreach programs, further support market growth.

Asia Pacific Prophy Dental Handpiece Market Trends

Asia Pacific is observed to grow at a significant rate due to the rising disposable incomes, growing aging population, and improved healthcare infrastructure. Furthermore, the expansion of dental clinics and hospitals in developing economies is boosting the demand for modern and sophisticated dental equipment. There is an increase in the uptake of digital dentistry and CAD/CAM systems in countries like India, Japan, and South Korea, which improves treatment time and quality of care. Medical tourism has also emerged as a contributor, as international patients seek economically priced quality dental care across Asian countries.

China is expected to have a stronghold on the market as its dentistry sector has been growing rapidly. The number of dental hospitals and clinics has expanded tremendously in the last few years, in line with the increase in demand for oral care services. There is a rising awareness of oral hygiene, supporting market expansion.

By Product Type

By Power Supply

By Usage

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

May 2024

October 2023

October 2023