January 2025

Protection Relay Market (By Voltage Range: Low, Medium, High; By Application: Feeder Protection, Transmission Line Protection, Transformer Protection, Generator Protection, Motor Protection, Emergency Shutdown Systems (ESD), Other Applications; By End-user Industry: Utilities, Industries, Railways, Other End-user Industries) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

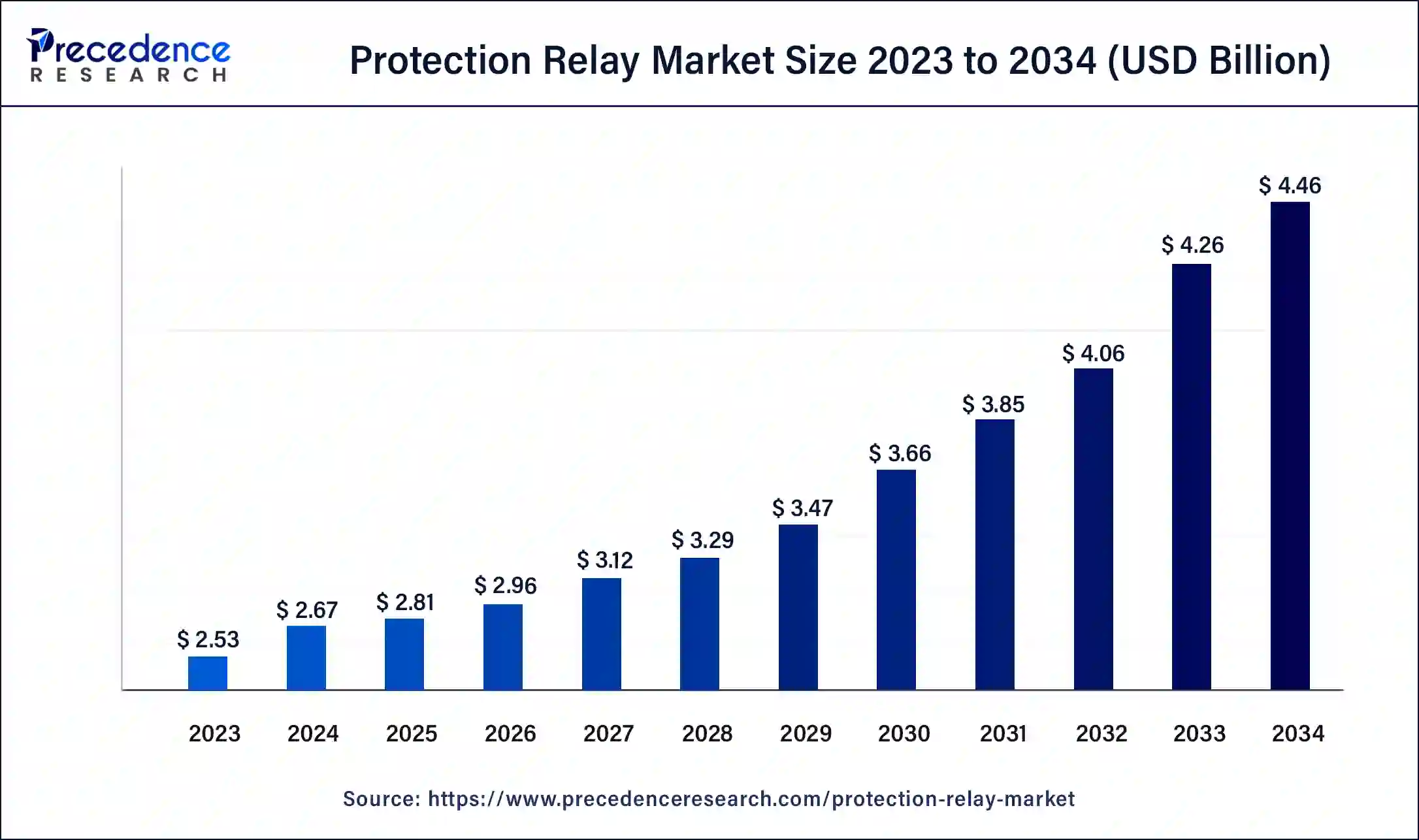

The global protection relay market size was USD 2.53 billion in 2023, accounted for USD 2.67 billion in 2024, and is expected to reach around USD 4.46 billion by 2034, expanding at a CAGR of 5.3% from 2024 to 2034.

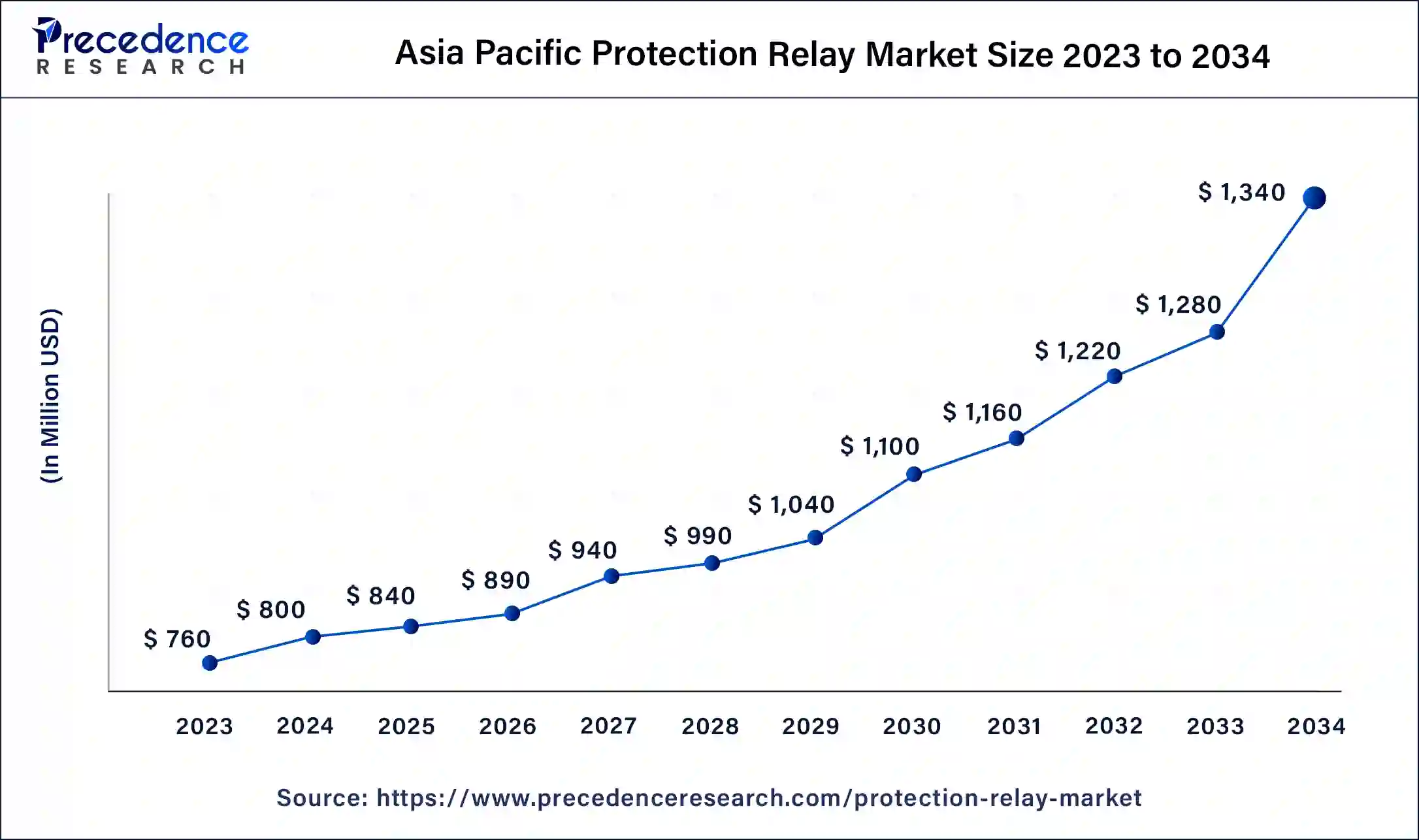

The Asia Pacific protection relay market size was estimated at USD 760 million in 2023 and is predicted to be worth around USD 1,340 million by 2034, at a CAGR of 5.5% from 2024 to 2034.

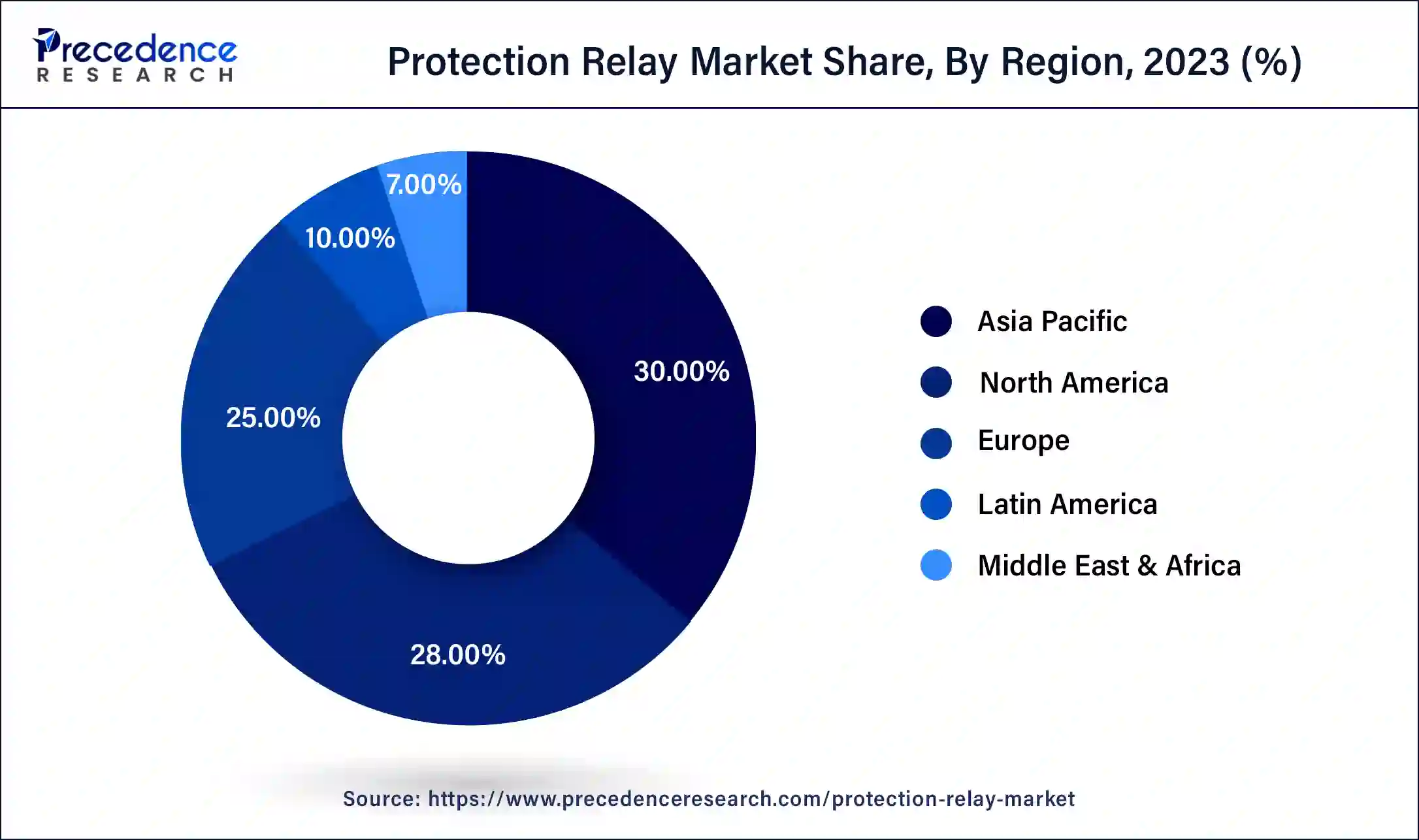

Asia Pacific accounted for the largest share of the global protective relay market in 2023; the region is anticipated to continue its growth during the forecast period owing to the increasing demand for electricity, presence of prominent market players, rapid industrialization, increasing investment in transmission and distribution infrastructure, and rising personnel safety in the workplace. The rising population in the Asia Pacific countries such as China, India, and Japan has accelerated the demand for residential infrastructure, therefore supporting the demand for electricity and spurring the demand for protective relays.

Asia Pacific global protection relay market is growing due to the increasing investment in renewable energy sources. For instance, to meet India’s 500-gigawatt renewable energy target which aims to address the annual issue of coal demand-supply mismatch, the Indian Ministry of Power has identified 81 thermal units that are aimed to replace coal with renewable energy generation by 2026.

North America would exhibit the highest CAGR from 2024-2034

On the other hand, North America is the fastest-growing region for the electrical enclosure market due to the increasing demand for electricity, the well-established power sector, the rapid progress of industrialization, and the rapid growth of renewable energy sources. As per the US Energy Information Agency, in 2022, about 4.24 trillion kWh of electricity was generated at utility-scale electricity generation facilities in the US. Nearly 60 percent of this electricity generation was from fossil fuels and 22 percent was from renewable energy sources. Several governments in North America are coming up with various initiatives to produce renewable energy sources and is expected to increase the demand for protection relays.

A protective relay is a switchgear that detects any fault in the electrical power grid and in less than no time, it also helps in starting the operation of the circuit breaker to isolate the faulty section from the rest of the system. It is installed in the electric system to monitor any abnormal or faulty conditions in the circuit. Protective relays are the essential components of modern electrical systems and play an important role in protecting electrical systems. Protective relays detect any faults or dangerous conditions and initiate the most appropriate responses to prevent damage and ensure equipment and personnel safety. A protective relay is a smart device that receives inputs, compares them with set points, and delivers output.

The inputs or electrical quantities that may change under defective conditions are current, voltage, power, frequency, pressure, temperature, flow, and vibration. The outputs it provides can be a visual response such as control warnings, communication, indicator lights, alphanumeric display, and turning the power on and off. A protective relay continuously monitors the voltage and current using CTs and PTs. One of the key functions of the protective relay is to issue a trip command to the breaker under abnormal operating conditions.

The use of protective relays in the electrical system provides uninterrupted electrical supply. Protective relays can reduce damage to the electrical components and equipment in cases of electrical failure. The ongoing increasing need for seamless and hassle-free electrical service led to the increasing demand for protective relays in the electrical system. Protective relays are indispensable in the prevention of equipment damage caused by overvoltage, overcurrent, or any other electrical faults. Protective relays quickly separate faulty sections to avoid any further damage to the electrical system. It improves the safety of personnel working with electrical systems and reduces the risk of electric shock and injuries.

| Report Coverage | Details |

| Market Size in 2023 | USD 2.53 Billion |

| Market Size in 2024 | USD 2.67 Billion |

| Market Size by 2034 | USD 4.46 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.4% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Voltage Range, By Application, and By End-user |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The rapid adoption of renewable sources of energy is anticipated to fuel the growth of the protection relay market during the forecast period. Several environmental issues related to fossil fuels such as coal, oil, and gas are continuously promoting renewable sources of energy such as solar, wind, hydropower, biomass, and others derived from natural sources. Renewable energy sources are abundant and all around us. Renewables are cheaper than fossil fuels and produce far lower emissions than burning fossil fuels.

Fossil fuels are burned to generate energy and cause harmful greenhouse gas emissions, such as carbon dioxide. Renewable energy is the most secure and sustainable solution to meet the growing energy demand across the globe in the coming years. Prominent players across the globe are coming up with smart products that use renewable energy sources. Electricity obtained from solar energy has the potential to improve energy security and partially fulfill global electricity demand.

According to the report from the International Energy Agency published in June 2023, global renewable capacity additions could reach 550 gigawatts in 2024. The International Energy Agency (IEA) said in a new report in June 2023, that the supply of renewables needs to accelerate to reach almost 13% expansion annually over 2023-2030 to match with the Net Zero Emissions (NZE) Scenario. The increasing demand for solar energy coupled with the rising installation of the smart grid system, is one of the key drivers of demand for protective relays during the forecast period. A smart grid uses Protective Relaying Devices at multiple operational layers and in multiple applications to prevent or lessen power outages and supply interruptions. The rapid expansion of power substation buildings across the globe is expected to boost the market expansion.

The fluctuation in the prices of raw materials of the protection relay is anticipated to hamper the market's growth rate during the forecast period. Copper, Iron, steel, Silver Nickel, and others are the major raw materials used in manufacturing relays. The prices of raw materials are volatile in nature and may adversely impact the protection relay market during the forecast period. Additionally, supply chain disruptions can be caused due to the fluctuations in the raw material prices. Such volatility in prices can cause major shift in demand and even changes in the prices of final product. Thus, the element is observed to act as a major restraint for the market’s expansion.

The rising government investment in the electrical power sector is projected to offer lucrative opportunities to the prominent market players in the protection relay market. As electricity requirements continue to increase globally, it is expected to improve the reliability of power systems as well as investments in power infrastructure. This leads to growing demand for protective relays to ensure reliable and secure power distribution and transmission.

On 6th April 2023, an announcement made by India’s Union Power & NRE Minister, India 27,000 circuit km of transmission lines are to be added at an investment of Rs. 75,000 crores by 2024-25. The transmission system plays a crucial part in the delivery system of power by establishing the connection between the generating stations and the distribution system, which is connected to the consumer. The transmission grids are being set up and electrification programs are being carried out across the globe. Solar electricity along with rising investments and the installation of the smart grid is projected to fuel the growth of the global protective relay market.

The motor protection segment holds the largest share of the protection relays market. The rapid growth of the manufacturing and commercial sectors is expected to fuel the demand for motor protection. Motor protection is widely used to protect an electric motor from various external and internal faults and damages. An electric motor is an important component of many domestic and industrial applications, varying from small appliances to large machines. It is crucial to ensure the proper functioning and safety of the motor and its circuit. Moreover, the protection relay prevents the disturbance from spreading back into the grid. On the other hand, transmission line protection is expected to witness a significant increase during the forecast period owing to the growing demand for energy, technological advancement, and rising focus on grid modernization.

The medium voltage segment is expected to continue its dominance during the forecast period owing to the rising use of medium voltage protective relays in power systems and substations. The medium voltage is suitable for many applications across the industrial and residential sectors. The increasing electricity demand in the residential sector also accelerates the growth of the market.

The utilities segment is the leading segment of the market; the growth of distribution networks along with the refurbishment of old electromechanical protective relays with new and advanced numeric relays are anticipated to boost the segment growth during the forecast period. Increasing adoption of protection relay results in a seamless supply of power to its ultimate customers. The rising use of protective relays in utilities in multiple applications such as feeders, transformers, busbars, and others.

Recent Developments:

Market Segmentation:

By Voltage Range

By Application

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

December 2024