August 2024

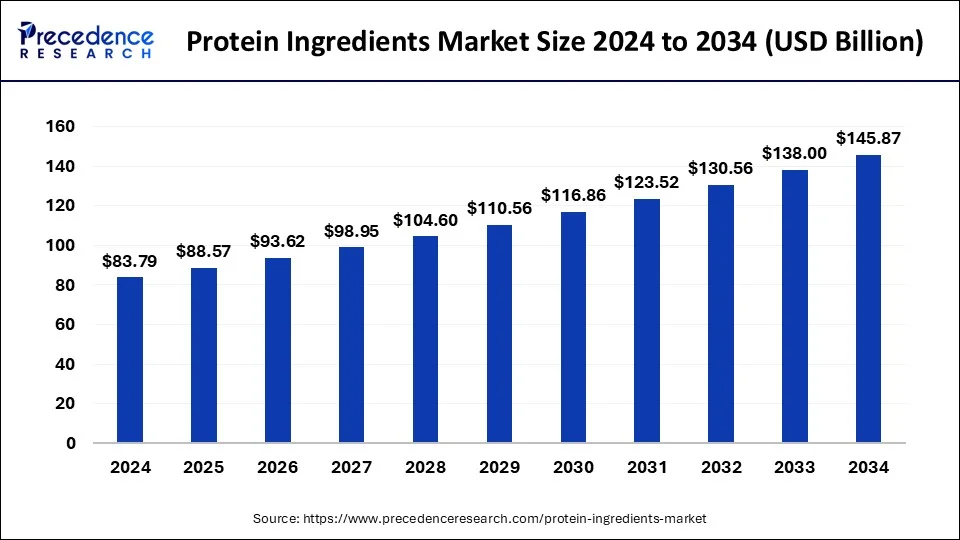

The global protein ingredients market size is calculated at USD 88.57 billion in 2025 and is forecasted to reach around USD 145.87 billion by 2034, accelerating at a CAGR of 5.7% from 2025 to 2034. The protein ingredients market size surpassed USD 34.35 billion in 2024 and is expanding at a CAGR of 5.74% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global protein ingredients market size was USD 83.79 billion in 2024, estimated at USD 88.57 billion in 2025, and is anticipated to reach around USD 145.87 billion by 2034, expanding at a CAGR of 5.7% from 2025 to 2034.

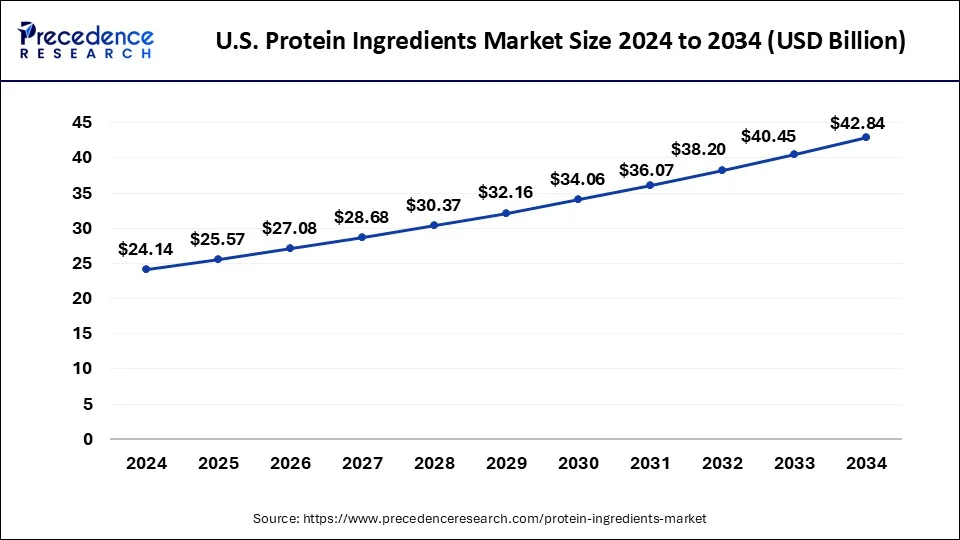

The U.S. protein ingredients market size was estimated at USD 24.14 billion in 2024 and is predicted to be worth around USD 42.84 billion by 2034, at a CAGR of 5.9% from 2025 to 2034.

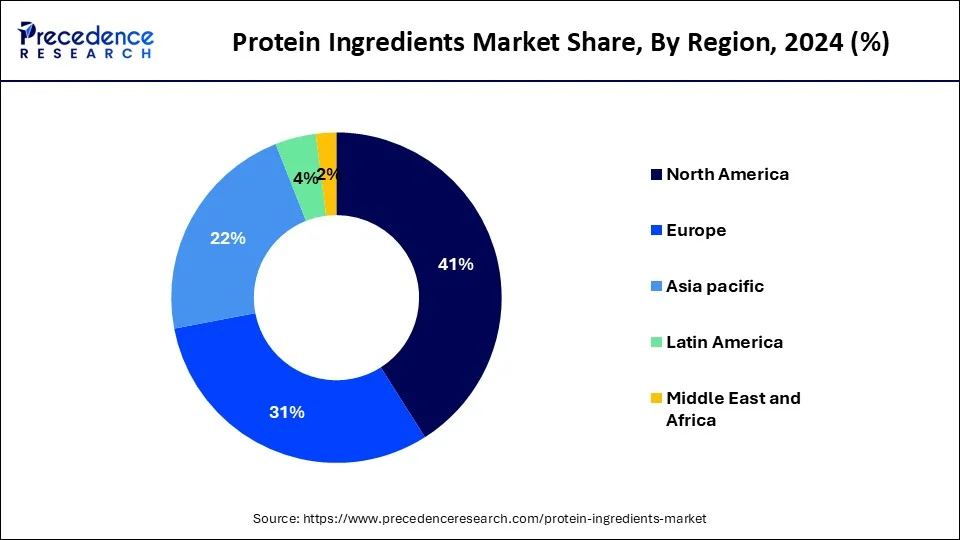

North America region led the market in 2024 with revenue share of around 41%. The North American protein ingredients market size was valued 12,650 million in 2020. The growing trend of consuming healthy and nutritious food products is driving the growth of North America protein ingredients market. The other factors driving the growth of protein ingredients market in North America region are shift in consumer patterns and growing demand for vegan food products. The evidence by the United States Department of Agriculture that soy protein lowers the risk of heart disorders has propelled the protein ingredients market in the U.S. and surged the demand for other vegan proteins.

Asia-Pacific is expected to develop at the fastest rate during the forecast period. India and China dominate the protein ingredients market in Asia-Pacific region. The growth of Asia-Pacific protein ingredients market is being driven by the surge in demand for animal and plant protein ingredients. The other factors contributing towards the growth of protein ingredients market in Asia-Pacific region are economic development and expansion of food and beverage and healthcare sectors.

One of the significant factors driving the growth of global protein ingredients market is rising consumer awareness regarding healthy and nutritious food products. In addition, the growing demand for plant-based proteins is also contributing towards the growth and development of global protein ingredients market. Moreover, dieticians and doctors are recommending people to consume proteins on a large scale. This is attributed to the growing prevalence of chronic disorders and infections. Furthermore, the surge in the number of geriatric people is also boosting the expansion of global protein ingredients market.

Due to the rapid rise of the global population and growing consumer awareness of health and nutritional meals, the global protein ingredients market is expanding dramatically. The consumer knowledge of the advantages of a protein rich diet has boosted the demand for protein components in the infant formulation, nutritional supplement, and food and beverage industries all over the world. In addition, the surge in demand for soy protein is also propelling the growth of protein ingredients market. The Food and Drug Administration approved a health benefit for lowering LDL cholesterol through nutritional recommendations that recommend four meals of soy per day to help lower LDL cholesterol levels by 10% in the body.

The government all around the world is taking constant efforts for the development of global protein ingredients market. The government is investing for the expansion of food and beverage industry. This is directly impacting the growth and expansion of global protein ingredients market. Moreover, the government of emerging nations is collaborating with market players for increasing market reach in the market. The government is also conducting awareness programs for the promotion of protein ingredients among people. Thus, all of these aforementioned factors are driving the growth of global market.

The key market participants are employing a variety of tactics in order to meet rising product demand while also lowering total costs by lowering raw material and labor prices. Due to the existence of organized and unorganized market structures in emerging and established nations, there is a great potential for public, small, and internationally famous firms in the global protein ingredients market. To grab growing markets and combat with domestic firms, major market players are pursuing acquisitions and mergers. The strategy has also aided corporations in expanding distribution networks in order to improve product supply across regions.

| Report Coverage | Details |

| Market Size in 2024 | USD 83.79 Billion |

| Market Size in 2025 | USD 88.57 Billion |

| Market Size by 2034 | USD 145.87 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.7% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Form, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The animal proteins segment accounted for a revenue share of around 71% in 2024. The growth of the segment is attributed to a rise in health and fitness consciousness. Furthermore, animal protein is widely employed in a variety of applications, including pet food and cosmetics, whereas egg and milk proteins are often used in confectionary and baking items.

The plant proteins segment is fastest growing segment of the protein ingredients market in 2023. The expansion of the segment can be attributed to the low cost of plant proteins as compared to animal proteins. The consumers are gradually adopting plant protein sources since they are perceived to be healthier and more nutritious than their animal-based alternatives.

The food and beverages segment dominated the market in 2024 with a revenue share of 40%. The customers are increasingly focusing on healthy diets with low fat and high nutritive value foods, leading to an increase in the consumption of protein components. As a result, there is a growing need for functional and nutritional food.

The infant formulations segment is expected to hit strong growth from 2025 to 2034. The premixes for infants can contain either plant or animal proteins. The milk protein isolates and concentrates are commonly utilized in newborn formulae. The liquid ready to eat and powder or liquid versions of the products are available on large scale. The non-fat milk, partially hydrolyzed whey protein, and casein concentrates are all products made from cow milk.

By Product

By Application

By Form

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2024

February 2025

November 2024