April 2025

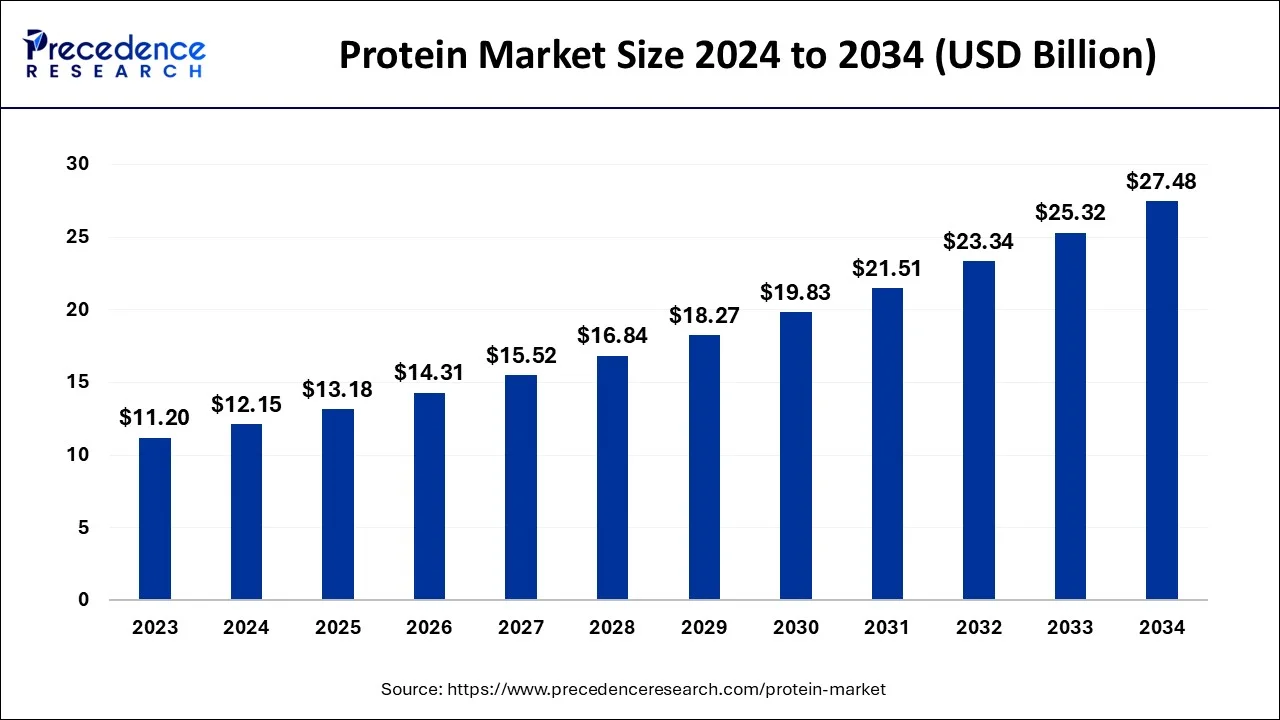

The global protein market size was estimated at USD 12.15 billion in 2024 and is anticipated to reach around USD 27.48 billion by 2034, expanding at a CAGR of 8.50% from 2025 to 2034.

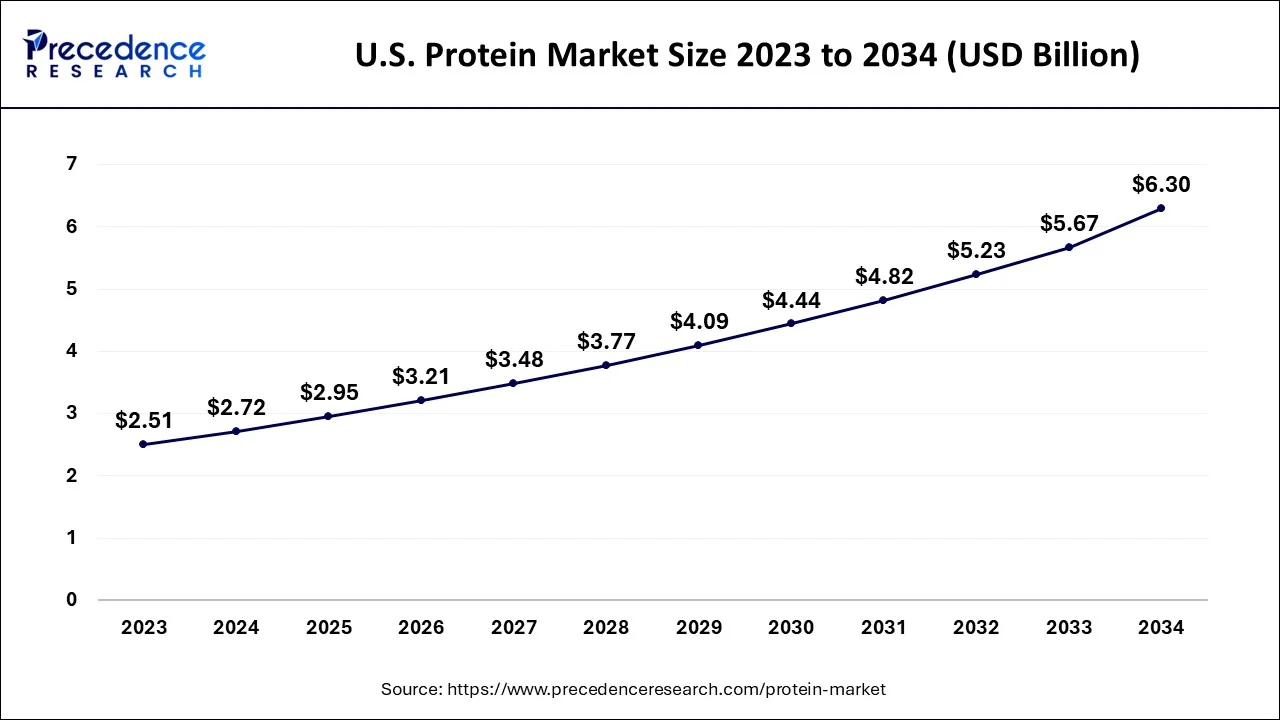

The U.S. protein market size was estimated at USD 2.72 billion in 2024 and is expected to be worth around USD 6.30 billion by 2034, rising at a CAGR of 8.76% from 2025 to 2034.

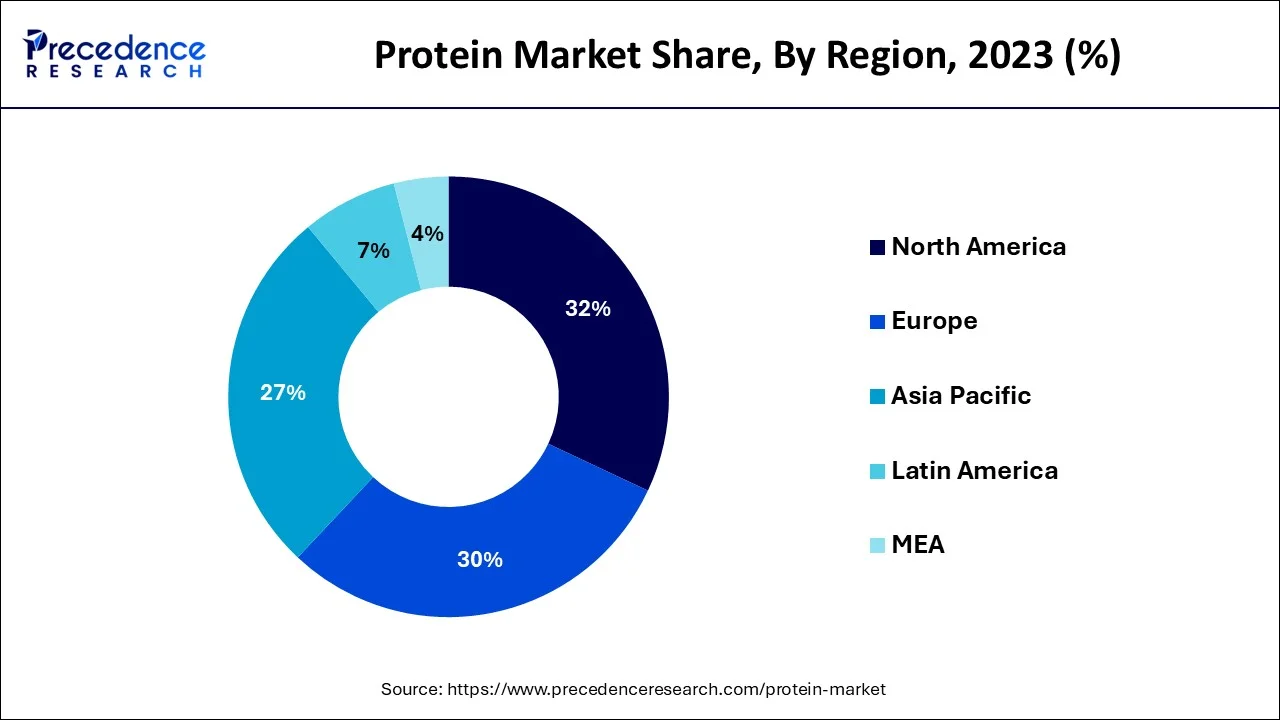

North America is driving the market's expansion with a more significant volume market share of 32%. Additionally, a CAGR of 3.40% by volume is expected for the forecast period. More than 57% of households opt for foods with high protein content, which is a crucial consideration when people shop for food for their families, creating enormous potential for market expansion in the area.

The consumer base of the sector is expanding along with the flexitarian population. Twenty-three percent of Americans reported eating plant-based meat, while 37 percent of consumers who don't already eat plant-based meat are open to the idea. As a result, this is expanding the demand for proteins and providing a massive opportunity for meat substitutes.

Due to the region's growing health consciousness, the demand for sustainable and natural ingredients will likely expand at the quickest rate in the Middle East. The area will likely experience a volume CAGR of 4.33% throughout the forecast period.

Europe is anticipated to grow at the fastest rate over the forecast period. The growth of the region can be attributed to the increasing use of protein products in synthetic and derived personal care products, along with the surge in health awareness among consumers. Furthermore, the increasing trend towards preventive healthcare and ongoing focus on healthy living will soon impact positive market growth.

The protein market is a growing industry driven by increasing demand for protein-rich foods and supplements. Protein is an essential macronutrient that plays several critical roles in the body, including building and repairing tissues, producing hormones and enzymes, and supporting immune function. It is found in various foods, including meat, poultry, fish, eggs, dairy products, beans, legumes, nuts, and seeds.

There are several types of protein on the market, including animal-based proteins (such as whey, casein, and egg) and plant-based proteins (such as soy, pea, and hemp). These proteins differ in their amino acid profiles, digestibility, and nutritional properties.

The protein market is highly competitive, with many companies producing and marketing protein products. These products are sold through various channels, including supermarkets, health food stores, online retailers, and direct-to-consumer sales.

In recent years, the protein market has been driven by trends such as the increasing popularity of plant-based protein, the rise of functional and fortified protein products, and the growing demand for high-quality, natural, and sustainable protein sources.

The consumption of items made from animals has significantly increased in the U.S. market in recent years. Over the following several years, animal protein consumption will likely grow more in the nation. The U.S. product demand will likely rise due to the significant domestic demand for these items made from animal sources. The market will likely grow over the forecast period due to supply chain activities implemented by ingredient manufacturing businesses to improve product distribution.

Crops like soy, wheat, canola, and pea are used to produce plant-based components. The highest proportion in the plant-based category has been held by soy protein, expanding at a special rate. Over the projected period, it will likely increase at a rapid compound annual growth rate. The Food and Drug Administration (FDA) also approved a health claim for lowering LDL cholesterol through dietary recommendations that suggested four servings of soy per day to help reduce the LDL cholesterol level in the body by 10%.

Throughout the forecast period, technological advances and product innovations will likely play a significant role in the market's growth. Protein components are increasingly used in various applications; for example, isolates are used frequently in dairy applications due to their tiny particle size and excellent dispersibility. Over the past several years, this market has been primarily driven by consumer conviction in the health benefits of these goods. This trend will likely continue during the projection period.

| Report Coverage | Details |

| Market Size in 2024 | USD 12.15 Billion |

| Market Size in 2025 | USD 13.18 Billion |

| Market Size by 2034 | USD 27.48 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 8.50% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Source and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

The conventional purple corn grits segment dominated the market by holding 64.80% share in 2024. The dominance of the segment can be attributed to the rising consumer awareness regarding health benefits and its versatility in different food applications. Also, the authentic nutritional profile of purple corn contributes to its popularity further.

The organic purple corn grits segment is expected to grow at the highest CAGR of 7.90% in 2024. The growth of the segment can be credited to the increasing consumer interest in organic purple corn grits and the health benefits they offer in fighting diseases such as cardiovascular disease and diabetes, leading to segment growth soon.

The medium grits segment held a 41.20% market share in 2024. The dominance of the segment can be linked to the increasing demand for plant-based protein, rising health awareness, and a surge in applications in various industries. Moreover, the medium grits segment is extracted from soy and is benefiting from the growing popularity of flexitarian diets.

The fine grits segment is expected to grow at the highest CAGR of 7.30% in 2024. The growth of the segment can be driven by growing consumer demand for healthy, fiber-rich foods because of the rise in health and fitness trends. In addition, consumers are increasingly aware of the advantages of protein and fiber with fine grits such as soy grits.

The food & beverage industry segment led the market by holding 52.50% share in 2024. Dairy and meat substitutes were the primary demand drivers, and customers wanted more plant-based protein-rich substitutes. The high demand for plant proteins was partly a result of this alternative market boom. More than 79 million people worldwide identify as vegans and seek meat and dairy substitutes with better protein content.

The nutraceuticals segment is expected to grow at the highest CAGR of 8.20% in 2024. The growth of the segment is owing to the increasing emphasis on preventive healthcare and the growing demand for functional foods and supplements. The rise of digital marketplaces and e-commerce is making it convenient for consumers to access and purchase nutraceutical products.

The B2B (Bulk Supply) segment held a 69.40% market share in 2024. The dominance of the segment can be attributed to the rise in health awareness, growing product demand from food and beverage manufacturers, and the growth of the sports nutrition industry. The development of advanced protein formulations, such as plant-based proteins and clean-label ingredients, is attracting an extensive range of consumers.

The B2C (Retail Packaged Sales) segment is expected to grow at the highest CAGR of 7.70% in 2024. The growth of the segment can be credited to the growing preference for convenient and ready-to-consume protein products. Furthermore, the convenience of online shopping platforms has made it easier for consumers to access an extensive array of protein products.

The bulk bags segment led the market by holding 54.10% share in 2024. The dominance of the segment can be linked to the growth of the food and pharmaceutical industries and the rise in protein demand. Also, the market is experiencing a transition towards food-grade bulk bags, fuelled by regulations and emphasis on food safety and traceability.

The retail pouches segment is expected to grow at the highest CAGR of 8.10% in 2024. The growth of the segment can be driven by the growing demand for convenient and portable protein sources, coupled with the rising health consciousness. Consumers are increasingly seeking meal replacements, and protein-rich snacks offer a portion-controlled option.

By Product Type

By Texture/Form

By Application

By Distribution Channel

By End User

By Packaging Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

July 2025

August 2025

February 2025