October 2024

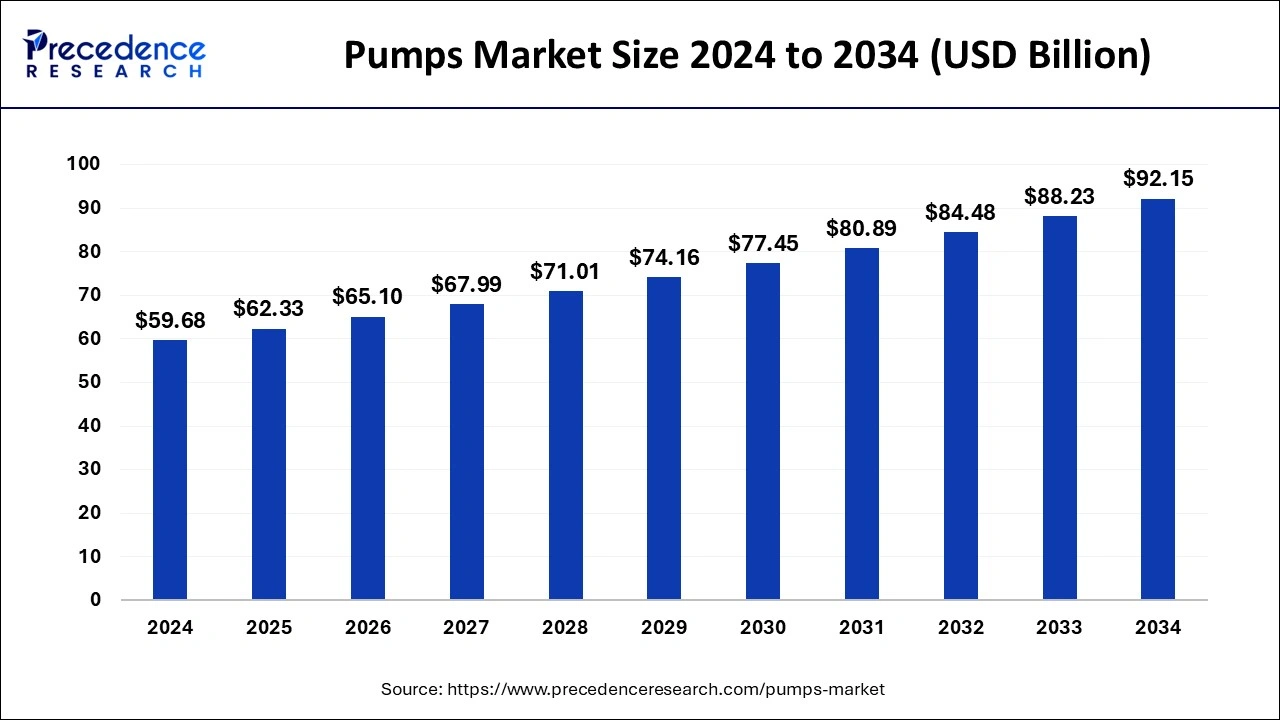

The global pumps market size is calculated at USD 62.33 billion in 2025 and is forecasted to reach around USD 92.15 billion by 2034, accelerating at a CAGR of 4.44% from 2025 to 2034. The Asia Pacific pumps market size surpassed USD 28.19 billion in 2025 and is expanding at a CAGR of 4.45% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global pumps market size was estimated at USD 59.68 billion in 2024 and is anticipated to reach around USD 92.15 billion by 2034, expanding at a CAGR of 4.44% from 2025 to 2034. The importance of pumps in the safe and precise administration of drugs related to chemotherapy, medicines, or nutrients and their insertion into petrochemical, agriculture, and other industries drives the need for pumps in healthcare sectors by accelerating the growth of the pumps market.

Artificial intelligence-powered pump systems utilize transmitted data to develop a precise picture of actual conditions in real-time. The companies are collaborating and revolutionizing the heating, ventilation, and air conditioning (HVAC) system of pumps which ensures air quality and thermal comfort. These efforts through AI-powered technology are also transforming the HVAC industry and assisting in the design, operation, and maintenance of pumps. AI-driven predictive maintenance utilizes data from sensors and other sources for a real-time monitoring of pump conditions.

AI algorithms can predict the potential risks associated with pump failures and allow maintenance before their breakdown. This approach reduces downtime and improves overall equipment effectiveness (OEE) by minimizing operational costs. AI also assists in design, simulation, remote monitoring and control, fault detection and diagnostics, supply chain optimization, and safety enhancement.

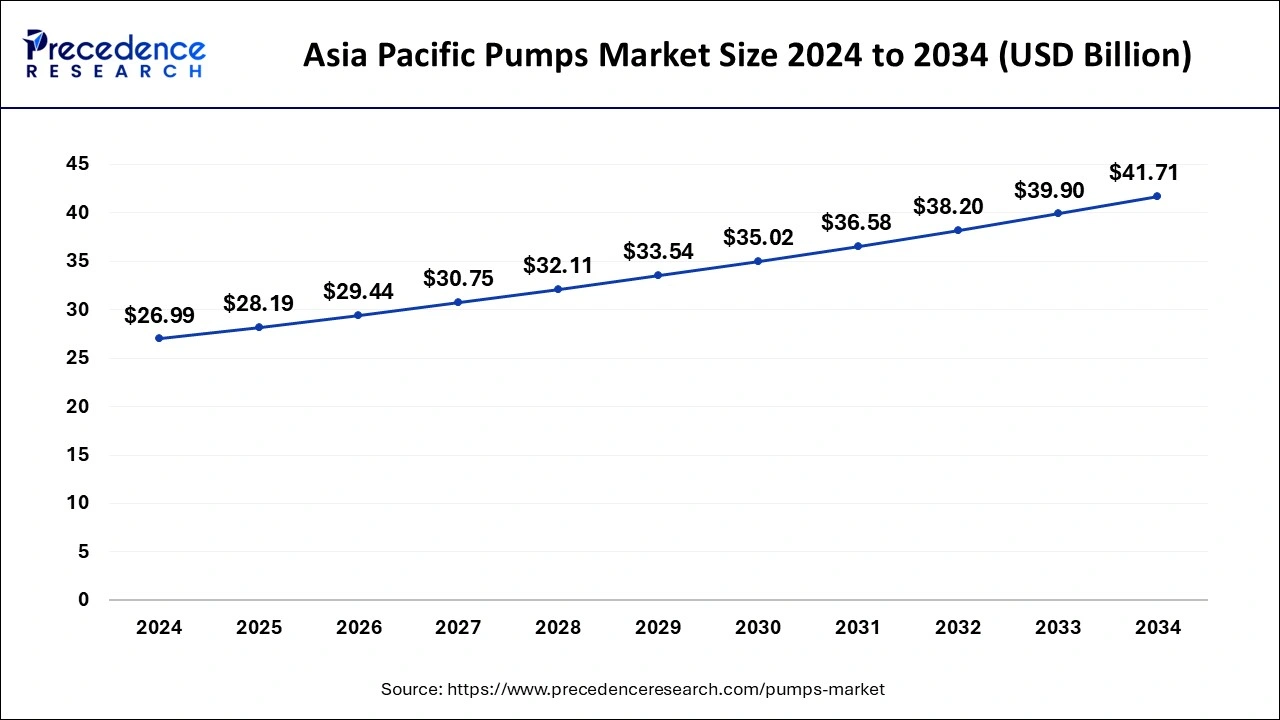

The Asia Pacific pumps market size was evaluated at USD 26.99 billion in 2024 and is predicted to be worth around USD 41.71 billion by 2034, rising at a CAGR of 4.45% from 2025 to 2034.

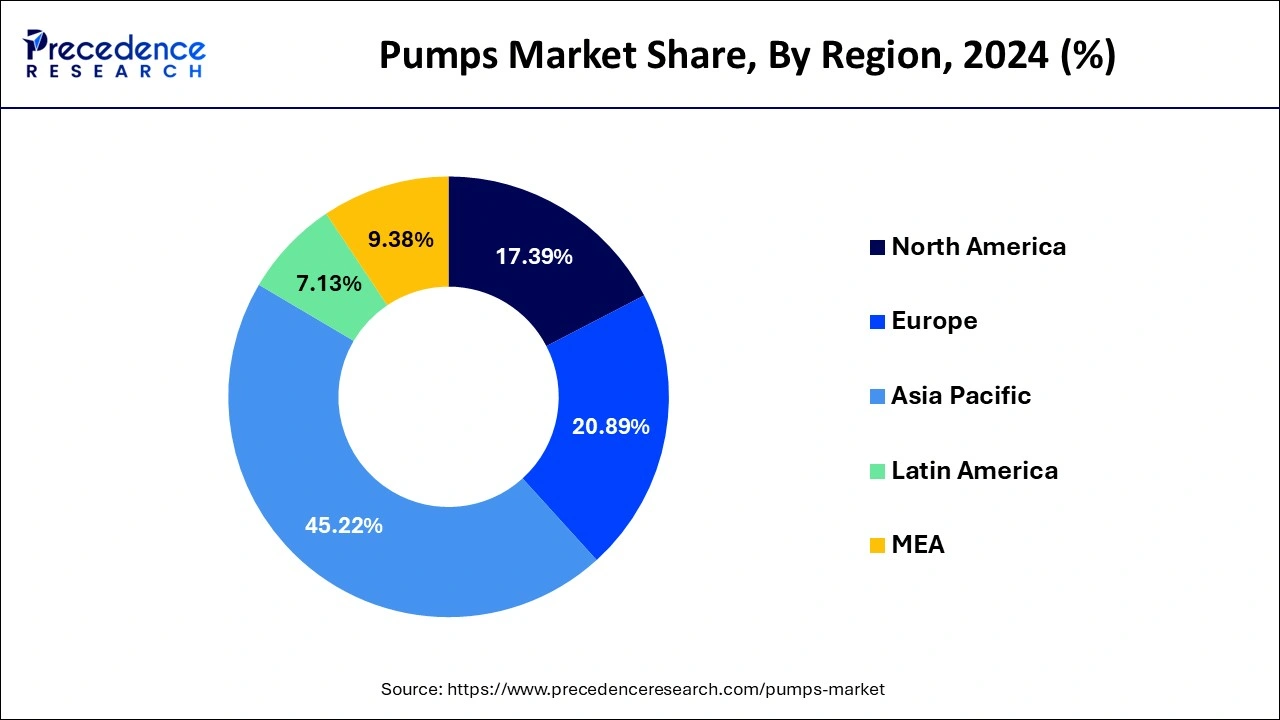

Asia Pacific dominated the global market with the largest market share of 45.22% in 2024. The rapid industrialization in Asia-Pacific’s developing countries, as well as increased investments in commercial and industrial projects, have all contributed to the region’s overall growth globally. The increased product penetration in several end use industries, such as petrochemical and agriculture, is also expected to contribute to the pumps market expansion.

The North America is estimated to be the most opportunistic segment during the forecast period. The North America pumps market has benefitted from advanced processing capacities, a highly skilled workforce, and expanding research and development initiatives in the U.S.

Pumps are devices that use mechanical action to transfer fluids and liquids. Pumps are categorized according to their functioning mechanisms, although they all operate on the same concept of using energy and moving fluid by mechanical action. Pumps can be manually operated or powered by an external source of energy. Engines, electric motors, and wind power are all common energy resources. Pumps come in a variety of sizes, ranging from small residential pumps to big industrial pumps. The number of centrifugal pumps in commercially accessible pumps is the primary criterion for classification.

Pumps use energy to move fluid or perform kinetic energy, which can come from wind power, electricity, and a variety of other sources, notably in industries. In addition, the number of end-user applications has increased in recent years, and the global pump market value is predicted to develop in accordance with the oil and gas industry’s progressive expansion. Centrifugal pumps, on the other hand, are used in the chemical industry to move and store fluids that are prone to reactions. Chemical manufacturers involve a number of complicated and detailed industrial processes.

| Report Coverage | Details |

| Market Size by 2034 | USD 92.15 Billion |

| Market Size in 2025 | USD 62.33 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4.44% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Based on the product type, the centrifugal pumps segment accounted largest market revenue share in 2024. Centrifugal pumps are utilized in the chemical industry because they can handle greater volumes. These are ideal for pumping liquids with high densities at low pressures and high capacities.

The positive displacement pumps segment is expected to hit CAGR of 3.5% during the forecast period. This is attributed to their efficient low-speed operation and steady flow rates. Furthermore, the oil and gas industry’s preference for positive displacement pumps is projected to support segment expansion.

Based on the application, the agriculture segment accounted largest revenue share in 2022. The technological developments in irrigation and farming, particularly in emerging countries, combined with an increase in the use of pumps for a variety of functions in agriculture, such as crop dewatering, irrigation, and reuse are expected to drive the growth of pumps market.

The water and wastewater segment is estimated to hit CAGR of 4% during the forecast period. Pump stations are increasingly being used in wastewater treatment plans where gravity flow is not possible, and their high flow rate deliverability and transmission velocity are expected to boost the global pumps market growth.

With the presence of several companies, the global pumpsmarket is moderately fragmented. The key market players are attempting to increase their market share by implementing various marketing strategies such as new product launches, investments, partnerships, and mergers and acquisitions. Companies are also investing in product development. Furthermore, they are emphasizing competitive pricing. Various development strategies, such as business expansion and joint venturepromote market growth and provide lucrative growth opportunities to market players.

By Product Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

January 2025

February 2025

July 2024