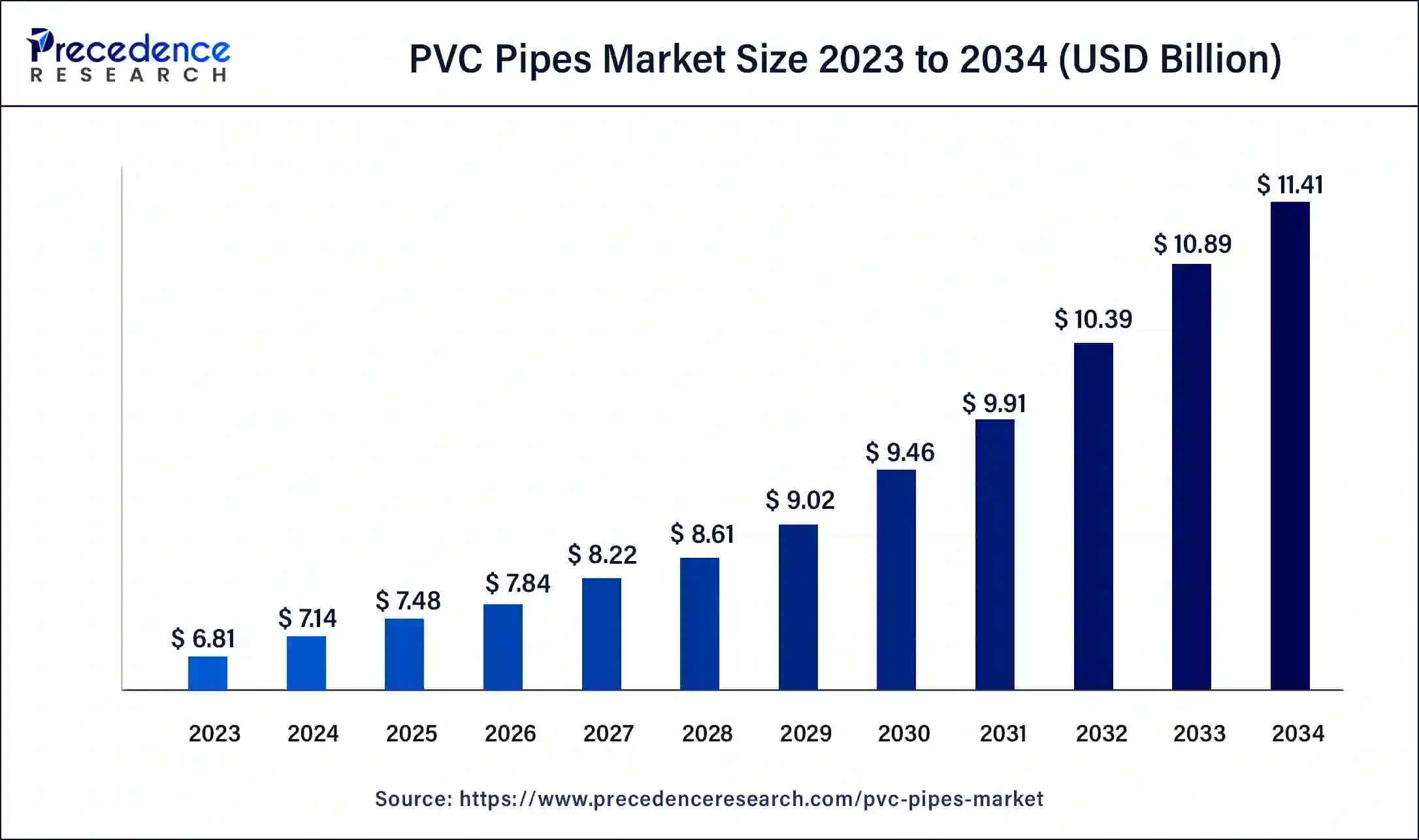

The global polyvinyl chloride (PVC) pipes market size was USD 6.81 billion in 2023, calculated at USD 7.14 billion in 2024 and is expected to reach around USD 11.41 billion by 2034, expanding at a CAGR of 4.8% from 2024 to 2034.

The polyvinyl chloride (PVC) pipes market size accounted for USD 7.14 billion in 2024 and is expected to reach around USD 11.41 billion by 2034, expanding at a CAGR of 4.8% from 2024 to 2034.

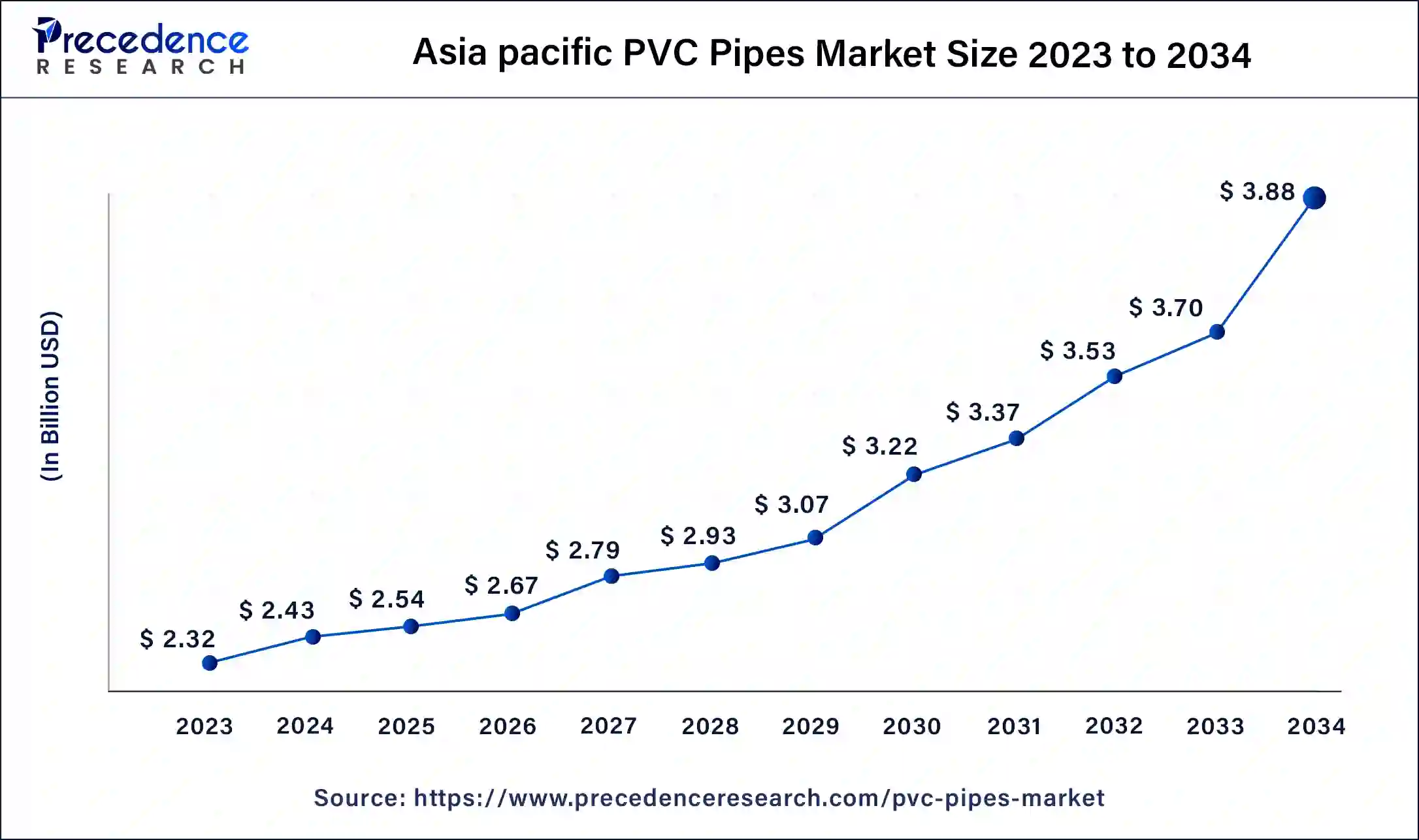

The Asia Pacific polyvinyl chloride (PVC) pipes market size was estimated at USD 2.32 billion in 2023 and is predicted to be worth around USD 3.88 billion by 2034, at a CAGR of 5% from 2024 to 2034.

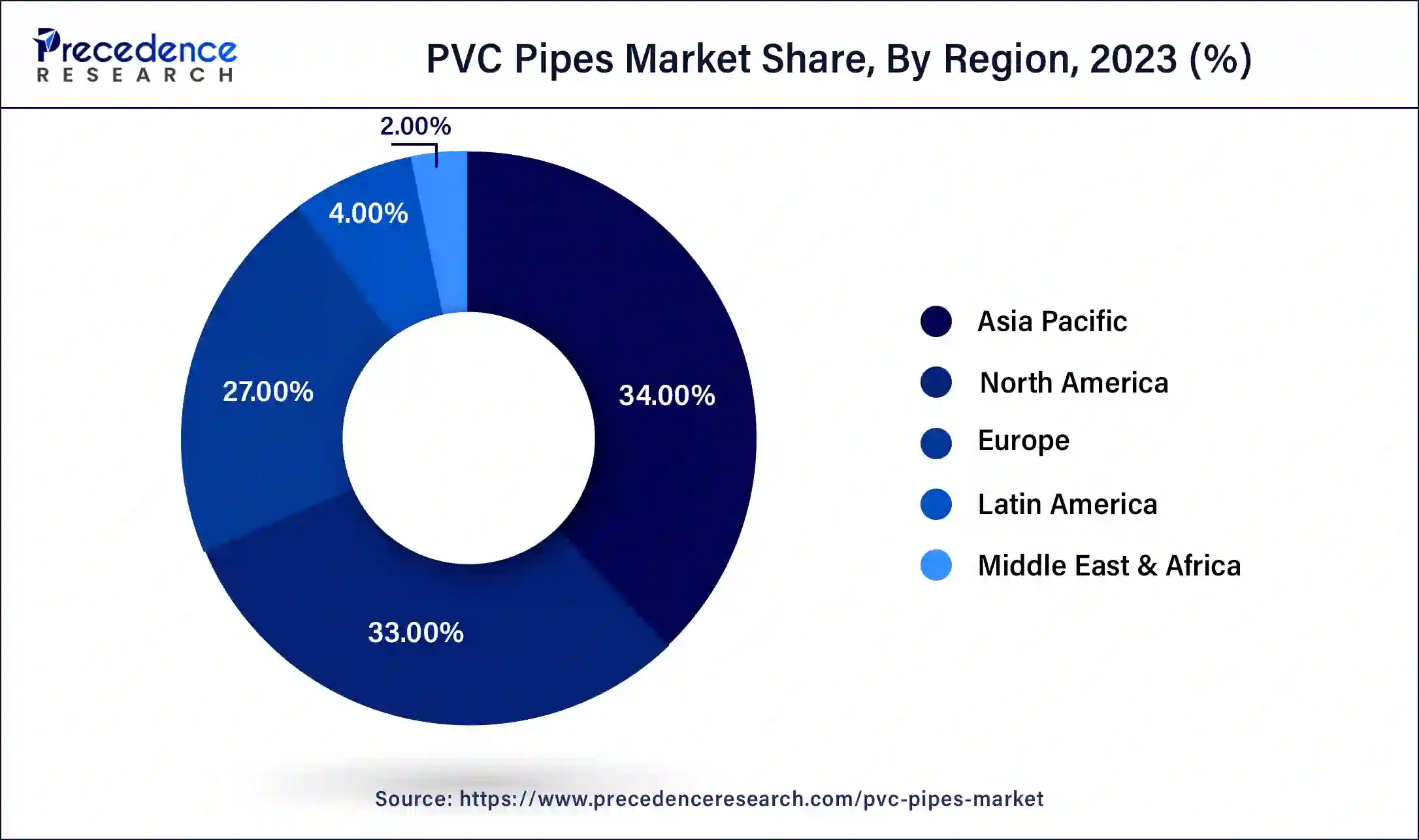

Asia-Pacific dominated the polyvinyl chloride (PVC) pipes market in 2023. China dominated the polyvinyl chloride (PVC) pipes market in Asia-Pacific region. The factors such as rising industrialization and urbanization, growing investments for the infrastructural development, and growing government initiatives for the development of infrastructure in agriculture sector are driving the growth of the polyvinyl chloride (PVC) pipes market in the region over the forecast period.

Europe, on the other hand, is expected to develop at the fastest rate during the forecast period. The UK dominates the polyvinyl chloride (PVC) pipes market in Europe region. The polyvinyl chloride (PVC) pipes market in Europe is being driven by growing applications of polyvinyl chloride (PVC) pipes in diverse sectors. In addition, existence of major market players in this region is also boosting the growth of polyvinyl chloride (PVC) pipes market.

The polyvinyl chloride (PVC) is considered as top selling material all around the world. The polyvinyl chloride (PVC) is cost-effective and durable in nature. Similarly, polyvinyl chloride (PVC) pipes are of low cost and corrosion resistant. The polyvinyl chloride (PVC) pipes are used for various purposes such as water supply, irrigation, and drainage system.

One of the key factors driving the growth of the global polyvinyl chloride (PVC) pipes market is growing investments in research and development activities. These investments are made by either government agencies or market players. In addition, the growth of the global polyvinyl chloride (PVC) pipes market is being driven by the surge in demand for polyvinyl chloride (PVC) pipes in various industries and sectors. The polyvinyl chloride (PVC) pipes provide various benefits that are the reason; the demand for them is growing at a faster rate.

Another factor driving the growth of the global polyvinyl chloride (PVC) pipes market is the technological advancements and adoption of innovative technologies. The molecular orientation technology is used for the manufacturing of polyvinyl chloride (PVC) pipes in the global market. These kinds of pipes are eco-friendly in nature. In addition, it is cost effective and efficient in nature.On the other hand, the alternatives for polyvinyl chloride (PVC) pipes are hindering the growth of the polyvinyl chloride (PVC) pipes market.

The impact of the COVID-19 pandemic on the growth of the global polyvinyl chloride (PVC) pipes market was quite negative. The supply chain disruption and halt of manufacturing units had negative impact on the expansion of the global polyvinyl chloride (PVC) pipes market.

The industries such as agriculture and building and construction are developing at a rapid pace all around the world. The polyvinyl chloride (PVC) pipes are widely used in these industries. In agriculture, the polyvinyl chloride (PVC) pipes are used for irrigation purpose. In addition, the polyvinyl chloride (PVC) pipes are used for roofing and flooring purpose in building and construction purpose.

To keep up with the fierce market competition, the major players in the worldwide polyvinyl chloride (PVC) pipes market used research and development, business expansion, product introduction, joint venture, and acquisition. The polyvinyl chloride (PVC) pipes manufacturers, who sell their products to a variety of industries around the world, are among the polyvinyl chloride (PVC) pipes market’s participants. Moreover, the market players are collaborating with government, which is creating lucrative opportunities for the growth of the global polyvinyl chloride (PVC) pipes market.

| Report Coverage | Details |

| Market Size in 2023 | USD 6.81 Billion |

| Market Size in 2023 | USD 7.14 Billion |

| Market Size by 2034 | USD 11.41 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4.8% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Europe |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, End User, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

The post-chlorinated segment dominated the polyvinyl chloride (PVC) pipes market in 2023. The post-chlorinated polyvinyl chloride (PVC) pipes are more flexible in nature as compared to other type of polyvinyl chloride (PVC) pipes. These type of polyvinyl chloride (PVC) pipes are used to transfer cold water as well as hot water. The post-chlorinated polyvinyl chloride (PVC) pipes are also used for welding, machining, and forming.

The plasticized segment is fastest growing segment during the forecast period. The demand for plasticized polyvinyl chloride (PVC) pipes is growing due to surge in demand for wastewater management. In addition, government is heavily investing for the installation of new pipelines. This factor is driving the growth of the segment.

The water supply segment led the market in 2023. The polyvinyl chloride (PVC) pipes were initially used for supplying water from one place to another. The polyvinyl chloride (PVC) pipes help to supply water at a faster rate as compared to metal and concrete pipes. The growing population has resulted to the surge in demand for water supply. This is possible due to growing installation of polyvinyl chloride (PVC) pipes globally.

The oil and gas segment is fastest growing segment over the forecast period. The oil and gas companies consider polyvinyl chloride (PVC) pipes as cost effective solution. This kind of pipes is light in weight and is resistant to the corrosion. Thus, the demand for polyvinyl chloride (PVC) pipes for oil and gas sector is growing at a rapid pace.

The agriculture segment dominated the polyvinyl chloride (PVC) pipes market in 2023. The polyvinyl chloride (PVC) pipes in agriculture are used for the purpose of supplying water in farms. The polyvinyl chloride (PVC) pipes are mainly used for irrigation purpose. In addition, the polyvinyl chloride (PVC) pipes are used for sprinkle of pesticides and fertilizers in the farms. Due to the low cost of polyvinyl chloride (PVC) pipes, the demand for this kind of pipes is growing for agriculture purpose.

The building and constructions segment is expected to hit highest growth in near future. The polyvinyl chloride (PVC) pipes are considered as most beneficial pipes as compared to other pipes for building and construction purposes. The polyvinyl chloride (PVC) pipes are cost effective and safety product that are used for roofing and flooring of the buildings. Thus, all of these factors are driving the growth of the segment.

Segments Covered in the Report

By Type

By Application

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client