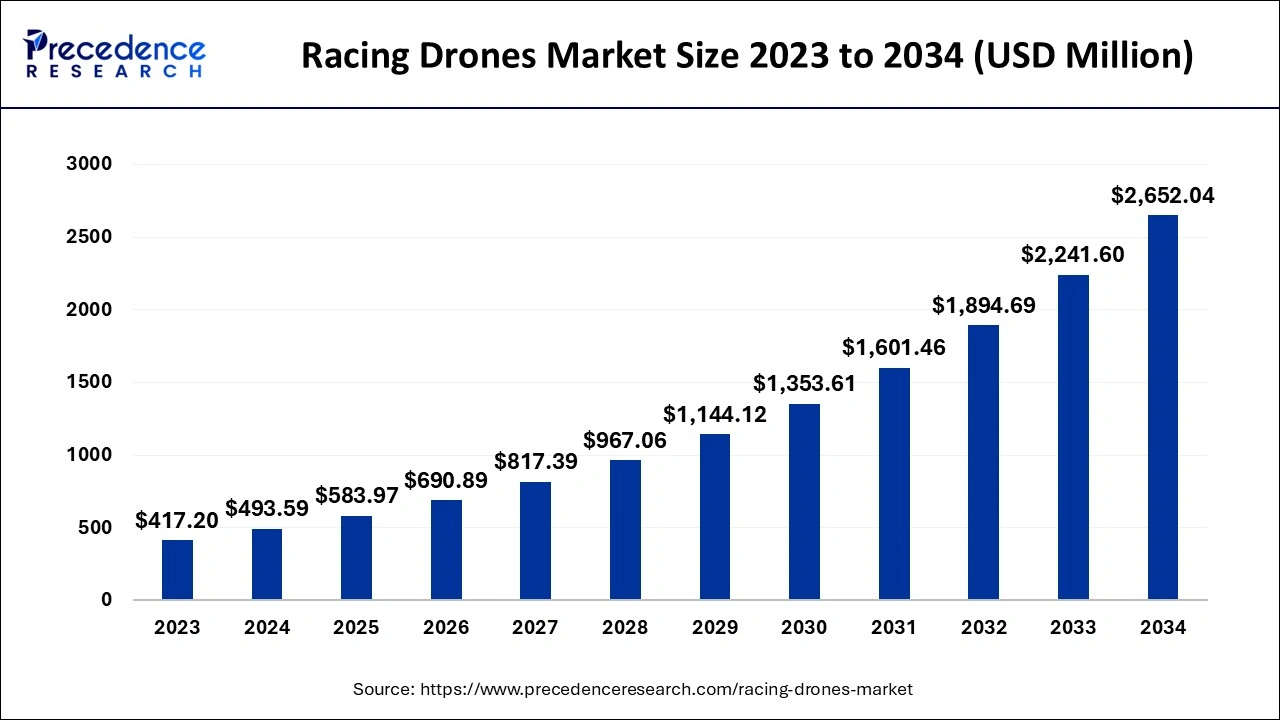

The global racing drones market size is calculated at USD 493.59 million in 2024, grew to USD 583.97 million in 2025 and is projected to reach around USD 2652.04 million by 2034. The market is expanding at a CAGR of 18.31% between 2024 and 2034. The North America racing drones market size is evaluated at USD 182.63 million in 2024 and is estimated to grow at a fastest CAGR of 18.45% during the forecast period.

The global racing drones market size is accounted for USD 493.59 million in 2024 and is projected to reach around USD 2652.04 million by 2034, growing at a CAGR of 18.31% from 2024 to 2034. The increase in drone technology is the key factor driving the market growth. Also, the rising accessibility of FPV racing along with the growing utilization of drones in sports is expected to fuel the market growth further.

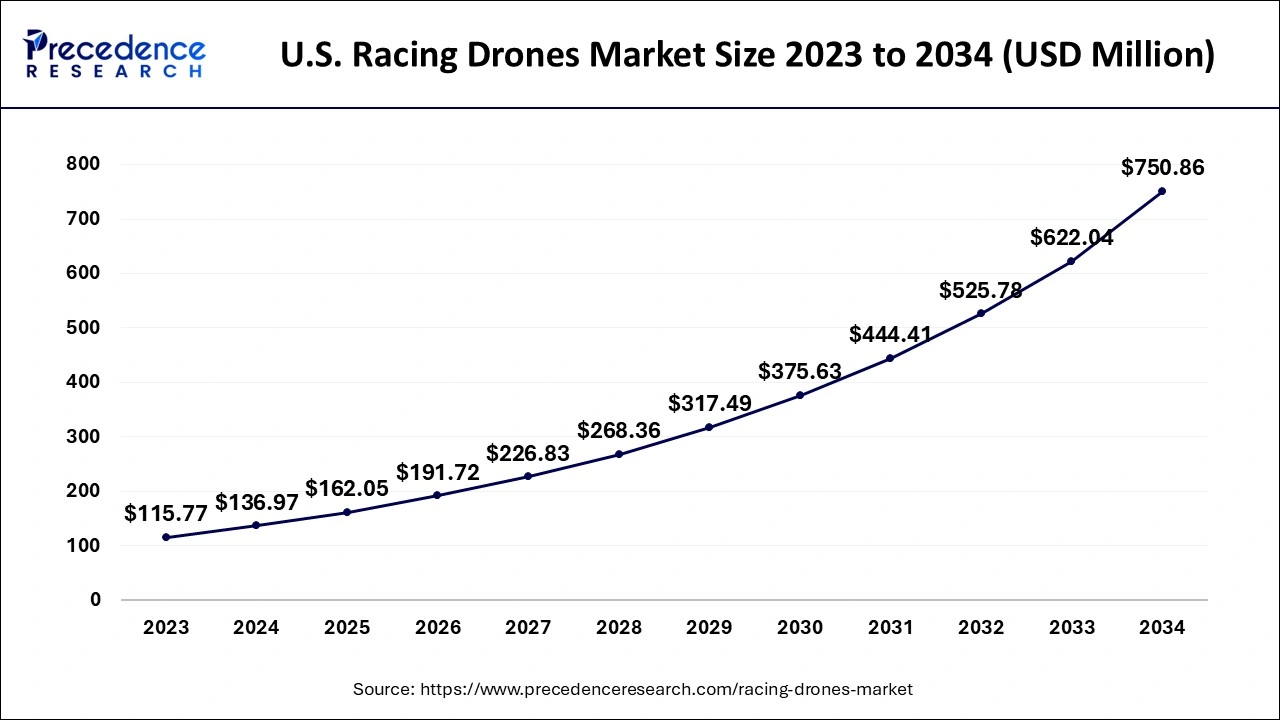

The U.S. racing drones market size is evaluated at USD 136.97 million in 2024 and is projected to be worth around USD 750.86 million by 2034, growing at a CAGR of 18.52% from 2024 to 2034.

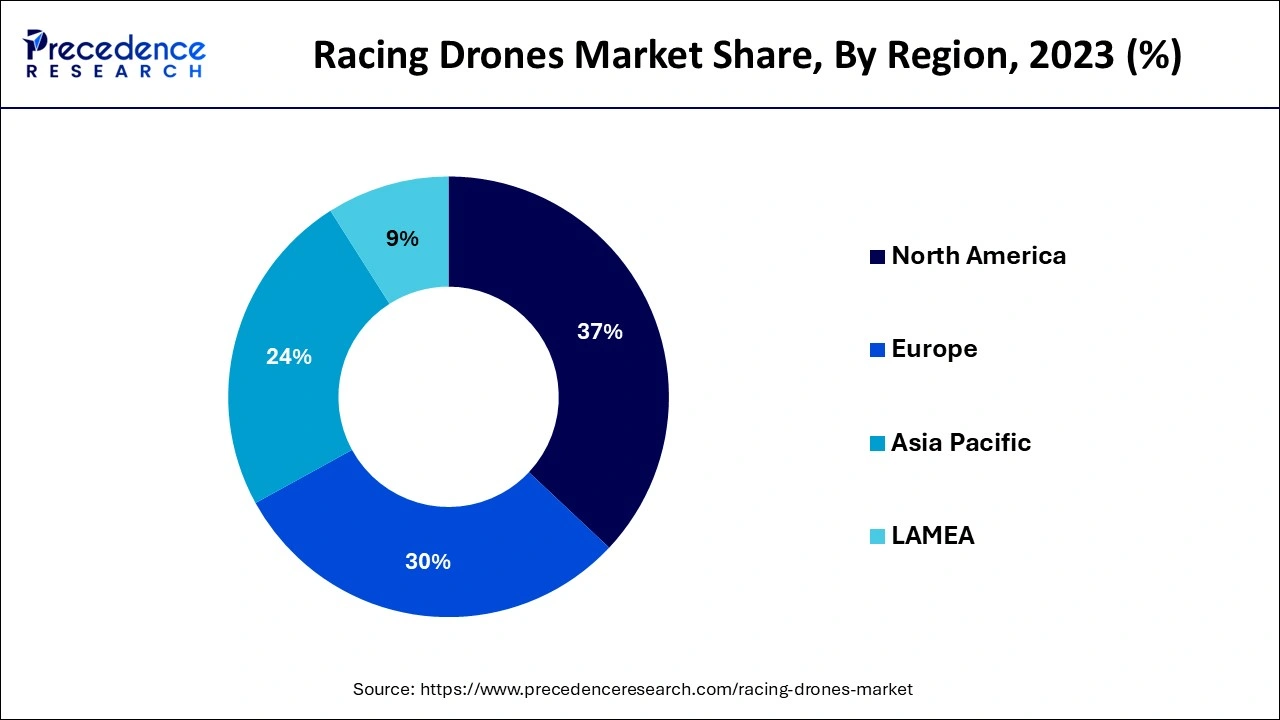

North America dominated the racing drones market in 2023. The dominance of the region can be attributed to the increasing Competitors' emphasis on creating more agile, faster, and more customizable drones that can fulfill the needs of racing enthusiasts. Furthermore, racing events are becoming a key attraction in the entertainment and media industry to meet the demand generated by the rising fan base, particularly in the US region.

Asia Pacific is expected to show the fastest growth during the forecast period. The growth of the region can be linked to the increase in the number of drone racing events, backed by a strong framework of regulations that ensures safety in sport. Moreover, the growing availability of drone racing accessories and kits makes it more accessible to end users at all levels. The growing region's focus on technological advancements can further help in the expansion of the racing drones market.

A racing drone is a small unmanned aerial vehicle with a front-faced camera employed on high-speed racing motors for drone racing competitions. A controller controls this device with a remote control on the drone through a head-mounted display control. This device is also utilized in racing competitions like drone racing World Cups and Multigap drone racing because it has high battery voltage, high speed, and a camera with wide angle features. These devices are used in defense and the military as they are available in different sizes.

AI Impact on Drone Technology

The implementation of AI into drone technology will substantially boost the growth of the racing drones market. AI-enhanced autonomy in drone technology is the primary factor that impacts the market positively. Furthermore, AI algorithms enable drones to set hard tasks independently, like navigating through difficult environments and avoiding hurdles without human intervention. This enhances the intelligence of drones, enabling them to analyze information in real time to make instant decisions.

| Report Coverage | Details |

| Market Size by 2034 | USD 2,652.04 Million |

| Market Size in 2024 | USD 493.59 Million |

| Market Growth Rate from 2024 to 2034 | CAGR of 18.31% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Drone Type, Component Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rise of Racing Drone Events and Leagues Globally

The increasing racing drone events and leagues globally can help in expansion of racing drones market. As drone racing gains recognition on a global scale the establishment of high-profile competitions and professional leagues can attract media coverage, sponsorships and a broader audience. Additionally, this global growth can also promote the sport and propel the demand for racing drones and training programs.

High Maintenance Costs

High maintenance costs related to the sport can significantly impact the racing drones market growth of racing drones. Market investment in a competitive racing drone coupled with the required accessories like FPV goggles and controllers can be quite expensive for newcomers. Moreover, the cost of regularly maintaining equipment to stay competitive, along with the crash-related repairs, can add financial burden, leading to market hindrance.

Continuous Development and Launches of Commercial Drones

Commercial drones have changed various industries due to their cost-effective maintenance, ease of deployment, and hovering capabilities. They also find applications in remote sensing, wireless coverage, goods delivery, security, civil infrastructure inspection, and precision agriculture. Furthermore, Commercial drone manufacturers are increasing their product offerings to gain customers' attention from various sectors.

The RTF segment dominated the racing drones market in 2023. The dominance of the segment can be attributed to the increasing demand for "Ready-To-Fly" drone type for enthusiasts and beginners. RTF drones require minimal setup before flight, which makes them an ideal choice for amateur pilots and seasoned enthusiasts searching for immediate aerial action. Additionally, advancements in battery life, speed, and agility have increased the demand for RTF drones.

The ATF segment is expected to witness the fastest growth over the forecast period. The growth of the segment can be linked to the increasing number of racing events like the drone Champions League, Drone Racing League, and Drone World Championship, which bring together pilots across the globe to compete, thereby driving the expansion of ARF drones. Also, advancements in the ATF segment have improved the flying experience along with the development of pilots' skills and racing tactics.

The airframe segment led the racing drones market in 2023 by holding the largest market share. This is because of the increasing demand for lightweight, high-performance frames that can face the rigors of racing. The segment has fulfilled this demand by developing new and enhanced frame designs that provide better performance, customization options, and durability. Moreover, the airframe segment is an important aspect of racing drones, which can influence the drone's maneuverability.

The camera/sensors segment is expected to grow at a significant rate in the racing drones market during the projected period. The growth of the segment can be credited to the increasing need for obstacle avoidance, navigation, and data collection. Drones can utilize optical sensors like red, green, and blue, as well as infrared cameras and stereo cameras to gather visual data. Furthermore, cameras and sensors offer visuals to pilots and record images as evidence.

The rotor cross segment dominated the racing drones market by holding of the market share in 2023. This is because of the growing popularity of rotor cross as a competitive sport. The trend of Rotor cross competitions is distinguished by its high-stakes and thrilling nature. These drones have features that improve battery life, speed, and maneuverability, fulfilling the high demand of sports. Also, the growth of the segment can be boosted by the rising number of organized competitions and events.

The drag racing segment is estimated to grow significantly during the studied period. The growth of the segment can be driven by increasing autonomous drone racing programs and technological advancements in drone technology, like improved battery life, camera quality, and superior motor speed. Additionally, the popularity of drone racing is increasing due to the establishment of various research programs in the racing drones market.

Segments Covered in the Report

By Drone Type

By Component Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client