August 2024

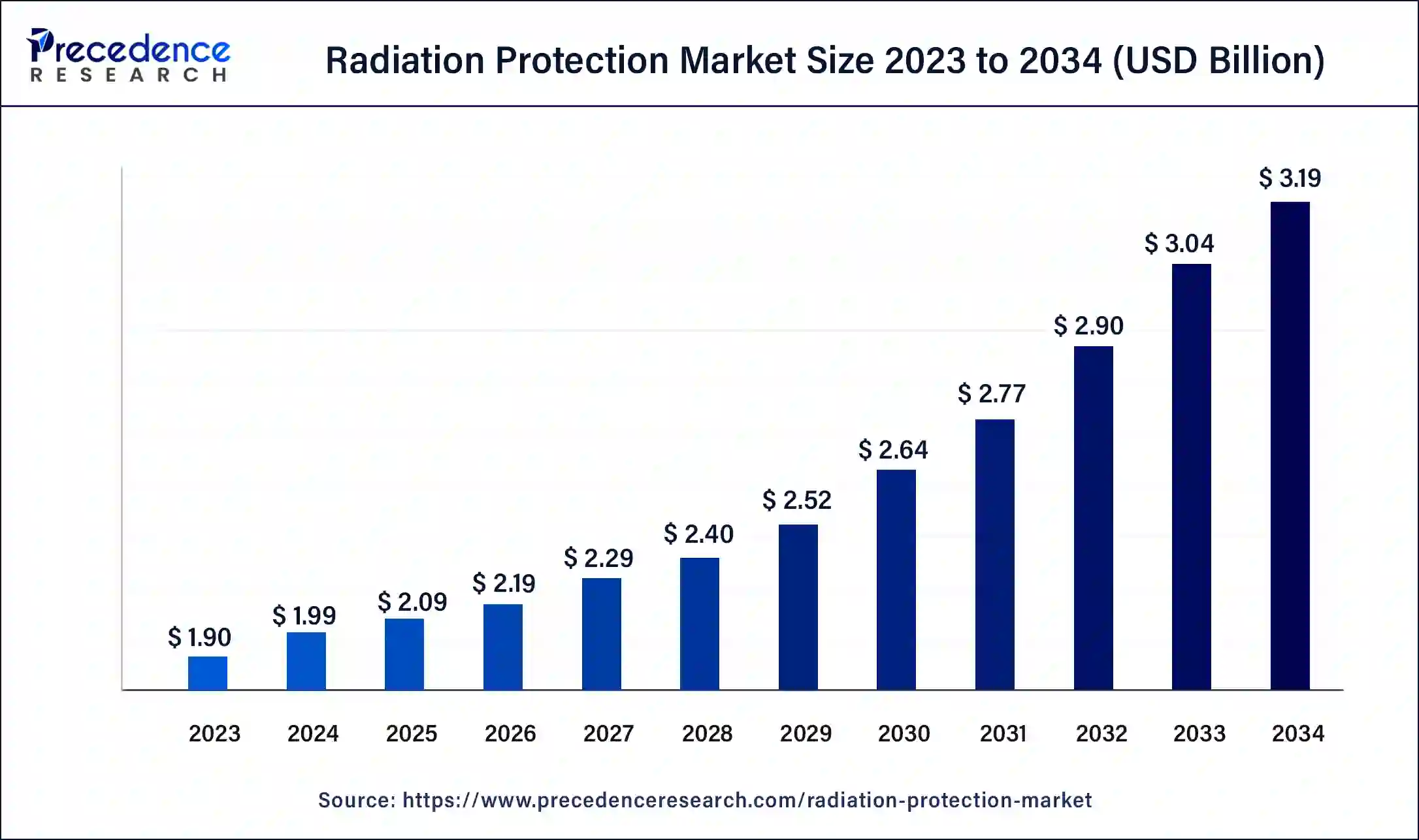

The global radiation protection market size was USD 1.90 billion in 2023, calculated at USD 1.99 billion in 2024 and is expected to be worth around USD 3.19 billion by 2034. The market is slated to expand at 4.81% CAGR from 2024 to 2034.

The global radiation protection market size is worth around USD 1.99 billion in 2024 and is anticipated to reach around USD 3.19 billion by 2034, growing at a CAGR of 4.81% over the forecast period 2024 to 2034.

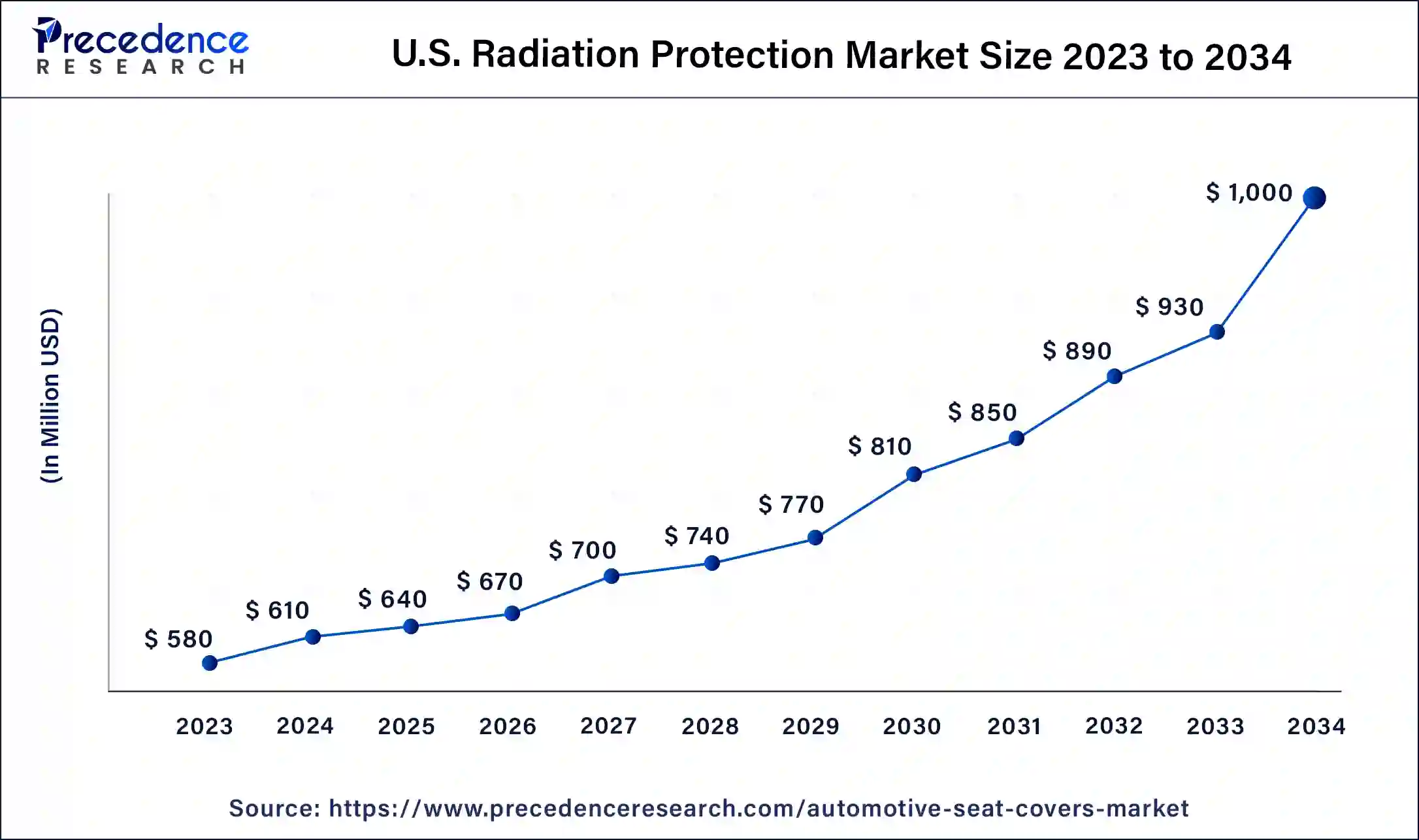

The U.S. radiation protection market size was exhibited at USD 580 million in 2023 and is projected to be worth around USD 1,000 million by 2034, poised to grow at a CAGR of 5.07% from 2024 to 2034.

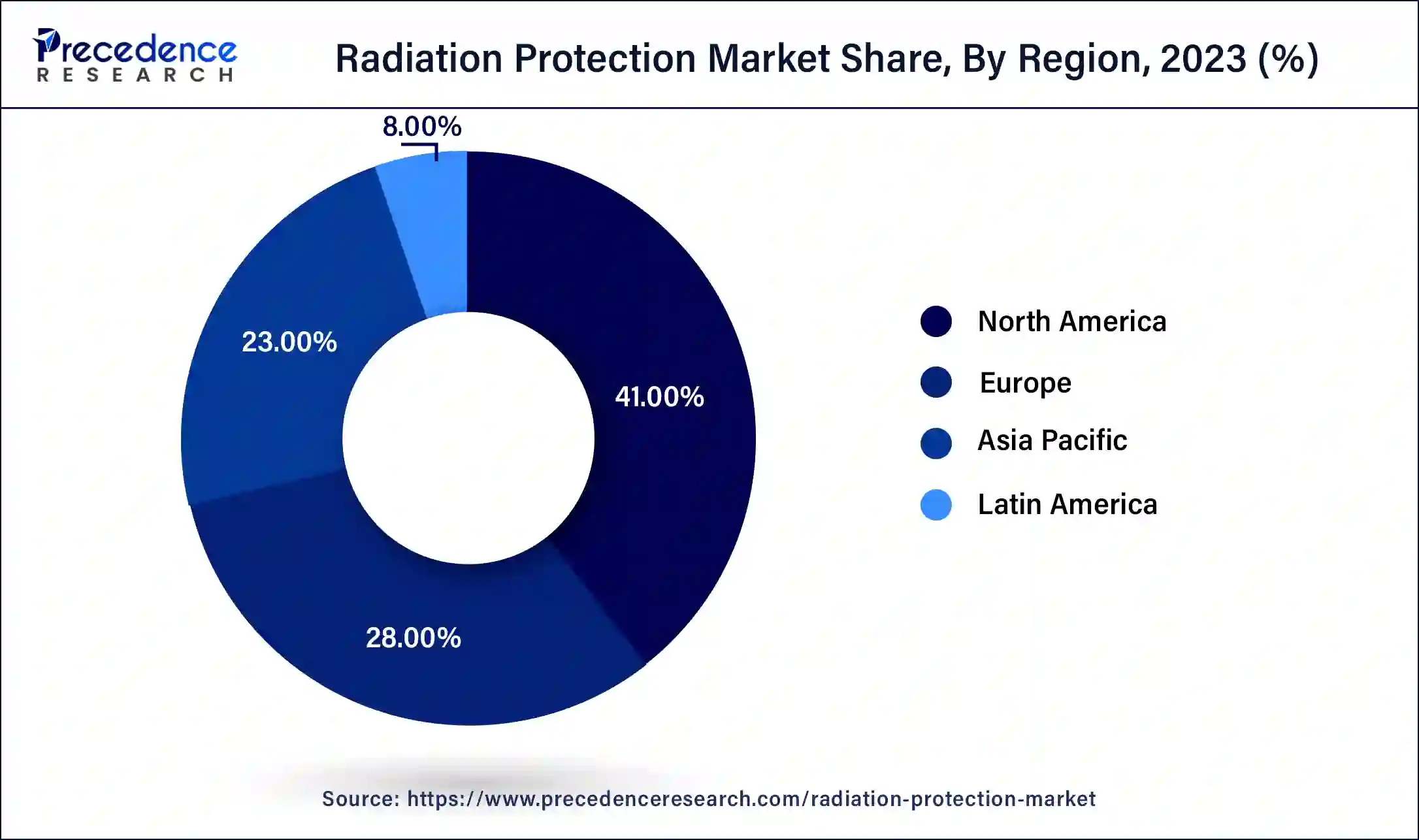

North America dominated the global radiation protection market in 2023. The dominance of the region is attributed to the advanced health infrastructure in countries like the United States and Canada. This provides many opportunities for emerging market players to expand their business with the help of advanced technologies. These governments are also investing heavily in radiation protection equipment due to the rising prevalence of cancer in North American countries. The availability of advanced infrastructure also helps them use this equipment in nuclear power plants and other industrial applications in radiation-prone environments.

Asia Pacific is anticipated to register the fastest growth in the radiation protection market with an exceptional CAGR during the forecast period of 2024 to 2034. Asian countries like China, Japan and India are investing heavily to adopt the use of advanced technologies in their healthcare infrastructure. Additionally, the region stands with multiple opportunities due to the increasing industrialization and urbanization. Chinese and Indian governments are focusing on implementing their nuclear power plants, which is also increasing the demand for radiation protection equipment in those settings.

Radiation protection refers to the practice that aims to protect the environment and people from the dangerous effects of ionizing radiation. It is a scientific practice that implements precautionary measures against exposure to various things like industrial applications, nuclear facilities, and medical procedures. Exposure to these radiations can cause many severe conditions like cancer, birth defects, skin burns, hair loss, and many more. This results in the rapid growth of the radiation protection market due to an increasing preference towards the adoption of nuclear techniques, which help in tackling issues related to exposure to ionizing radiation.

How AI is revolutionizing the radiation protection market

AI has been playing a vital role in innovating various ideas and solutions for multiple industries, which has helped them gain significant progress. The radiation protection market has also been growing significantly as AI has contributed to increasing accuracy in processes like imaging analysis, risk assessment, and radiation dose management. AI is also capable of analyzing huge datasets, which might help assist in developing new technologies related to radiation protection.

Analyzing data might also help researchers learn from past mistakes and make improvements through research and development (R&D). This increasing focus on R&D might play a key role in developing and innovating technologies, which might help in the development of technologies that help to detect radiation in multiple areas.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.19 Billion |

| Market Size in 2023 | USD 1.90 Billion |

| Market Size in 2024 | USD 1.99 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 4.81% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product Type, Solution, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Rising prevalence of non-communicable diseases (NCD)

The prevalence of non-communicable diseases like cancer and cardiovascular diseases is increasing rapidly due to multiple factors that affect human life. The ongoing increase in the number of these cases is driving the demand for diagnostic imaging and other procedures, including ionizing radiation in the radiation protection market. These factors increase the demand for nuclear medicine modalities like CT scans, X-rays, PET scans, and many more, which play a key role in the early detection of these diseases.

Advancements in nuclear medicine

The increasing need for advancement in healthcare is leading to the growth of the radiation protection market to fulfill the demand for diagnosis and treatment of various diseases. The constant focus on development has helped in many ways, like the use of radioisotopes in healthcare setups, which play a vital role in imaging. Additionally, there is an increase in focus towards developing equipment like PET scanners.

Higher equipment costs

The evolving technologies in the radiation protection market are constantly contributing to the market growth, but these factors might also restrict the growth due to the higher costs of the equipment used in nuclear medicine. They also require advanced materials to cure the patients from harmful radiation. This also impacts the overall manufacturing process and makes it costlier.

Rising awareness and safety

The increasing educational campaigns regarding the impacts of ionizing radiation are leading to multiple safety measures in healthcare infrastructures and workplaces, which create multiple opportunities for the radiation protection market. The increasing awareness increases the demand for the safety of the workers and the public. Studies have been conducted among professionals to rank their radiation awareness, which helps to get a better understanding.

Increasing regulatory support

The increasing effects of radiation exposure are leading to the increasing need for the radiation protection market. These factors are resulting in the demand for laws that aim to protect professionals and employees from radiation exposure by investing heavily in radiation protection equipment. Many governments have launched policies that aim to protect the people from the harmful effects of radiation. For instance, the Australian government has launched a national strategy for radiation safety, which aims to increase the use of technologies to protect people from the harmful effects of radiation.

The shields segment held a dominant presence in the radiation protection market in 2023. A radiation shield is a barrier that is placed between a source of radiation and the person who needs to be protected in a radiation-prone environment. They are usually made from materials like concrete, lead, and tungsten, which have the capability of absorbing and blocking harmful radiation. This increases the demand for shields in healthcare settings where diagnoses are performed using X-ray and CT scan machines. Additionally, the use of radiation shields can also be helpful in research labs and power plants, where they protect the things and people present in that environment.

The radiation detection & monitoring equipment segment is expected to grow at the fastest rate in the radiation protection market during the forecast period. This equipment is specially designed to detect and monitor ionizing radiation levels in different settings, which might help eliminate the risks associated with them. They are gaining popularity, especially in the healthcare sector, due to the increasing healthcare infrastructure in the developing regions. Many governments and organizations are focusing on radiation safety, which aims to tackle radiation exposure to protect the common people and professionals. Governments are investing in the development of this equipment, which are more accurate.

The radiation therapy shielding segment registered its dominance over the radiation protection market in 2023. Radiation therapy shielding includes the use of protective barriers that help absorb and block the exposure of radiation during cancer treatment. This protects both the patients and the professional during the entire therapy process. The increasing prevalence of cancer among adults increases the need for cancer treatment. This is attracting multiple emerging markets to invest in radiation therapy shielding equipment. Many healthcare organizations are implementing the use of this equipment, which stands out as a major growth factor in the radiation protection market.

The diagnostic shielding segment is expected to grow rapidly in the radiation protection market from 2024 to 2034. This shielding is designed to be used in medical imaging setups like CT scans and X-rays. This helps to protect the patient and professional from harmful radiation during the diagnosis. They also help in enhancing the overall imaging result with more accuracy. The segment is growing efficiently due to the increasing diagnostic setups in the developing regions. There are special centers that provide various tests under one roof, which increases the growth of diagnostic shielding solutions. Additionally, the increasing awareness regarding the risks of radiation exposure is contributing to the growth of the radiation protection market.

The hospitals segment held the largest share of the radiation protection market in 2023. The dominance of this segment is attributed to the rising prevalence of cancer among adults. According to a report, there were around 10 million global deaths due to cancer in 2023. This showcases the need for treatments and therapies in hospitals, which will lead to the expansion of radiation protection and detection equipment. Additionally, international health organizations and governments are creating regulations to make safety standards in healthcare settings as they are focused on the safety of patients and professionals. The increasing investment and expansion of the healthcare sector are also considered to drive the overall growth of the radiation protection market in the upcoming years.

Segment Covered in the Report

By Product Type

By Solution

By End-user

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

July 2024

January 2025

June 2024