What is the Rapid Prototyping Market Size?

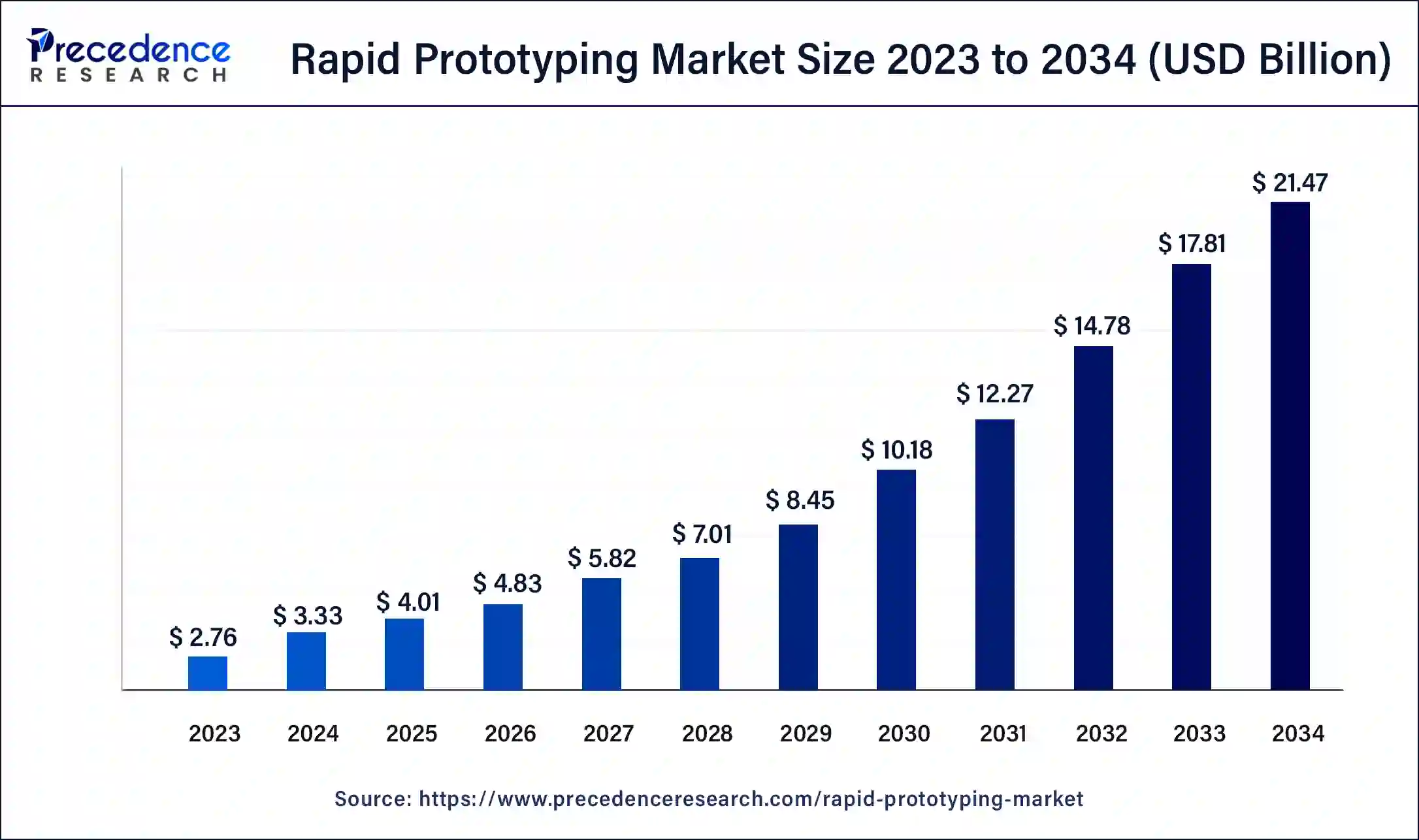

The global rapid prototyping market size accounted for USD 4.01 billion in 2025 and is predicted to increase from USD 4.83 billion in 2026 to approximately USD 24.71 billion by 2035, expanding at a CAGR of 19.94% between 2026 to 2035.

Rapid Prototyping Market Key Takeaways

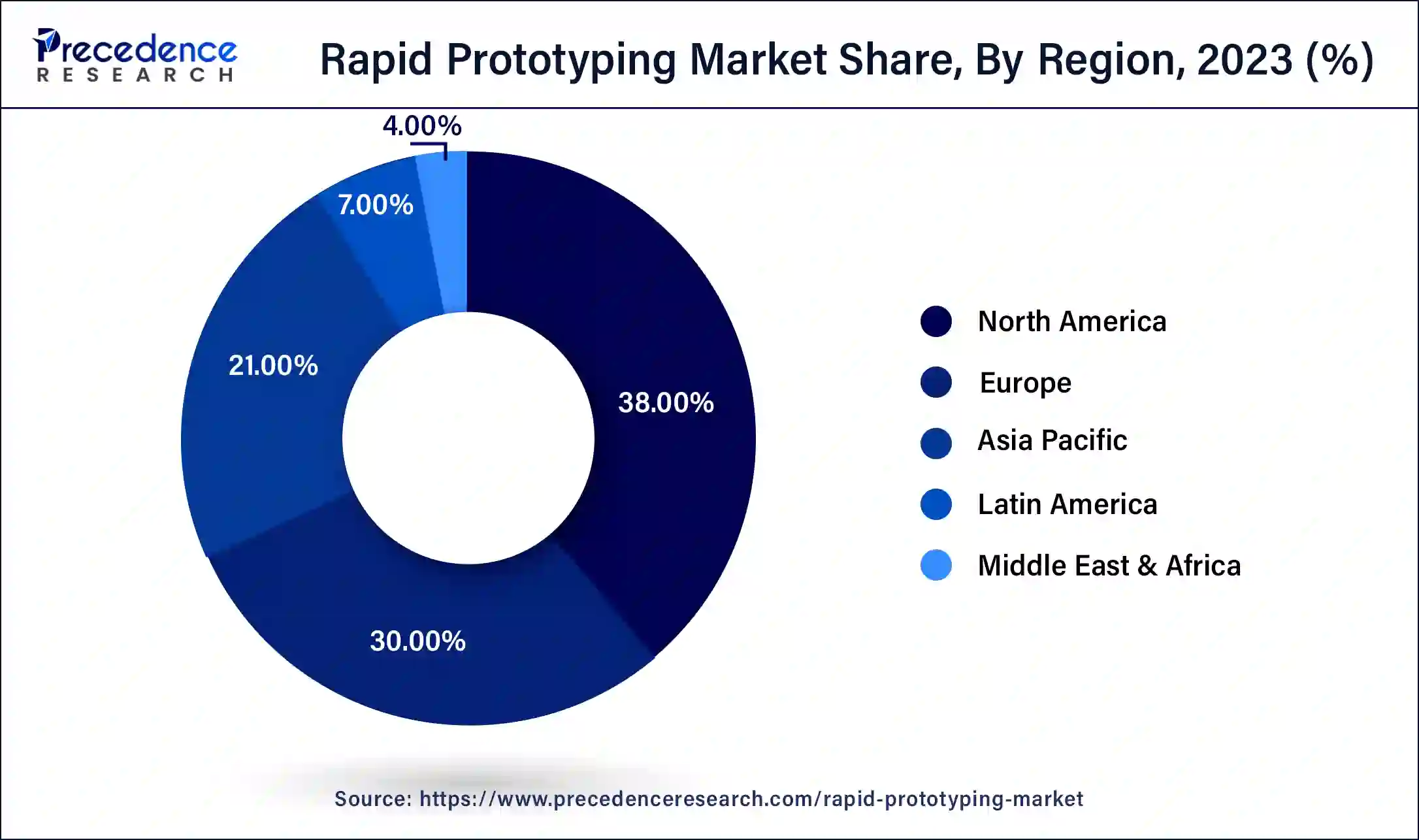

- North America contributed more than 38% of revenue share in 2025.

- Asia-Pacific is estimated to expand the fastest CAGR between 2026 to 2035.

- By material, the thermoplastics segment has held the largest market share of 46% in 2025.

- By material, the ceramics segment is anticipated to grow at a remarkable CAGR of 21.4% between 2026 to 2035.

- By technology, the stereolithography generated over 32% of revenue share in 2025.

- By technology, the digital light processing (DLP) segment is expected to expand at the fastest CAGR over the projected period.

- By end-user industry, the manufacturing and construction segment generated over 28% of revenue share in 2025.

- By end-user industry, the consumer goods and electronics segment is expected to expand at the fastest CAGR over the projected period.

What is Rapid Prototyping?

Rapid prototyping is an advanced approach in product development, aimed at swiftly crafting scaled-down, cost-efficient models of a product or system. These models serve as tangible or digital representations for rigorous testing and validation of design concepts and functionalities. This method leverages diverse techniques, such as 3D printing, computer-aided design (CAD), and additive manufacturing, to produce prototypes.

These prototypes enable teams to gain early insights, visualize their concepts, and gather invaluable user feedback, ensuring that the final product perfectly aligns with customer requirements and expectations. Widely adopted in industries like manufacturing, software development, and product design, rapid prototyping fosters innovation and agility by expediting decision-making and facilitating efficient development cycles.

Rapid Prototyping Market Growth Factors

- Constant innovation in rapid prototyping technologies drives market growth, offering more efficient and diverse solutions.

- Rapid prototyping accelerates product development, leading to faster market entry and increased competitiveness.

- By minimizing traditional tooling and development expenses, rapid prototyping offers significant cost advantages.

- Growing consumer preferences for personalized products boost the need for rapid prototyping solutions.

- The healthcare industry relies on rapid prototyping for custom implants, prosthetics, and surgical planning, spurring market growth.

- These industries leverage rapid prototyping for complex component testing and production, driving demand.

- Educational institutions adopt rapid prototyping for hands-on learning, fueling market expansion.

- Eco-friendly materials and reduced waste in rapid prototyping align with sustainability goals, increasing adoption.

- Rapid prototyping replaces traditional tooling methods, offering more efficient and versatile manufacturing.

- Enhanced design validation and iteration capabilities attract businesses to rapid prototyping solutions.

- Quick design iterations and functional prototypes cater to the fast-paced electronics market.

- Architects and developers employ rapid prototyping for intricate and accurate scale models.

- Dentistry: 3D printing in dentistry facilitates precise dental prosthetics and aligners, boosting market demand.

- Military Applications: Rapid prototyping aids in the development of military equipment, from prototypes to replacement parts.

- IoT and Wearables: Rapid prototyping supports the design and testing of small, intricate devices.

- Outsourcing rapid prototyping services to specialized firms fosters market growth.

- On-demand production reduces inventory costs and improves supply chain efficiency.

- Artists and jewelers utilize rapid prototyping for intricate and customized creations.

- Film and gaming industries rely on rapid prototyping for intricate props and character designs.

Market Outlook

- Industry Growth Overview:

The rapid prototyping market is experiencing significant growth as rising demand for 3D printing, faster product development requirements, and demand in industries such as automotive, aerospace, and healthcare. - Global Expansion:

The rapid prototyping market is experiencing significant global expansion, as this prototyping is a methodology that includes creating physical models of designs or concepts using computer-aided design (CAD) software. North America is dominated in the market by advanced and innovation-driven economies and huge R&D investments. - Major investors:

Major investors in the rapid prototyping market include established tech and materials giants such as 3D Systems, Stratasys, EOS, GE (Arcam), BASF, Arkema, Covestro, and service providers like Proto Labs, Fathom, and Xometry.

SWOT Analysis - Rapid Prototyping Market

- Drivers:

-

- Advanced rapid prototyping comes as a fast, affordable, and multipurpose strategy to product innovation and design.

- Rapid prototyping is a relatively new term and, in its simplest form, creating a prototype quickly to visually and functionally evaluate a part or some part features.

- Rapid prototyping (RP) quickly creates a physical part directly from its CAD model data using various manufacturing techniques.

- Advanced rapid prototyping comes as a fast, affordable, and multipurpose strategy to product innovation and design.

-

Restraints:

-

- Prototyping parts often includes challenging geometries that are problematic to machine. Intricate designs can lead to longer machining times and an increased hazard of errors.

- High material expenses, specialized equipment, and multifaceted machining operations can rapidly drive-up expenses.

- Prototyping parts often includes challenging geometries that are problematic to machine. Intricate designs can lead to longer machining times and an increased hazard of errors.

- Opportunity:

-

- Rapid prototyping (RP) has significantly transformed the landscape of product advancement and production over the past. Novel strategies for creating physical models have evolved into an advanced ecosystem of technologies that allows engineers and designers to bring concepts to reality with unprecedented speed and accuracy.

- Rapid prototyping has been transformed with 3D printing, tools that enable the creation of highly precise prototypes in record time.

- Threat:

-

- Rapid prototyping is complex and requires specialized equipment and skilled labor. Major companies need to invest in the necessary equipment or hire specialists to achieve the process.

- The materials used in the technology are limited, and the quality of the end product may not be as good as that produced by traditional production processes.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 19.94% |

| Market Size in 2025 | USD 4.01 Billion |

| Market Size in 2026 | USD 4.83 Billion |

| Market Size by 2035 | USD 24.71 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Technology, End-user Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Reduced time-to-market and industry diversification

Reduced time-to-market and diversification across Industries stand as two influential drivers propelling the demand for rapid prototyping. The imperative to expedite the introduction of products has become a dominant theme in the contemporary and fast-paced business landscape. Rapid Prototyping plays a pivotal role in enabling companies to hasten their product development processes. This expedites design revisions, early identification and resolution of potential issues, and culminates in swifter product launches.

In essence, rapid prototyping not only truncates the timelines for product development but also ensures that products make their market entry at the zenith of demand. Such rapid responsiveness carries particular significance in sectors where the punctual release of products can exert a substantial impact on market success. Industry diversification represents another significant force behind the mounting demand for rapid prototyping.

The adaptability and versatility of this technology have rendered it applicable across a broad spectrum of sectors, encompassing aerospace, healthcare, automotive, and consumer goods. This breadth of application underscores the technology's capacity to tackle an assortment of industry-specific challenges.

The extensive array of applications has ignited interest and investments in rapid prototyping, with more enterprises recognizing its intrinsic value in attaining their distinct goals, whether it entails the crafting of intricate aerospace components, the bespoke fabrication of medical implants, or the fine-tuning of designs for consumer products. This diversification not only broadens the market but also guarantees its sustained growth by adeptly catering to the evolving requisites of various industries.

Restraint

Post-processing requirements

Post-processing requirements pose a notable restraint on the growth of the rapid prototyping market. While rapid prototyping technologies excel in quickly creating initial prototypes, many of them demand additional post-processing steps to meet the desired quality standards. This adds extra time, cost, and complexity to the overall product development process, counteracting the efficiency benefits that rapid prototyping offers. Post-processing can involve tasks such as sanding, painting, or assembling multiple components, depending on the specific technology and material used. These manual interventions not only increase production time but also introduce the potential for human error.

Additionally, the need for post-processing may make the technology less attractive for applications where a pristine finish or immediate results are crucial, such as in consumer goods or medical devices. As a result, manufacturers may find it challenging to fully embrace rapid prototyping without efficient and cost-effective solutions to streamline post-processing, which remains a critical hurdle in the market's expansion.

Opportunity

Artistic creations and prototyping services

Artistic creations and prototyping services are emerging as significant opportunities in the rapid prototyping market, contributing to its growth in various ways. Rapid prototyping empowers artists and jewelers to transform their imaginative designs into physical, intricate, and customized creations with remarkable precision.

Moreover, specialized prototyping services cater to businesses looking to harness the benefits of rapid prototyping without the need for in-house capabilities. These services provide expertise in various rapid prototyping technologies, enabling companies to access advanced prototyping solutions, reduce upfront investments, and accelerate their product development cycles.

As businesses increasingly outsource their rapid prototyping needs, this presents a thriving opportunity for service providers to offer customized and cost-effective solutions, helping clients bring their innovative concepts to market faster. Both these opportunities underscore the versatility and adaptability of rapid prototyping, extending its applications beyond traditional industrial and engineering sectors into the realms of art, design, and entrepreneurship. This diversification promises a bright future for the rapid prototyping market.

Segment Insights

Material Insights

According to the material, the thermoplastics segment has held 46% revenue share in 2023. The thermoplastics segment's significant presence in the rapid prototyping market is mainly due to its remarkable adaptability. Thermoplastic materials, including ABS, PLA, and nylon, are highly valued for their unique ability to be melted and reshaped repeatedly.

This characteristic makes them exceptionally suitable for 3D printing and additive manufacturing processes, resulting in robust and practical prototypes. Their widespread use across various industries, from aerospace to consumer goods, underscores their effectiveness. Moreover, the availability of advanced thermoplastic materials with enhanced strength and eco-friendly qualities has further cemented their pivotal role in the rapid prototyping market.

The ceramics segment is anticipated to expand at a significant CAGR of 21.4% during the projected period. The ceramics segment commands significant growth in the rapid prototyping market due to its remarkable attributes. Ceramics are prized for their exceptional heat resistance, robustness, and excellent electrical insulation, making them indispensable in industries like aerospace, healthcare, and electronics.

Employing ceramics in rapid prototyping enables the creation of intricate and high-performance components, such as dental implants, advanced aerospace parts, and specialized electronics. Ceramics' prominence in the rapid prototyping market is a result of their ability to meet the demand for precise, heat-resistant, and biocompatible products, establishing them as a preferred choice for a range of cutting-edge applications across diverse sectors.

Technology Insights

The stereolithography (SLA) segment had the highest market share of 32% in 2023. The stereolithography (SLA) segment commands a substantial share in the rapid prototyping market primarily because of its precision and adaptability. SLA technology utilizes photopolymerization to produce highly detailed and accurate 3D models, making it especially well-suited for industries where exactness is paramount, such as aerospace and healthcare.

Its extensive material options, including high-quality resins for engineering purposes, cater to the diverse needs of different sectors. Furthermore, SLA's capability to swiftly create intricate designs further solidifies its position as a favored choice for design validation and functional prototyping, establishing a significant presence in the rapid prototyping market.

The digital light processing (DLP) segment is anticipated to expand fastest over the projected period. The digital light processing (DLP) segment commands significant growth in the rapid prototyping market due to its unique advantages. DLP technology offers rapid prototyping capabilities with high precision and speed, making it ideal for a wide range of applications.

It employs digital micromirror devices to project light and cure photosensitive resin layer by layer, resulting in faster build times and exceptional detailing. The efficiency, accuracy, and versatility of DLP technology attract various industries, including healthcare, automotive, and consumer goods, contributing to its dominant market share as a preferred choice for rapid prototyping.

End User Industry Insights

The manufacturing and construction segment had the highest market share of 28% in 2023. The manufacturing and construction segment holds a significant share in the rapid prototyping market due to its ability to streamline product development and innovation. Rapid prototyping techniques enable the quick creation of prototypes for components, architectural models, and building elements, reducing design-to-production lead times. This not only accelerates time-to-market but also facilitates efficient testing and design validation.

Additionally, the segment benefits from cost savings by minimizing the need for traditional tooling and reducing material waste. The manufacturing and construction industry's strong reliance on precision, customization, and functionality makes rapid prototyping an ideal solution, driving its prominent presence in the market.

The consumer goods and electronics segment is anticipated to expand fastest over the projected period. The consumer goods and electronics sector commands substantial growth in the rapid prototyping market due to its dynamic and responsive nature. This industry leverages rapid prototyping to expedite product development, craft tailor-made designs, and swiftly adapt to changing consumer demands.

With the growing appetite for consumer electronics, wearables, and personalized items, manufacturers turn to rapid prototyping to streamline product launches, reduce production costs, and maintain a competitive edge. Hence, this segment plays a pivotal role in propelling the adoption and expansion of rapid prototyping technologies across the broader market landscape.

Regional Insights

What is the U.S. Rapid Prototyping Market Size?

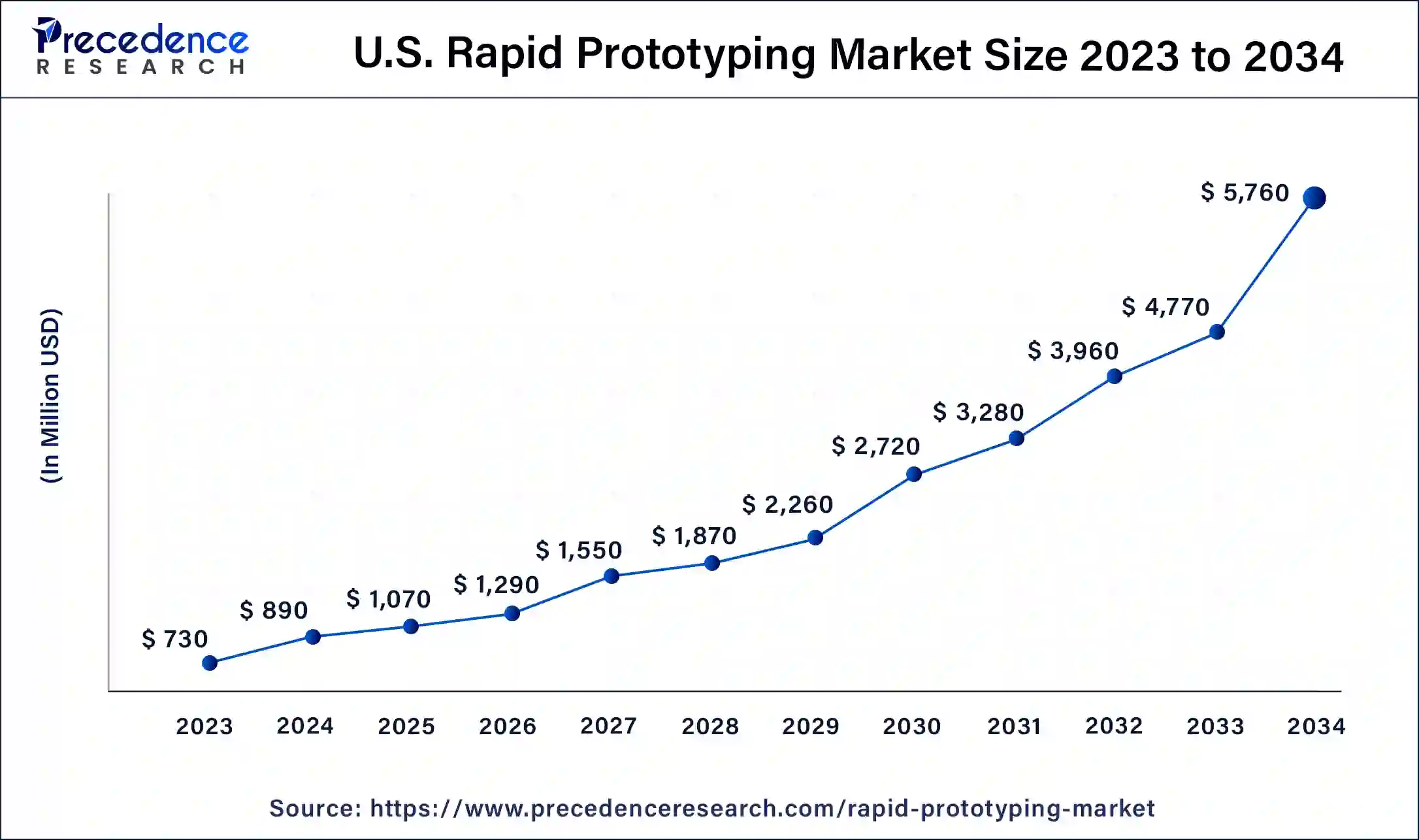

The U.S. rapid prototyping market size is valued at USD 1,070 million in 2025 and is expected to be worth around USD 6,630 billion by 2035, growing at a CAGR of 20.01% from 2026 to 2035.

North America has held the largest revenue share 38% in 2023. North America's dominance in the rapid prototyping market can be attributed to several factors. The region boasts a robust presence of key market players, advanced technological infrastructure, and a strong focus on research and development.

Additionally, North America has a mature manufacturing industry, especially in aerospace and healthcare, where rapid prototyping is extensively employed for innovation and product development. Furthermore, a culture of early technology adoption and a supportive regulatory environment contribute to the region's leadership in this market. These factors collectively position North America as a major player, both in terms of market demand and technological advancements in rapid prototyping.

U.S. Rapid Prototyping Market Trends

3D printing and rapid prototyping services in the United States have benefited from advanced growth over the past years, driven by rapid technology development and novel applications for 3D printing technology, which drives the growth of the market.

Asia Pacific: Why are there increasing research and development activities?

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific holds significant growth in the rapid prototyping market for several compelling reasons. Its strong manufacturing presence drives the demand for rapid prototyping across industries like automotive, aerospace, and electronics. Additionally, the region benefits from a burgeoning consumer market that seeks unique and innovative products, fostering the adoption of rapid prototyping technologies.

Moreover, favorable governmental policies, increased investments in research and development, and a growing startup ecosystem collectively contribute to Asia Pacific's prominence in the global rapid prototyping arena, establishing it as a pivotal player in the industry.

India Rapid Prototyping Market Trends

In India, major programs like Make in India, Startup India, and Atmanirbhar Bharat provide funding, training, and regulatory support for additive manufacturing and prototyping. 3Ding plays a critical role in bridging the gap between innovative technology and organisations across India, which drives the growth of the market

Europe: Advancement in rapid prototyping

Europe is significantly growing in the market as the rising demand for fast, affordable diagnostics and the increasing prevalence of chronic diseases require rapid prototyping. This type of prototyping drives quicker design iterations and instantaneous feedback, ensuring that products meet high standards and drive market growth.

The UK Rapid Prototyping Market Trends

In the UK, Rapid prototyping solutions support reducing production costs by identifying design flaws initially, preventing expensive challenges in mass production. They also enable for testing of various materials and production processes before committing to large-scale production. By refining designs effectively, major organizations save time and resources.

Rapid Prototyping Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

United States |

Rapid prototyping and production of enhanced products |

Stratasys Direct offers fast, high-quality 3D prototyping services using advanced technologies and materials. |

|

|

United States |

Advanced technological expertise |

3D Systems achieved a groundbreaking milestone in the medical field with the FDA clearance of its VSP PEEK Cranial Implant. |

|

|

Proto Labs |

United States |

Powerful proprietary software |

Protolabs has significantly expanded its U.S. manufacturing capacity in 2025 in response to rising domestic demand for metal 3D-printed parts. |

|

ExOne |

United States |

Expertise in sand casting |

In October 2025, ExOne's metal binder jetting capability was acquired by Arc Impact Acquisition Corporation in a separate acquisition of Desktop Metal assets. |

|

Materialise |

Belgium |

Pioneering software solutions and expertise |

Materialise's strength lies in its pioneering software solutions, backed by over three decades of experience in 3D printing. |

Other Major Key Players

- HP Inc.

- EOS GmbH

- Renishaw

- Voxeljet

- SLM Solutions

- Formlabs

- EnvisionTEC

- Arcam AB (GE Additive)

- Autodesk

Recent Developments

- In November 2025, Monstarlab Inc., announced the global launch of MonstarX. It is an AI-driven workflow which transforms software advancement by carrying enterprise-grade applications up to six times quicker and at one-fifth the expensive than traditional methods.

(Source: monstar-lab.com/) - In May 2025, Peak Technology announced the acquisition of Jinxbot 3D Printing. Jinxbot 3D Printing is a premier additive manufacturing company known for its high-mix, rapid-turn prototyping solutions and creative engineering support.

(Source: www.businesswire.com/) - In December 2025, Tata Consultancy Services signed a definitive agreement to acquire a 100% stake in Coastal Cloud. The partnership is bringing a leading Salesforce Summit partner, which significantly focuses on Salesforce Consulting, for a consideration of $700 million.

(Source: www.tcs.com/) - In September 2021, 3D Systems Corporation expanded its material offerings by introducing certified Scalmalloy (A) and M789 (A). These materials were designed to create high-strength components for various industries, including energy, mold making, automotive, electronics, aerospace, and defense. The company's Direct Metal Printing platform facilitates the production of parts using Scalmalloy (A) and M789 (A), providing a versatile solution for diverse applications.

Segments Covered in the Report

By Material

- Thermoplastics

- Metals and Alloys

- Ceramics

- Others

By Technology

- Stereolithography (SLA)

- Selective Laser Sintering (SLS)

- Digital Light Processing (DLP)

- Fused Deposition Modeling (FDM)

- Others

By End-user Industry

- Aerospace and Defense

- Healthcare

- Manufacturing and Construction

- Consumer Goods and Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting