October 2024

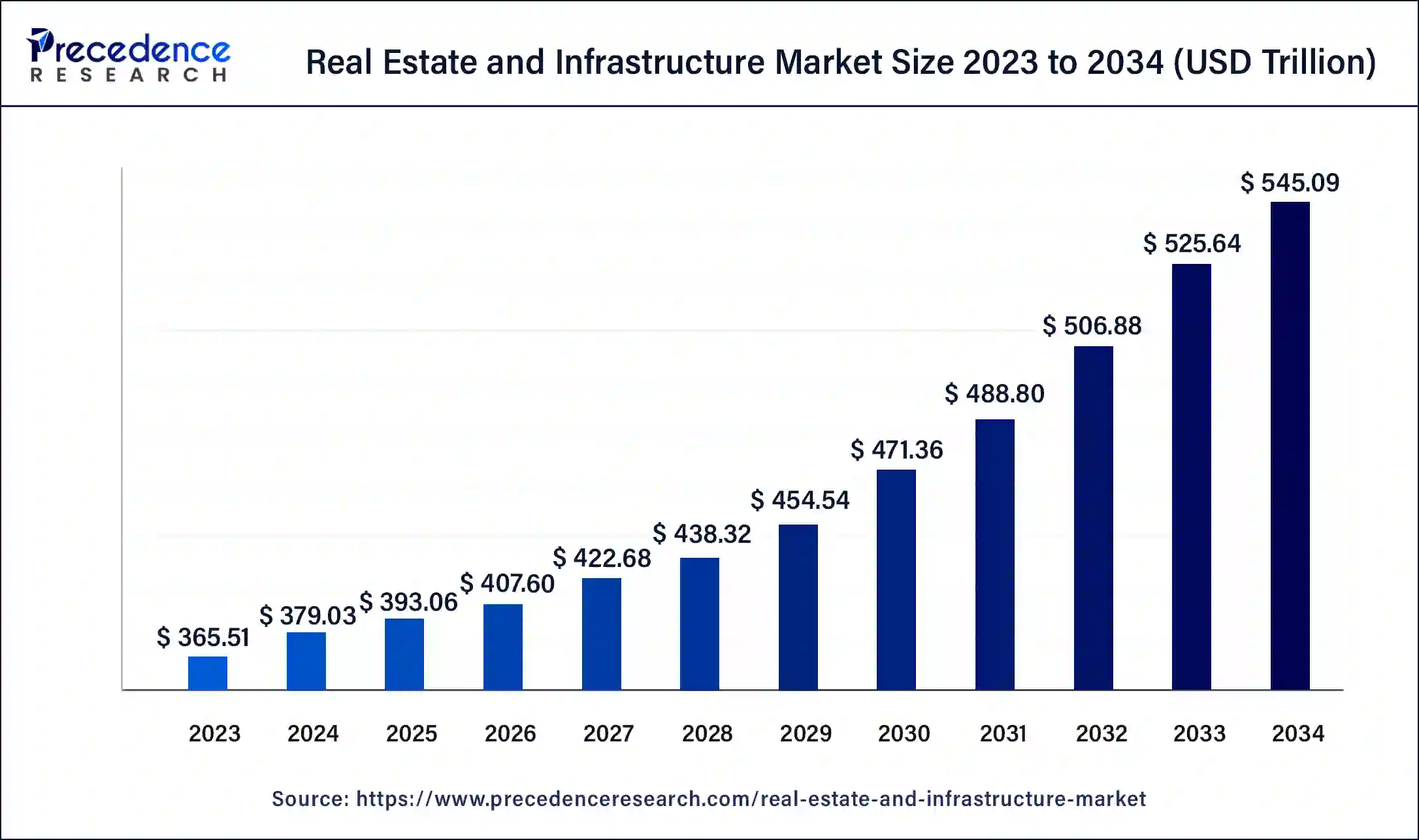

The global real estate and infrastructure market size was USD 365.51 trillion in 2023, estimated at USD 379.03 trillion in 2024 and is expected to be worth around USD 545.09 trillion by 2034, expanding at a CAGR of 3.70% from 2024 to 2034.

The global real estate and infrastructure market size accounted for USD 379.03 trillion in 2024 and is anticipated to reach around USD 545.09 trillion by 2034, growing at a CAGR of 3.70% from 2024 to 2034.

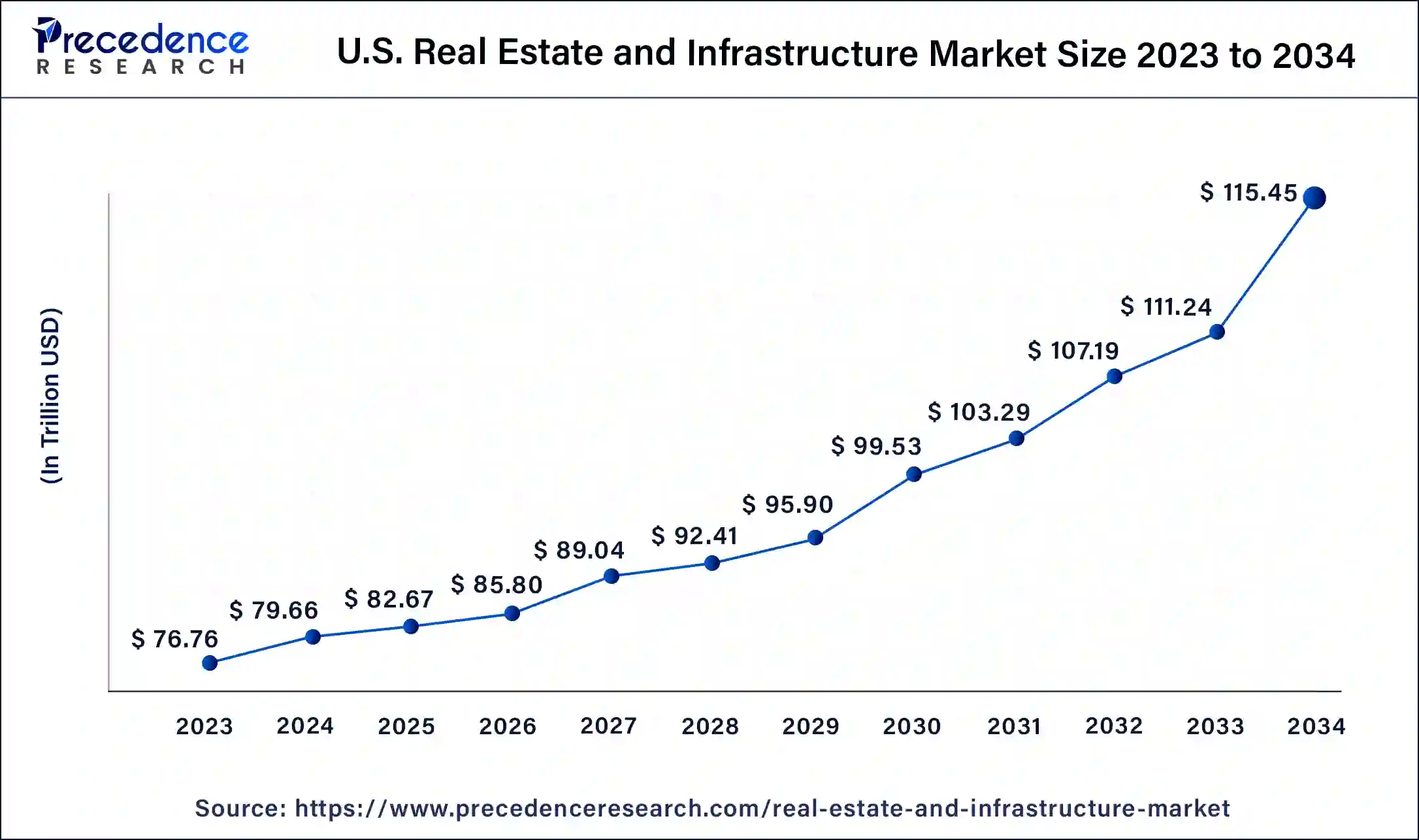

The U.S. real estate and infrastructure market size was estimated at USD 76.76 trillion in 2023 and is expected to reach USD 115.45 trillion by 2034, growing at a CAGR of 3.78% from 2024 to 2034.

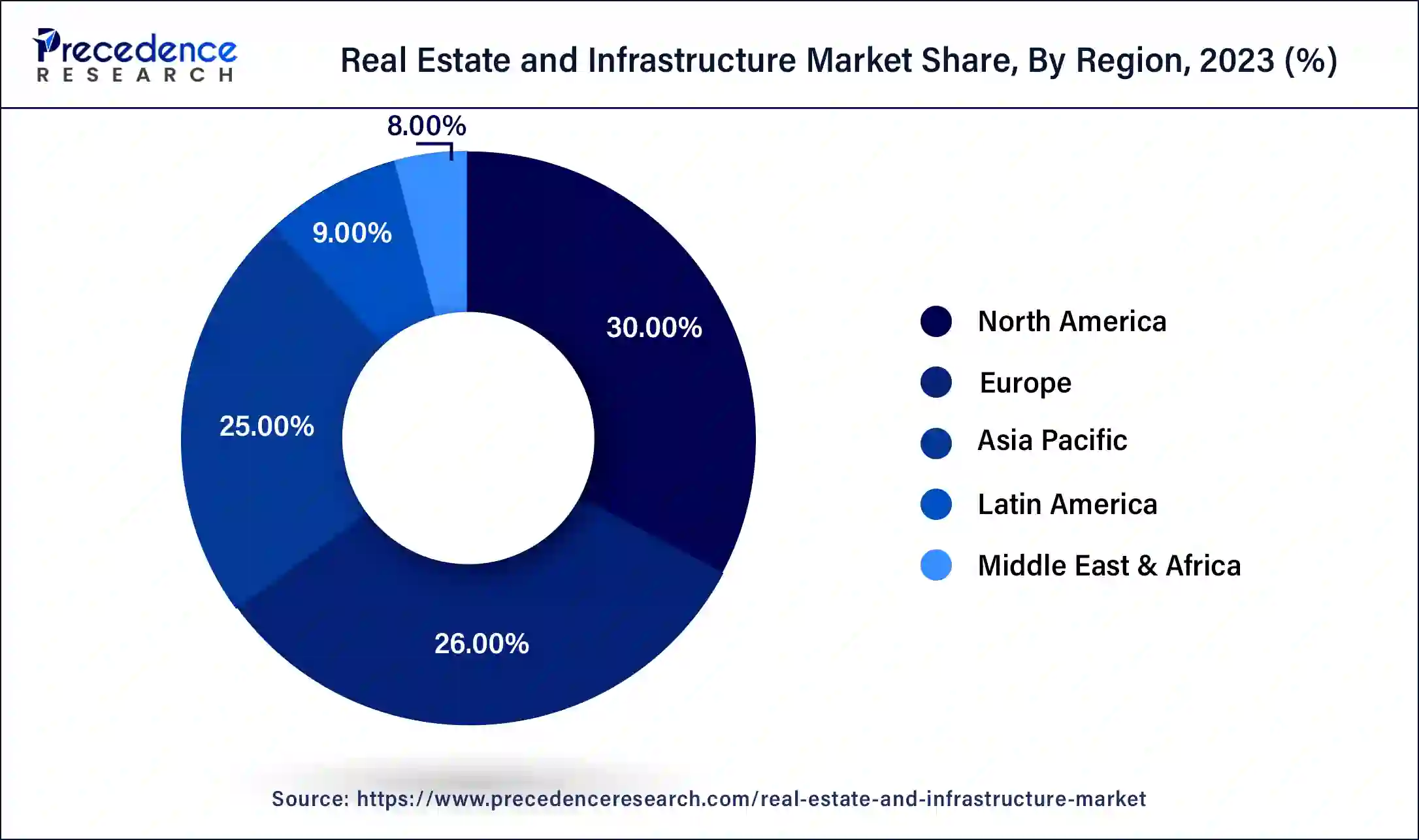

North America dominates the real estate and infrastructure market. The growth of the real estate market in North America dominates the market owing to the increasing population and need for residential buildings as well as commercial sectors. Expanding construction and real estate in countries like the United States and Canada drives the growth of the real estate and infrastructure market. The residential sector dominated the real estate and infrastructure market in the region due to significant growth and rising demand in the commercial sector which significantly contributes to the overall market growth. Increasing preferences towards urban living and trends focusing on innovation and technology are observed in the region. Additionally, consumers are shifting towards sustainable and energy-efficient properties that drive the growth of the real estate and infrastructure market.

Europe is expected to grow with a CAGR of 4.0% during the forecast period. The growth of the real estate market in the region is expected to increase due to a growing investment by the major companies in the real estate market due to the geopolitical conditions. Europe is considered one of the major attractions for investors in the real estate and infrastructure market. Cities like Paris, London, and Berlin have the highest prospectus in the real estate market due to their excellent performance and outstanding quality with the existing market investments. Increasing commercial sectors in European countries also drives the growth of the real estate and infrastructure market.

Real estate refers to property consisting of land, buildings, and natural resources. The real estate market encompasses buying, selling, leasing, and managing these properties. Infrastructural developments, like highways, transportation networks, metro systems, and airports are contributing to the growing demand for development and increasing value of real estate in several regions around the world.

The increasing population around the world demands efficient and cost-effective residential as well as commercial properties for living and business, respectively. There are several components that play the role of catalysts in the growth of the real estate market such as transportation networks, highways, metros, urbanization, and economic growth in the population. All these factors collectively contribute to the growth of the real estate and infrastructure market.

| Report Coverage | Details |

| Market Size in 2023 | USD 365.51 Trillion |

| Market Size in 2024 | USD 379.03 Trillion |

| Market Size by 2034 | USD 545.09 Trillion |

| Growth Rate from 2024 to 2034 | CAGR of 3.70% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Property Type, Commercial Property Type, Specialized Property Type, Infrastructure Property Type, Business Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Urbanization and shift in economies

Increasing tendencies to shift life to urban areas for better connectivity, workplaces, career opportunities, and entertainment purposes are driving the growth in urbanization. The rising population boosts the demand for residential and commercial buildings driving the growth of real estate in urban areas. Increasing infrastructural development like hospitals, commercial spaces, and retail hubs boost entrepreneurship and drive economic growth in urban areas. The rise in the buying properties due to the higher proficiency in housing loans and lower interest rates is driving the buying rate of properties in urban areas. Moreover, shift in disposable incomes along with per capita income is also contributing to the growth of the real estate and infrastructure market.

Economic downturns

Economic downturns can negatively impact real estate and infrastructure development. Economic instability, recessions, or financial crises can lead to reduced demand, financing difficulties, and delays in projects. Changes in interest rates can affect the cost of financing for real estate and infrastructure projects. Higher interest rates may lead to increased borrowing costs, making projects less financially viable.

Rising industrialization in developing countries

Industrialization often necessitates improvements in transportation, energy, and utilities infrastructure. Governments and private investors may undertake large-scale infrastructure projects, leading to increased demand for construction and real estate development. The establishment and expansion of industries requires additional office spaces, manufacturing facilities, warehouses, and logistics centers. This surge in demand can drive the growth of the commercial real estate sector. As industrialization attracts a workforce to urban areas, there is a need for housing, creating opportunities for residential real estate development. This includes the construction of housing complexes, apartments, and supporting amenities.

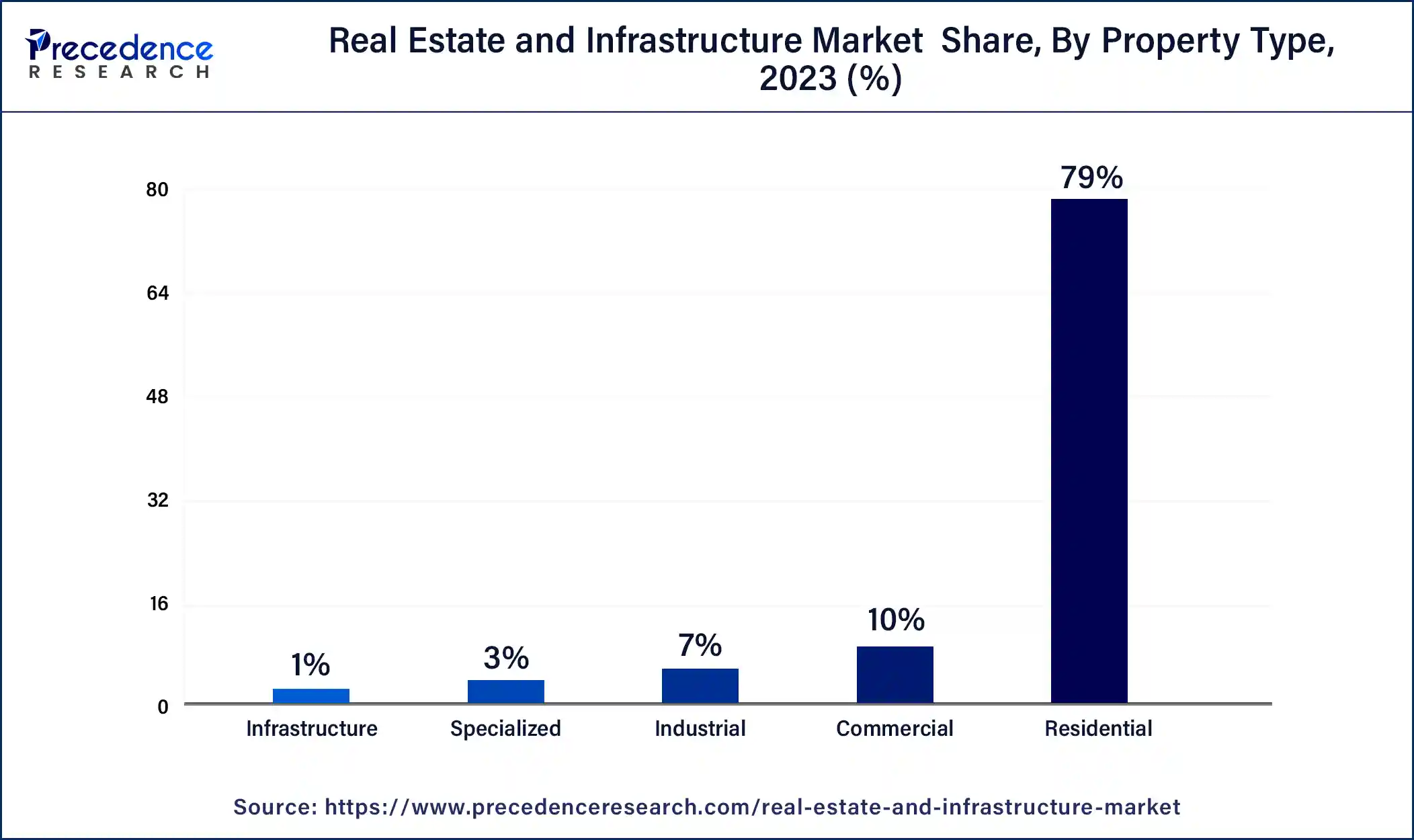

The growth of the residential segment in the real estate and infrastructure market is attributed to the increasing population around the world. The residential sector majorly focuses on selling and buying properties houses or homes. It includes single-family homes, condominiums, apartments, planned development, and others. Increasing urban population, rising household disposable income, and financial institutions offering lower interest rates for decades are some factors driving the growth of the residential segment in the real estate and infrastructure market. Furthermore, rising involvement of private developers in the residential infrastructure development sector of the real-estate business contributes to the growth of the real estate and infrastructure market.

The growth of the commercial segment of the real estate and infrastructure market is attributed to a rising demand for commercial products and services among the population. Increasing commercialization tends to generate more disposable income and lifestyle changes. The commercial segment includes office buildings, hospitals, retail, etc. Increasing investment by public and private investors for commercial development like malls, office buildings, and multi-specialty hospitals is driving the growth of the commercial segment. An increasing number of startup companies and the growth of multi-national companies with bigger workforces in different cities demand high-end office buildings which will drive demand for the commercial real estate and infrastructure market.

The buying segment will dominate the real estate and infrastructure market in 2023 due to the rising participation of financial institutions with efficient home loan plans with minimum interest rates over longer durations is driving the tendency to buy homes or properties in people. Additionally, increasing urbanization and the rise in real estate projects by several builders are promoting competition and variety in the real estate market. Buying properties as a future investment is also one of the major contributing factors in the growth of the buying segment in the real estate and infrastructure market.

Property renting is gaining popularity in urban areas of the world due to high selling rates. The rising value of infrastructure is a driving factor of the rental segment in the real estate and infrastructure market. An increasing urban population further drives the demand for residential or commercial spaces for living and occupational needs which is also drives the growth of the rent segment in the real estate and infrastructure market.

Segments Covered in the Report:

By Property Type

By Commercial Property Type

By Specialized Property Type

By Infrastructure Property Type

By Business Type

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

July 2024

February 2025

July 2024