January 2025

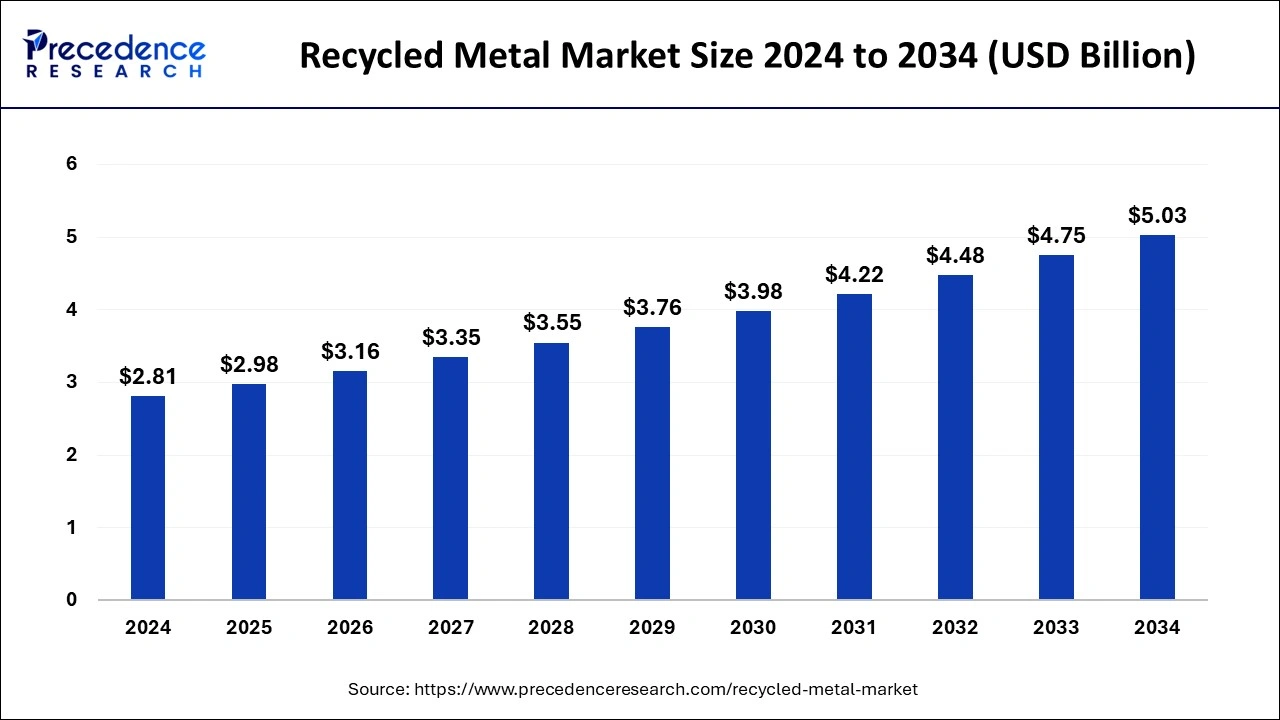

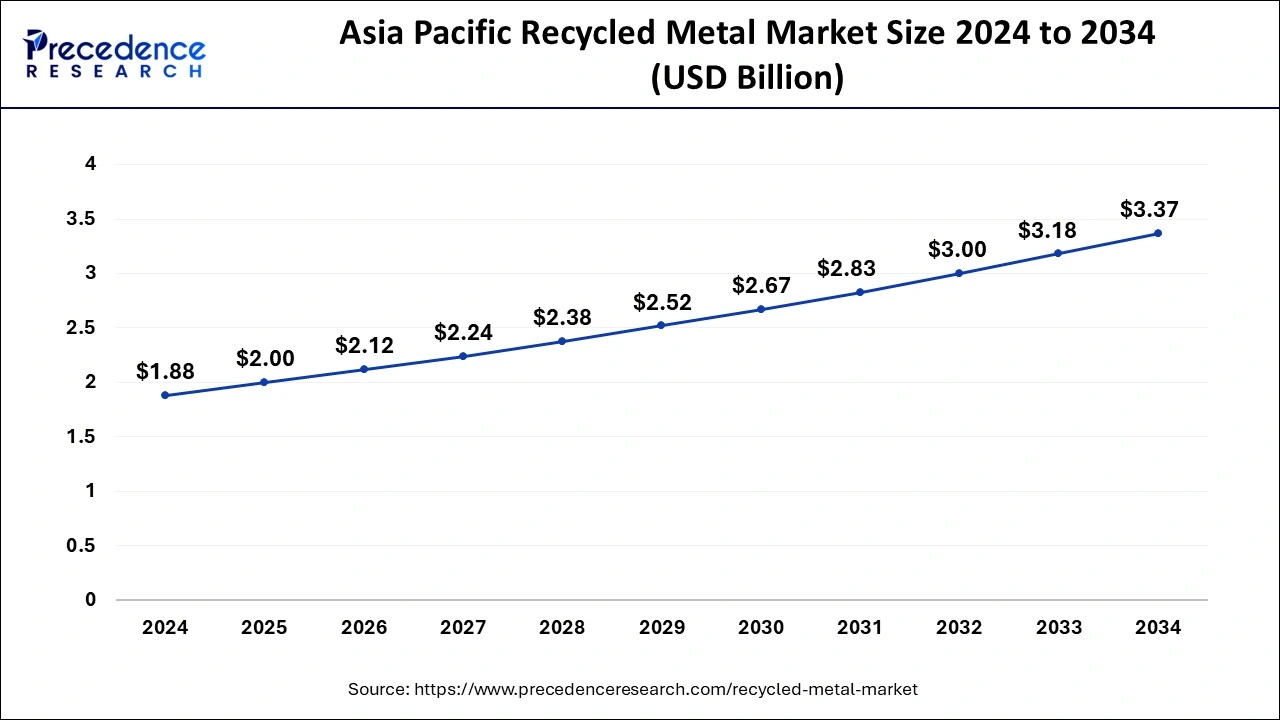

The global recycled metal market size calculated at USD 2.98 billion in 2025 and is projected to surpass around USD 5.03 billion by 2034, expanding at a CAGR of 6% from 2025 to 2034. The Asia Pacific recycled metal market size reached USD 2 billion in 2025 and is expanding at a CAGR of 6.03% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global recycled metal market size accounted for USD 2.81 billion in 2024 and is expected to be worth around USD 5.03 billion by 2034, at a CAGR of 6% from 2025 to 2034.

The Asia Pacific recycled metal market size was estimated at USD 1.88 billion in 2024 and is predicted to be worth around USD 3.37 billion by 2034, at a CAGR of 6.03% from 2025 to 2034.

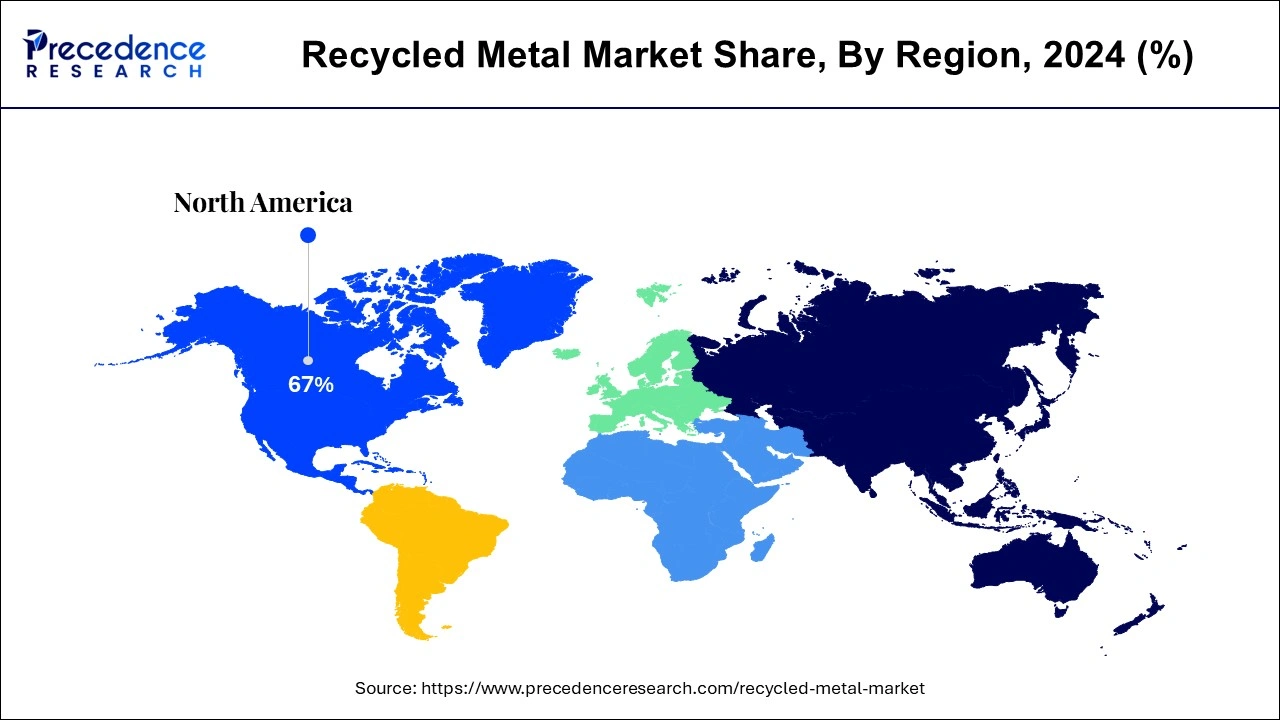

Asia Pacific dominated the global recycled metal market with a share of over 67% in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. Asia Pacific is the highest consumer of the recycled metal. The development of improved waste management system and recycling technologies coupled with increased awareness regarding the deteriorating environmental concerns is fostering the growth of the market in this region. Moreover, Rising urbanization and rapid industrialization is augmenting the demand for the recycled metal in the region. According to the Indian Brand Equity Foundation, India requires an investment of more than US$ 750 billion by 2022 in the development of infrastructure in order to achieve sustainable development. China is planning to invest more than US$2.5 trillion in transport and construction sector that is expected to boost the demand for the recycled metal significantly. These rising investments by the developing economies in the growth of the infrastructure is boosting the market growth.

On the other hand, North America is expected to be the most opportunistic market. This is attributable to the highest production of steel in US, increased environment consciousness, and rising demand for the aluminium from the automotive sector for manufacturing of electric vehicle. The automotive sector is expected to drive the demand for the non-ferrous metals in the upcoming years that may propel the growth of the recycled metal market in the region. Further, rising government initiatives to reduce carbon footprint is encouraging the different industries to adopt recycled metal, thereby fostering market growth in the region.

The global recycled metal market is primarily driven by the rapid growth of the building and construction industry. The rapid urbanization and rapid industrialization is augmenting the recycled metal market growth across the globe. The rising demand for steel owing the infrastructural development and rapid urbanization in the Asia Pacific, Latin America, Middle East, and Africa is significantly boosting the demand for the recycled metal market. Rising awareness regarding the negative environmental impact of mining has resulted in the increased government interference in the metal mining sector to reduce carbon footprint and reduce the environmental impacts of metal mining. Therefore, increase in government initiatives to reduce dependency on mining is positively impacting the growth of the global recycled metal market across the globe. This has resulted in an increased adoption of metal recycling technologies and boosted the usage of recycled metals in various end use applications such as industrial, construction, automotive, and electronics industries.

The rapid growth of the building and construction and automotive industry in the developed regions like North America and Europe has significantly propelled the growth of the global recycled metal market in the past years. Further, the rising public and private investments in building sophisticated infrastructure in the developing economies such as Brazil, China, India, and Argentina is expected to drive the growth of the recycled metal market during the foreseeable future. Moreover, the rapid growth and popularity of the metal recycling technologies to develop a sustainable solution is fostering the demand for the recycled metal market. Metal recycling results in energy savings as compared to the energy consumption in metal mining. The rising awareness regarding the utilization of waste metals and strict government norms regarding the usage of recycled metal is expected to foster the market growth across the globe. Further, the rising demand for the transport services, automotive, construction, and electronics among the global consumers is contributing towards the growth of the recycled metal market.

| Report Highlights | Details |

| Market Size By 2034 | USD 5.03 Billion |

| Market Size in 2025 | USD 2.98 Billion |

| Market Size in 2024 | USD 2.81 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6% |

| Largest Market | Asia Pacific |

| Base year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Mental Type, End User, Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

The ferrous segment dominated the global recycled market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The ferrous metal includes iron, steel, stainless steel, and titanium. These metals are extensively used in the construction, electronics, and industrial machineries production. The increased volume usage of such electronics and industrial machineries and construction across the globe have resulted in the increased consumption of ferrous metals that made this a leading segment in the market.

On the other hand, the non-ferrous segment is estimated to be the fastest-growing segment during the forecast period. This is attributable to the rising usage of aluminium in various end use industries such as building & construction, industrial machineries, aerospace, and automotive. The aluminium is a durable and light-weight metal and hence its consumption is growing all over the globe.

The transport & automotive segment dominated the global recycled market in 2024, in terms of revenue and is estimated to sustain its dominance during the forecast period. The extensive usage of recycled metals in the transport and automotive sector across the globe has had increased the consumption of the recycled metal in this end use application, making it the most dominant segment.

On the other hand, the construction segment is estimated to be the most opportunistic segment during the forecast period owing to the rising investments in the developing nations like China, India, and Brazil for infrastructural development. The rapid urbanization and rapid industrialization is boosting the consumption of recycled metal in the construction industry, thereby fueling the market growth.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved solutions. Moreover, they are also focusing on maintaining competitive pricing.

In June 2019, Tata Steel, a major steel producer in India, announced to establish a metal recycling facility. It would be India’s first recycling unit.

The various developmental strategies like business expansion, fosters market growth and offers lucrative growth opportunities to the market players.

By Metal Type

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

September 2024

December 2024

February 2025