Refractories Market (By Form: Bricks & Shape, Monolithic & Unshaped; By Product: Clay, Non-Clay; By Alkalinity: Acidic & Neutral, Basic; By End-Use Industry: Iron & Steel, Non-Ferrous Metals, Glass, Cement, Others.) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

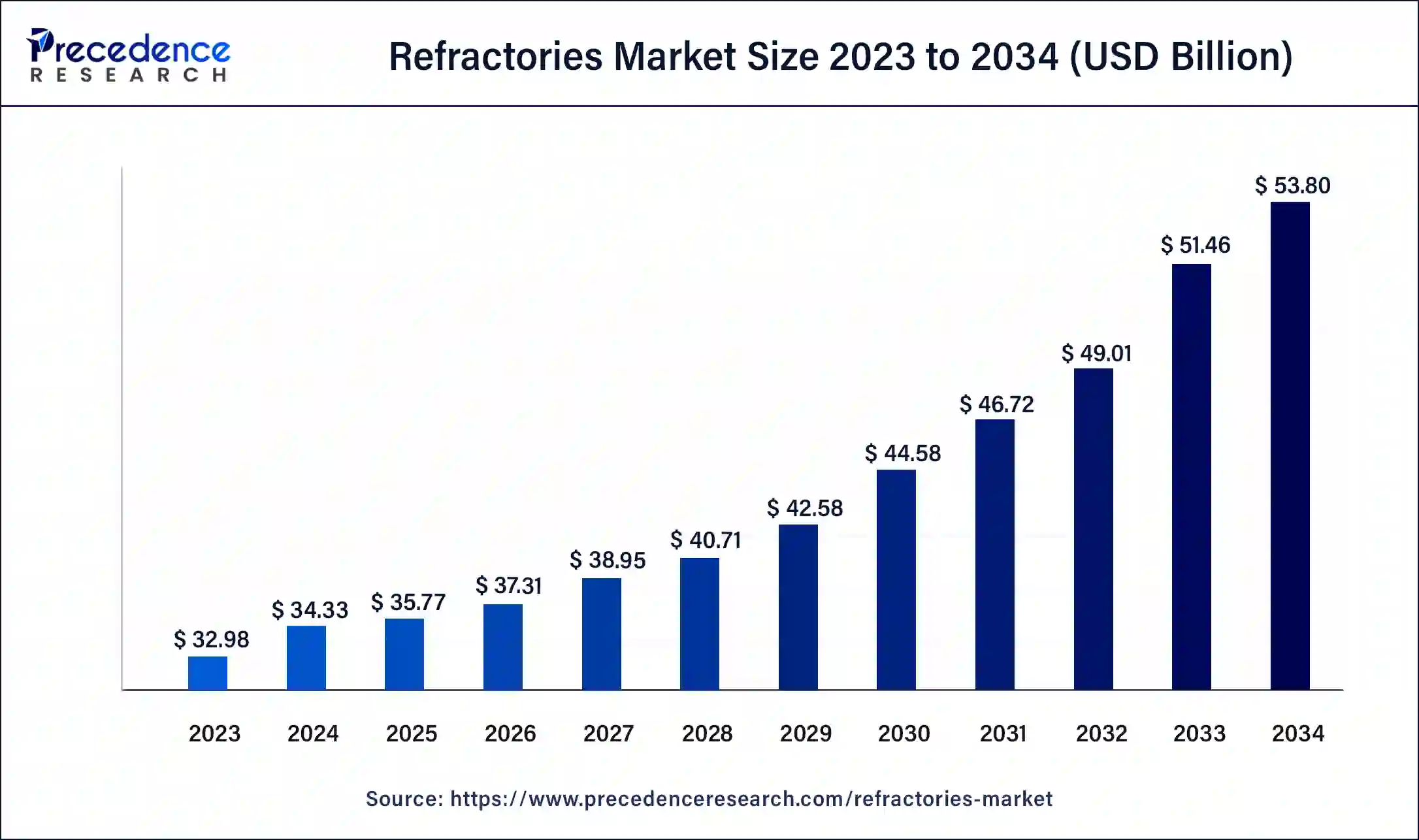

The global refractories market size was USD 32.98 billion in 2023, calculated at USD 34.33 billion in 2024 and is expected to reach around USD 53.80 billion by 2034, expanding at a CAGR of 4.60% from 2024 to 2034.

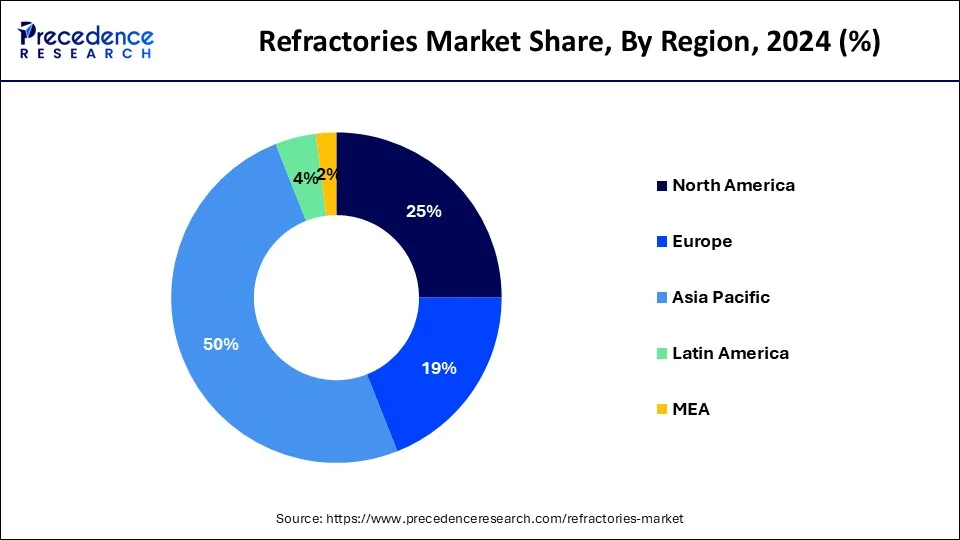

The Asia-Pacific refractories market size was valued at USD 20.26 billion in 2023 and is projected to reach USD 43.56 billion by 2033, registering a CAGR of 8% from 2024 to 2033.

The region's thriving steel, cement, and manufacturing sectors propel the demand for refractory materials essential in high-temperature processes. Additionally, the construction boom in Asia-Pacific further contributes to the market's growth. The region's economic growth, coupled with increased infrastructure development, underscores its pivotal role in the refractories market, making it a major contributor to both production and consumption within the industry.

North America is poised for rapid growth in the refractories market due to a surge in industrial activities and a revival of construction projects. The region's robust manufacturing sector, particularly in steel, glass, and cement industries, is driving increased demand for refractory materials. Additionally, infrastructure development and the growing focus on energy efficiency are propelling the adoption of advanced refractories. As industries seek sustainable solutions, the market in North America is expected to witness significant expansion, creating opportunities for innovation and market development in the coming years.

On the other hand, Europe is witnessing notable growth in the refractories market due to increased demand from the flourishing steel and construction industries. The region's commitment to sustainability and stringent environmental regulations is driving the adoption of advanced refractory materials that enhance energy efficiency. Additionally, ongoing infrastructure projects and a resurgence in manufacturing activities contribute to the heightened demand. The focus on innovative solutions and a thriving industrial sector positions Europe as a significant market for refractories, showcasing robust growth driven by a combination of industry expansion and environmental considerations.

Refractories, specialized materials designed to withstand high temperatures and harsh conditions, play a crucial role in industries like metallurgy and glass manufacturing. Crafted from robust minerals such as alumina and silica, these materials maintain their structural integrity and chemical properties even under extreme heat. They function as protective linings and insulators in furnaces and kilns, shielding industrial equipment from the intense temperatures generated during processes like metal smelting. This durability ensures the effectiveness and longevity of industrial operations in sectors where the ability to withstand high temperatures is paramount. Essentially, refractories are essential elements that contribute significantly to the dependability and extended life of various manufacturing processes.

Refractories Market Data and Statistics

| Report Coverage | Details |

| Global Market Size by 2034 | USD xx Billion |

| Global Market Size in 2023 | USD xx Billion |

| Global Market Size in 2024 | USD xx Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of xx% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Form, Product, Alkalinity, and End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expansion of the manufacturing sector

The expanding manufacturing sector is a key catalyst for the growing demand in the refractories market. As global manufacturing activities surge, there is a parallel need for sturdy and heat-resistant materials capable of withstanding the high temperatures inherent in industrial processes. Refractories, crucial linings for furnaces and kilns, become indispensable in ensuring the smooth functioning of manufacturing operations. The escalating demand for a variety of manufactured goods, spanning from vehicles to electronic devices, directly correlates with an increased necessity for refractory materials to uphold the efficiency and reliability of these production processes.

Moreover, the continuous evolution of manufacturing technologies necessitates refractories that can withstand more extreme conditions. With the global manufacturing Purchasing Managers' Index (PMI) consistently indicating growth, currently standing at 53.3 as of the latest data, the demand for refractories is poised to continue its upward trajectory, ensuring the resilience and longevity of industrial operations worldwide.

Slow adoption of innovations

The slow adoption of innovations poses a notable constraint on the market demand for refractories. Despite continuous advancements in refractory technologies, certain industries exhibit a cautious approach towards adopting new materials. This reluctance can be attributed to the conservative nature of industrial practices and the need for extensive testing and validation processes before integrating innovative refractories into existing systems. The hesitation to deviate from established methods and the perceived risks associated with adopting novel materials contribute to a delayed uptake of these innovations.

Moreover, the refractories market faces challenges in convincing industries to transition from traditional refractory solutions to more advanced alternatives. The time and resources required for thorough testing and the conservative mindset prevalent in certain sectors can hinder the swift incorporation of innovative refractories. This slow adoption impedes market growth, as the full potential of advanced materials may not be realized until broader acceptance and implementation occur across diverse industrial applications.

Renewed Focus on Energy Efficiency

The renewed emphasis on energy efficiency is creating significant opportunities in the refractories market. As industries globally prioritize sustainable practices, there is a growing demand for refractory materials that contribute to more energy-efficient operations. Advanced refractories, designed to withstand high temperatures while minimizing heat loss, align with this focus on energy conservation. Industries, such as steel and cement production, are actively seeking refractory solutions that not only endure harsh conditions but also enhance overall process efficiency, thereby reducing energy consumption.

This shift towards energy-efficient refractories presents opportunities for manufacturers to innovate and develop products that align with environmental sustainability goals. The implementation of these advanced materials not only meets regulatory requirements but also allows industries to improve their carbon footprint. As a result, the refractories market is well-positioned to capitalize on the increasing awareness and commitment to energy efficiency, providing solutions that address both environmental concerns and the operational efficiency of industrial processes.

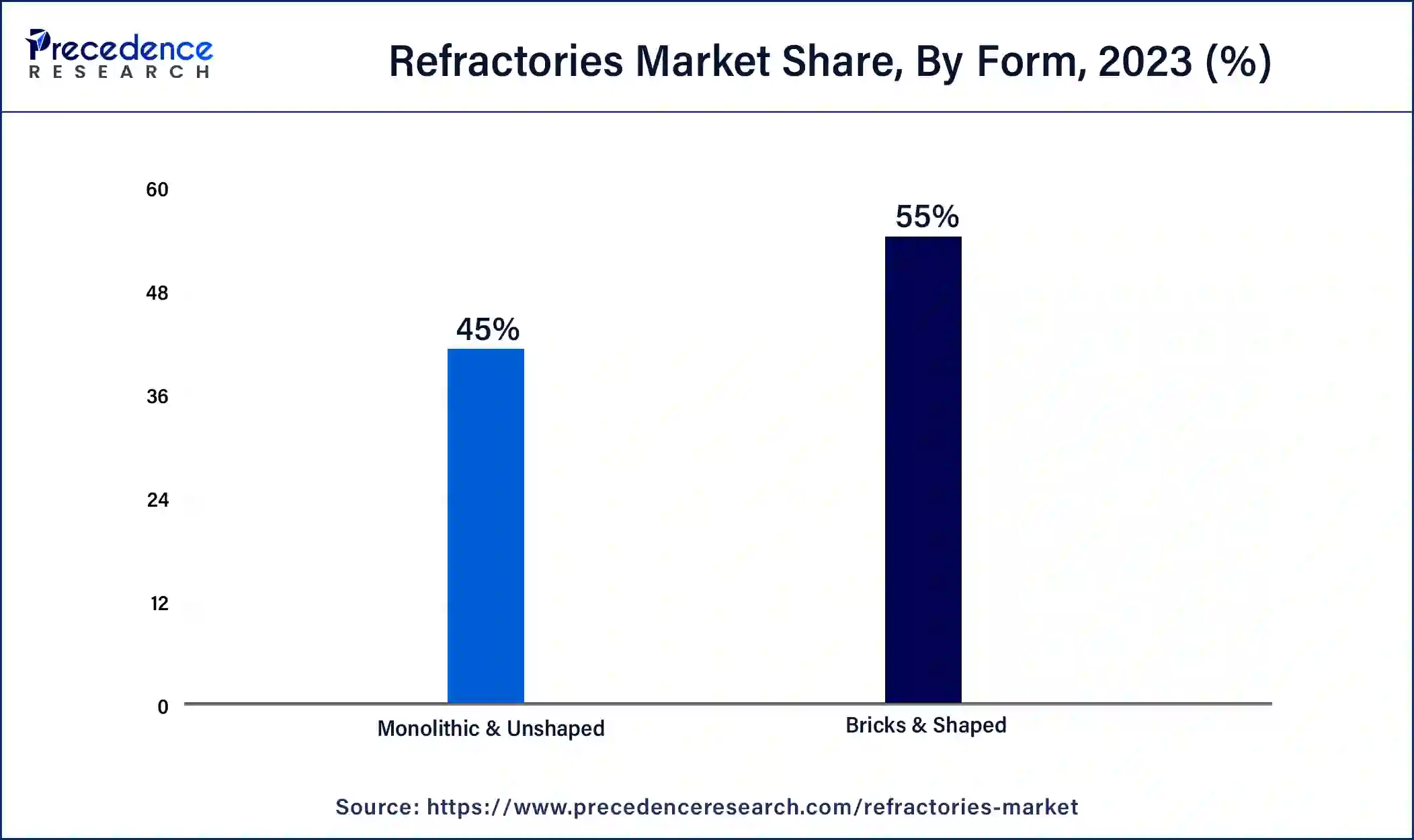

The 2023, the bricks & shaped segment had the highest market share of 55% in 2023 based on the form. In the refractories market, bricks refer to moulded and fired ceramic blocks with standardized shapes, offering durability and heat resistance. Shaped segments encompass various pre-formed refractory components designed for specific applications, providing ease of installation. A notable trend in the refractories market involves an increased demand for advanced brick and shaped segment solutions, driven by innovations in material formulations. These developments aim to enhance the longevity and performance of refractory linings in high-temperature industrial processes, meeting the evolving needs of sectors like steel, cement, and petrochemicals.

The monolithic & unshaped segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. In the refractories market, the monolithic or unshaped segment refers to a category of materials that are applied in a pliable state and then hardened in place. Monolithic refractories, such as castables and plastic refractories, offer versatility and ease of application, adapting to complex shapes and varying installations. Recent trends in the refractories market indicate a growing preference for monolithic formulations due to their efficiency, time-saving application, and adaptability to diverse industrial processes. This trend reflects the industry's inclination towards innovative solutions that enhance ease of use and overall performance in high-temperature applications.

The clay segment has held 66% market share in 2023. In the realm of refractories, the clay segment involves products derived from natural clay minerals. These refractories, valued for their versatility and cost-efficiency, are widely applied in industries like ceramics and steel production. Recent trends show an increasing inclination towards high-alumina clay refractories due to their superior performance under high temperatures. As industries prioritize durability and resilience in challenging conditions, the clay segment is adapting to meet evolving needs with advanced formulations, showcasing a continuous effort to provide effective and reliable refractory solutions.

The non-clay segment is anticipated to expand fastest over the projected period. In the realm of refractories, the non-clay sector encompasses materials that extend beyond those originating from clay. This category includes refractory products like alumina, silica, magnesia, and zirconia. Recent market dynamics showcase a growing inclination toward non-clay refractories, driven by their superior resistance to high temperatures and effectiveness in demanding applications. Industries, notably steel, cement, and glass, are increasingly gravitating towards non-clay refractories due to their resilience, resistance to corrosion, and capacity to endure extreme conditions. This trend is instrumental in the expanding prevalence and adoption of non-clay refractory solutions.

The basic segment has held 59% market share in 2023. In the refractories market, the basic segment of alkaline refractories encompasses materials with a high alkali metal oxide content, such as magnesia and dolomite. These refractories exhibit resistance to basic slag and are commonly used in applications like steelmaking and cement production. A notable trend in this segment involves ongoing research to enhance the performance and longevity of alkaline refractories, ensuring they meet the evolving demands of industries. Innovations focus on optimizing compositions and production processes to bolster the alkalinity of refractories, contributing to increased durability and efficiency in high-temperature applications.

The acidic & neutral segment is anticipated to expand fastest over the projected period. In the refractories market, the acidic segment comprises materials with high silica content, offering excellent resistance to acidic environments. These refractories find application in industries where corrosive conditions prevail, such as in the chemical and petrochemical sectors. Conversely, the neutral segment involves materials with balanced compositions, suitable for applications requiring resistance to both acidic and basic conditions. A trend in the refractories market involves the continual development of neutral refractories with enhanced thermal shock resistance, catering to the evolving needs of industries for versatile and durable refractory solutions.

According to the end-use industry, the iron & steel segment has held 36% market share in 2023. The iron and steel segment in the refractories market pertains to the use of refractory materials in the production of iron and steel. These materials are essential in maintaining the integrity of furnaces, converters, and ladles subjected to extreme temperatures in the steelmaking process. A notable trend in this segment involves a growing demand for high-performance refractories, capable of withstanding harsh conditions and optimizing energy efficiency. As the iron and steel industry continues to expand globally, the refractories market is witnessing increased adoption of advanced materials to enhance durability and productivity in steel manufacturing processes.

The cement segment is anticipated to expand fastest over the projected period. In the refractories market, the cement segment refers to the utilization of refractory materials in the production of cement. These materials are crucial for lining kilns and furnaces in cement plants, withstanding extreme temperatures and chemical reactions involved in the cement-making process. A significant trend in this segment is the increasing demand for high-performance refractories that enhance the durability and efficiency of cement manufacturing, aligning with the industry's focus on sustainable practices and energy efficiency. Manufacturers are continually innovating to provide solutions that contribute to both environmental goals and operational excellence in the cement sector.

Segments covered in the report

By Form

By Product

By End-Use Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client