August 2024

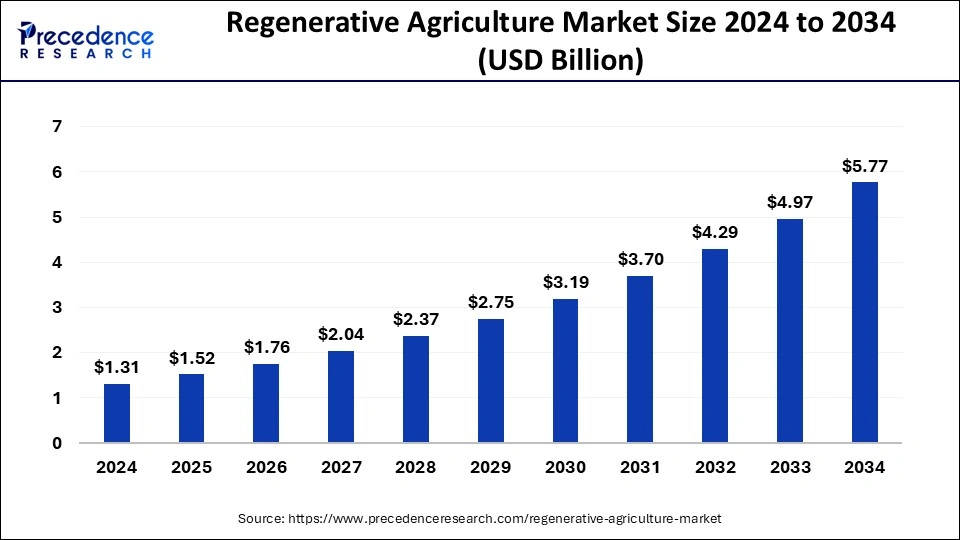

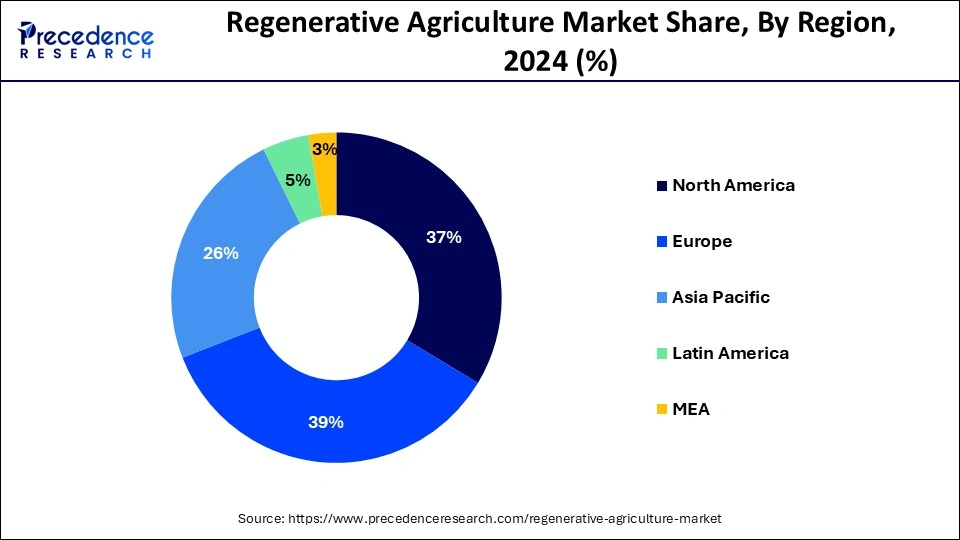

The global regenerative agriculture market size is calculated at USD 1.52 billion in 2025 and is projected to surpass around USD 5.77 billion by 2034, representing a healthy CAGR of 15.97% between 2025 and 2034. The North America regenerative agriculture market size is calculated at USD 480 million in 2024 and is expected to grow at a fastest CAGR of 16.23% during the forecast year. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global regenerative agriculture market size was estimated at USD 1.31 billion in 2024 and is predicted to increase from USD 1.52 billion in 2025 to approximately USD 5.77 billion by 2034, expanding at a CAGR of 15.97% from 2025 to 2034.

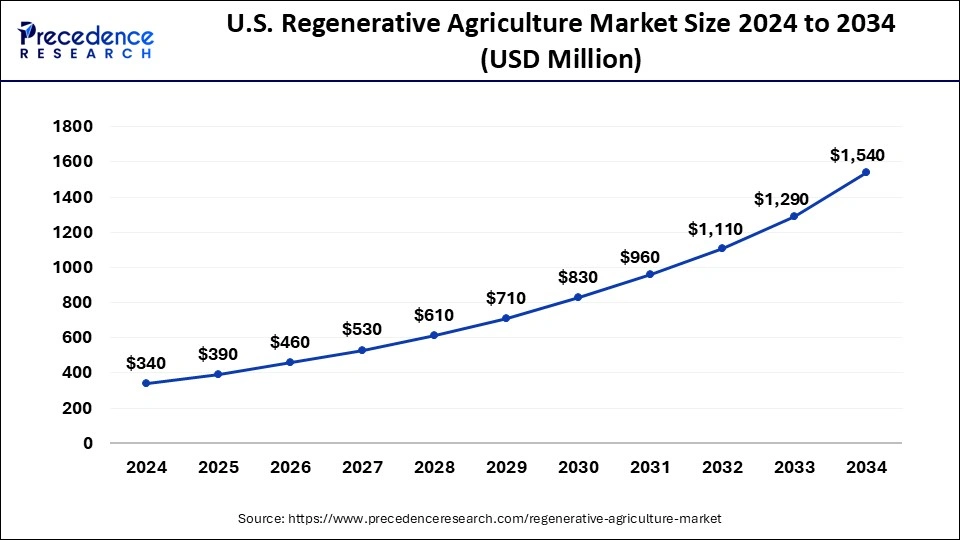

The U.S. regenerative agriculture market size accounted for USD 1.31 billion in 2024 and is expected to be worth around USD 5.77 billion by 2034, growing at a CAGR of 15.97% from 2025 to 2034.

The regenerative agriculture market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. In 2022, the North American region held the largest revenue share in the regenerative agriculture market. In 2024, the United States held the highest share followed by Canada and Mexico in North America. North America is one of the most developed continents owing to the presence of countries with favorable agriculture policies and an inclination towards regenerative agriculture.

Grupo Bimbo and CIMMYT partnership has planned to enhance regenerative agricultural practices for maize and wheat in Mexico. Grupo Bimbo has set a goal that 200,000 hectares of wheat should be cultivated with regenerative agriculture practices by 2030. Grupo Bimbo also aims that 100% of key wheat ingredients must be produced with regenerative agriculture solutions by 2050.

In Mexico, the production volume of wheat is forecast to rise by 0.1 million metric tons in the coming years. The production volume of wheat in Mexico is predicted to amount to about 3.22 million metric tons in 2031. The production of maize in Mexico is predicted to increase continuously by 1.7 million metric tons during the next years. The production of maize in Mexico is expected to amount to around 29.52 million metric tons in 2031. The partnership between Grupo Bimbo and CIMMYT, and the high production of wheat and maize are anticipated to create promising opportunities for the regenerative agriculture market in the near future.

The European regenerative agriculture market is segmented into France, Germany, the United Kingdom (UK), Italy, and the Rest of Europe. Germany is expected to hold the highest share of the European regenerative agriculture market during the study period. The European Agroforestry Federation (EURAF) promotes the growth of trees across farms and any kind of silvopastoral throughout various environmental regions of Europe. The European Agroforestry Federation has over 500 members from 20 European nations. The presence of such agroforestry federations is supporting the market growth in the region.

Organic farming methods that involve lesser use of pesticides and store more carbon in the soil are considered to be more popular. Experts suggest that the regenerative farming shift can decrease UK climate emissions. In November 2021, General Mills started its 1st regenerative agriculture project in Europe to help farmers who provide milk for Häagen-Dazs ice cream.

The regenerative agriculture market in the Asia Pacific (APAC) region is segmented into China, India, Japan, South Korea, and the rest of the Asia Pacific (APAC) region. In 2022, China dominated the Asia Pacific (APAC) regenerative agriculture market followed by Japan and India.

Latin America, Middle East, and African (LAMEA) regenerative agriculture market is segmented into South Africa, Saudi Arabia, Brazil, North Africa, Argentina, and the Rest of LAMEA. The Latin American region is estimated to hold a considerable share of the regenerative agriculture market during the forecast period. In 2022, Brazil held the largest market share in the LAMEA regenerative agriculture market. Owing to the low literacy rate, civil war, and unfavorable economic conditions in a few African countries, the regenerative agriculture market in the African region is expected to grow at a slower rate.

Regenerative agriculture combines a set of agricultural practices whose main objective is to enhance soil quality naturally. Regenerative agriculture also refers to restoring the fertility of exhausted or diseased soils. The global regenerative agriculture market is majorly driven by the growing uptake of regenerative agricultural practices, and rising awareness regarding environmental impacts of conventional farming techniques. Regenerative agriculture has emerged as a sustainable alternative that prioritizes biodiversity, soil health, and ecosystem resilience. The regenerative agriculture market tends to have a lucrative opportunity owing to the increasing demand for sustainable food production systems.

Unilever, General Mills, Nestle, and PepsiCo pledged notable support for regenerative agriculture practices, which involve the avoidance of synthetic pesticides and fertilizers. As of September 2022, out of 900 million arable acres in the United States, around 1.5% is farmed regeneratively. Thus, there exists a vast scope for regenerative agriculture in the US. As per a new report, Soil Wealth, investments in regenerative agriculture-related projects are surprisingly high. As of July 2019, the report suggested that were around 70 investment strategies with assets under management of more than $47.5 billion across the United States.

A meta-review conducted by the Consultative Group on International Agricultural Research (CGIAR) in 2021 concluded that by maintaining biodiversity in agricultural lands, regenerative agriculture practices are able to create additional critical ecosystem services.

| Report Coverage | Details |

| Market Size in 2024 | USD 1.31 Billion |

| Market Size in 2025 | USD 1.52 Billion |

| Market Size by 2034 | USD 5.77 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 15.97% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Practice and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

In July 2023, as part of a multi-year partnership with ALUS, General Mills, Inc. announced an investment of $2.3 million for supporting farmers and boosting regenerative agriculture in Canada. ALUS, a national charitable organization offers resources, expertise, and financial support to 35 communities in 6 provinces in Canada.

McCain Foods announced that by 2030, all potatoes bought by the company will be grown with regenerative agriculture techniques. The Regenerative Soils Program by BioSafe Systems follows the regenerative agriculture model, where soil health is improved using sustainable farming practices. This program is cost-effective and provides disease protection from pre-plant to harvest. Such regenerative soil programs are helpful in the production of tomatoes.

In order to enhance various regenerative agriculture techniques, respective companies can consider collaborations, partnerships, acquisitions & mergers, and joint ventures. Furthermore, continuously evolving regenerative agricultural technology can make the existing agricultural technology obsolete very soon. This may intensify the competition among the crucial market players in the coming years.

Since the count of regenerative agriculture solution providers (suppliers) is less in comparison to the count of buyers, the bargaining power of suppliers is relatively high as compared to the bargaining power of buyers. Due to promising profit margins, the threat of new entrants in the regenerative agriculture market is moderate as of now.

Our regenerative agriculture market report includes an in-depth analysis of the current market situation. This report covers crucial key factors such as the competitive landscape, the latest trends, regional analysis, and key players. The analytical research on the impact of the pandemic of COVID-19 helps in realizing the effects on the demand and supply side. The segmental analysis offers a distinct view of particular practices involved in regenerative agriculture.

Based on practice, the global regenerative agriculture market is segmented into agroecology, aquaculture, biochar & terra preta, agroforestry, no-till & pasture cropping, holistically managed grazing, silvopasture, and other practices. The agroforestry segment held the highest market share in 2024. The aquaculture segment is expected to hold a significant market share during the forecast period.

Regenerative agroforestry, a sustainable and resilient agricultural practice is considered to have the potential to deal with the climate issue. Regenerative agroforestry enhances food security for the rising population while reducing climate change, enabling economically viable production, and safeguarding biodiversity. This method is a nature-based and cost-effective practice that can be adopted across various parts of the world.

Based on application, the global regenerative agriculture market is segmented into soil & crop management, biodiversity, operations management, and other applications. The biodiversity segment had the highest revenue share in 2024. The biodiversity segment is expected to dominate the market during the study period.

Numerous regenerative agricultural practices such as planting cover crops, no-tillage, and planting buffer strips help in enhancing biodiversity. A few other advantages of biodiversity include a clean and safe water supply, nutrient recovery, protection of the soil, the provision of fertilizer, and a greater variety of wildlife.

By Practice

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

August 2024

December 2023

December 2024

November 2022