January 2025

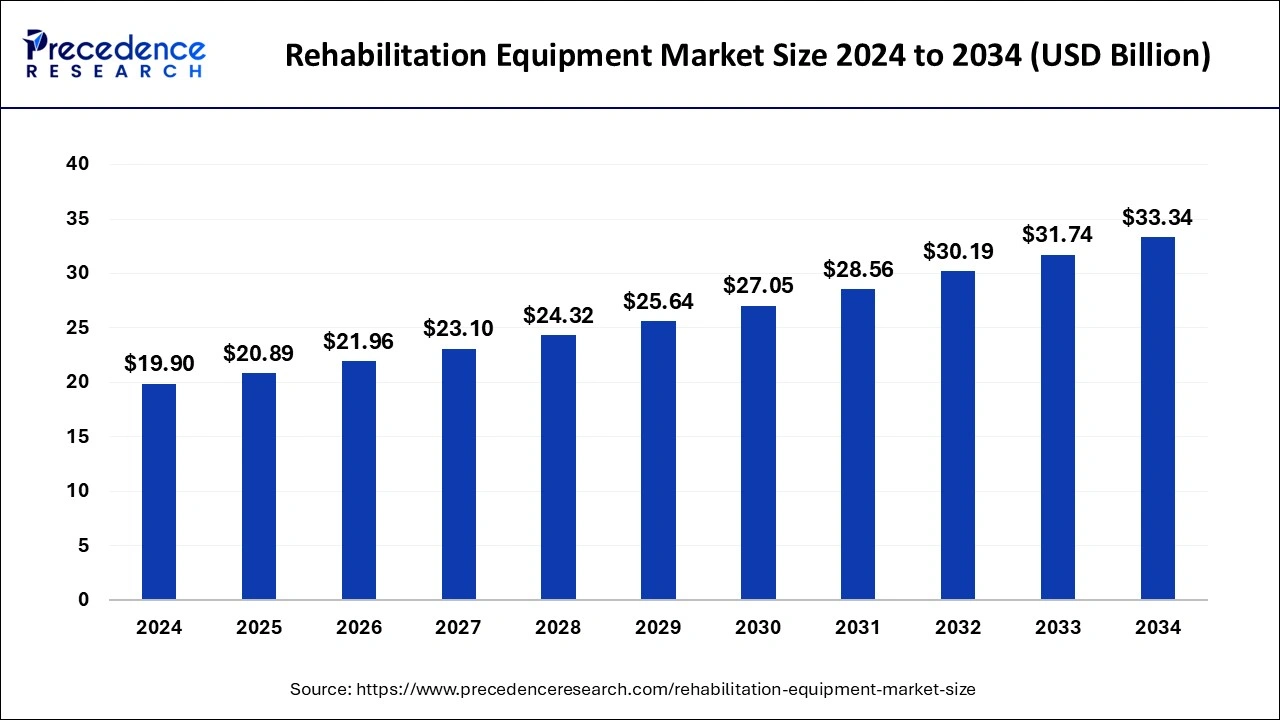

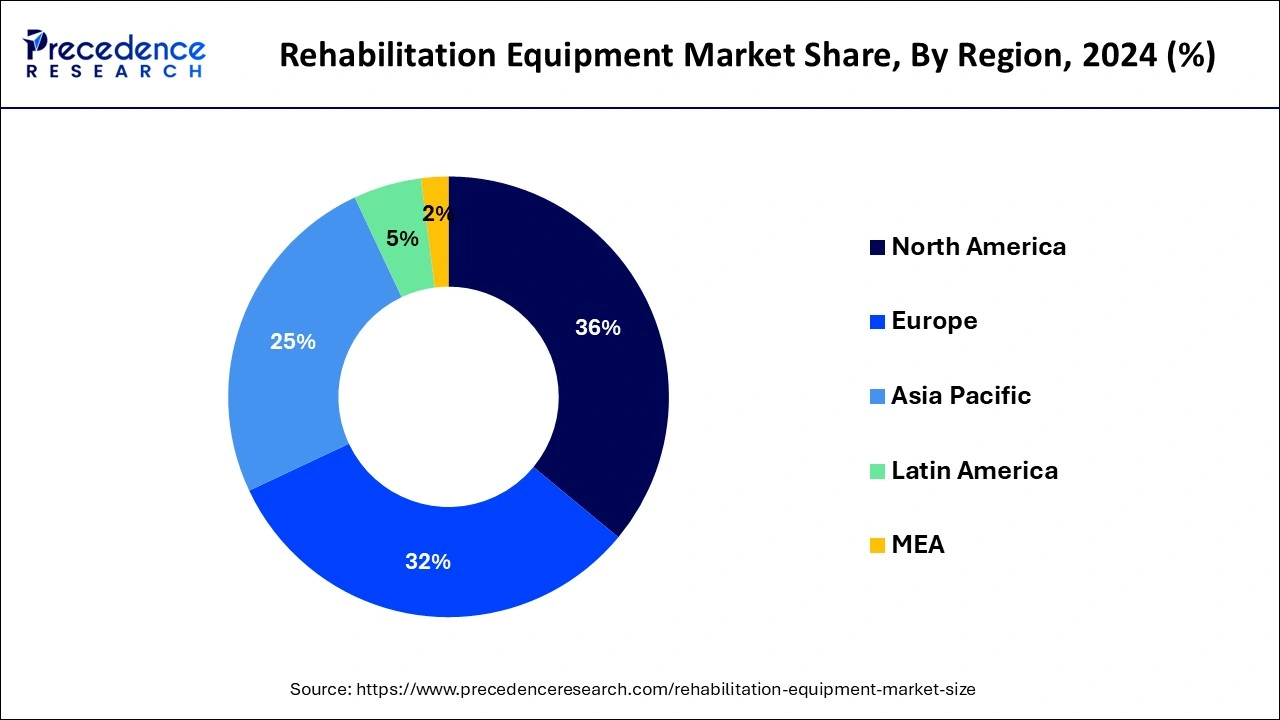

The global rehabilitation equipment market size is accounted at USD 20.89 billion in 2025 and is forecasted to hit around USD 33.34 billion by 2034, representing a CAGR of 5.30% from 2025 to 2034. The North America market size was estimated at USD 7.16 billion in 2024 and is expanding at a CAGR of 5.32% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global rehabilitation equipment market size accounted for USD 19.90 billion in 2024 and is expected to exceed around USD 33.34 billion by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

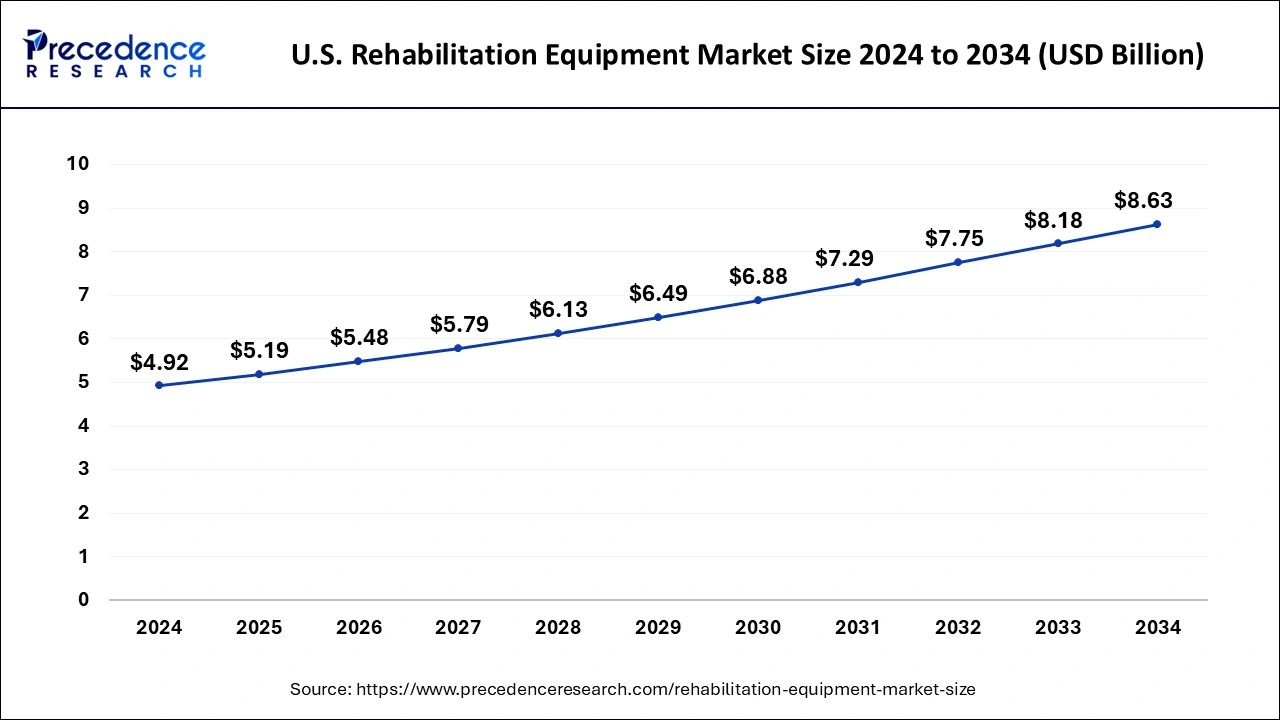

The U.S. rehabilitation equipment market size was exhibited at USD 4.92 billion in 2024 and is projected to be worth around USD 8.63 billion by 2034, growing at a CAGR of 5.78% from 2025 to 2034.

With a share of 35.11%, North America led the field and is predicted to hold that position throughout the forecast period. The elderly make up a sizable portion of the population in North America. In this area, the prevalence of non-communicable illnesses including Parkinson's, diabetes, arthritis, and cardiovascular disease is rising. Access to rehabilitative items is being improved by reimbursement systems like Medicare.

The fastest-growing regional market is anticipated to be Asia Pacific, with a promising CAGR of 8.9% over the course of the projected period. A growing patient base, better public and private reimbursement systems, and ongoing healthcare facility construction make emerging nations like India and China the most profitable markets. Growth in this area is anticipated to be boosted by rising medical awareness, an increase in doctors, and supporting government initiatives and regulations. The market for rehabilitation equipment is expanding as a result of patients' quick acceptance of innovative items. In 2016, Europe had the second-largest share. Due to the slowing economy and the healthcare sector, the market for rehabilitation equipment in Europe is predicted to develop slowly. Additionally, it is anticipated that changes in the regulatory environment would impede the expansion of the market for rehabilitation equipment in Europe.

The widespread use of rehabilitation equipment in clinics, hospitals, home care settings, and rehabilitation and physiotherapy centers is currently made possible by the rising prevalence of many chronic and non-communicable diseases, such as cancer, arthritis, and Parkinson's, especially among the growing geriatric population. Accordingly, the deployment of virtual or remote healthcare programs on various internet platforms has been prompted by the rapid emergence of the coronavirus illness (COVID-19) pandemic and the ensuing adoption of lockdowns.

Another significant growth-inducing feature is the ability of this trend to allow patients to acquire individualized training drugs and share the diagnostics record with rehab specialists. Additionally, major competitors are heavily working with other businesses to offer affordable, enduring, and high-performance rehabilitation equipment, which is aiding in the market expansion and meeting the growing need for improved equipment and clinical outcomes. Other factors, such as rising consumer healthcare spending, increased investment in research and development (R&D), and numerous beneficial initiatives taken by governments and non-governmental organizations (NGOs) of different countries to strengthen the current healthcare infrastructure are fostering a positive outlook for the market.

Worldwide demand for everyday assistance equipment for the disabled population is rising quickly. The use of new communication channels by manufacturers has increased consumer awareness of newly released items. Patients are therefore kept up to date on new products entering the market. Local governments in a number of nations have made it simple to finance, offered subsidies, and given other financing choices for rehabilitation equipment, which is anticipated to increase demand for assistive goods and spur growth. Favorable reimbursement practices in major markets like the U.S. are anticipated to give manufacturers considerable sales prospects. Medicare reimbursements make it possible for patients to use assistive technology for rehabilitation. Hospital beds, walkers, wheelchairs, canes, crutches, commode chairs, patient lifts, and other durable medical equipment needed for rehabilitation are all covered under Medicare. Additionally, in order to enhance access to high-quality and reasonably priced assistive technologies, the WHO created the Priority Assistive Products List (APL) in support of the Global Cooperation on Assistive Technology (GATE). These approaches should boost manufacturing companies' growth prospects.

| Report Coverage | Details |

| Market Size in 2025 | USD 20.89 Billion |

| Market Size by 2034 | USD 33.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Other factors influencing the worldwide market for rehabilitation goods include rising disposable income, which makes it easier to obtain better treatment, and expanding healthcare infrastructure, particularly in highly populated emerging nations like China and India. The rehabilitation goods market is expected to have generally positive growth. This is mostly relevant to developed economies, where access to cutting-edge medical facilities and contemporary medications is greater than in underdeveloped nations. A substantially larger patient population that can access and afford medical rehabilitation treatments has been able to emerge in emerging nations because of the expansion of healthcare facilities. Consequently, it is anticipated that the market for rehabilitation goods in emerging nations would expand quickly over the prediction period.

Drivers

Growing prevalence of musculoskeletal disorders

Growing prevalence of neurological disorders

Key Market Challenges

Key Market Opportunities

Increasing technological advancements

Increasing geriatric population and rise in surgical procedures

With a share of 38%, the mobility equipment category led the market as a whole in 2024. Because of the increasing number of elderly and disabled people throughout the world, this market segment is anticipated to retain its dominance over the forecast period. The wheelchairs and scooters section and the walking assistance devices segment make up the mobile devices segment. Due to their low cost and ease of use, walking assistance devices—the most basic type of mobility equipment are favored by the target group.

The exercise equipment used in the rehabilitation of patients following trauma or the start of degenerative illnesses is included in the physiotherapy sector. The method in occupational therapy is more all-encompassing. The market is expected to be driven by an aging population, changing lifestyles, an increase in physiotherapy clinics, and supportive healthcare reforms during the course of the forecast period. Exoskeletons, robotics, implanted technology for pain treatment, and other technical developments are also major drivers of the rehabilitation equipment market in physiotherapy, as is growing demand in emerging nations. After an injury, surgery, or sickness, physiotherapy employs a number of approaches to enhance, maintain, and restore a person's physical strength and mobility. In order to help the patient, execute everyday tasks effortlessly, occupational therapy is utilized to conduct a thorough assessment of the patient, the patient's family, and the environment. The goal of occupational therapy is to motivate patients to carry out routine tasks. Between 2023 and 2032, this market is projected to develop at a CAGR of 7%.

The market is expected to be driven by an aging population, changing lifestyles, an increase in physiotherapy clinics, and supportive healthcare reforms during the course of the forecast period. Exoskeletons, robotics, implanted technology for pain treatment, and other technical developments are also major drivers of the rehabilitation equipment market in physiotherapy, as is growing demand in emerging nations. After an injury, surgery, or sickness, physiotherapy employs a number of approaches to enhance, maintain, and restore a person's physical strength and mobility.

The rehabilitation equipment market is divided into hospitals & clinics, rehabilitation facilities, home care settings, and physiotherapy centers based on end-use. In 2024, hospitals held the greatest percentage with around 35%. Due to hospitals' huge patient populations, this market sector is anticipated to increase significantly over the next years.

Due to increased public awareness of physiotherapy, technical developments in physiotherapy facilities, and an increase in the frequency of non-communicable illnesses including Parkinson's and arthritis, revenue for rehab centres is anticipated to increase throughout the projection period. During the projected period, it is anticipated that the penetration of rehab centres in emerging economies would expand, leading to a large increase in the number of rehab facilities. In 2023, the market for rehabilitation equipment was worth roughly USD 2.8 billion across home care settings and physiotherapy facilities. Because home care is more affordable than hospital care, there has been a movement in long-term care from hospitals to homes.

By Product

By Application

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

February 2025

February 2025

March 2025