January 2025

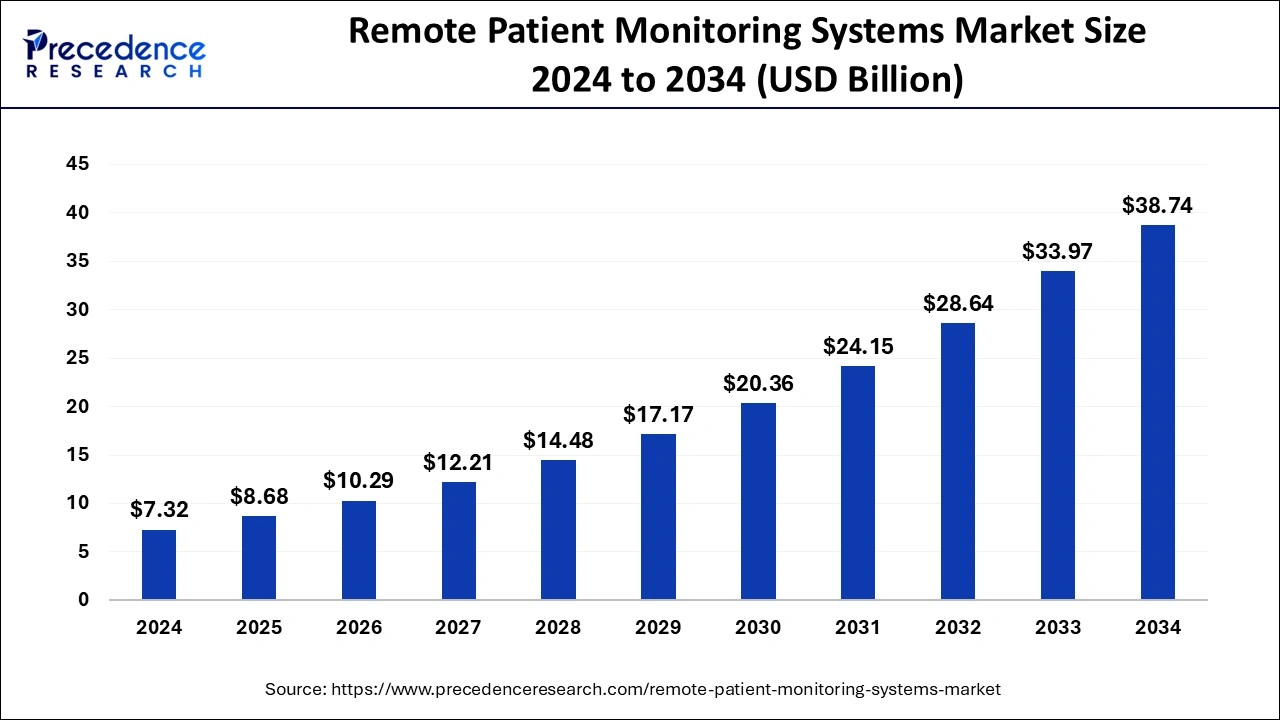

The global remote patient monitoring systems market size is estimated at USD 8.68 billion in 2025 and is anticipated to reach around USD 38.74 billion by 2034, expanding at a CAGR of 18% from 2025 to 2034. The North America remote patient monitoring systems market size was estimated at USD 3.07 billion in 2024 and is expanding at a CAGR of 18.04% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global remote patient monitoring systems market size accounted for USD 7.32 billion in 2024 and is predicted to reach around USD 38.74 billion by 2034, growing at a CAGR of 18% from 2025 to 2034.

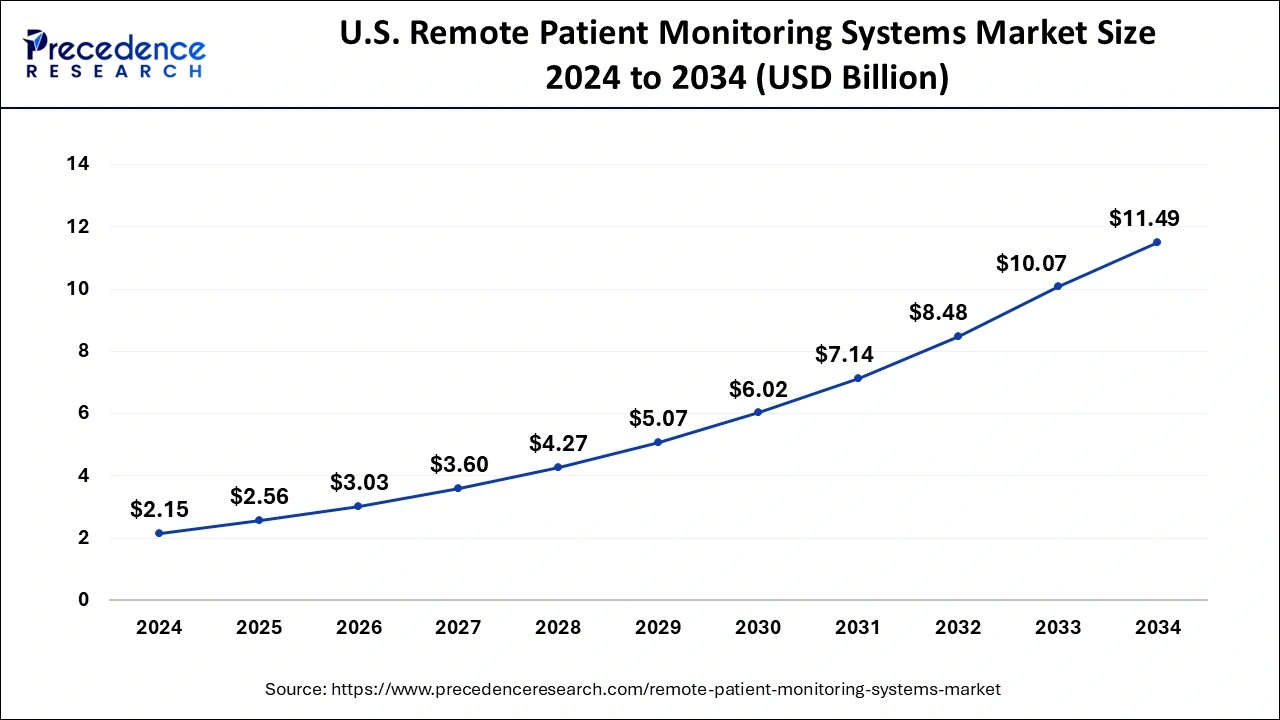

The U.S. remote patient monitoring systems market size was estimated at USD 2.15 billion in 2024 and is predicted to be worth around USD 11.49 billion by 2034, at a CAGR of 18.22% from 2025 to 2034.

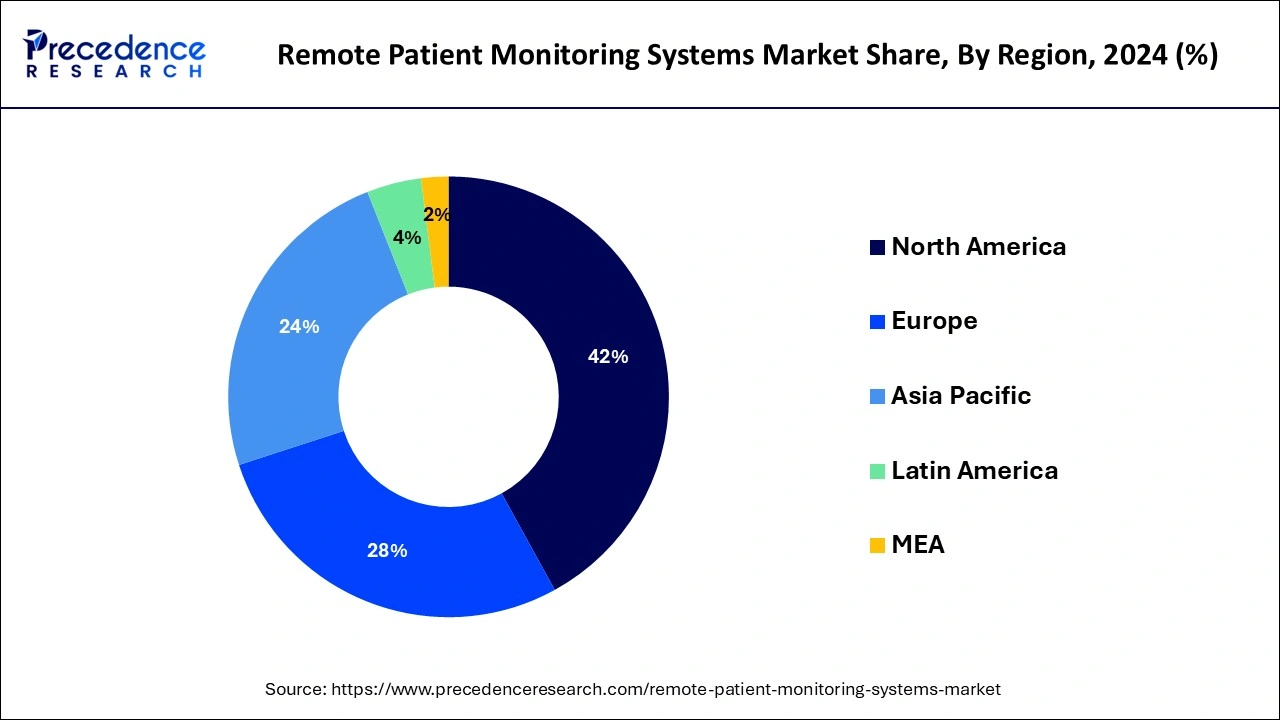

Based on region, North America accounted for around 42% of the market share in 2024. The increased awareness regarding the RPM systems, increased disposable income of the consumers, high adoption rate of advanced technologies in the healthcare industry, presence of developed healthcare infrastructure, growing geriatric population, and increased prevalence of various chronic diseases among the population are the major factors that developed the RPM market in North America.

The Asia Pacific is expected to be the fastest-growing market during the forecast period. The rising consumer disposable income, increased healthcare costs, rising healthcare expenditure, and rising prevalence of chronic diseases in the region is fostering the adoption of the RPM systems in the region. Further, the rising government investments for the development of advanced healthcare infrastructure are expected to boost the growth of the market.

The increasing adoption of digital technologies in the global healthcare industry is significantly driving the remote patient monitoring (RPM) systems market. Further, the rising prevalence of various deadly diseases, growing geriatric population, and increasing incidences of road accidents is boosting the growth of the global RPM systems market. The demand for the RPM systems is rapidly growing among the old age population as this age group needs continuous monitoring of their health conditions. According to the Unite Nations, there were around 382 million old age people, aged 60 years or above, across the globe in 2017 ad this number is expected 2.1 billion by 2050. The rapidly growing geriatric population across the globe is expected to be the major driver of the RPM systems market in the foreseeable future. Moreover, rising disposable income, demand for the advanced healthcare facilities, and increased consumer expenditure on healthcare are the crucial factors the supplements the market growth across the globe.

The rising government initiatives and investments to build a strong and sophisticated healthcare infrastructure is boosting the demand for the latest technologies in the healthcare sector. Moreover, raising investments in the digitalization and automation in the healthcare units in order to increase the operational efficiency of the healthcare units is fueling the adoption of the RPM systems across various markets. The RPM systems provides enhanced diseases and health management by detecting the deteriorating health conditions early and tracks the progress in the health condition of the patients, which helps the healthcare units to offer improved patient care. The RPM systems can reduce hospitalization and chronic conditions that cost higher and hence help to save healthcare costs for the consumers. Hence, this factor may boost the adoption of the RPM systems in the forthcoming years.

| Report Coverage | Details |

| Market Size by 2034 | USD 38.74 Billion |

| Market Size in 2025 | USD 8.68 Billion |

| Market Size in 2024 | USD 7.32 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The specialized monitors segment accounted for around 81% of the market share in 2024. This is attributed to the increased usage of specialized monitors in remotely monitoring the patient pre and post-surgery owing to its increased efficiency in monitoring clinical data. The introduction of advanced features like smartphones connectivity and wireless communication facilitates remote monitoring efficiently.

The vital sign monitors segment is projected to hit remarkable growth during the forecast period. This is attributed to the increased usage of these monitors for common purposes. The heart rate monitor is extensively used across the healthcare sector all over the globe. Furthermore, the surging prevalence of cardiovascular diseases is expected to boost the growth of this segment. According to the World Health Organization, around 17.9 million deaths were directly linked with the cardiovascular diseases in 2019, globally. This was around 32% of the global deaths in 2019.

Based on application, the diabetes segment accounted for 12% of revenue share in 2024. This segment was closely followed by the hypertension segment. The rising prevalence of diabetes across the globe resulted in the increased demand for the RPM systems for the diabetic patients. According to the World Health Organization, in 2019, around 1.5 million global deaths were directly linked to the diabetes. The unhealthy food habits among the global population are estimated to spur the growth in the number of diabetic population in the upcoming years.

The cardiovascular diseases segment is expected to be the fastest-growing segment during the forecast period. This is simply attributed to the rising prevalence of CVD among the population and the surging number of global deaths due to the CVD. According to the World Health Organization, around 17.9 million deaths were directly linked with the cardiovascular diseases in 2019, globally.

Based on end use, the hospital patients segment accounted for over 80% of the market share in 2024. This is simply attributed to the increased presence of the hospitals in the developed nations and its rising penetration in the developing markets. The rising number of hospital admissions and the availability of advanced healthcare facilities in the private hospitals have exponentially contributed towards the growth of the hospital patients segment in the past few years.

The home healthcare segment is expected to witness the fastest growth during the forecast period. The rising disposable income, increased demand for convenience, and rising awareness regarding hospital acquired infections among the population are the major factors that can be held responsible for the growth of the home healthcare segment during the forecast period.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

In August 2020, Johnson & Johnson invested in Thirty Madison, a telehealth company to participate in the digital health or e-health industry.

In July 2020, Philips and BioIntelliSense collaborated to improve its RPM solutions by integrating the RPM system of BioIntelliSense to its product portfolio.

The various developmental strategies like collaborations, acquisitions and mergers foster market growth and offers lucrative growth opportunities to the market players.

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

August 2024

February 2025

February 2025