January 2025

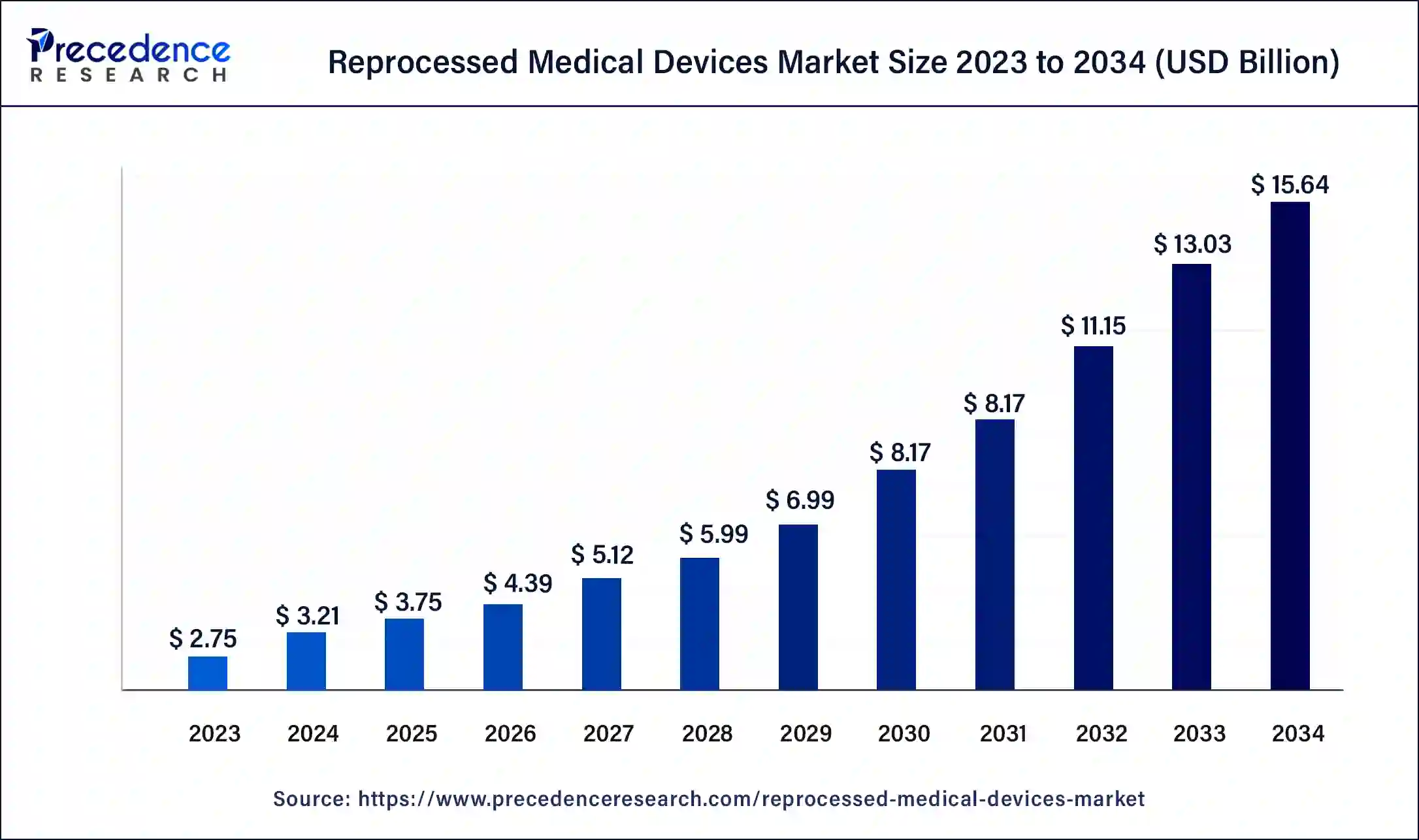

The global reprocessed medical devices market size was USD 2.75 billion in 2023, estimated at USD 3.21 billion in 2024 and is anticipated to reach around USD 15.64 billion by 2034, expanding at a CAGR of 17.16% from 2024 to 2034.

The global reprocessed medical devices market size was valued at USD 3.21 billion in 2024 and is predicted to reach around USD 15.64 billion by 2034, growing at a CAGR of 17.16% from 2024 to 2034. The reprocessed medical devices market is driven by the need to reduce medical waste in healthcare settings, the cost benefits, and increasing awareness about the advantages of reprocessed devices.

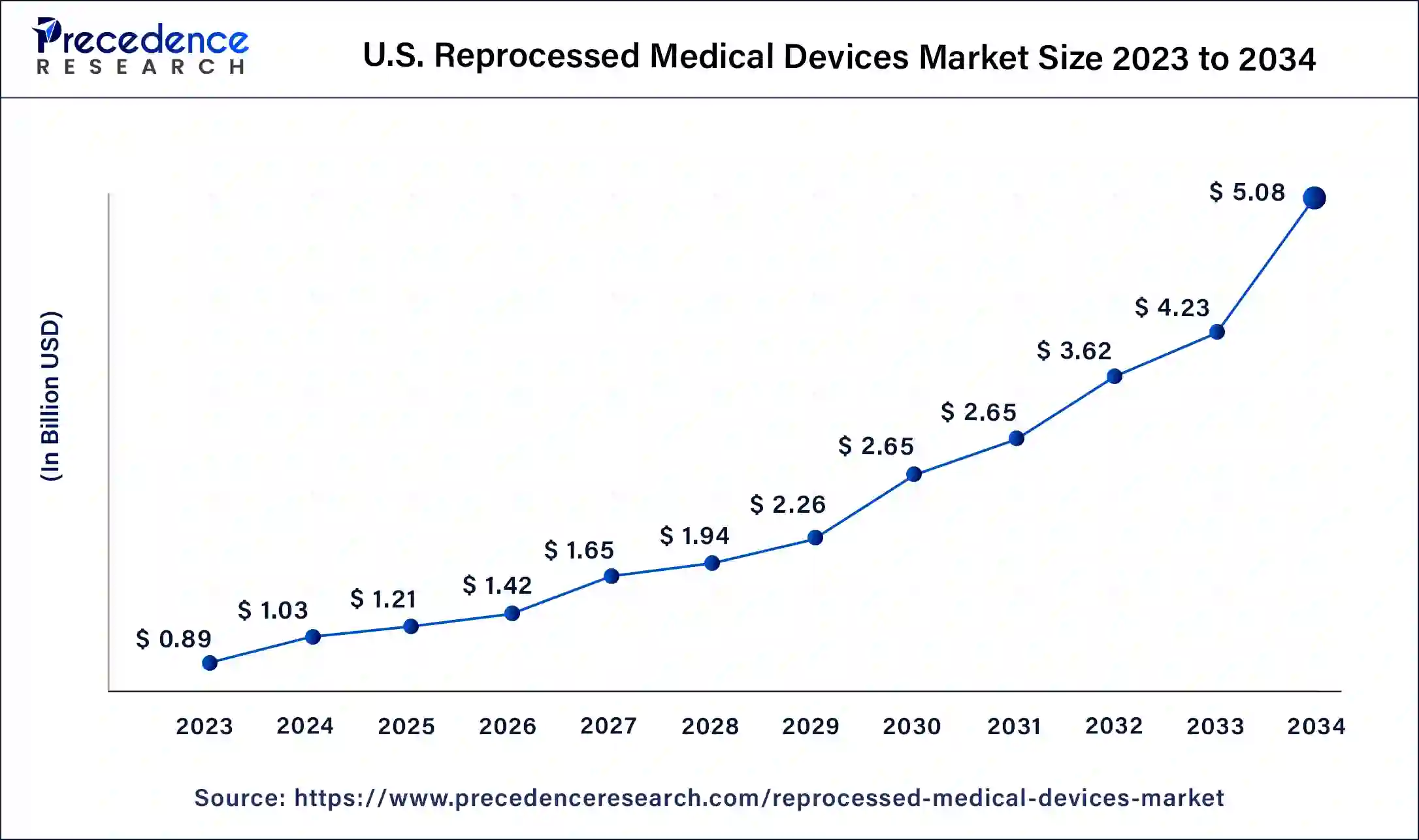

The U.S. reprocessed medical devices market size was estimated at USD 0.89 billion in 2023 and is predicted to be worth around USD 5.08 billion by 2034 with a CAGR of 17.25% from 2024 to 2034.

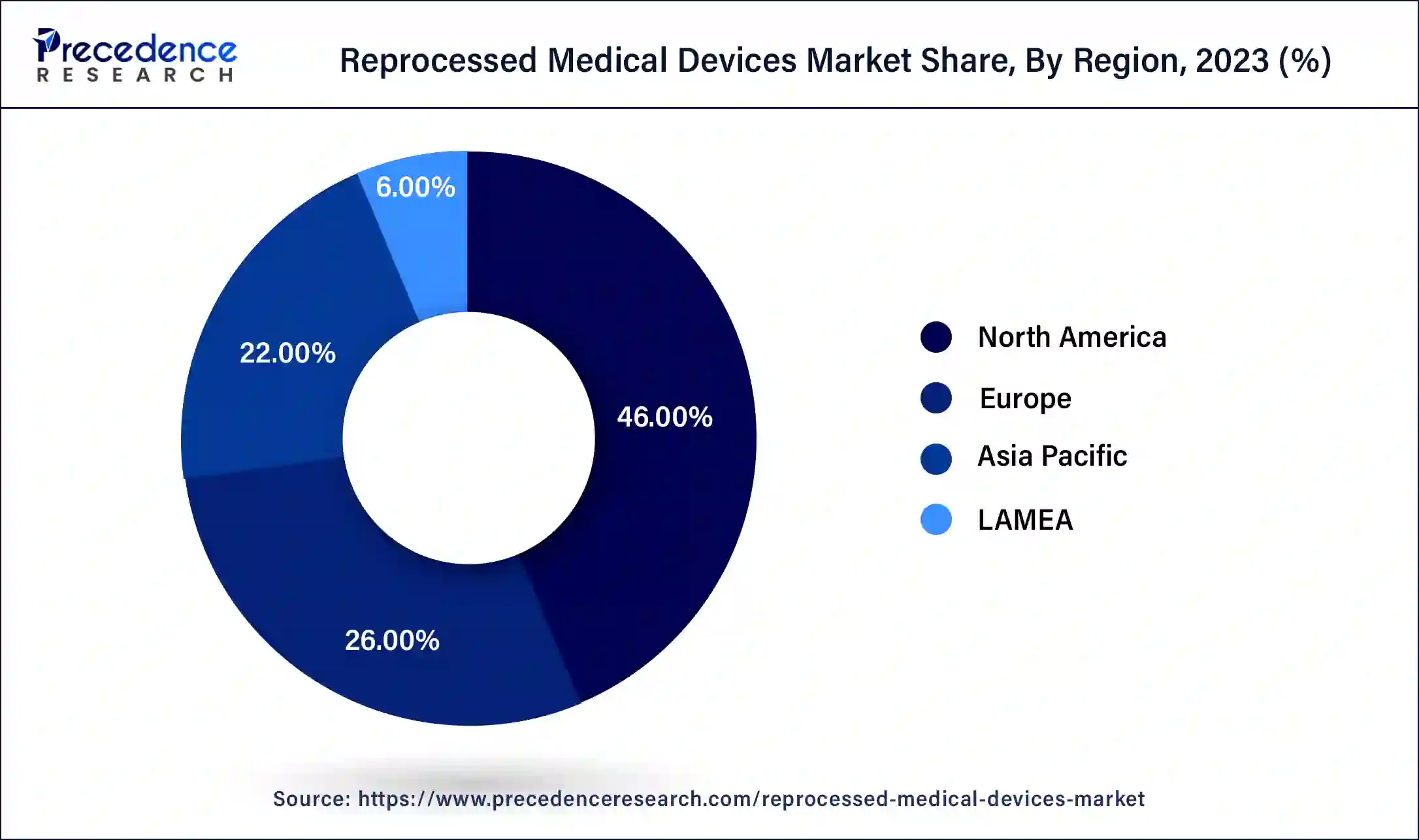

North America dominated the reprocessed medical devices market in 2023. North America's well-established healthcare infrastructure and advanced medical facilities lead to high medical device usage, providing a larger pool of devices for reprocessing and driving market growth. Stringent regulations ensure reprocessed devices meet quality and safety standards. Cost containment initiatives by healthcare providers promote the adoption of reprocessed devices to achieve savings without compromising patient care. Furthermore, increasing environmental awareness and sustainability efforts further boost the demand for reprocessed medical devices, contributing to North America's significant revenue share in the market.

Asia Pacific is expected to register the fastest rate over the forecast period. The expanding market for reprocessed medical devices in the region is driven by a growing economy, rising prevalence of chronic conditions, and an increasing need to reduce hospital costs. Developing countries like China and India have experienced a surge in chronic diseases, prompting a greater emphasis on healthcare. While governments are actively investing in healthcare infrastructure, their spending is constrained, which results in high demand for cost-effective, reprocessed medical devices.

The reprocessed medical devices market is growing quickly as healthcare providers aim to reduce costs, minimize medical waste, and promote environmental sustainability. Reprocessed medical devices undergo rigorous cleaning, sterilization, and testing to meet quality and safety standards for reuse, providing a sustainable solution without compromising patient safety or the quality of medical care.

However, some industry players have raised concerns about potential risks and performance variations. To mitigate these risks, regulatory agencies worldwide oversee the reprocessing industry, establishing guidelines and standards. Healthcare providers must carefully consider the benefits and risks of using reprocessed medical devices to make informed decisions and ensure patient safety.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 17.16% |

| Market Size in 2023 | USD 2.75 Billion |

| Market Size in 2024 | USD 3.21 Billion |

| Market Size by 2034 | USD 15.64 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, Type, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Wide range of applications

Many reprocessed medical devices are in use, including endoscopes, surgical forceps, cardiac stabilization and positioning machines, balloon inflation devices, and more. Reprocessing is mainly used for minimally invasive disposables and surgical instruments, saving on landfill costs and reducing repurchasing expenses for hospitals. Most hospital waste originates from the operating room. The global reprocessed medical devices market is expected to see significant growth due to increased investment by companies in emerging countries in manufacturing facilities and cost reduction efforts. Also, growing awareness in developing countries about the benefits of reprocessed medical devices is encouraging consumer purchasing behavior.

Concerns about safety and efficacy

The growth of the reprocessed medical devices market is hampered by several restraints. Hesitation among healthcare providers and resistance from patients arise from concerns about the safety and efficacy of reprocessed devices. To address these concerns and establish reliability, clear evidence and studies are essential. Regulatory scrutiny and compliance requirements present additional challenges for reprocessing companies, raising their operational costs. Furthermore, the limited availability of certain high-demand devices for reprocessing can constrain market growth. The preference for new devices by some market players and the potential for liability issues also slow down the widespread adoption of reprocessed medical devices.

Government initiatives

The global demand for medical devices is rising. Key devices in early clinical treatment include respiratory support equipment like life support machines, atomizers, oxygen generators, and monitors. The COVID-19 pandemic has significantly increased the need for medical products, including personal protective equipment such as masks, gloves, and eyeglasses. Healthcare personnel now require more medical supplies than before, driving market expansion. Additionally, growing awareness and initiatives from various non-governmental organizations (NGOs) aimed at reducing medical waste and promoting recycling efforts are expected to boost the reprocessed medical devices market growth further.

The cardiovascular segment dominated the reprocessed medical devices market in 2023. Several factors contribute to the significant market presence of reprocessed cardiovascular medical devices. Cardiovascular diseases remain a major global health concern, with high prevalence and rising cases, leading to substantial demand for devices such as catheters, pacemakers, stents, and electrophysiological devices. Reprocessing these devices offers a cost-effective solution for healthcare providers to meet growing demand without compromising patient care. Cardiovascular procedures often require expensive and complex devices, and reprocessing them provides a viable alternative to reduce costs for hospitals and healthcare facilities while ensuring safety and efficacy.

The laparoscopy segment is expected to grow at a rapid rate in the reprocessed medical devices market during the forecast period. The significant waste generated by disposable devices is driving the demand for reprocessed laparoscopic devices. The growing preference for minimally invasive techniques is expected to create opportunities for increased reprocessing approvals in laparoscopy by contributing to the growth of this segment.

The third-party reprocessing segment was the dominant force in the reprocessed medical devices market in 2023. Healthcare facilities, such as hospitals, engage in in-house reprocessing by sterilizing and refurbishing medical devices for reuse within their own premises. Conversely, third-party players collect used medical devices that would otherwise become medical waste and utilize various cleaning, sterilization, and refurbishment techniques to make them suitable for reuse. AMDR member companies are estimated to reprocess a wide range of clinical devices used in respiratory therapy, orthopedics, and cardiology, catering to outpatient surgery centers and hospitals.

The in-house reprocessing segment is expected to show significant growth in the reprocessed medical devices market over the forecast period. The practice of in-house reprocessing involves healthcare facilities, such as hospitals, sterilizing and refurbishing medical devices for reuse on their premises. This industry is highly regulated, which requires reprocessors to meet stringent regulatory demands and guidelines to ensure the safety and efficacy of reprocessed devices. To achieve this, the program must include appropriate equipment, ongoing quality control measures, trained personnel, and documented procedures.

The hospital segment dominated the reprocessed medical devices market in 2023. Hospitals play a significant role in the market, holding a substantial share. As major healthcare providers with high patient volumes, they have a greater demand for the practice of in-house reprocessing involving healthcare facilities, such as hospitals, sterilizing and refurbishing medical devices for reuse on their premises. This industry is highly regulated, which requires reprocessors to meet stringent regulatory demands and guidelines to ensure the safety and efficacy of reprocessed devices.

To achieve this, the program must include appropriate equipment, ongoing quality control measures, trained personnel, and documented procedures and medical devices. Reprocessed devices offer hospitals a cost-effective solution to meet equipment needs without compromising patient care. The cost savings from reprocessed devices help hospitals manage tight budgets and allocate resources more efficiently. Hospitals prioritize patient safety and adhere to rigorous quality control standards, further supporting their prominent presence in this market segment.

The home healthcare segment is anticipated to grow at a modest rate over the forecast period. The rising demand for low-cost home equipment drives the market for reprocessed home medical devices. These devices, including patient monitoring systems, orthopedic equipment, and external support devices, significantly enhance patient mobility at home. Furthermore, growth prospects are anticipated to improve due to the increasing potential for incorporating reprocessed products in home healthcare, largely driven by the limited number of home medical device suppliers.

Segments Covered in the Report

By Product

By Type

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

March 2025

August 2024

January 2025