September 2023

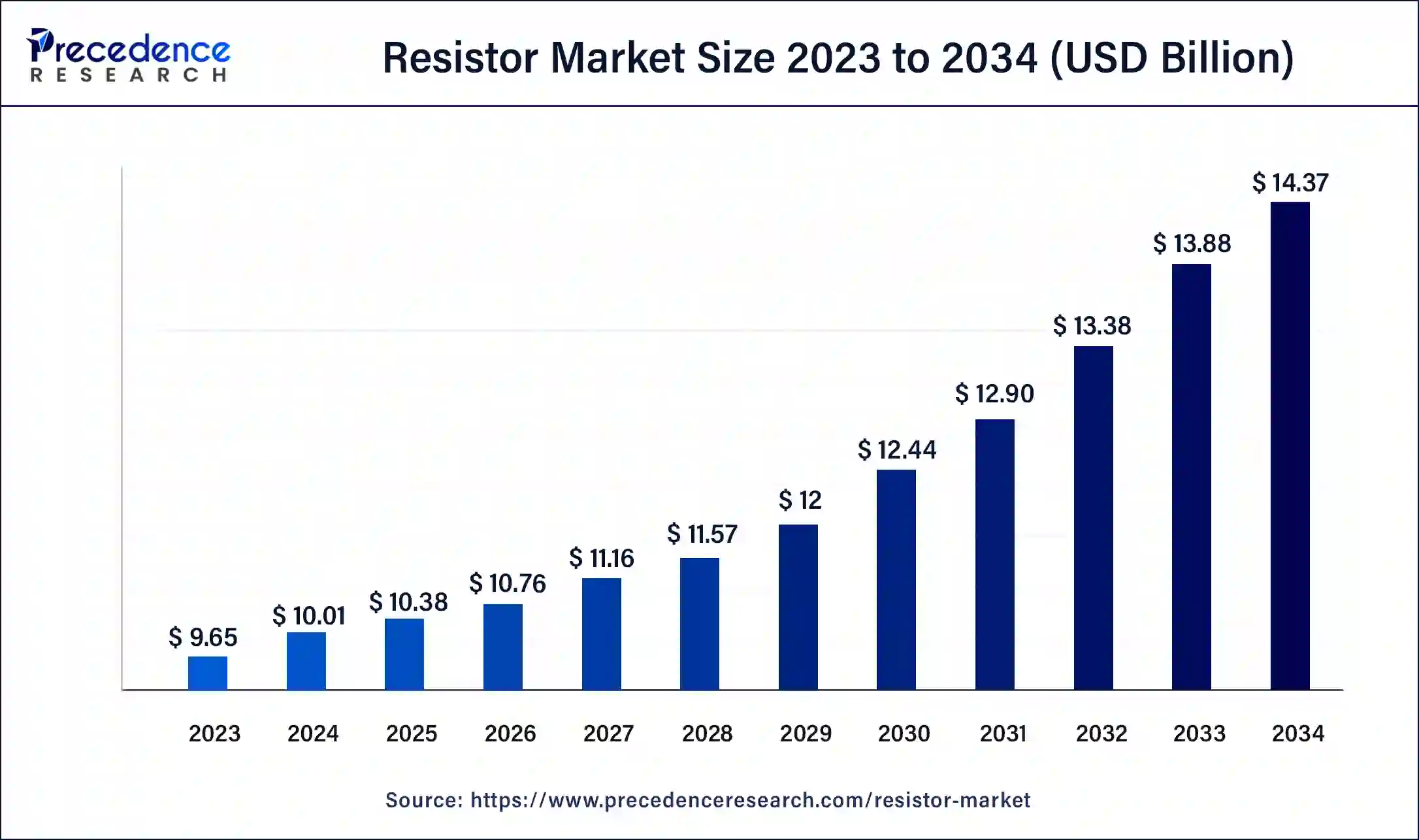

The global resistor market size was USD 9.65 billion in 2023, estimated at USD 10.01 billion in 2024 and is anticipated to reach around USD 14.37 billion by 2034, expanding at a CAGR of 3.68% from 2024 to 2034.

The global resistor market size accounted for USD 10.01 billion in 2024 and is predoicted to reach around USD 14.37 billion by 2034, growing at a CAGR of 3.68% from 2024 to 2034.

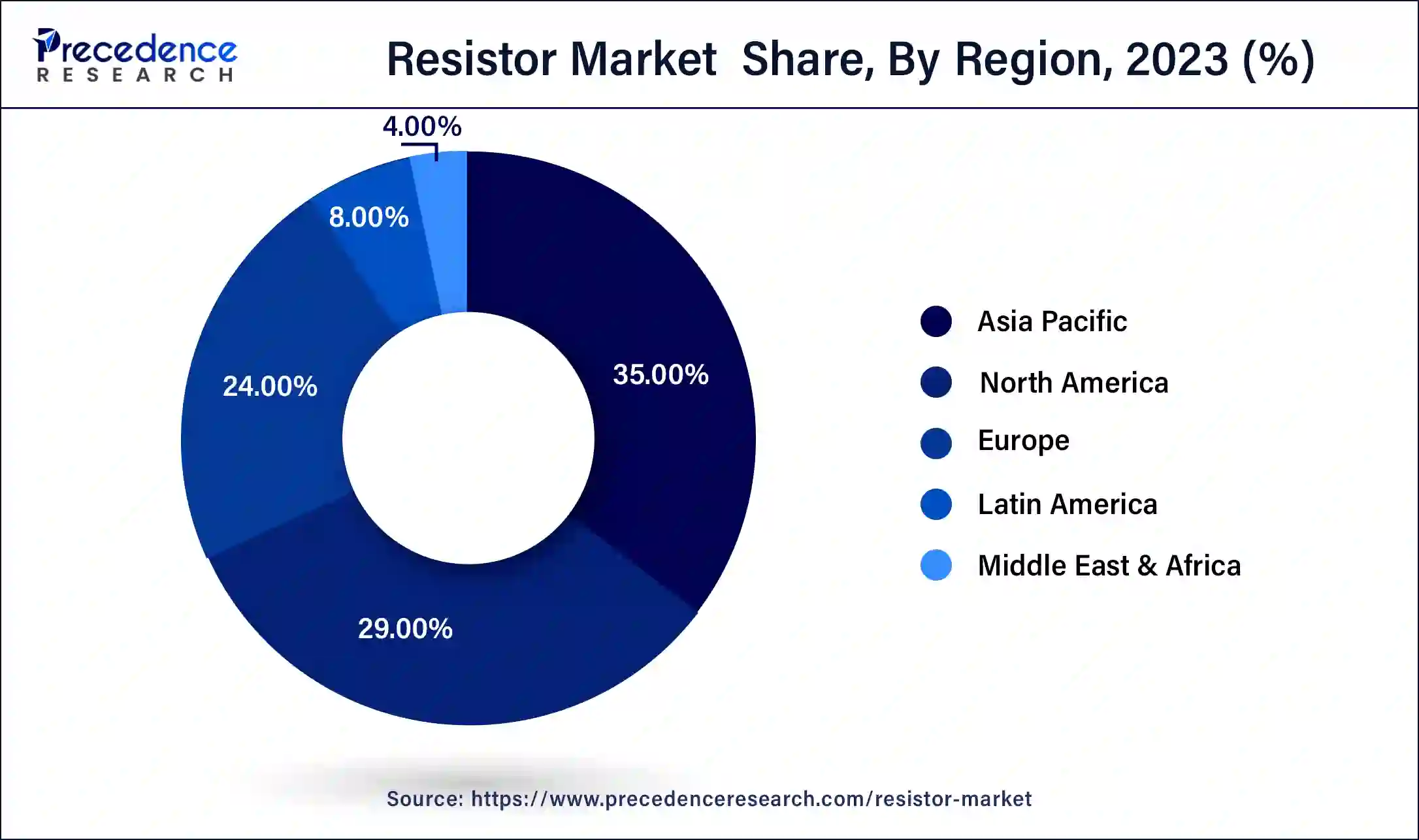

The Asia Pacific resistor market size was valued at USD 3.38 billion in 2023 and is expected to be worth around USD 5.03 billion by 2034, growing at a CAGR of 4% from 2024 to 2034.

Asia-Pacific has held the largest revenue share 35% in 2023. Asia-Pacific commands a significant share of the resistor market due to the region's robust electronics manufacturing sector, particularly in countries like China, Japan, and South Korea. The burgeoning demand for consumer electronics, automotive technologies, and industrial automation has fueled the need for resistors. Moreover, the rapid adoption of emerging technologies such as 5G, IoT, and electric vehicles further boosts the demand. The region's role as a manufacturing hub, coupled with increasing technological advancements, positions Asia-Pacific as a key player in driving the growth of the resistor market.

North America is estimated to observe the fastest expansion. North America commands substantial growth in the resistor market due to a robust presence of key industries such as automotive, aerospace, and electronics. The region's advanced technological infrastructure, coupled with a high adoption rate of electronic devices, fuels the demand for resistors. Moreover, the aerospace and defense sectors in North America are significant contributors to the market, relying heavily on resistors for critical applications. The region's emphasis on innovation and the presence of major market players further solidifies North America's dominant position in the global resistor market.

A resistor is a fundamental electronic component designed to impede the flow of electric current within a circuit. Its primary function is to introduce resistance, measured in ohms (Ω), which limits the current passing through it. Resistors are crucial for controlling the voltage and current levels in various electronic devices. They come in various shapes and sizes, ranging from small, discrete components to larger, power-handling resistors.

Resistors can serve diverse purposes in electronic circuits, including voltage division, current limiting, and signal conditioning. They are often employed to set bias points, ensuring the proper operation of transistors and other active components. Additionally, resistors find extensive use in voltage dividers for sensors and feedback networks in amplifiers. Their ubiquitous presence in electronic systems underscores their importance in tailoring and optimizing the performance of circuits, making resistors essential building blocks in the realm of electronics.

| Report Coverage | Details |

| Market Size in 2023 | USD 9.65 Billion |

| Market Size in 2023 | USD 10.01 Billion |

| Market Size by 2034 | USD 14.37 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 3.68% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Electronic device proliferation and 5G technology deployment

The widespread use of electronic gadgets and the rollout of 5G technology are driving a surge in demand for resistors. As everyday items increasingly incorporate electronic features, such as smartphones and smart appliances, the necessity for resistors as essential components rises significantly. These resistors play a vital role in managing and directing the flow of electric current within these devices, ensuring they function effectively and reliably.

Additionally, the introduction of 5G technology, promising faster data speeds and enhanced connectivity, necessitates advanced and efficient electronic components. Resistors, as foundational elements in circuitry, become crucial in supporting the complex signal processing required for seamless communication in 5G networks. With the escalating need for higher data transfer rates and expanded network capabilities, the demand for resistors tailored to meet these technological demands is escalating, driving growth in the resistor market.

Commoditization and price pressure

Commoditization and price pressure present significant challenges restraining the growth of the resistor market. The commoditization of basic resistor types has led to a situation where these components are viewed as standardized and interchangeable, fostering intense price competition among manufacturers. This heightened competition places considerable pressure on profit margins, limiting the financial resources available for research and development initiatives.

Moreover, as resistors are perceived as commodities, differentiation becomes challenging, hindering the ability of manufacturers to establish unique selling propositions. The focus on cost-cutting measures in commoditized markets may also compromise product quality and innovation. This dynamic discourages investment in advanced technologies or the development of specialized resistors, impacting overall market growth. In order to overcome these constraints, resistor manufacturers need to strategically position themselves through innovation, emphasizing value-added features, and diversifying their product portfolios to navigate the challenges posed by commoditization and price pressures.

5G network expansion

The expansion of 5G networks presents substantial opportunities for the resistor market. As 5G technology continues to proliferate globally, the demand for high-performance resistors escalates, particularly in critical applications within communication infrastructure and devices. The intricate and advanced circuitry of 5G base stations and devices requires resistors with precision and efficiency to ensure optimal signal processing and transmission.

Moreover, the increased data speeds and connectivity promised by 5G necessitate electronic components capable of handling the elevated demands on network infrastructure. Resistors play a pivotal role in supporting the functionality of 5G-enabled devices, including smartphones, IoT devices, and other connected systems. As the deployment of 5G networks expands, resistor manufacturers have the opportunity to provide specialized components that meet the stringent requirements of this transformative technology, positioning themselves at the forefront of a dynamic and rapidly growing market.

In 2023, the thick film segment had the highest market share of 43% on the basis of the type. Thick film resistors are a kind of electronic part known for their resistive layer, made from a thicker ceramic material. Unlike thin film resistors, the thick film variety is produced using a deposition process, allowing for a more substantial resistive layer, which brings advantages in terms of durability, cost efficiency, and easy large-scale production. The thick film resistor segment is witnessing a trend towards miniaturization, improved power handling capabilities, and increased demand for customized resistors to meet specific application requirements.

The growing adoption of thick film resistors in automotive electronics, consumer electronics, and industrial applications reflects the industry's inclination towards robust and versatile electronic components.

The thin film segment is anticipated to expand at a significant CAGR of 4.2% during the projected period. Thin-film resistors in the market are crafted by layering a thin resistive material onto a substrate, providing accurate resistance and stability in different conditions. A rising trend in this category is the call for smaller and more precise electronic components. These resistors, valued for their compact size and reliable performance, are increasingly popular in sectors like telecommunications, medical devices, and consumer electronics. The increased demand is fueled by the necessity for efficient and precise components in contemporary electronic devices.

According to the application, the automotive and transportation segment has held 34% revenue share in 2023. In the automotive and transportation sector of the resistor market, resistors find application in crucial vehicle components like electric drivetrains, battery management systems, lighting, and electronic control units. The ongoing trends in this segment include the growing adoption of electric vehicles (EVs), the overall electrification of vehicles, and the integration of advanced driver-assistance systems (ADAS).

The aerospace and defense segment is anticipated to expand fastest over the projected period. The aerospace and defense segment commands a significant growth in the resistor market due to its critical role in enhancing electronic systems within aircraft, satellites, and defense equipment.

The sector's stringent requirements for reliability, precision, and durability drive the demand for specialized resistors. Ongoing technological advancements in aerospace, the proliferation of unmanned aerial vehicles (UAVs), and the need for lightweight yet high-performance electronic solutions further contribute to the dominance of this segment. As these industries continue to evolve, the demand for advanced resistors tailored to their unique specifications remains robust.

Segments Covered in the Report

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2023