February 2025

Respiratory Care Devices Market (By Types: Therapeutic Devices, Diagnostic, Monitoring Devices, Diagnostic Devices, Consumables and Accessories; By End User: Hospitals, Homecare) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

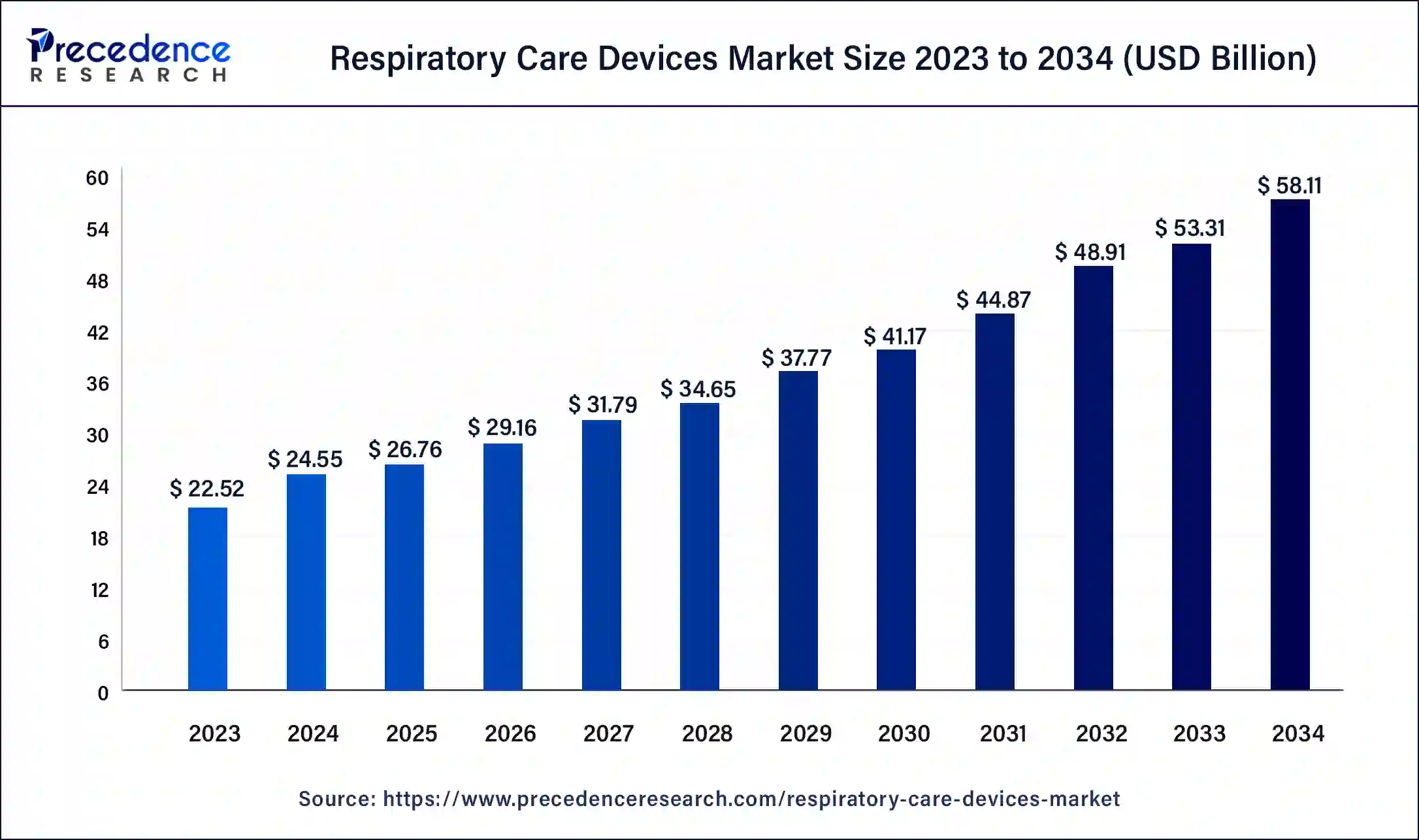

The global respiratory care devices market size was USD 22.52 billion in 2023, accounted for USD 24.55 billion in 2024, and is expected to reach around USD 58.11 billion by 2034, expanding at a CAGR of 9% from 2024 to 2034.

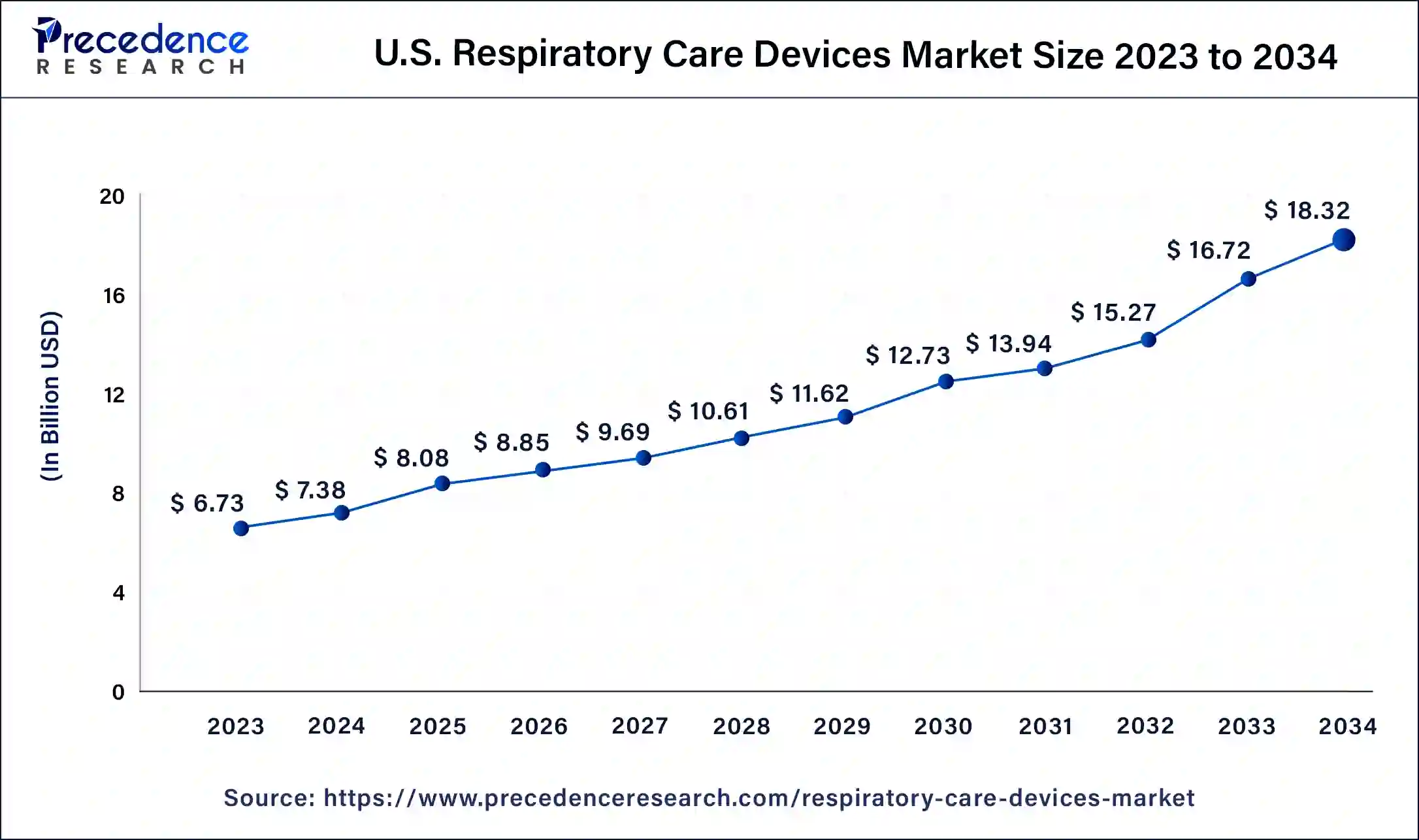

The U.S. respiratory care devices market size was estimated at USD 6.73 billion in 2023 and is predicted to be worth around USD 18.32 billion by 2034, at a CAGR of 9.5% from 2024 to 2034.

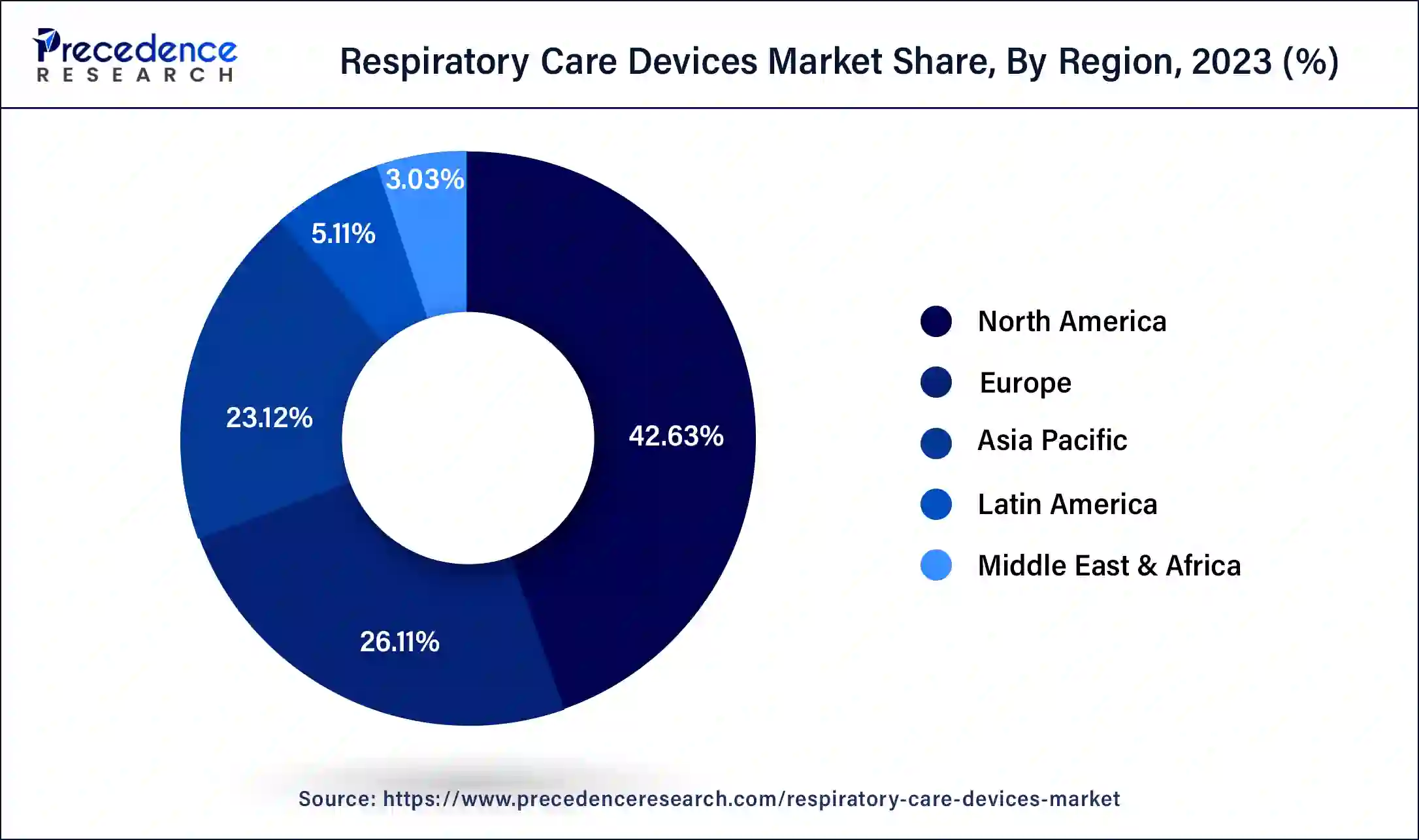

On the basis of geography, North America dominates the market, primarily driven by the increasing prevalence of respiratory diseases such as COPD, TB, asthma, and sleep apnea. The region is expected to witness significant growth in the respiratory care device market during the forecast period. This is due to the large patient population, high healthcare expenditure, advanced healthcare infrastructure, and a strong focus on technological advancements. The U.S. is the major country driving the demand for respiratory care devices in the North American region. The country has a burden of respiratory diseases, including COPD, asthma, and other chronic respiratory conditions. In addition, these countries are investing heavily in technology and advanced healthcare infrastructure, which is expected to drive the demand for respiratory care devices in the region.

Europe is a significant market for respiratory care devices, with Germany, France, and the United Kingdom being the major contributors to the market's growth. This is due to the rising adoption of healthcare systems, robust regulatory frameworks, and a growing prevalence of respiratory diseases. These countries have well-established industries that are major consumers of patient safety, quality standards, and the adoption of innovative medical technologies, contributing to the demand for the respiratory care devices market.

The region in the Asia Pacific is anticipated to have the greatest CAGR. The market is driven by various factors, such as expanding healthcare infrastructure and increasing awareness about respiratory care devices. China, Japan, and India are the major countries driving the demand for respiratory care devices in the Asia Pacific region. These countries have well-established industries, a large population base, increasing healthcare expenditure, and a rising prevalence of respiratory conditions. Moreover, these countries are investing heavily in developing technology and advanced healthcare infrastructure, which is expected to drive the demand for respiratory care devices in the region.

Market Overview

Respiratory care devices are medical devices used for treating and managing respiratory conditions. These devices are designed to assist patients in breathing, improve respiratory function, and provide respiratory support. Respiratory care devices' primary objective is to increase the prevalence of respiratory diseases, a growing aging population, technological advancements in device design, and a rise in healthcare spending.

The market is driven by the increasing prevalence of respiratory diseases, the growing aging population, and the increasing demand for home care settings. The rising incidence of respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and sleep apnea drives the demand for respiratory care devices. As the global population ages and environmental factors contribute to respiratory issues, the need for effective respiratory care solutions is rising.

Furthermore, the growing aging population has a higher prevalence of respiratory conditions among elderly individuals. Elderly individuals are more susceptible to respiratory diseases such as chronic obstructive pulmonary disease (COPD), pneumonia, and sleep apnea. This drives the demand for respiratory care devices to maintain adequate breathing and ensure optimal respiratory function. Thus, the respiratory care device market is expected to grow significantly during the forecast period. As people diagnosed with respiratory diseases increase, the demand for respiratory care devices grows.

However, the high cost of respiratory care devices, growing demand for home care therapeutic devices, and lack of awareness and education impede the market growth. Respiratory care devices require a reliable and efficient infrastructure for low-income individuals or healthcare facilities. The inadequate infrastructure and training distribution is currently limited, which may restrict the growth of the respiratory care device market. Also, cost constraints may create challenges for manufacturers of respiratory care devices and end-users. These challenges may restrain demand for the respiratory care device market.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have caused disruptions in supply chains and manufacturing, leading to a slowdown in economic activity and affecting demand for supply chain disruptions for respiratory care devices. However, the pandemic has also highlighted the importance of respiratory care devices and prompted collaborations across industries to meet the increased demand. The pandemic has also increased government stimulus spending on infrastructure projects and producing ventilators, which could provide opportunities for the respiratory care device market during the forecast period.

| Report Coverage | Details |

| Market Size in 2023 | USD 22.52 Billion |

| Market Size in 2024 | USD 24.55 Billion |

| Market Size by 2034 | USD 58.11 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Types and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing prevalence of respiratory diseases to brighten the market prospect

The global burden of respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea is rising. Factors such as air pollution, smoking, and aging populations contribute to the increased occurrence of these conditions. Age-related changes in lung function weakened immune systems, and comorbidities make the elderly more susceptible to respiratory diseases. Moreover, unhealthy lifestyle habits, such as smoking tobacco, contribute significantly to the prevalence of respiratory diseases. According to the American Lung Association, Smoking is a leading cause of COPD, lung cancer, and other respiratory disorders. Exposure to secondhand smoke also increases the risk of respiratory conditions in non-smokers. This makes respiratory care devices essential in producing and distributing respiratory care devices.

Furthermore, using respiratory care devices in elderly individuals often requires oxygen therapy, nebulizers, and other devices to manage their respiratory health. In addition, governments and industries worldwide are investing heavily in developing healthcare and infrastructure, which is anticipated to drive the growth of the respiratory care device market. For instance, in March 2022, the Australian Government announced its commitment to investing in a robust health system as part of its strategy for a stronger future. This investment entails a record amount of $132 billion for the fiscal year 2022-23, which may increase to $140 billion by 2025-26. The Government has pledged a total commitment of $537 billion over the next four years, emphasizing its dedication to enhancing the healthcare sector. Moreover, with the awareness about respiratory diseases, their prevention, and the importance of early diagnosis and treatment, the demand for respiratory care devices will likely increase to meet the needs of this growing market.

Growing aging population

As the global population ages, respiratory conditions and diseases are more prevalent and associated with age-related changes and comorbidities. Respiratory care devices are essential in ensuring quality and innovative respiratory care devices. The growing risk of respiratory situations with age is associated with physiological changes in the respiratory system, such as decreased lung function, reduced respiratory muscle strength, and increased susceptibility to respiratory infections. Oxygen therapy, nebulizers, positive airway pressure devices, and ventilators are generally used to provide respiratory support and develop the quality of life for elderly patients.

Furthermore, elderly individuals may experience a decline in lung function and are more susceptible to respiratory ailments such as chronic obstructive pulmonary disease (COPD), pneumonia, and sleep apnea. This has led to a rise in the need for respiratory devices that may assist in managing these conditions and improve the quality of life for older adults. Moreover, the aging population may require long-term care and assistance, leading to a growing demand for home healthcare solutions. Respiratory devices that are portable, easy to use, and suitable for home settings are generally sought after as they allow older adults to receive respiratory care and treatment in the comfort of their own homes.

Low awareness and a significant population with under-diagnosed and under-treated respiratory conditions

Respiratory care devices are complex devices, and low awareness about respiratory diseases and available treatment options may result in limited market penetration for respiratory care devices. Many individuals may not know the available devices or their benefits in managing their respiratory conditions. This lack of awareness may lead to the underutilization of respiratory care devices and hinder market growth. Furthermore, a population with under-diagnosed and under-treated respiratory conditions means many individuals are not receiving timely and appropriate care. This delay in diagnosis and treatment may result in the progression of respiratory diseases, worsening symptoms, and increased healthcare costs. This may result in a limited customer base and, ultimately, slow down the growth of the respiratory care device market.

However, increasing awareness, early detection, and appropriate utilization of respiratory care devices may improve patient outcomes, enhance the quality of life, and contribute to the market's overall growth. In addition, with the growth of the respiratory care device market, economies of scale may be achieved, reducing demand for devices. Furthermore, the increasing awareness and the continued investments made in the respiratory device industry by governments and industries worldwide may create an opportunity to drive innovation and cost reductions in the respiratory care device market.

On the basis of types, the respiratory care device market is divided into therapeutic devices, diagnostic, monitoring devices, diagnostic devices, and consumables and accessories. The increasing use of ventilators, nebulizers, positive airway pressure devices, oxygen concentrators, inhalers, and humidifiers mainly drives the demand for therapeutic and respiratory care devices. Furthermore, improving respiratory function, providing relief, and enhancing the quality of life for individuals with respiratory conditions further drive demand for the segment across the market. Therapeutic and respiratory care devices remove impurities and produce high-purity devices that may be used in various applications.

On the basis of the end-user, the respiratory care device market is divided into hospitals and home care. Hospitals accounted for the largest market share. This is because it provides critical care, manages acute respiratory conditions, and supports patients during surgeries or post-operative recovery. Respiratory care devices the need for effective diagnosis, treatment, and management of respiratory conditions, ensuring optimal patient outcomes.

Recent Developments:

Segments Covered in the Report:

By Types

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

August 2024

January 2025

January 2025