January 2025

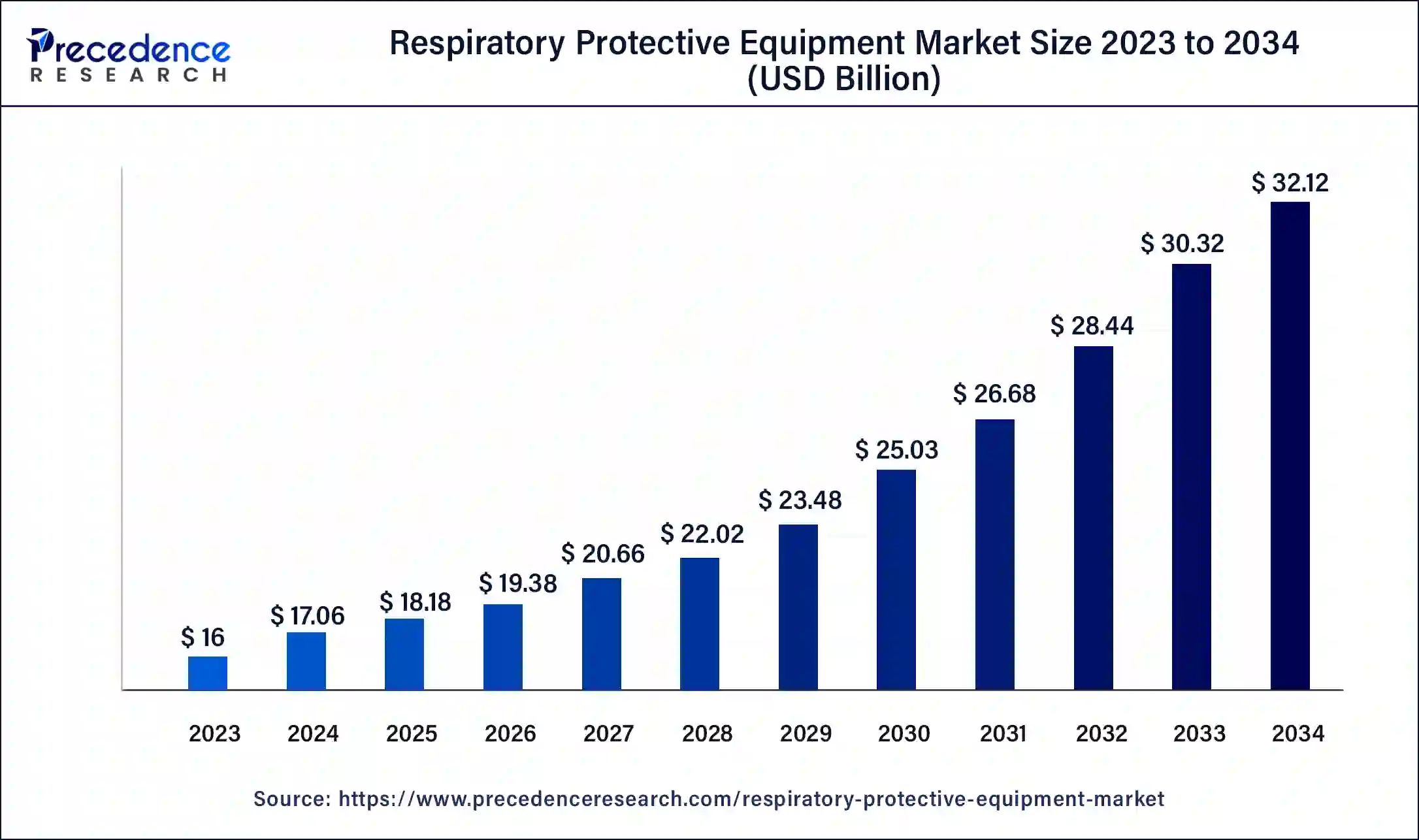

The global respiratory protective equipment market size was USD 16 billion in 2023, estimated at USD 17.06 billion in 2024 and is anticipated to reach around USD 32.12 billion by 2034, expanding at a CAGR of 6.53% from 2024 to 2034.

The global respiratory protective equipment market size accounted for USD 17.06 billion in 2024 and is predicted to reach around USD 32.12 billion by 2034, growing at a CAGR of 6.53% from 2024 to 2034.

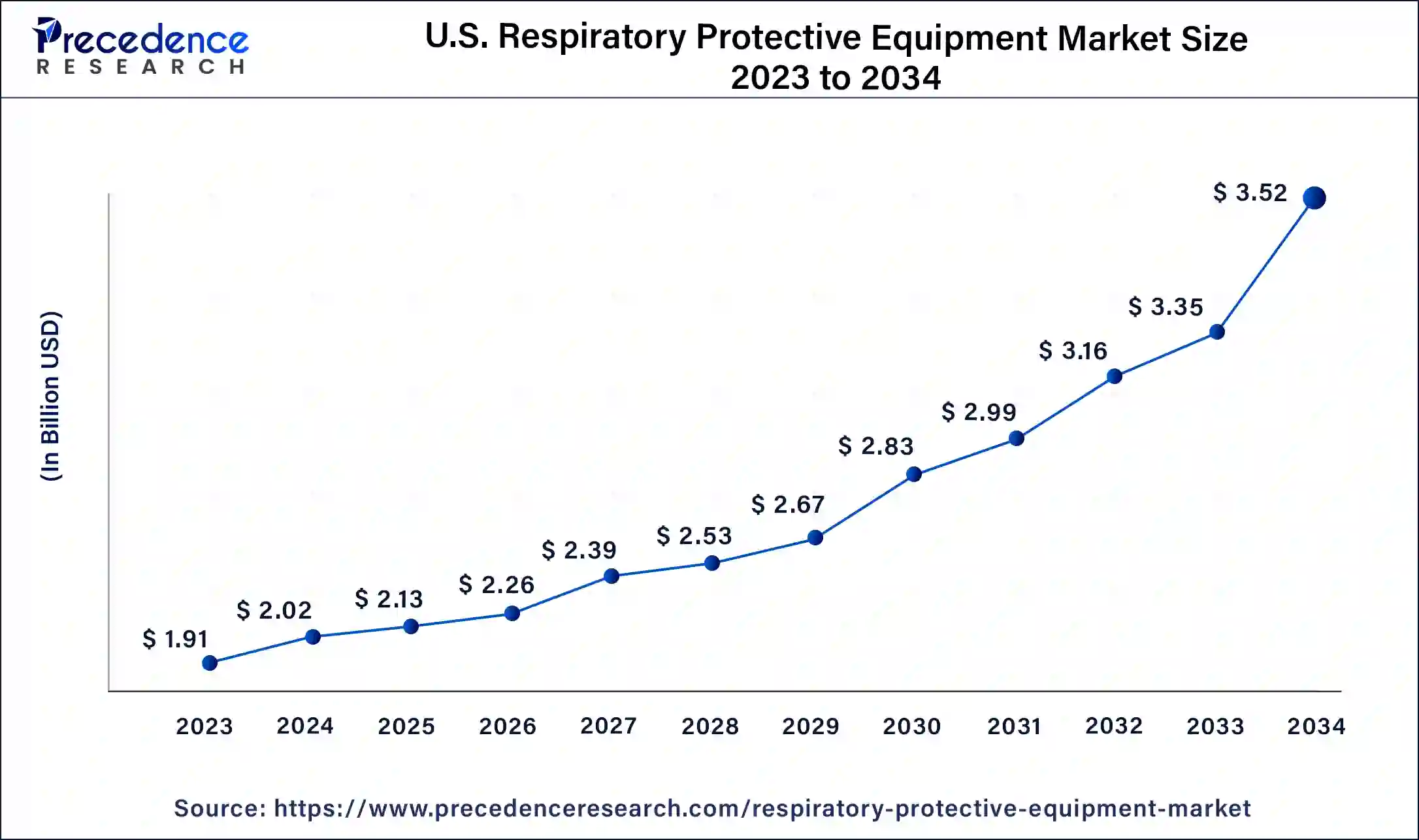

The U.S. respiratory protective equipment market size was valued at USD 4.03 billion in 2023 and is expected to be worth around USD 8.16 billion by 2034, growing at a CAGR of 6.61% from 2024 to 2034.

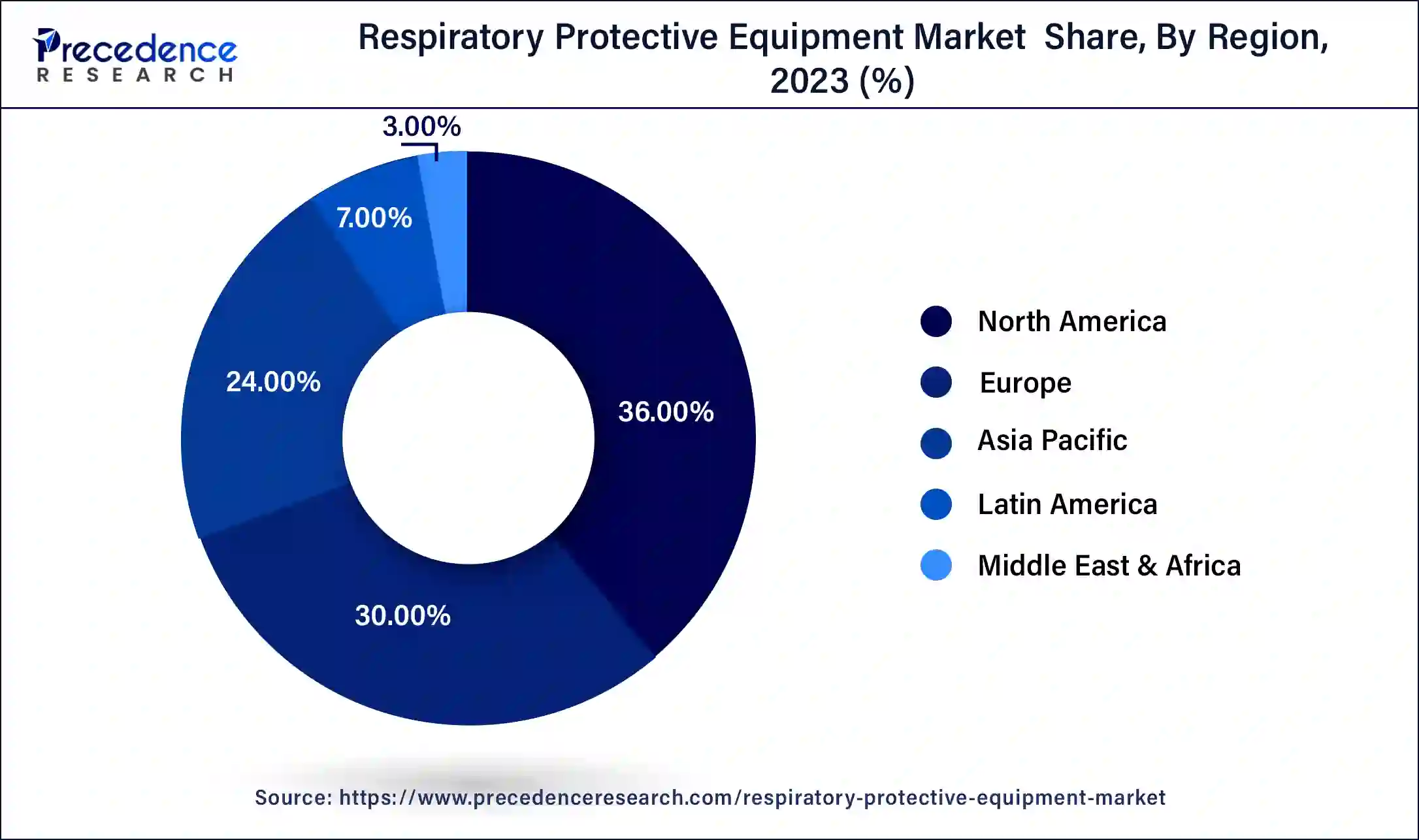

North America held the largest revenue share 36% in 2023. North America holds a major share in the respiratory protective equipment (RPE) market due to stringent occupational safety regulations, a robust industrial sector, and heightened awareness of workplace safety standards. The region's emphasis on health and safety compliance, coupled with the presence of key market players and a proactive approach to adopting advanced respiratory protection technologies, contributes to its dominant market share. Additionally, increasing concerns about respiratory health, especially in light of the COVID-19 pandemic, have further accelerated the demand for high-quality RPE in North America.

Asia-Pacific is estimated to witness the highest growth. Asia-Pacific holds a significant share in the respiratory protective equipment (RPE) market due to several factors. The region's robust industrialization, particularly in manufacturing and construction, contributes to increased demand for RPE to ensure worker safety. Additionally, stringent regulatory frameworks emphasizing occupational health and safety standards drive market growth. The heightened awareness of respiratory risks, coupled with the region's response to global health concerns, further amplifies the adoption of RPE. The Asia-Pacific market continues to expand as businesses prioritize employee well-being, fostering the widespread use of respiratory protection across diverse industries.

Respiratory Protective Equipment (RPE) is a vital category of personal safety gear crafted to shield individuals from inhaling harmful substances in the air. It encompasses an array of devices and accessories that establish a barrier between the respiratory system and potential hazards like airborne particles, gases, vapors, and biological contaminants. Essentially, RPE serves to prevent the intake of pollutants that could pose risks to respiratory health.

RPE comes in diverse forms, from disposable masks to advanced respirators fitted with filters and purifying mechanisms. Widely used in sectors like healthcare, manufacturing, construction, and emergency response, these devices play a pivotal role in safeguarding workers exposed to airborne threats. Choosing the right type of RPE, ensuring proper fit, and adhering to correct usage procedures are critical elements to guarantee its efficacy in providing a dependable defense against respiratory risks. This commitment to occupational safety standards underscores the significant role RPE plays in preserving the well-being of individuals across various professional settings.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.53% |

| Market Size in 2023 | USD 16 Billion |

| Market Size in 2023 | USD 17.06 Billion |

| Market Size by 2034 | USD 32.12 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Growing awareness and pandemic impact

Growing awareness and the impact of the COVID-19 pandemic have synergistically surged the market demand for respiratory protective equipment (RPE). As awareness regarding the importance of workplace safety and the potential respiratory hazards associated with various industries increases, both employers and employees recognize the need for robust protective measures. This heightened consciousness is driving a proactive approach towards respiratory health, resulting in a substantial uptick in the adoption of RPE across diverse sectors.

The COVID-19 pandemic has further accelerated the demand for respiratory protection, emphasizing the crucial role of RPE in curbing the transmission of respiratory diseases. Governments, businesses, and individuals globally are prioritizing respiratory safety measures, resulting in an increased demand for top-quality masks, respirators, and related protective equipment. The combined influence of heightened awareness and pandemic-related concerns is reshaping the landscape of the respiratory protective equipment market, positioning it as a pivotal element in modern workplace safety and public health strategies.

Training requirements and limited user awareness

Training requirements and limited user awareness collectively act as significant restraints on the market demand for respiratory protective equipment (RPE). The necessity for comprehensive training programs to educate users on the proper selection, usage, and maintenance of RPE can impose a constraint on businesses, demanding additional resources and time commitments. Ensuring that users are adequately trained is crucial for the effective utilization of respiratory protection, but the associated costs and efforts can deter widespread adoption.

Limited user awareness compounds this challenge, as gaps in understanding regarding the importance of respiratory protection may lead to inconsistent or incorrect usage. Despite growing overall awareness, some users may still lack the knowledge needed to make informed decisions about the appropriate RPE for their specific environments. Overcoming these restraints requires targeted education campaigns and accessible training programs to enhance user awareness and ensure proper utilization of respiratory protective equipment in diverse industries.

E-commerce expansion and global health concerns

The expansion of e-commerce and heightened global health concerns are creating significant opportunities in the Respiratory Protective Equipment (RPE) market. The growing prevalence of online platforms allows manufacturers to leverage e-commerce channels for the convenient and efficient distribution of respiratory protection products. This expansion enhances accessibility, enabling a broader reach to consumers and facilitating streamlined supply chains.

Online platforms also offer a platform for educating users about the importance of respiratory protection, fostering awareness and promoting informed decision-making. Global health concerns, particularly in the wake of events like the COVID-19 pandemic, are driving increased demand for respiratory protective equipment.

The focus on pandemic preparedness, along with ongoing health crises, has elevated the importance of RPE across various sectors. Governments, businesses, and individuals worldwide are prioritizing respiratory safety, creating opportunities for manufacturers to meet the heightened demand for high-quality protective gear. This convergence of e-commerce expansion and global health concerns positions the RPE market at the forefront of ensuring widespread access to essential safety measures on a global scale.

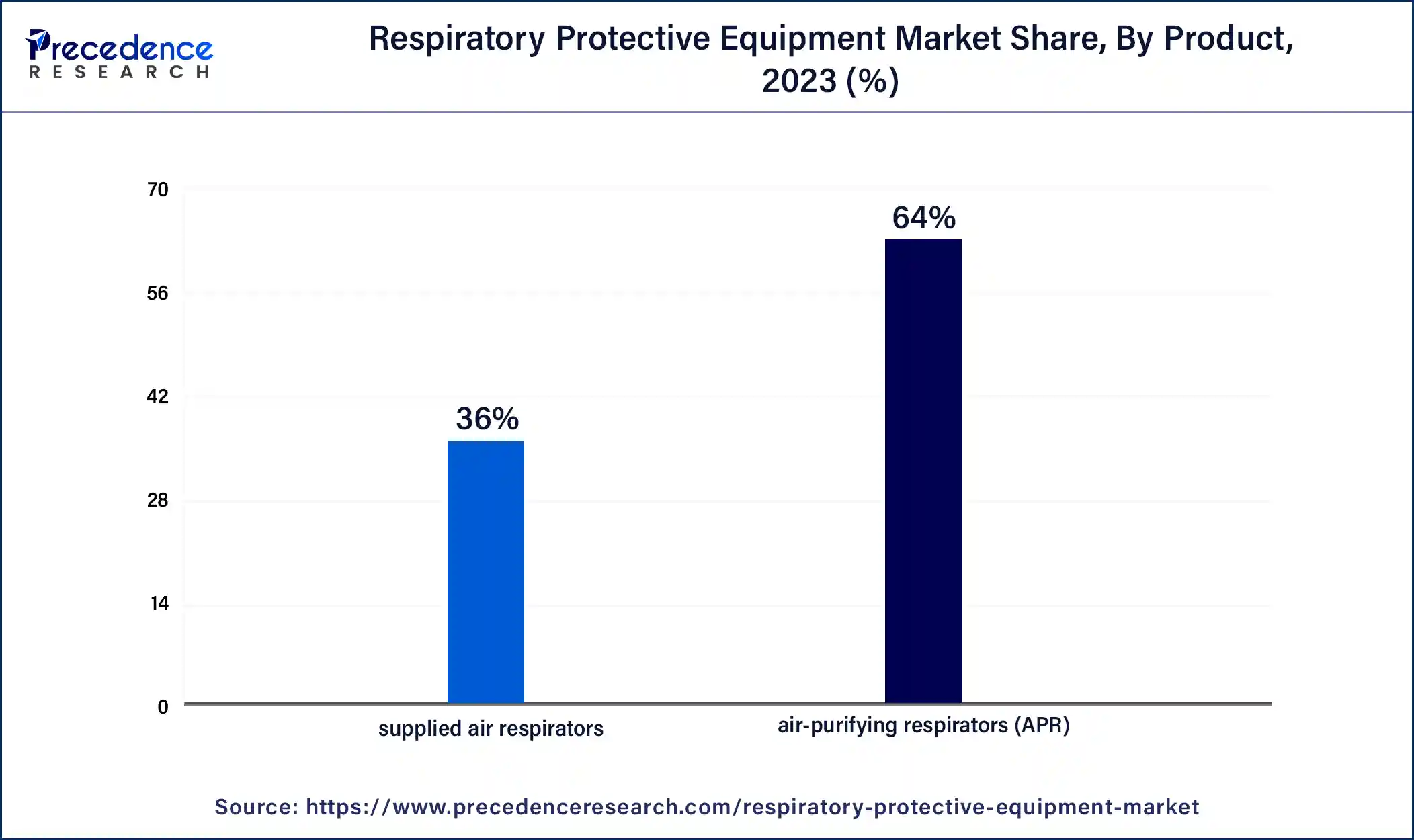

In 2023, the air-purifying respirators (APR) segment held the highest market share of 64% on the basis of the product. Air-purifying respirators (APR) belong to the category of respiratory protective equipment that works by cleansing the air before inhalation. These respirators employ filters to eliminate particles and harmful elements from the surrounding air, offering protection against gases and vapors. A notable trend in the APR segment involves the integration of advanced filtration technologies, like HEPA and carbon filters, to enhance their efficacy. Manufacturers are also emphasizing user comfort by incorporating ergonomic designs and user-friendly features, promoting better adherence to respiratory safety standards in various industries.

The supplied air respirators (SARs) segment is anticipated to witness the highest growth at a significant CAGR of 7.8% during the projected period. Supplied Air Respirators (SARs) are a critical segment in the Respiratory Protective Equipment (RPE) market, providing a continuous supply of clean air to the wearer through an external source. SARs eliminate the need for filters and rely on a remote air source, offering enhanced protection in environments with contaminants.

A notable trend in the SARs segment involves the integration of advanced technologies for improved comfort, communication features, and compatibility with other personal protective equipment, catering to the evolving needs of diverse industries such as healthcare, construction, and manufacturing.

According to the end use, the healthcare segment held a 25% revenue share in 2023. The healthcare segment in the Respiratory Protective Equipment (RPE) market pertains to the use of respiratory protection in medical settings. With the ongoing emphasis on infection control, the healthcare sector is witnessing a surge in demand for high-performance RPE. Trends include the adoption of advanced respirators with enhanced filtration capabilities, increased use of powered air-purifying respirators (PAPRs), and the development of innovative, comfortable designs to ensure optimal respiratory protection for healthcare professionals in various medical environments.

The mining segment is anticipated to witness the highest growth over the projected period. The mining segment in the Respiratory Protective Equipment (RPE) market refers to the use of respiratory protection in mining operations to safeguard workers from inhaling harmful particles, dust, and gases.

In this sector, the demand for RPE is driven by the need to mitigate the risk of respiratory hazards prevalent in mining environments, including silica dust and various airborne contaminants. Current trends in the mining segment include the adoption of advanced respiratory technologies, increased focus on user comfort, and the development of robust, durable RPE to enhance worker safety in mining operations.

Segments Covered in the Report

By Product

By End-Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

January 2025

February 2025

August 2024