What is the Retail Automation Market Size?

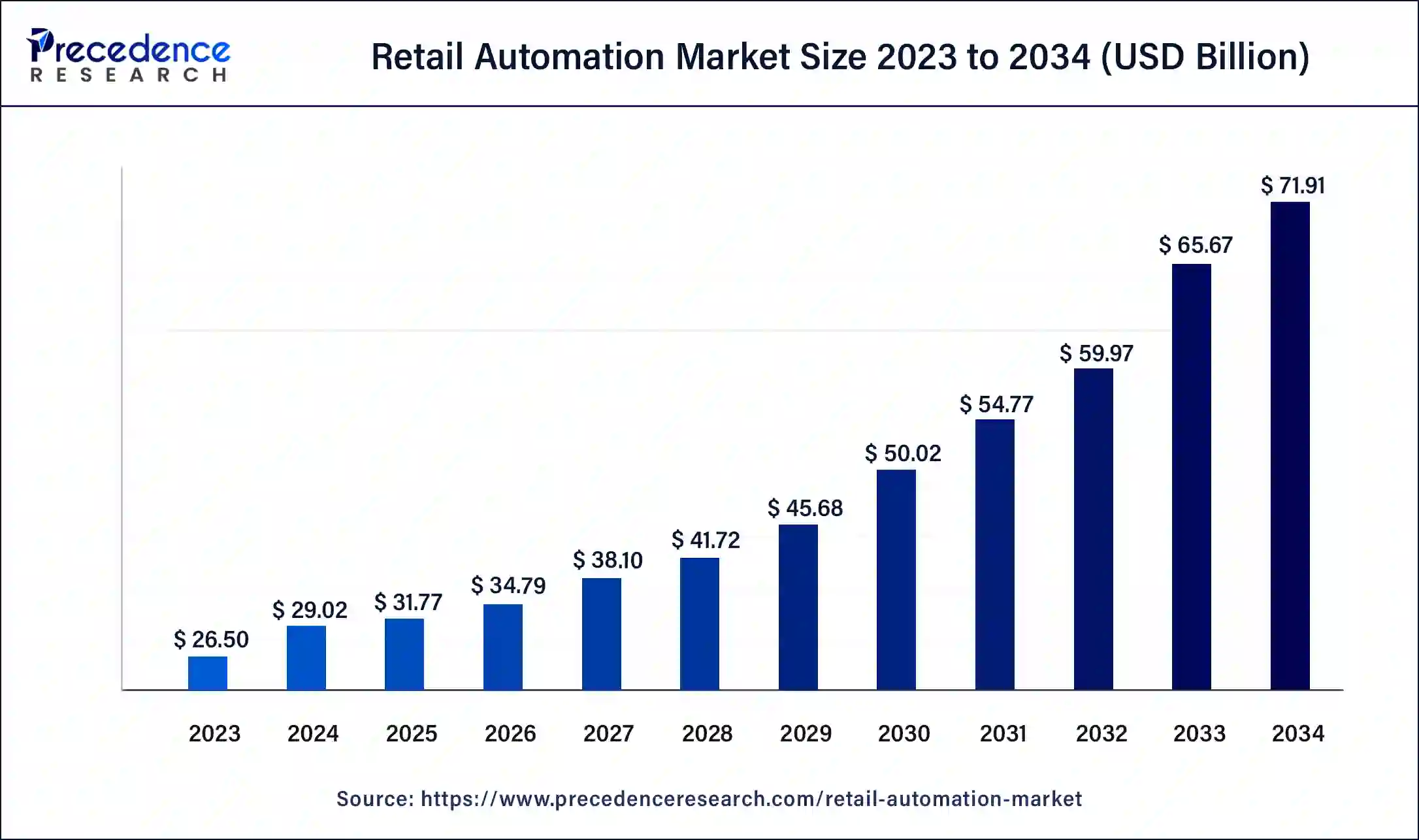

The global retail automation market size accounted for USD 31.77billion in 2025, and is expected to reach around USD 77.79 billion by 2035, expanding at a CAGR of 9.37% from 2026 to 2035.

Retail Automation Market Key Takeaways

- In terms of revenue, the retail automation market is valued at $31.77billion in 2025.

- It is projected to reach $77.79billion by 2035.

- The retail automation market is expected to grow at a CAGR of 9.37% from 2026 to 2035.

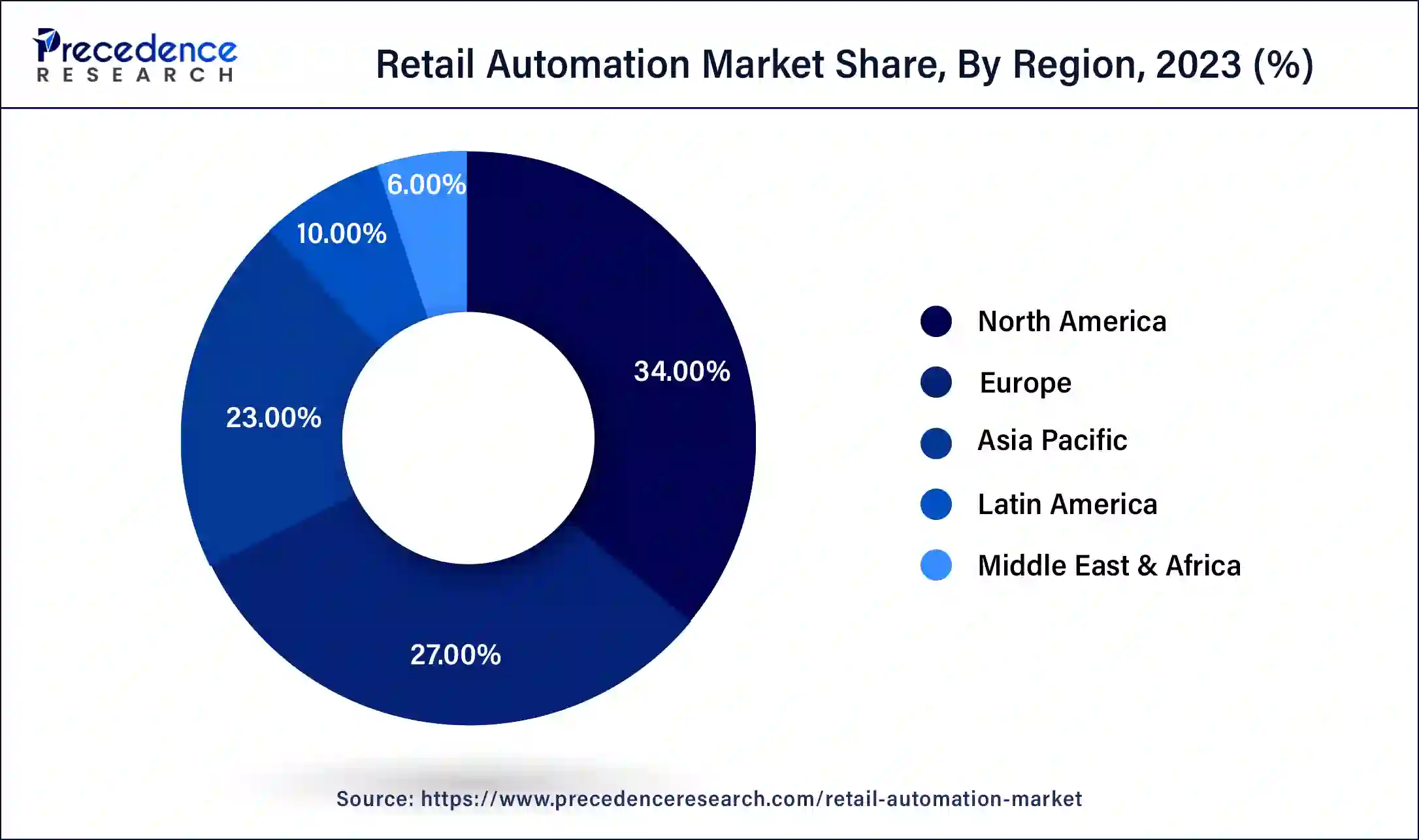

- North America held the largest market share of 34% in 2025.

- Asia-Pacific is estimated to expand at the fastest CAGR of 11.05% between 2026 to 2035.

- By implementation, the in-store segment has held the largest market share of 61% in 2025.

- By implementation, the warehouse segment is anticipated to grow at a remarkable CAGR of 10.04% between 2026 to 2035.

- By product, the point-of-sale (POS) segment has generated the largest market share of 26% in 2025.

- By product, the camera segment is projected to expand at a notable CAGR of 10.05% over the projected period.

- By end-use, the supermarket segment has accounted for the largest market share of 28% in 2025.

- By end-use, the hypermarket segment is expected to expand at the fastest CAGR of 10.10% over the projected period.

What is Retail Automation?

The retail automation market offers services associated with the integration of technology and systems to streamline and enhance various processes within the retail industry. It involves the deployment of tools such as self-checkouts, robotics, and artificial intelligence (AI) to automate tasks traditionally performed by human workers. The primary goal of retail automation is to improve operational efficiency, reduce costs, and enhance the overall customer experience. For example, self-checkout kiosks allow customers to scan and pay for their purchases independently, while robotics and AI are utilized in inventory management, order fulfillment, and even customer service. This transformation is driven by factors like rising labor costs, the need for faster and more accurate transactions, and the demand for a seamless and efficient shopping journey. Retailers adopting automation aim to stay competitive, optimize resource utilization, and adapt to the evolving expectations of modern consumers.\

How is AI contributing to the Retail Automation Industry?

The AI spurs the automation of retail by forecasting demand, automatically monitoring inventory, and personalization of customers. Behavioral and operational data are analyzed with the help of algorithms, which are used to optimize replenishment, store layouts, and promotions. The cashierless checkout and security are made possible through computer vision. Chatbots are used to automate the service, and analytics enhance strategic decision-making.

Retail Automation Market Data and Statistics

- The retail industry has advanced in automation by incorporating self-checkouts, robotics, and artificial intelligence (AI) in supply chains. This progress is driven by factors such as rising prices and wages, competitive labor markets, and reduced consumer spending. Currently, around 40% of the sector is automated, as estimated by the World Economic Forum (WEF). However, over the next three to four years, this figure is expected to increase to 60–65%. This renewed emphasis on automation presents opportunities for logistics, robotics, and retailers alike.

- In October 2022, Nigerian retail automation platform Bumpa secured a USD 4 million funding round led by Base10 Partners. Following a USD 200,000 pre-seed investment in September the previous year, the funds will be used to expand into new African markets, bolster the team, and enhance its systems and structures.

- Additionally, Walmart announced in October 2022 that it had acquired Alert Innovation, an e-grocery automation company specializing in innovative inventory-handling technology. In the realm of cloud POS solutions, a survey by Citixsys Technologies highlighted that over 67% of respondents in the United States, particularly those utilizing iVend Retail, have left stores empty-handed due to challenges in locating the products they sought.

Retail Automation Market Growth Factors

- Retailers are increasingly adopting automation to enhance operational efficiency. Automated processes, such as self-checkouts, inventory management, and order fulfillment, streamline day-to-day operations, reduce errors, and improve overall efficiency in the retail environment.

- The implementation of retail automation helps in reducing labor costs and minimizing operational expenses. Automated systems can perform repetitive and time-consuming tasks more efficiently than human counterparts, leading to significant cost savings for retailers.

- Automation contributes to an improved customer experience by offering convenience and speed. Self-service kiosks, personalized recommendations powered by AI, and efficient check-out processes contribute to a seamless and positive shopping experience, enhancing customer satisfaction and loyalty.

- Modern consumers expect a convenient and technology-driven shopping experience. Retail automation aligns with these expectations, enabling retailers to meet the evolving demands of consumers who seek efficiency, speed, and personalized services.

- The growth of the retail automation market is closely tied to advancements in technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT). These technologies enable retailers to implement sophisticated automation solutions for tasks like predictive analytics, inventory optimization, and personalized marketing.

- The expansion of e-commerce and omnichannel retailing has driven the demand for automation in order fulfillment, inventory management, and last-mile delivery. Retailers are investing in automation solutions to efficiently manage the complexities of online orders and deliver a seamless shopping experience across various channels.

Market Outlook

- Industry Growth Overview: The use of AI and workforce limitations hasten the process of automation in the checkout, fulfillment, and customer communication processes.

- Sustainability Trends: Retailers use automation to reduce energy consumption, waste reduction, and optimize environmentally friendly logistics.

- Global Expansion: The automation of checks, robots in warehouses, and cost-cutting efforts are the primary leaders in North America and Europe.

- Major Investors: Amazon, Walmart, Zebra Technologies, Honeywell International, Fujitsu Limited, and venture capital firms are the investors in retail automation.

- Startup Ecosystem: Startups provide computer vision, robotic picking experiences, and intelligent inventory solutions that improve contemporary retail experiences.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 9.37% |

| Market Size in 2025 | USD 31.77Billion |

| Market Size in 2026 | USD 34.79 Billion |

| Market Size by 2035 | USD 77.79Billion |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Implementation, By Product, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Consumer demand for convenience

The retail automation market is experiencing a surge due to the increasing consumer demand for convenience in shopping experiences. As modern consumers seek quick and hassle-free transactions, retailers are turning to automation to meet these expectations. Self-checkout kiosks, contactless payment options, and automated inventory management systems are among the solutions implemented to enhance overall shopping convenience.

Studies reveal that 66% of global consumers prefer using self-checkout options, emphasizing the importance of automation in aligning with consumer preferences.

The convenience factor extends beyond the checkout process, influencing the adoption of technologies like smart shelves and personalized recommendations powered by artificial intelligence. Retailers recognize the pivotal role of automation in providing a seamless and efficient shopping journey, contributing to increased customer satisfaction and loyalty. The growing emphasis on consumer convenience is a driving factor behind the expanding market demand for retail automation solutions.

Restraint

Maintenance costs

Maintenance costs pose a significant restraint on the market demand for retail automation. While automation systems offer operational efficiency and streamlined processes, the ongoing expenses associated with maintenance can be a deterrent for retailers. Regular upkeep, software updates, and addressing technical issues contribute to the overall cost of ownership, impacting the cost-effectiveness of adopting automation solutions. For businesses, the concern over maintenance costs becomes a crucial factor in the decision-making process, especially for smaller retailers with limited budgets. The fear of unexpected or recurring expenses can hinder the widespread adoption of retail automation, as businesses weigh the benefits of operational efficiency against the potential financial burden of maintaining and sustaining automated systems over time. Balancing the advantages of automation with the long-term cost implications becomes crucial for retailers navigating the landscape of technological adoption in the retail sector.

Opportunity

Omnichannel integration

Omnichannel integration is a pivotal driver of opportunities in the retail automation market. By seamlessly integrating automation across various channels, retailers can create a cohesive and synchronized shopping experience for consumers. Opportunities arise for retailers to connect online and offline operations, enabling customers to transition effortlessly between different touchpoints, such as in-store, online, and mobile platforms. This integration allows for unified inventory management, consistent product information, and synchronized promotions, fostering a more engaging and convenient shopping journey.

Furthermore, omnichannel integration opens opportunities for retailers to leverage automation in order fulfillment processes. Automated systems can optimize inventory levels, reduce fulfillment times, and enhance overall operational efficiency. As consumers increasingly expect a unified and convenient shopping experience, the implementation of omnichannel integration through automation positions retailers to meet these expectations, driving customer satisfaction and loyalty.

Segment Insights

Implementation Insights

The in-store segment held the largest share of the market in 2025. The in-store segment in the retail automation market refers to the implementation of automated technologies within physical retail spaces. This includes the deployment of self-checkout kiosks, smart shelves, and AI-driven customer service solutions. The trend in this segment involves enhancing the in-store shopping experience through automation, offering technologies like contactless payments, personalized recommendations, and efficient inventory management. Retailers are increasingly adopting in-store automation to streamline operations, reduce wait times, and provide customers with a seamless and technologically advanced retail environment.

The warehouse segment is anticipated to witness rapid growth at a significant CAGR during the forecast period. In the retail automation market, the warehouse segment focuses on implementing automated solutions to streamline and optimize warehouse operations. This involves deploying technologies such as robotics, conveyor systems, and automated storage and retrieval systems (AS/RS) to enhance efficiency in tasks like inventory management, picking, packing, and shipping. The trend in the warehouse segment is the growing adoption of advanced robotic systems, leveraging artificial intelligence and machine learning for more intelligent and adaptive warehouse automation, improving overall supply chain performance.

Product Insights

According to the product, the point-of-sale (POS) segment held the largest share of the market. The Point-of-Sale (POS) segment in the retail automation market refers to the technology and systems used to complete customer transactions at the point of purchase. This includes hardware like cash registers, barcode scanners, and terminals, as well as software that facilitates payment processing and inventory management. A significant trend in the POS segment involves the adoption of cloud-based POS solutions, offering retailers flexibility, real-time data access, and enhanced security. Mobile POS systems and contactless payment options are also gaining popularity, providing a seamless and efficient checkout experience for both retailers and customers.

The camera segment is anticipated to witness rapid growth over the projected period. In the retail automation market, the camera segment involves the use of surveillance and imaging technology to enhance security, monitor customer behavior, and optimize operational processes. Cameras are deployed for tasks such as people counting, facial recognition, and inventory management, contributing to a more efficient and secure retail environment. A notable trend in the camera segment is the integration of artificial intelligence (AI) for advanced analytics. AI-powered cameras enable real-time insights into customer behavior, aiding retailers in making informed decisions to improve store layout, product placement, and overall customer experience.

End-use Insights

According to the end-use, the supermarket segment held the dominating share of the retail automation market. In the market, the supermarket segment pertains to large-scale grocery stores that offer a wide range of products. A notable trend in this segment is the adoption of self-checkout kiosks, enabling customers to scan and pay for items independently. Supermarkets are also integrating inventory management systems and smart shelving to enhance operational efficiency. These trends aim to streamline the shopping process, reduce wait times, and improve overall customer satisfaction in the dynamic landscape of supermarket retailing.

The hypermarket segment is anticipated to witness rapid growth over the projected period. The hypermarket segment in the retail automation market refers to large-scale retail stores that offer a wide range of products, including groceries, household items, and electronics. Trends in this segment involve the adoption of automation solutions to streamline operations. Hypermarkets are increasingly implementing self-checkout kiosks, inventory management systems, and AI-driven analytics to enhance customer experiences, optimize inventory levels, and improve overall operational efficiency. This trend aligns with the industry's focus on providing a seamless and efficient shopping journey in large-scale retail environments.

Regional Insights

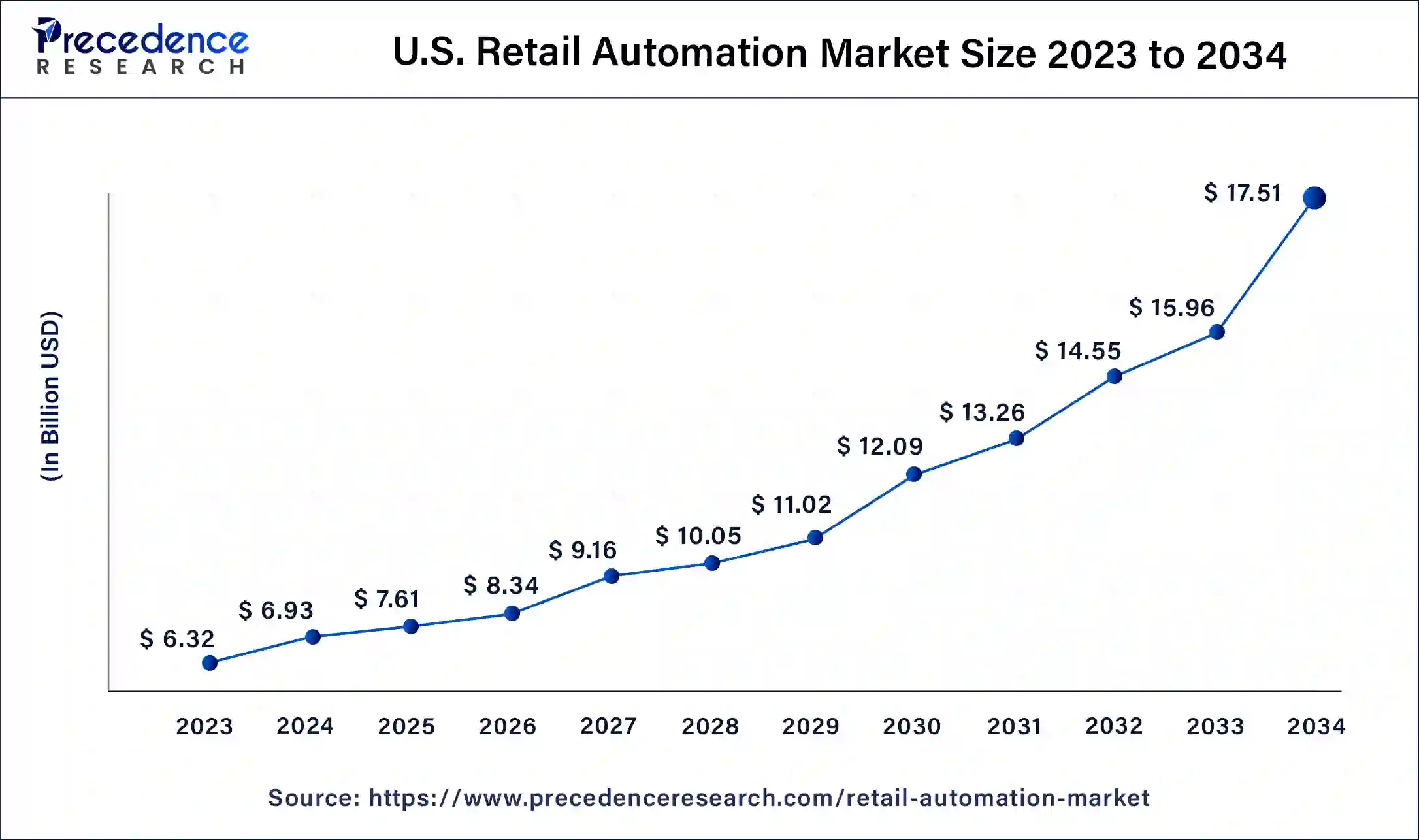

What is the U.S. Retail Automation Market Size?

The U.S. retail automation market size was estimated at USD 7.61 billion in 2025 and is predicted to be worth around USD 18.97 billion by 2035, at a CAGR of 9.56% from 2026 to 2035.

North America held the largest share of 34% in 2025. the retail automation market due to its advanced technological infrastructure, widespread adoption of innovative retail solutions, and a mature retail sector. The region's retail industry is quick to embrace automation technologies, including self-checkout systems, AI-driven analytics, and omnichannel integration. Additionally, the high consumer demand for convenience and efficiency in shopping experiences drives retailers in North America to invest significantly in automation solutions, contributing to the region's dominant position in the global retail automation market.

U.S. Retail Automation Market Trends

Demand planning and replenishment AI is the means used by the U.S. to accelerate the automation of retail. Vision technologies are used to grow cashierless formats. The retail media networks generate computerized ad revenues. The use of robotics enhances efficiencies of fulfillment and overcomes labour limitations inside the stores and at warehouses.

Asia-Pacific is poised for robust growth in the retail automation market due to factors such as rapid urbanization, increasing consumer demand for convenient shopping experiences, and the expansion of organized retail. With a rising middle class and a tech-savvy population, businesses in the region are embracing automation to improve operational efficiency and enhance customer satisfaction. The adoption of technologies like self-checkout systems, smart shelves, and AI-driven analytics is expected to drive substantial growth in the retail automation sector across Asia-Pacific.

India is a significant player in the regional market, driving growth due to government investments in retail infrastructure, which allows the adoption of automation technologies in the retail sector.

- Indian Standalone net sales of Honeywell Automation have increased 17.23% to Rs 1114.50 crore in March 2025.

- The Net profit of Honeywell Automation India declined 5.60% to Rs 139.90 crore in the quarter ended March 2025 as against Rs 148.20 crore during the previous quarter ended March 2024.

- Honeywell Automation's net profit rose 4.43% to Rs 523.60 crore net profit for the full year, in the year ended March 2025, as against Rs 501.40 crore during the previous year ended March 2024.

- Sales rose 3.24% to Rs 4189.60 crore in the year ended March 2025.

- In the previous year, at the end of March 2024, the sale was Rs 4058.20 crore. Source: business-standard.com

China Retail Automation Market Trends

China is a pioneer with regard to instant automation in retail by incorporating micro fulfillment hubs and quick delivery prototypes. AI is used to control inventory and routing. Dynamic pricing is made possible by electronic shelf labels. Social commerce fits well in automated stores. Facial recognition payment is assisted by computer vision.

Meanwhile, Europe is experiencing notable growth in the retail automation market due to a convergence of factors. Rising labor costs, a push for operational efficiency, and the demand for enhanced customer experiences are driving the adoption of automation solutions. Retailers in Europe are increasingly integrating technologies like self-checkouts, AI-driven analytics, and robotics to stay competitive and meet the evolving expectations of consumers. Additionally, the emphasis on sustainability and the need for contactless solutions have further fueled the growth of retail automation in the European market.

Germany Retail Automation Market Trends

Germany supports automation via sustainability-oriented retail designs. Online and offline inventory are linked together in the omnichannel. AI allows hyper-segmented marketing and effective management of stock. IoT-inspired logistics enhance resilience and real-time visibility on distribution networks in supply chains.

Value Chain Analysis of the Retail Automation Market

- Raw Material Procurement: The acquisition of silicon, specialty chemicals, and rare gases is the foundation of the automation semiconductors.

Key players: Shin-Etsu Chemical, SUMCO, Siltronic, GlobalWafers, Merck Group - Wafer Fabrication (Front-end): Production of intelligent hardware systems for retail using integrated circuits on a silicon wafer.

Key players: TSMC, Samsung Electronics, Intel, GlobalFoundries, SMIC - Photolithography and Etching: Patterning circuits- Chemical etching and ultraviolet projection.

Key players: ASML, Applied Materials, Tokyo Electron (TEL), Lam Research - Doping and Layering Processes: Modification of conductivity by the addition of impurities and multiple layers of films deposited in chips.

Key Players: Applied Materials, Tokyo Electron, Hitachi Kokusai Electric, ASM International - Assembly and Packaging (Back-end): Dicing Wafers and artistically sealing them to last long and integrate hardware.

Key players: ASE Technology Holding, Amkor Technology, JCET Group, SPIL

Retail Automation Market Companies

- IBM Corporation: Offers AI-powered multi-channel solutions and asset management technology, optimizing supply chains and personalized shopping experiences.

- Honeywell International Inc.: Provides barcode scanning, RFID, and warehouse automation software that enhances inventory accuracy and speed of fulfillment.

- Zebra Technologies Corporation: Provides mobile computing, thermal printing, and autonomous robots to facilitate real-time frontline retail operations.

Other Major Key Players

- NCR Corporation

- Toshiba Global Commerce Solutions

- Pricer AB

- Fujitsu Limited

- KUKA AG

- Wincor Nixdorf AG

- Diebold Nixdorf, Incorporated

- ECR Software Corporation

- Posiflex Technology, Inc.

- ECR Retail Systems

- First Data Corporation

- Panasonic Corporation

Recent Developments

- In May 2025, UiPath (NYSE: PATH), a global leader in?agentic automation, was named a leader in the???IDC MarketScape: Worldwide Business Automation Platforms 2025 Vendor Assessment?. The company has become a leader across the segments, including automation planning, agentic automation, business process automation, decision automation, platform and life-cycle management, end-to-end orchestration, robotic process automation, and performance measurements. Source: itwire.com

- In May 2025,DHL Group, the world's leading logistics provider, and Boston Dynamics, a global leader in advanced robotics, signed a strategic Memorandum of Understanding (MOU). The agreement provides ways for the global deployment of more than 1,000 additional units. DHL is expected to expand its range of applications for the robots, including additional use cases such as case picking, through the agreement. Source: group.dhl.com

- In May 2025, a groundbreaking tool that auto-populates merchandise, CoPlanner, was launched by 7thonline, a leader in multi-channel, AI-based merchandise planning and inventory management solutions for retail. The solution is to plan by analyzing historical data to identify what has worked best in the past. Source: wreg.com

- In October 2022, Focal Systems, a leading retail automation provider, partnered with Piggly Wiggly Midwest locations. Piggly Wiggly Midwest is set to conduct a trial of Focal Operating System (FocalOS) in its Wisconsin and Illinois stores. The primary goal of this collaboration is to elevate the customer experience by utilizing FocalOS to digitize and automate various aspects of their operations, including ordering, inventory management, merchandising, and in-store personnel management.

- In February 2022,RetailNext Inc., a prominent player in smart store retail analytics, announced the expansion of its free traffic system upgrades. This strategic move addresses the challenge faced by retailers in upgrading their outdated hardware, ensuring alignment with the latest industry standards and enhancing the overall shopping experience.

Segments Covered in the Report

By Implementation

- In-store

- Warehouse

By Product

- Point-of-Sale (POS)

- RFID & Barcode

- Camera

- Electronic Shelf Label

- Warehouse Robotics

- Others

By End-use

- Hypermarkets

- Single Item Stores

- Supermarkets

- Fuel Stations

- Retail Pharmacies

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting