April 2025

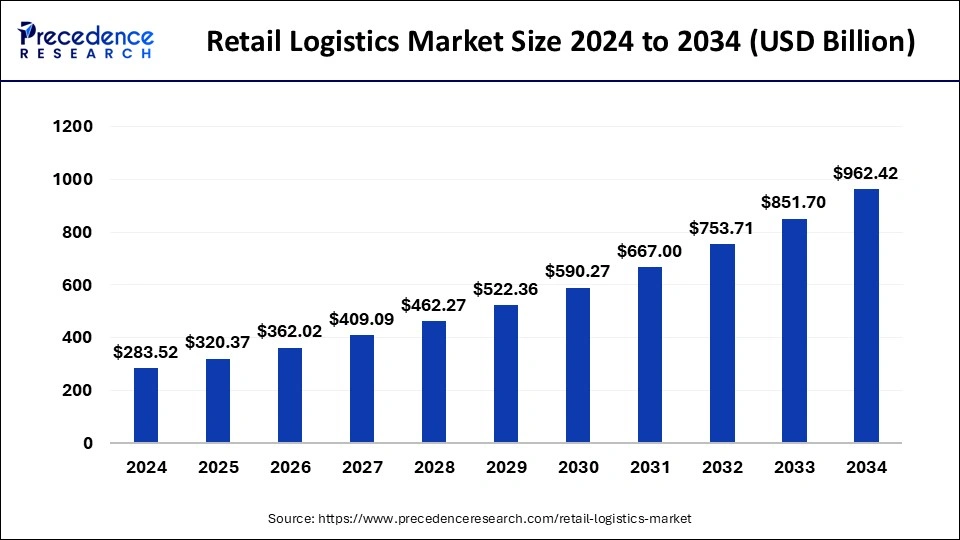

The global retail logistics market size accounted for USD 320.37 billion in 2025 and is forecasted to reach around USD 962.42 billion by 2034, accelerating at a CAGR of 13% from 2025 to 2034. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global retail logistics market size was recorded at USD 283.52 billion in 2024 and is predicted to increase from USD 320.37 billion in 2025 to approximately USD 962.42 billion by 2034, expanding at a CAGR of 13% from 2025 to 2034.

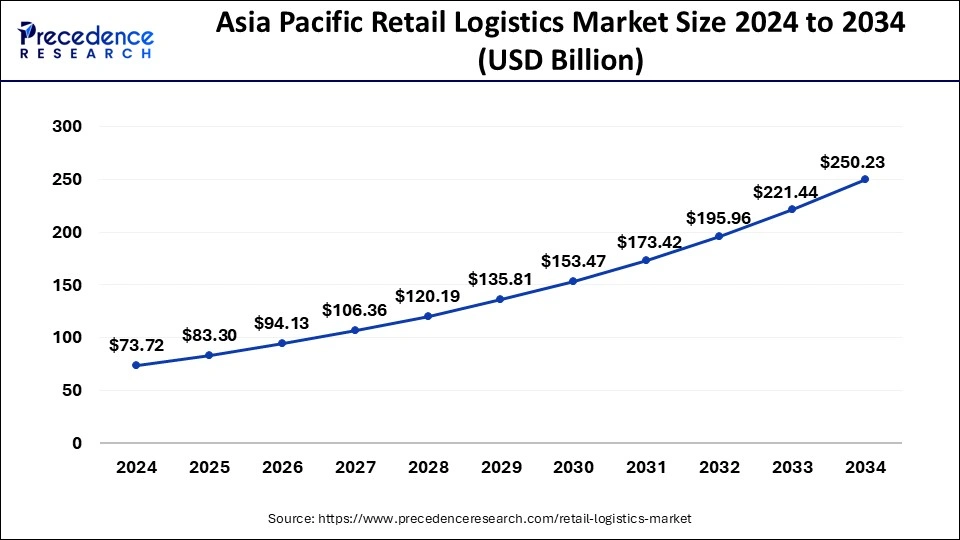

The Asia Pacific retail logistics market size was exhibited at USD 73.72 billion in 2024 and is predicted to be worth around USD 250.23 billion by 2034, at a CAGR of 13.2% from 2024 to 2034.

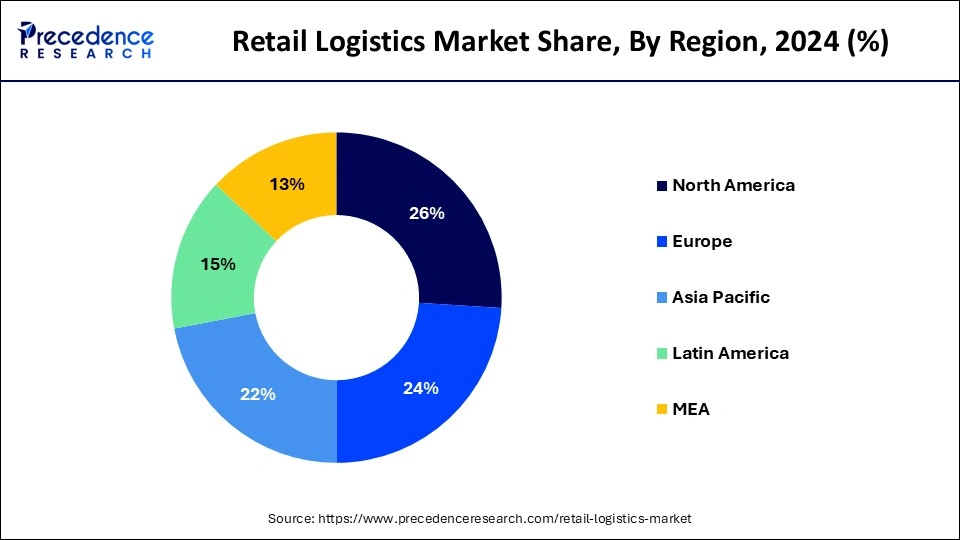

In terms of geography, the Asia Pacific is the front-runner in the global retail logistics market holding a revenue share of approximately 26% in the year 2024 and anticipated to maintain its dominance in the forthcoming years. This is majorly attributed to the significant developments in the logistics infrastructure, particularly in the emerging nations such as China, India, South Korea, Australia, Singapore, ASEAN nations, and many others. For instance, a framework agreement was signed between Cambodia’s Ministry of Public Works and Transport (MPWT) and Singapore based YCH Group Pte Ltd in order to develop Phnom Penh Logistics Complex Project.

In addition, several manufacturers are planning to shift their manufacturing sites in the Asia Pacific region is the other most prime factor that drives the retail logistics market growth. For example, in July 2021, Taiwan Semiconductor Manufacturing Company announced its plan to open its first chip manufacturing plant in Japan and stat its operation by the early of year 2024. Again, in November 2018, Alltech, leading supplier of animal foods expanded its manufacturing facility in India. Similarly, various other companies of different markets are expanding their manufacturing facilities in the region owing to low labor cost and other favorable conditions for decreasing the overall manufacturing cost. These activities from the manufacturers significantly boosts the growth of retail logistics in the region.

However, North America and Europe are the other significant revenue contributors to the global retail logistics market owing to prominent growth in the food & beverages industry for online delivery. In 2019, the UK food delivery market accounted for a value of US$ 10 billion registering a growth of 39% over the past three years. Similarly, US online food delivery market was valued at US$ 26.5 billion in the year 2020 and expected to grow at a rate of 11% during the forecast period. This all above statistics states the significant contribution to the growth of retail logistics in the North America and Europe markets.

Significant growth in the retail and e-commerce platform has significantly boosted the retail logistics business across the world. Further, rising trend for online purchasing is one of the other major factors that triggers the demand for retail logistics. Online purchasing has boosted the demand for easy and fast delivery and pick of products selected by the customers that prospers the demand for logistics both across nation and cross-border.

Moreover, with the sudden outbreak of COVID-19 in the start of the year 2020 various industries were badly hit by the lockdown scenario across the country, whereas retail logistics seeks profound growth. This has boosted the trend for online shopping because of public isolation that in turn triggered the market growth and hence the retail logistics market witnesses an opportunistic growth over the upcoming years.

| Report Highlights | Details |

| Market Size in 2034 | USD 962.42 Billion |

| Market Size in 2025 | USD 320.37 Billion |

| Market Size in 2024 | USD 283.52 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 13% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Solution, Mode of Transport, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Based on the solution, supply chain captured the largest market revenue share of 35% in the year 2024 and is anticipated to continue its dominance during the future outlook period. Significant growth of the segment is mainly attributed to its favorable features such as on-time delivery, optimization of omnichannel operations, personalizing the kitting & order fulfillment, and effectively manages the customer return. Supply chain also enables direct-to-store and direct-to-customer shipping that significantly decreases the time of delivery and improves the efficiency of warehouses as well as also optimizes the inventory. The supply chain segment also registers a rapid growth rate of approximately 13% due to penetration of cloud and data analytics solutions in the supply chain management.

On the contrary, reverse logistics & liquidation segment registers a considerable growth during the forecast period owing to magnificent growth in e-commerce platform along with rising number of e-shoppers across the world. Today, consumer prefer easy return and exchange process on the purchase of any goods. This emphasizes retailers to make return process for online goods easy and convenient for their customers.

Roadways segment accounted for the major share of revenue of approximately 52% in the year 2024 and was predicted to forecast the same trend over the upcoming years. The impressive growth of the segment is mainly because of increasing demand for road transportation for long distances, preferably in the domestic regions. Further, an easy and fast possible way for delivering and return process of goods is the other major factor propelling the growth of the segment. Besides, various government initiative to improve the condition of national and international highways. In addition, the government also focuses on continuous monitoring the health of highways by using cognitive analytics and Internet of Things (IoT). These all factors collectively support the growth of the segment.

Moreover, the roadways segment also registers the fastest growth over the forthcoming years attributed to increasing road connectivity particularly in the developing nations. This triggers the demand for road transportation compared to other modes of transportation. Further, tier 1 and tier 2 cities are well connected through road networks that again propels the demand for road transportation among retailer as is an easy way to deliver and pick up of goods.

By Type

By Solution Type

By Mode of Transport Type

By Regional Type

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

August 2024

March 2025

January 2025