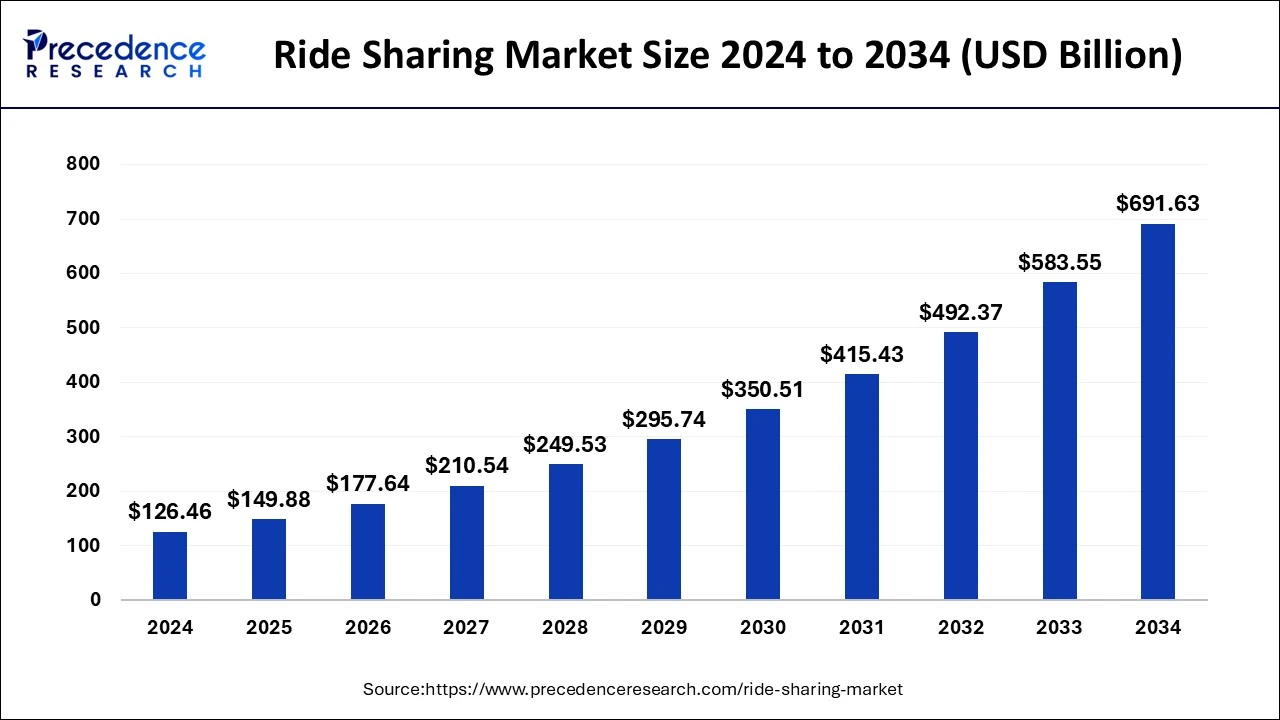

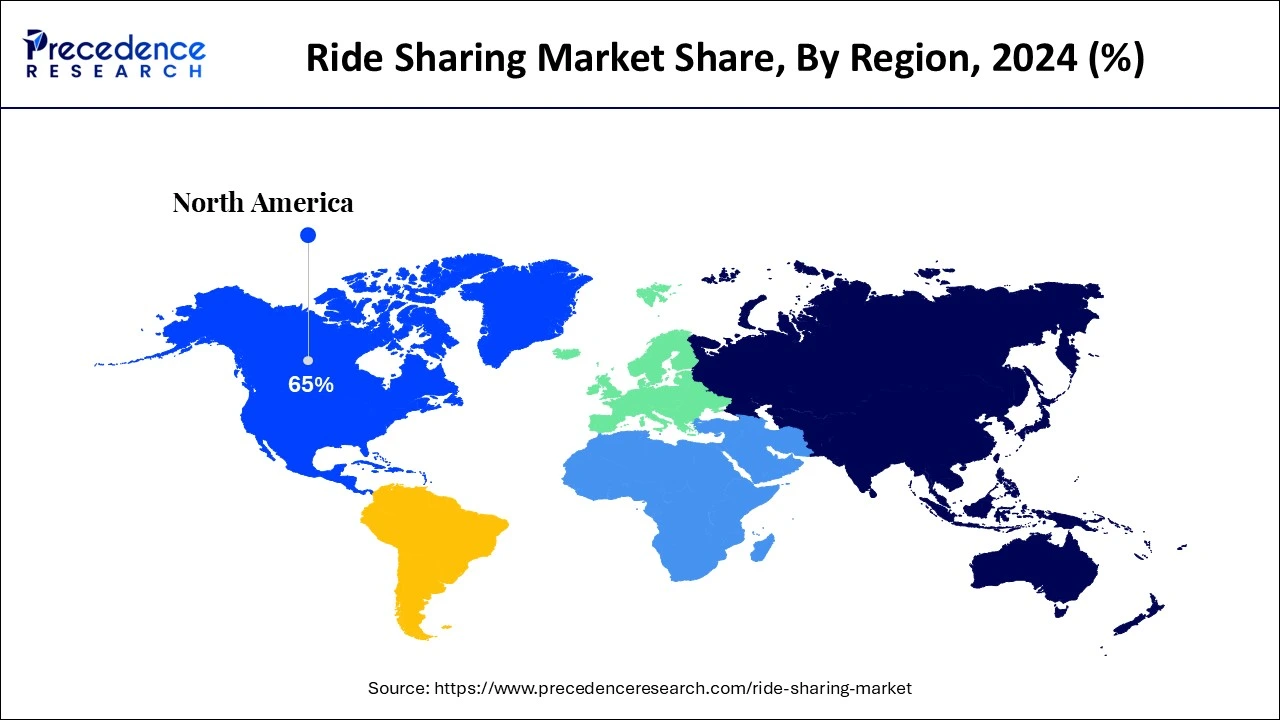

The global ride sharing market size is calculated at USD 149.88 billion in 2025 and is forecasted to reach around USD 691.63 billion by 2034, accelerating at a CAGR of 18.52% from 2025 to 2034. The North America market size surpassed USD 82.20 billion in 2024 and is expanding at a CAGR of 18.61% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ride sharing market size accounted for USD 126.46 billion in 2024 and is expected to exceed around USD 691.63 billion by 2034, growing at a CAGR of 18.52% from 2025 to 2034.

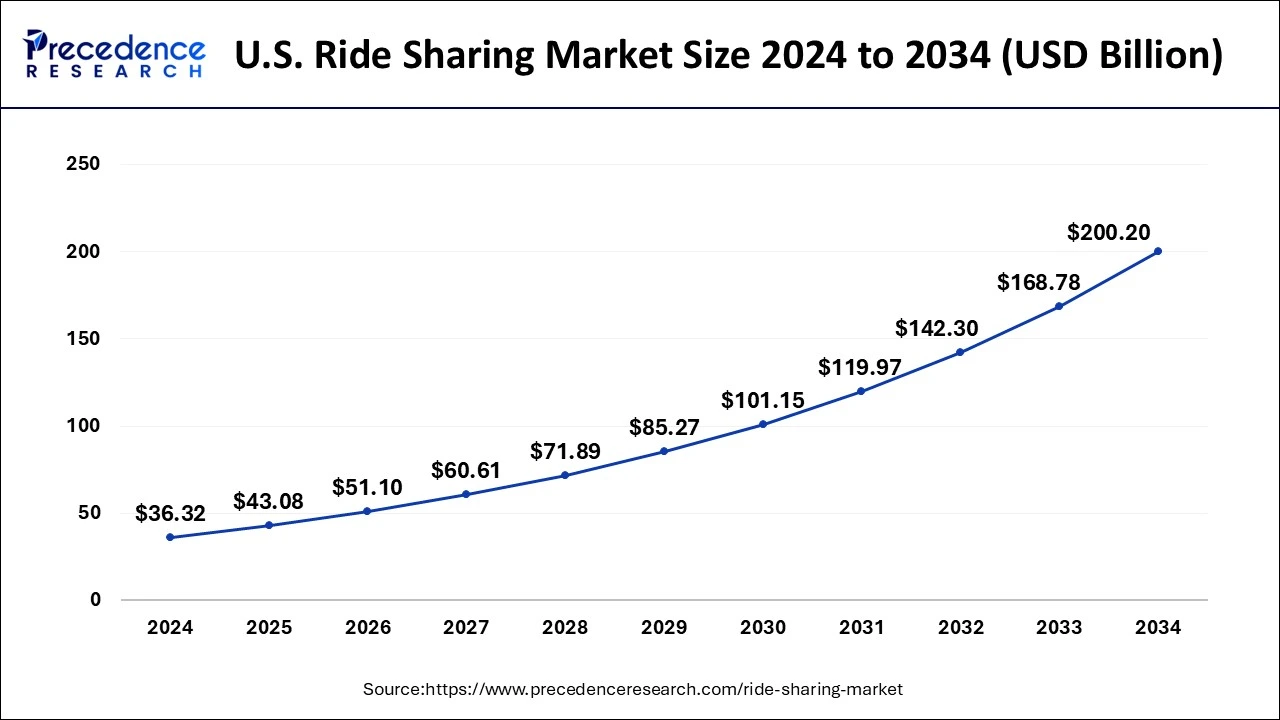

The U.S. ride sharing market size was was exhibited at USD 36.32 billion in 2024 and is projected to be worth around USD 200.20 billion by 2034, growing at a CAGR of 18.65% from 2025 to 2034.

North America is the major revenue share holder in the global ride sharing market because of technology advancement in the region as well as a leading innovator across the world. Further, the region being an early adopter to new technologies promotes the entrance of new market players, this in turn triggers the competition in the region. In addition, the government of United States favors ride sharing in order to reduce the traffic congestion as well as to control the rapidly rising air pollution in the country. Based on the data released by the Environmental Assessment Agency, the United States is the second highest CO2 emitting country after China. Hence, the risk for increasing pollution is much higher in the country, thus government supports the ride sharing mobility trend in order to reduce the traffic on road and in turn the rate of CO2 emissions from the passenger vehicles.

As a result of promoting ride sharing, New York government has replaced 13,000 taxis to 3,000 ride sharing cars. This concludes, that the United States is significantly supporting ride sharing trend in the modern mobility except few cities such as Florida, Texas, Pennsylvania, and a few other cities where bill to legalize ride sharing failed to pass. The demand for ride sharing expected to rise in the region owing to initiatives taken by the both the government as well as the market vendors in order to strengthen their presence in the booming market.

Rising demand for time-saving and cost-saving trend in the mobility drives the market growth for ride sharing in the coming years. Further, the increasing cost of vehicle ownership along with rising concern for environmental protection is the other major factors that proliferates the market pace. In support to the environmental protection, governments of various regions have mandated the adoption of ride sharing in the country.

Meanwhile, startups in the ride sharing market believe that smartphones along with digital networks are likely to further prosper the market growth of ride sharing in the coming years. Increasing popularity of smartphones and digital networks favors the development of application for booking carpools and other ride sharing services and thus promotes the market growth.

Other than this, increasing commutation time owing to high traffic congestion is the other significant factor that favors the adoption of ride sharing mobility trend across various regions. For instance, average commutation time in Los Angeles is 53.68 minutes. The ride sharing trend is being most popular in highly populated regions such as North America, Europe, and Asia Pacific. French startup, BlaBlaCar has already reached to 40 million members across the globe. In United Kingdom, people more than 500,000 uses Liftshare.

| Report Highlights | Details |

| Market Size in 2025 | USD 149.88 Billion |

| Market Size by 2034 | USD 691.63 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 18.52% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Vehicle Type, Membership Type |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

By service type, e-hailing anticipated to grow as the largest revenue contributor during the analysis timeframe owing to increasing demand for e-hailing services because of increasing traffic congestion, ease of booking, and higher level of comfort to the passengers. In addition, increasing government initiatives to create awareness among public regarding the rapid rise in the air pollution propels the demand for e-hailing market. Further, several e-hailing providers are entering in the established ride sharing market in order to expand their offerings. For instance, DIDI, a China-based ride-hailing service provider has relaunched its carpool service to stay competitive in the global market.

Based on membership type, the market is segmented into fixed ridesharing, corporate ridesharing and dynamic ridesharing.

The corporate ride sharing segment is expected to be the fastest growing segment during the forthcoming years because of rising subscription from multinational companies to avail the ride sharing services for the commutation of their employees. Increasing industrialization and shifting of information technology company’s bases to the Asia Pacific region likely to accelerate the market pace for the adoption of ride sharing services in the region. In addition, the corporate ride sharing services offer lucrative opportunity for the market vendor to proliferate in the coming years.

Segments Covered in the Report

By Service Type

By Membership Type

By Vehicle Type

By Regional Outlook

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client