October 2024

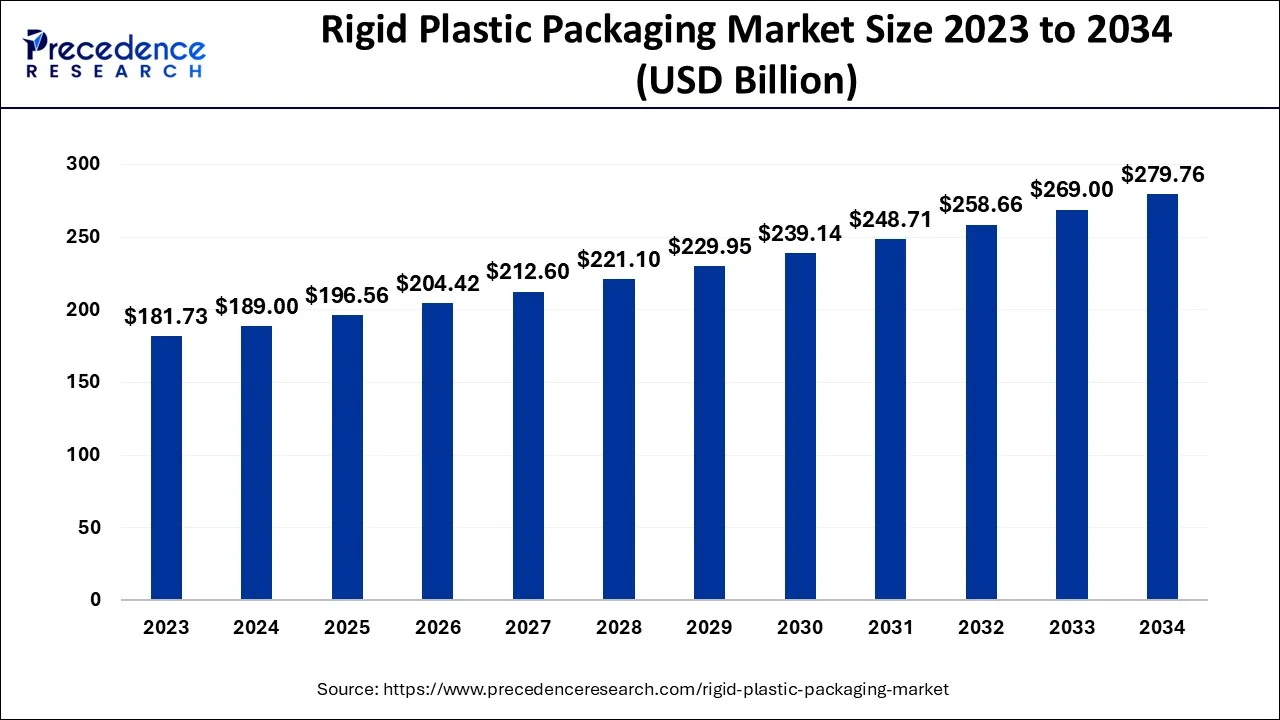

The global rigid plastic packaging market size accounted for USD 189.00 billion in 2024, grew to USD 196.56 billion in 2025 and is predicted to surpass around USD 279.76 billion by 2034, representing a healthy CAGR of 4% between 2024 and 2034.

The global rigid plastic packaging market size is estimated at USD 189.00 billion in 2024 and is anticipated to reach around USD 279.76 billion by 2034, expanding at a CAGR of 4% from 2024 to 2034.

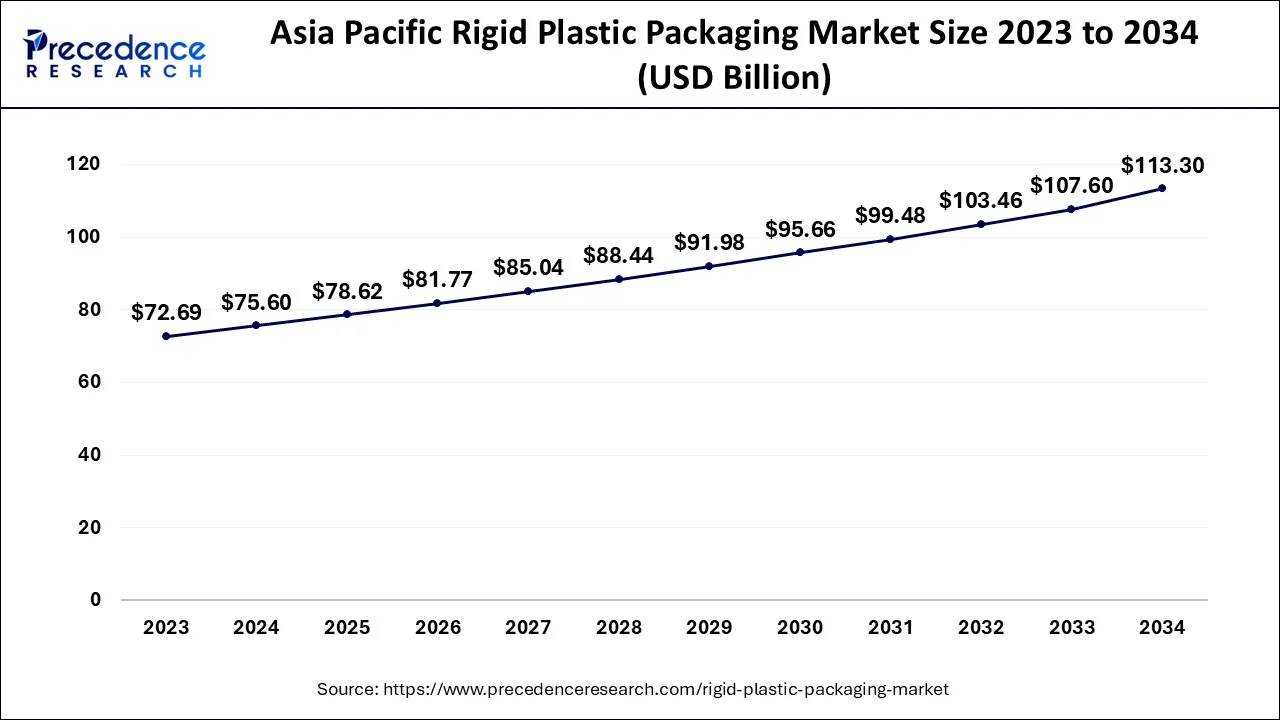

The Asia Pacific rigid plastic packaging market size is evaluated at USD 75.60 billion in 2024 and is predicted to be worth around USD 113.30 billion by 2034, rising at a CAGR of 4.12% from 2024 to 2034.

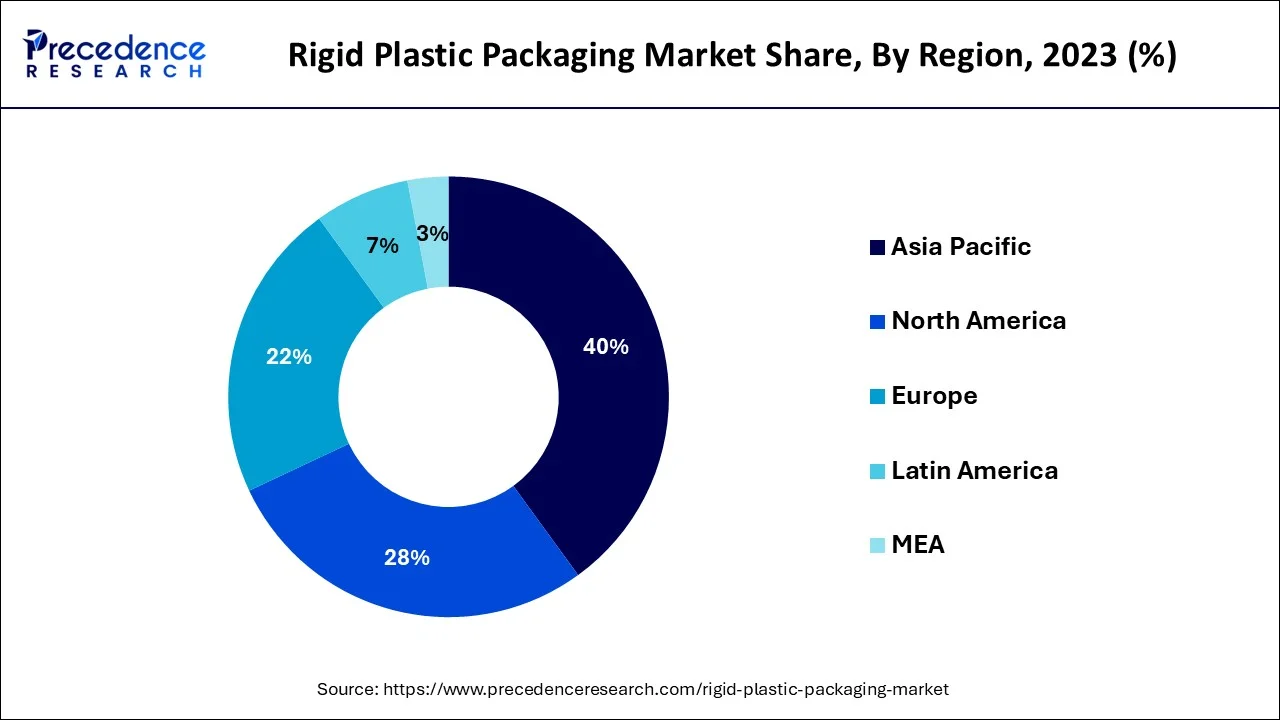

In 2023, the Asia Pacific area held the greatest share, and it is anticipated that it would continue to hold that position during the projection period. The rigid plastic packaging industry is predicted to grow rapidly in nations like China and India due to their expanding economies and expanding economic activity. In addition, these nations' expanding populations provide a sizable market for FMCG goods and consumer durables, which is anticipated to fuel the expansion of the rigid plastic packaging industry.

The market for rigid plastic packaging has expanded due to important reasons such industrialization, the expansion of the convenience food business, expanding manufacturing activities, rising disposable income, rising consumption levels, and rising e-retail sales during the past several years.

For the packaging of new bottles and containers, rigid plastic packaging uses plastic materials including polypropylene (PP), high-density polyethylene (HDPE), and polyethylene (PET). These materials are lightweight and enduring. Packaging made of polyethylene and polypropylene may be used in a variety of sectors, including food and beverage, agricultural, aerospace, automotive, and medical. The food and beverage industry's explosive growth is a significant factor in the rigid plastic packaging market's rise since it increases demand for bottles, fruit jars, juice containers, food packaging containers, and gastronomic bags. For instance, by 2021, the U.S. hotel market has grown to almost $154.34 billion. Increased demand for electronics switches, containers, and bicycle wheels is further boosting the growth of the global market for rigid plastic packaging. Additionally, market expansion is predicted to be fueled by the expansion of the automotive sector. For instance, Trading Economics predicts that from 2021 to 2023, Mexico's automobile output would increase at a pace of 43.12%. Due to the increased need for plastic packaging systems, rigid plastic packaging solutions are also employed in a variety of industrial verticals, including agriculture, medicine, personal care, and pharmaceuticals.

However, it is projected that strict government restrictions on the use of plastic and fluctuations in the price of raw materials would impede the expansion of the world market for rigid plastic packaging. On the other hand, it is predicted that the increase in e-commerce sales would create profitable chances for the market's expansion.

The growing need for rigid plastic packaging is a result of the expansion of the food and beverage, healthcare, personal care, and other sectors on a global scale. In these businesses, rigid plastic packaging offers qualities including sturdiness, low weight, and flexible packaging. Several processes, including extrusion, injection molding, blow molding, thermoforming, and others are used to create these packing components. To keep the products, secure for a longer period of time, stiff plastic packaging produced from materials like polyethylene, expanded polystyrene, and others is used. Additionally, one of the key factors fueling the expansion of the rigid plastic packaging market is the increase in packaged goods sales, which is a result of changing lifestyles.

| Report Coverage | Details |

| Market Size in 2024 | USD 189 Billion |

| Market Size by 2034 | USD 279.76 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 4% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, Production Process, Material, End User, and Geography |

Surging Demand for Rigid Plastic Packaging in Cosmetics & Personal Care

Use of fiber-based material for packaging

In terms of value, the bottles and jars category accounted for the biggest market share in the rigid plastic packaging industry in 2023, and it is anticipated to expand at the second-highest CAGR over the forecast period. Water, juice, carbonated soft drinks, cosmetics, food, personal care, and pharmaceutical goods are just a few of the things that are packaged in rigid plastic bottles. These bottles and jars are mostly constructed out of PET, PE, PP, HDPE, PS, and PVC. The expanding retail sector in addition to customers' rising disposable money. The market is expanding due to the increased demand for drinks and home care goods as well as the growing urbanization and population.

During the anticipated period, the extrusion segment is anticipated to dominate the rigid plastic packaging market. The method allows for the creation of components and products with a range of straightforward to extremely complicated continuous cross-sections by accommodating a wide range of die profiles. The extruded rolling stock doesn't need to cure before thermoforming. The overall materials and waste costs for an extrusion operation are cheaper than those of other molding processes because thermoplastics—which may repeatedly go through the melting, moulding, and hardening operations—are frequently used in extrusion processes.

In 2023, the rigid plastic packaging market's greatest share belonged to the polypropylene (PP) material category. In comparison to other plastic materials like polystyrene (PS), polyethylene terephthalate (PET), and others, polypropylene offers superior barrier qualities, improved surface polish, cheap cost, and high tensile strength.

These features make polypropylene an ideal material for a range of packaging applications. Some of the expanding uses for polypropylene include medicine bottles, ketchup and syrup containers, and bottle caps and closures. The market for rigid plastic packaging will thus continue to increase over the projected period as a result of the rising demand for the polypropylene (PP) material.

The market for rigid plastic packaging was dominated by the food and beverage sector in 2022, and it is anticipated to expand at a CAGR of 5.35% from 2024 to 2034. The stiff plastic packaging gives the containers qualities like taste absorption, durability, lifespan, and low weight. Bottles, cans, jars, and other rigid plastic packing containers keep the food item secure and free from contamination. In developing nations including the United States, Canada, China, India, and other nations, the need for rigid plastic packaging is rising quickly. The need for rigid plastic packaging is rising as the food and beverage sector expands.

By Type

By Production Process

By Material

By End User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

August 2024

November 2024

January 2025