October 2024

Risk Analytics Market (By Component: Solution; By Deployment: On-premises, Cloud; By Enterprise: Large enterprises, Small and medium-sized enterprises; By Risk Type Application: Financial Risk, Strategic Risk, Operational Risk, Others; By End-User: Banking and Financial Services, Insurance, Manufacturing, Transportation and Logistics, Retail and Consumer Goods, IT and Telecom, Government and Defense, Others) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2024-2034

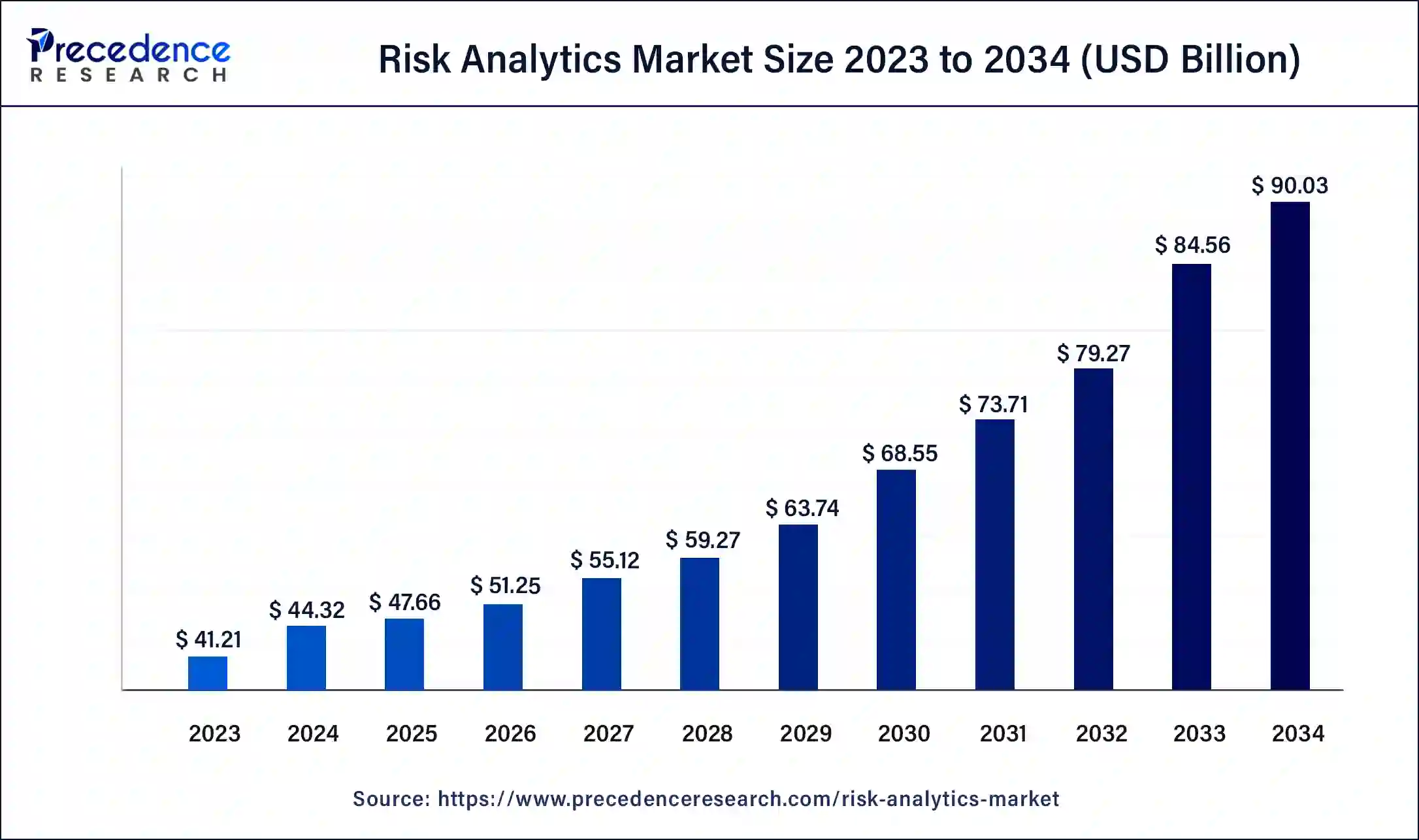

The global risk analytics market size was USD 41.21 billion in 2023, calculated at USD 44.32 billion in 2024, and is expected to reach around USD 90.03 billion by 2034, expanding at a CAGR of 6.7% from 2024 to 2034.

Risk analytics is a tool for analyzing and measuring risk actively. Risk analytics uses statistical methods and data analytics to measure, identify the risk, and manage it systematically and accurately. It collects data insights and analyzes the potential risks and potential effects. Several organizations use this information to make informed decisions, handle risks, and optimize risk management strategies. Risk analytics used in risk identification and assessment like risk analytics helps to find out the potential risks and problems within the organization and projects.

It supports the decision-making process by providing valuable insights. These evaluate the potential risks scenario. Also, risk analytics is helpful for the organization to allocate its resources effectively. Risk analytics allows organizations to develop robust risk-management capabilities.

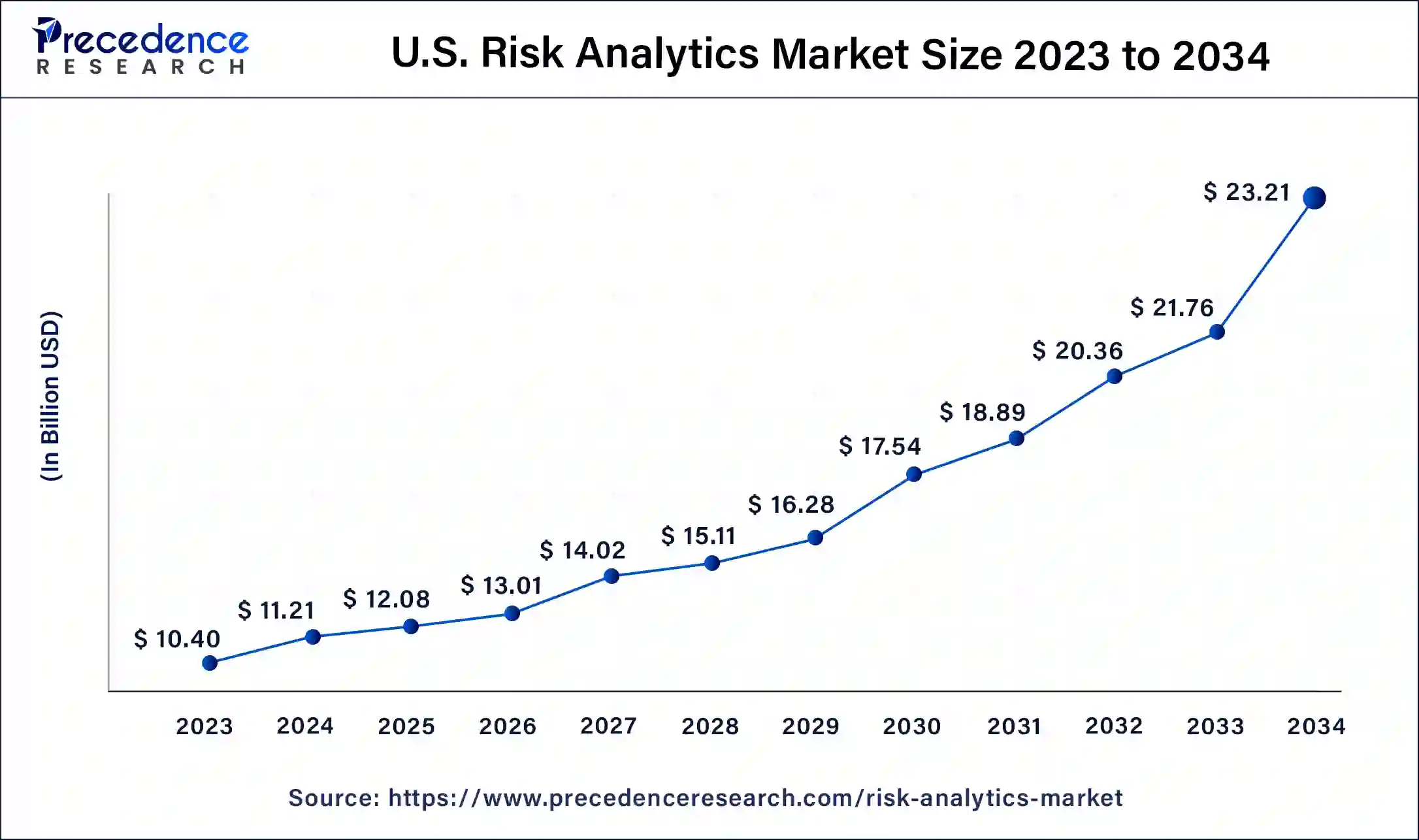

The U.S. risk analytics market size was valued at USD 41.21 billion in 2023 and is estimated to reach around USD 90.03 billion by 2034, growing at a CAGR of 6.7% from 2024 to 2034.

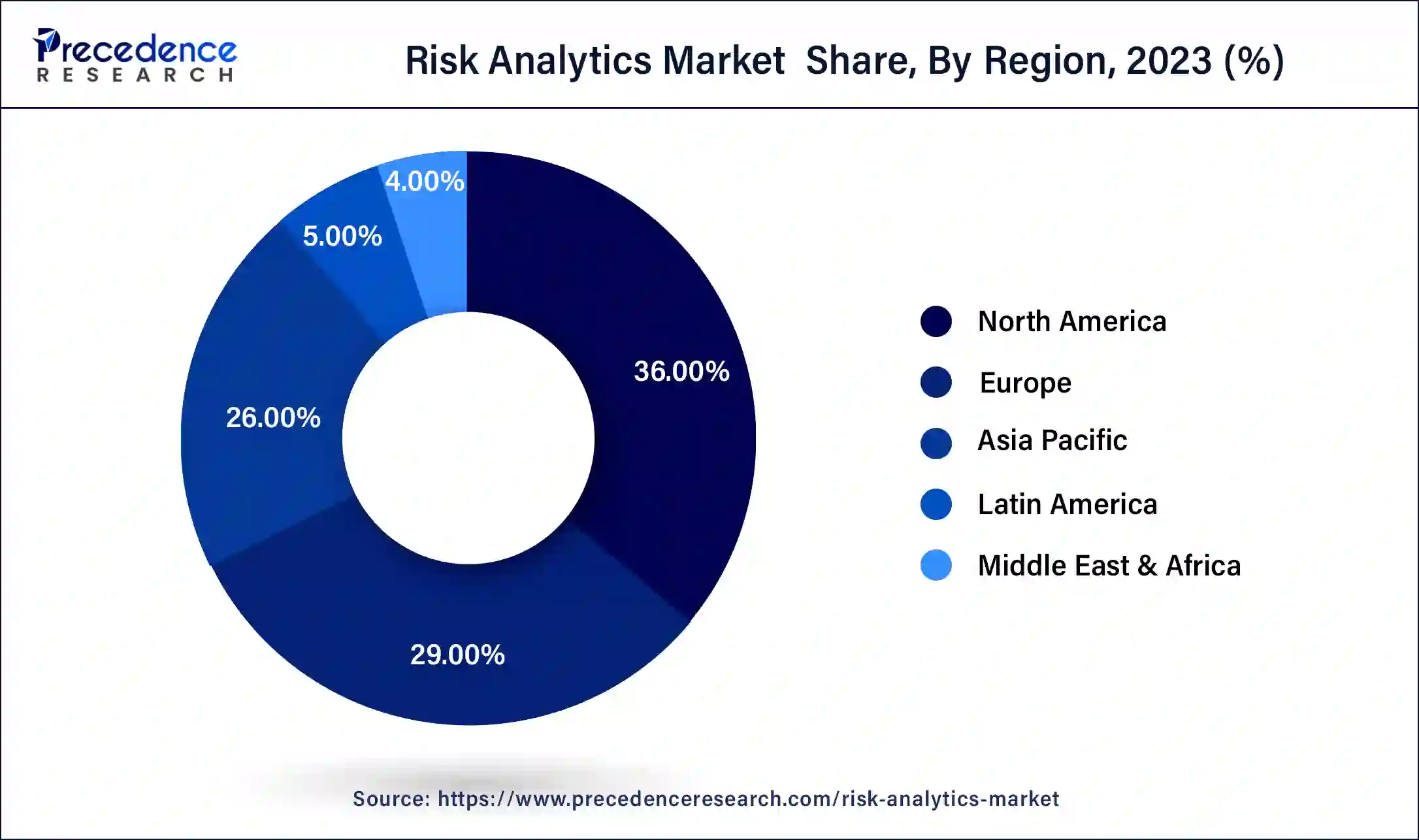

North America dominated the global risk analytics market in 2023; the region is expected to sustain the growth rate throughout the forecast period. The dominance of the region can be attributed to the rate of industrialization that requires advanced risk analytics software. Moreover, the penetration of major industries in the market, including IT, banking and other financial sectors promotes the expansion of the risk analytics market in North America. The United States and Canada are observed to be major contributors to the market in North America.

Additionally, multiple banks and financial companies in the region are actively adopting advanced solutions such as artificial intelligence and machine learning for detecting errors and malicious activities. Such expansion of end-users is observed to propel the market’s growth in North America.

On the other hand, Asia Pacific is expected to witness the fastest rate of growth in the risk analytics market during the forecast period. Rising cases of cybercrime and substantial requirements for cyber security in the region are major factors to accelerate the market’s growth in Asia Pacific. Asian countries are witnessing significant penetration of internet services in multiple industries, this is expected to boost the requirement for risk analytics software and services.

Risk analytics tools are responsible for overcoming cyber threats and they measure and predict the risk more precisely. Organizations now improve their performance using increased computing capabilities, big data, and advanced analytics. Risk analytics is used for several applications for organizations. Rising cases of cyber-attacks, and data enforcement in the organization are driving the growth of the risk analytics market.

There are several industries that are adopting risk analytics tools for risk management, industries such as the banking and financial sector, manufacturing, healthcare, IT and telecommunication, etc. are driving the growth of the risk analytics market. The primary point of risk analysis is identifying the problematic area of the business. One of the major factors of risk analytics is to identify and better understand how risk will financially hamper the business. Rising demand from the organization for better risk management of the company is driving the growth of the risk analytics market.

| Report Coverage | Details |

| Market Size by 2034 | USD 90.03 Billion |

| Market Size in 2023 | USD 41.21 Billion |

| Market Size in 2024 | USD 44.32 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 6.7% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Component, Deployment, Enterprise, Risk Type Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Driver

Rising risk on cyber attacks

High-profile cyberattacks and data breaches have raised public awareness of cyber risks. As a result, organizations are under more scrutiny and pressure to protect customer data, making risk analytics more critical. Many organizations rely on third-party vendors and service providers, which can introduce additional cyber risk. Risk analytics can be used to assess and manage third-party cyber risk to protect the organization's ecosystem. Risk analytics can help organizations allocate resources more effectively by identifying high-priority vulnerabilities and areas of concern. This ensures that security efforts are focused on the most critical areas.

Restraints

Regularity compliance

Regulatory compliance often involves complex and frequently changing rules and regulations. Financial institutions and other organizations must stay up-to-date with these regulations to ensure they are in compliance. This can make it challenging for them to implement risk analytics solutions that are flexible enough to adapt to changing requirements. Regulatory compliance often requires organizations to maintain detailed records and documentation to demonstrate that they are following the rules.

Opportunity

Advancements in risk analytics methods

As businesses collect and process more data for risk analytics, there is a growing need for advanced methods to ensure data security and privacy. Vendors that can offer robust solutions for data protection will find increased demand in the market. Many industries are subject to stringent regulatory requirements.

Advanced risk analytics methods can help organizations stay in compliance with these regulations and demonstrate their commitment to effective risk management, reducing the risk of legal and financial penalties. Improved risk analytics methods can help businesses streamline their risk management processes and reduce costs associated with risk mitigation and compliance. This is particularly important for financial institutions and industries with heavy regulatory requirements.

The software segment dominated the risk analytics market in 2023. Risk analytics software uses the technology for the management and organizational dynamics and problems. Risk analytics software is used by several industries like banking and finance, manufacturing, IT and telecommunication, etc. Risk analytics software is used for several operations in organizations such as risk identification and assessment, decision-making processes, increasing risk management strategies, and other organizational operations.

The on-premise segment dominated the risk analytics market in 2023. In industries where data security and compliance with regulatory requirements are critical, on-premise deployments may still be preferred. Some organizations, especially in highly regulated sectors like finance and healthcare, may choose to keep their risk analytics solutions on-premises to maintain greater control over data and ensure compliance with data protection regulations. On-premise solutions often offer more flexibility for customization and integration with existing infrastructure. This is important for businesses that have complex IT ecosystems and want to tailor their risk analytics tools to specific needs.

The cloud-based segment is anticipated to witness the quickest growth during the forecast period. Cloud providers handle updates, patches, and maintenance, reducing the burden on internal IT teams and ensuring that risk analytics software is up to date. Cloud-based risk analytics solutions can be easier and quicker to adopt compared to on-premises solutions, making them attractive to businesses looking for rapid deployment.

The large enterprise dominated the risk analytics market in 2023; the segment will continue the trend throughout the forecast period. The rapid adoption of risk analytics tools or software in large-scale enterprises is due to the substantial requirement for risk management tools to resolve major issues. Risk management tools are responsible for improving and monitoring the operations of a large-scale organization.

Risk analytics plays an important role in large enterprises, it helps several industries like the financial sector, insurance industry, supply chain management, healthcare, and cybersecurity. Large enterprises often face issues with data security and data storage; risk analytics tools and software are helpful in managing such concerns with ease. Thereby, these factors are observed to propel the segment’s growth in the upcoming years.

The small and medium-scale enterprises segment is expected to witness a significant rate of growth in the risk analytics market during the forecast period. Risk analytics is able to provide a risk measurement tool in small and medium-scale organizations for assessing and management of the existing issues in the enterprises and predicting upcoming issues in the operation by analyzing the existing work process and operation of the business. Small and medium-scale enterprises are likely to be harmed by threats like financial loss, budgeting, and market risks. Risk analytic software is used to help the SMEs to overcome these kinds of risks.

The financial risk segment dominated the market in 2023. Financial risk is one of the major concerns in organizational risk management. Financial risk management is the process of evaluation of potential risk and its possible impacts. It evaluates the degree of potential risk. For example, credit risk is one of the most common types of financial risk with the possibility of debtor not fulfilling their obligations. With that predictability, banks or financial institutions take precautionary steps to prevent this and to minimize the impacts as much as possible. Also in multiple organizations, internal factors are also observed to impact the organizational financial activity. Risk analytics services and solutions are widely adopted to resolve poor financial management in an organization.

The operational risk segment is expected to grow at a significant rate during the forecast period. Operational risk is directly associated with the financial loss of the company. Operational risk refers to the risk in process management and operating organizational operations at the time of planning, training, and enforcing policies. Risk analytics works in the operational risk by reducing risk from the linear process of risk assessment, identification, mitigation, measurement, reporting, and monitoring.

The banking, financial services, and insurance (BFSI) segment dominated the market in 2023; the segment is observed to continue the trend throughout the forecast period. The banking and financial sectors are some of the major platforms where risk analytics is highly used due to their complex operations and financial security issues. There is major three areas of risk in the banking and finance industry that is credit, market, and operational risk. Risk analytics allow the banks to create certain policies in several areas. Security and data breaches are the major concern of the banking and financial sector. Risk analytics is designed to prevent this kind of issue and malicious behavior. The development of artificial intelligence is also impacting the growth of risk analytics in the BFSI segment for the global risk analytics market.

The manufacturing industry segment is expected to witness a notable rate of growth during the forecast period in the global risk analytics market. Manufacturing companies generate vast amounts of data from their processes, equipment, and supply chains. Risk analytics allows them to harness this data to make informed decisions and identify potential risks. This data-driven approach can help in predicting and preventing disruptions. The manufacturing sector relies heavily on complex supply chains. Risk analytics can help in monitoring and mitigating risks associated with supply chain disruptions, such as natural disasters, geopolitical issues, or supplier-related problems. This optimization is crucial to maintaining operational efficiency.

Segments Covered in the Report

By Component

By Deployment

By Enterprise

By Risk Type Application

By End-User

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

October 2024

April 2025

August 2024