September 2024

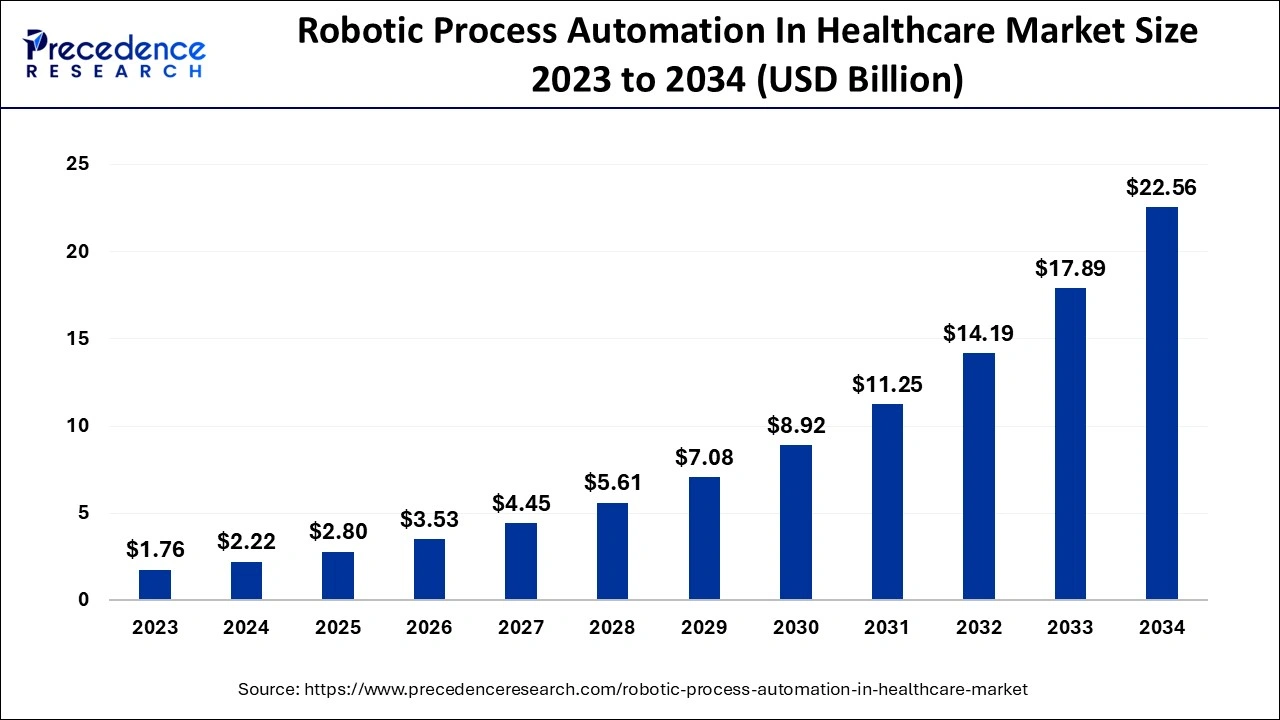

The global robotic process automation in healthcare market size accounted for USD 2.22 billion in 2024, grew to USD 2.80 billion in 2025 and is projected to surpass around USD 22.56 billion by 2034, representing a healthy CAGR of 26.10% between 2024 and 2034. The North America ABC market size is calculated at USD 950 million in 2024 and is expected to grow at a fastest CAGR of 26.18% during the forecast year.

The global robotic process automation in healthcare market size is estimated at USD 2.22 billion in 2024 and is anticipated to reach around USD 22.56 billion by 2034, expanding at a CAGR of 26.10% between 2024 and 2034.

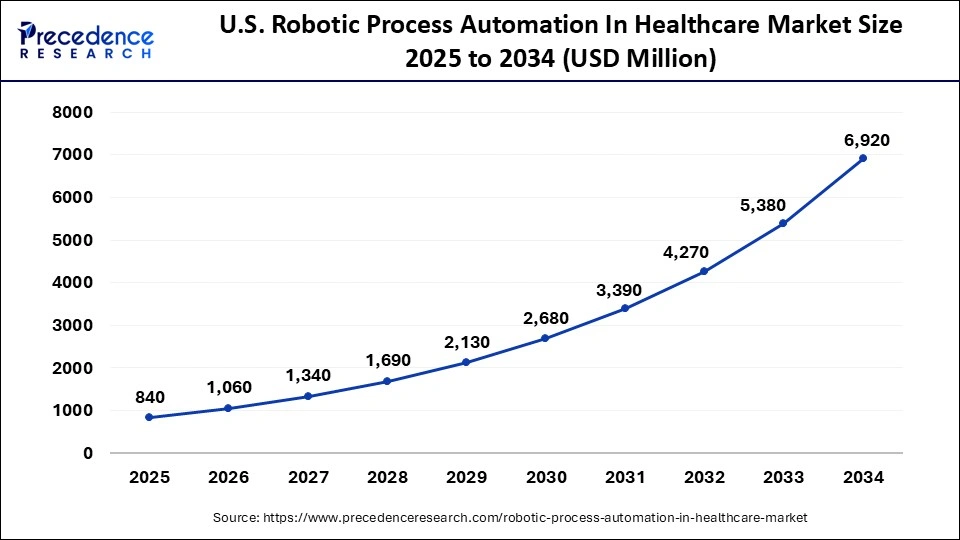

The U.S. robotic process automation in healthcare market size accouted for USD 0.67 billion in 2024 and is expected to be worth around USD 6.92 billion by 2034, growing at a CAGR of 26.31% between 2024 and 2034.

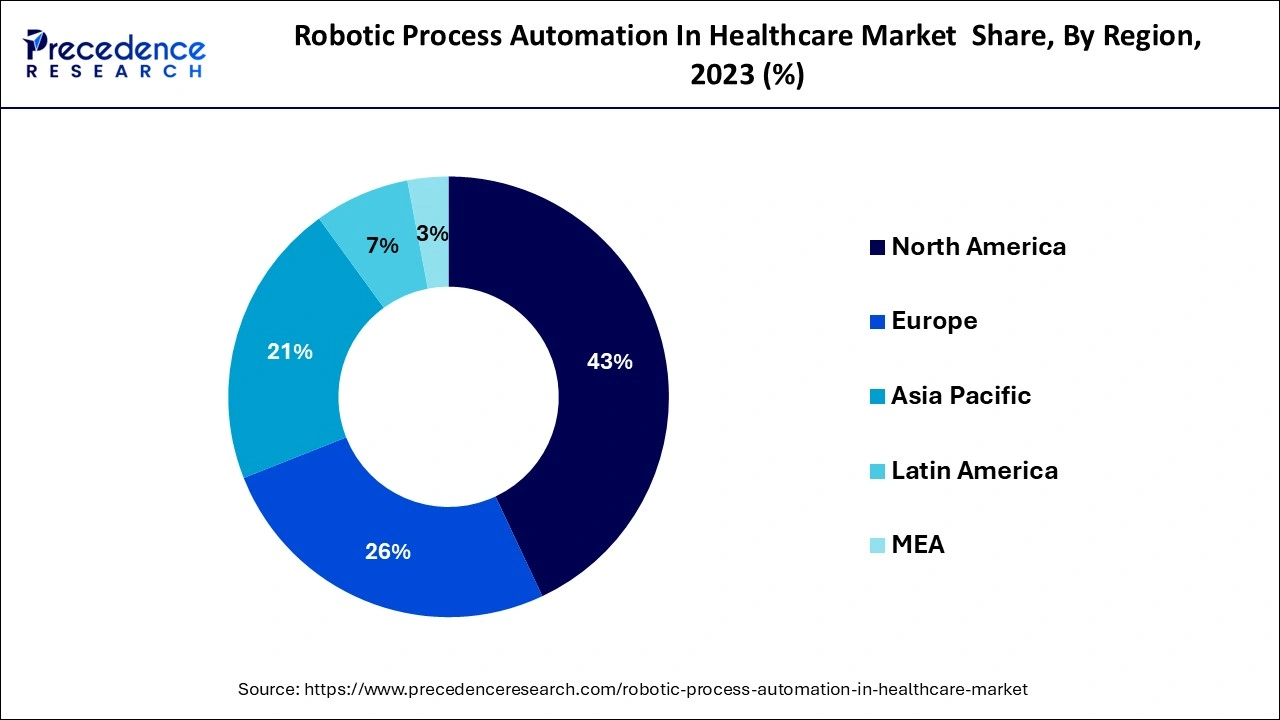

Due to the growing implementation of sophisticated, self-regulatory technologies like AI and machine learning, North America is anticipated to have the biggest market share in the worldwide robotic process automation in the healthcare market throughout the course of the projected period. In order to motivate private healthcare companies to implement automated solutions for efficient workflow, the US government is sponsoring and running initiatives.

For instance, the US government implemented new RPA initiatives that resulted in the creation of 1,000 robotic automation solutions and the release of 1.5 million hours of capacity. The growing use of automation software, procedures, and solutions by businesses and government organizations in this area support market expansion. In order to better serve American citizens, the US Federal government allotted a budget in March 2019 that supports the deployment of RPA and AI.

Robotic process automation (RPA) is a type of automation that makes use of software to do backend tasks that would often be performed by humans, including completing forms, extracting data, and transferring files. To connect and perform monotonous operations across corporate and productivity apps, it mixes APIs as well as user interface interactions. RPA solutions use scripts that simulate human operations to execute a variety of jobs, activities, and transactions through not linked software platforms.

RPA frequently automates decisions on the basis of pre-established rules and circumstances using a business rules solution. Additionally, it automates processes using logic and structured data. RPA has the characteristics to manage unstructured data, but only when a bot gathers the data and converts it to structured data using techniques like character recognition as well as natural language processing. Intelligent automation often referred to as cognitive automation, is made when an RPA system and AI are coupled. This type of automation typically employs bots in an effort to closely match human skills and activities. In the healthcare industry, there are a lot of delicate client interactions as well as time-consuming, boring labor and administrative responsibilities that don't require specialized expertise. RPA may automate tasks for the whole company, from front-end office duties to operational procedures to patient involvement and bill collection.

The worldwide pandemic has had an effect on business operations both inside and outside. Healthcare facilities were being overburdened by the increased number of Covid-19 cases, while business was falling in the retail, manufacturing, and IT & Telecom industries. Both the front-end and back-end office operations were impacted by this rare occurrence, which resulted in things like extended response times, worker fatigue, a backlog of documents, and disruptions in the distribution network, among other things. An automated solution must be used in order to save costs, expedite customer service, and make testing and reporting easier. Additionally, COVID-19 has increased the demand for a digital workplace across industries, opening up additional opportunities for RPA suppliers to gain market share. After the pandemic, employment will likely be determined by automation as businesses go through structural changes and more people work from home. The benefits of using RPA during a recession brought on by a pandemic are anticipated to boost demand for the technology following the epidemic and propel market expansion.

The handling of claims and patient scheduling are only two examples of the numerous taxing activities and tight restrictions that healthcare systems involve. This causes inefficiencies, expensive operating expenses, and sluggish procedures. Healthcare practitioners may solve these problems, speed up healthcare operations, increase patient satisfaction overall, and make healthcare systems more efficient by utilizing automation and RPA. Treatment providers may avoid expensive, time-consuming digital transformation implementation projects with automation and quick implementation projects, made possible by RPA and intelligent automation. This allows them to focus more resources on providing healthcare. The market is expanding as a result of all these factors.

| Report Coverage | Details |

| Market Size in 2024 | USD 2.22 Billion |

| Market Size by 2034 | USD 22.56 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 26.1% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered |

|

| Regions Covered |

|

Robotic process automation is becoming more prevalent in healthcare

RPA in healthcare industry to grow, driven by AI, algorithms, and cloud adoption

Growth in innovations in RPA to accommodate changing consumer demands

The increasing need to manage unstructured data

Due to its wide range of applications, the software sector led the worldwide market in 2023, and this trend is anticipated to continue over the coming years. Recently, the Asia Pacific area has emerged as a major worldwide center for this software and services as a result of rising urbanization and technological innovation. Due to rising client awareness, consulting services now represent the bulk of the market value. Organizations in emerging markets are now looking for technological options that are more affordable. Therefore, the most in-demand service category is consulting services that inform firms about robotic process automation.

The second-largest service sector is training stakeholders in the technical skill set needed to properly employ robotic process automation. Organizations are spending more money on training and developing industry 4.0 skill sets to increase employee productivity and, therefore, income. Throughout the projected period, it is anticipated that the training sector will continue to hold the second-largest service segment position.

The market is divided into Rule-based and Knowledge-based segments depending on operations. A new foundation for effective decision-making in the logistics and warehousing sectors is provided by knowledge-based operations. By providing interactive monitoring and hybrid technique-based flow optimization for logistical tasks, it empowers users.

The segment's greatest contribution to the worldwide market in 2022 was clinical documentation, billing, and workflow management, and it is very expected that this trend will persist over the forecast period. At every healthcare company, managing routine workflow encompasses a number of activities, including but not limited to patient care, inventory management, follow-ups, resource use, and much more. It is undoubtedly a time-consuming, error-prone, and ineffective strategy to manage them all manually. By automating these fundamental operations, resources will be used more effectively and attention will be paid to crucial tasks.

In recent years, other applications have developed and grown rapidly in South Asian nations, attracting the attention of several American and European MNCs. Without human participation, the appointment scheduling procedure is made quick and easy by automating it. Customers feel appreciated and significant when they receive timely notifications and are reminded of their appointments. To prevent misunderstanding and inconvenience, any modifications to the timetable caused by the doctor's absence can also be promptly communicated. Consequently, it is expanding quickly within the predicted period.

By Solution

By Operations

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

September 2024

February 2025

November 2024