November 2024

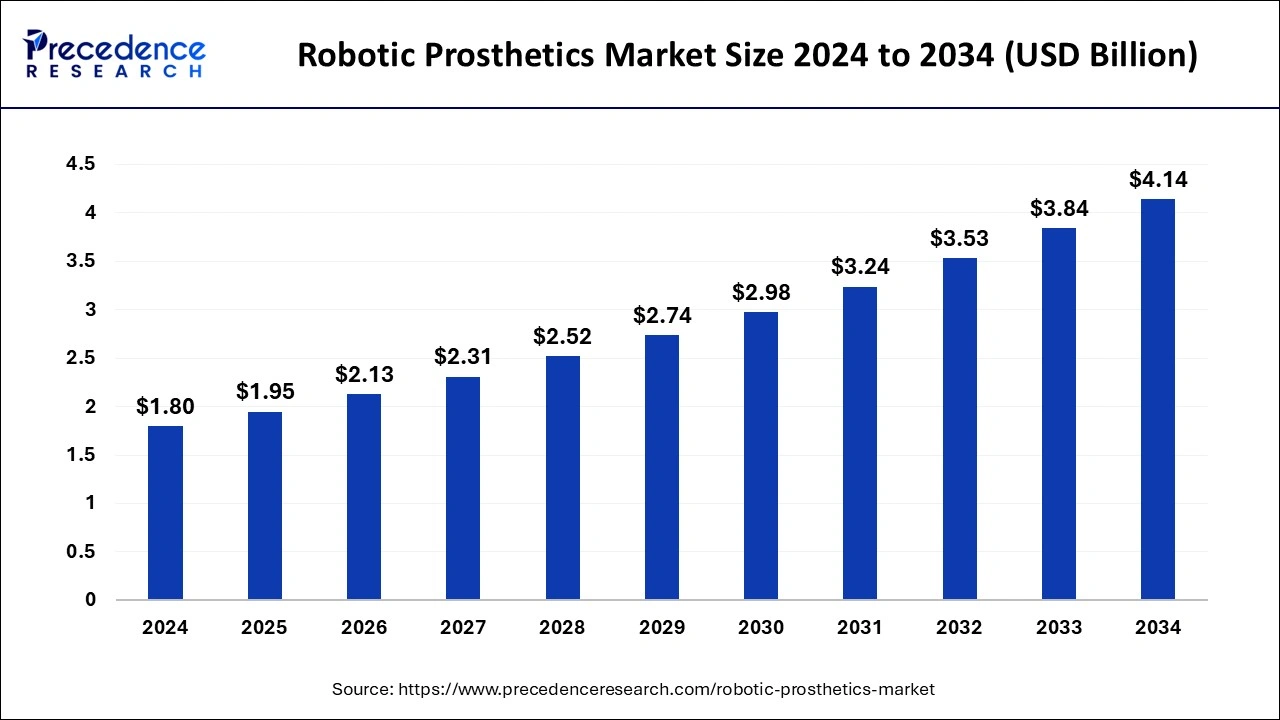

The global robotic prosthetics market size is calculated at USD 1.95 billion in 2025 and is forecasted to reach around USD 4.14 billion by 2034, accelerating at a CAGR of 8.69% from 2025 to 2034. The North America robotic prosthetics market size surpassed USD 810 million in 2024 and is expanding at a CAGR of 8.67% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global robotic prosthetics market size was estimated at USD 1.80 billion in 2024 and is predicted to increase from USD 1.95 billion in 2025 to approximately USD 4.14 billion by 2034, expanding at a CAGR of 8.69% from 2025 to 2034. Rising incidence of traumatic injuries from accidents, etc, can boost the robotic prosthetics market.

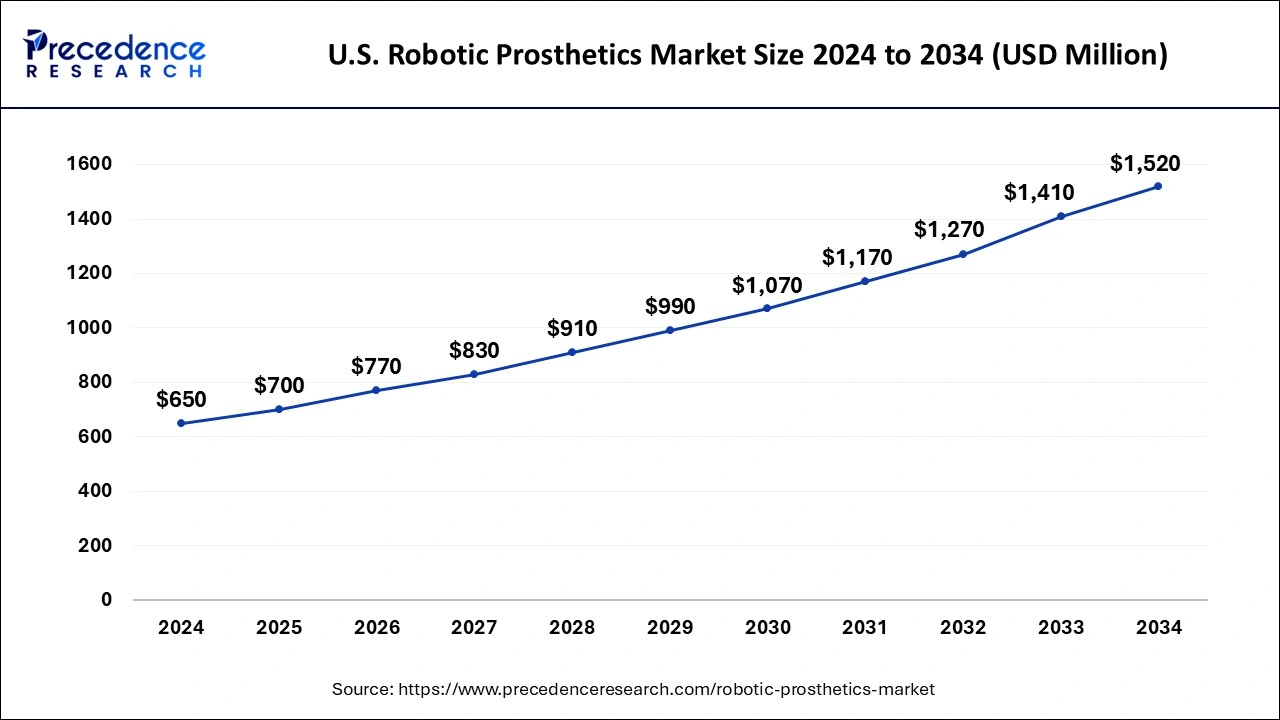

The U.S. robotic prosthetics market size was exhibited at USD 650 million in 2024 and is projected to be worth around USD 1,520 million by 2034, poised to grow at a CAGR of 8.87% from 2025 to 2034.

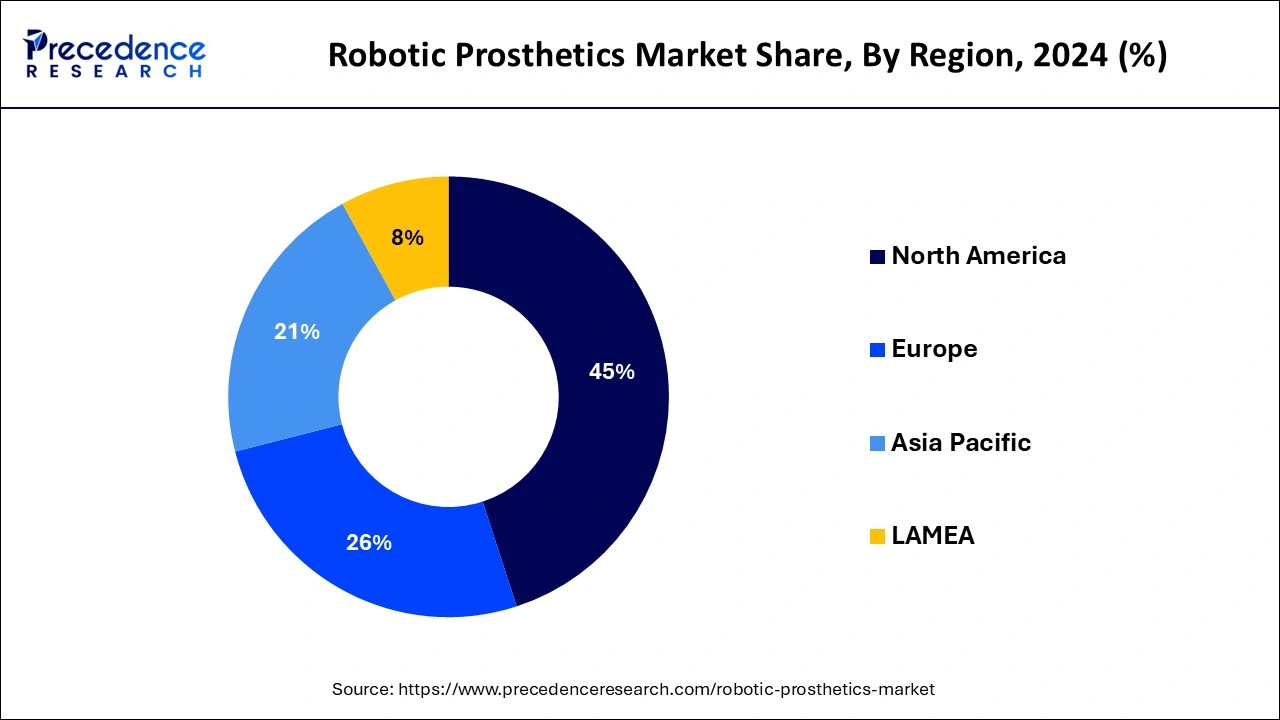

North America dominated the robotic prosthetics market in 2024. The United States and other countries in North America are the centers of technical innovation and advances in prosthetics and medical equipment. The existence of top research centers, academic institutions, and tech firms propels ongoing advancements in robotic prostheses. The area boasts a sophisticated medical infrastructure, a large pool of highly qualified healthcare workers, and cutting-edge medical facilities. The modern prosthetic technology uptake and integration are facilitated by this infrastructure.

The fast growth and commercialization of novel prosthetic technology can be attributed to significant expenditures made in research and development by both the public and private sectors. The innovation is accelerated by funding from industry stakeholders, private investors, and government subsidies.

Asia Pacific is expected to grow at the highest CAGR in the robotic prosthetics market during the forecast period. The advances in medical technology, such as robotic prosthetics, are being driven by increased healthcare expenditures and infrastructure investments in nations like China, India, and Japan. Diabetes, vascular illnesses, and other disorders that cause limb loss have become more common in the area. There is a significant need for prosthetic solutions as a result of this increasing occurrence. The aging population is the result of a demographic transition occurring in several Asia Pacific nations. Due to age-related health problems, older persons are more likely to need prosthetic devices, which is fueling the market's expansion.

The robotic prosthetics market refers to the advanced prosthetic devices called robotic prosthetics, sometimes referred to as bionic limbs or robotic limbs, which are made to imitate the functions of natural human limbs and replace missing limbs. These gadgets use cutting-edge biomechanics, robotics, and artificial intelligence (AI) technologies to improve the dexterity and mobility of people who have lost limbs. Robotic prostheses are a major development in medical technology that provides people who have lost limbs with enhanced functionality and quality of life.

Prosthetic gadgets are predicted to become even more advanced and widely available as technology develops. The robotic prosthetics market is driven by the rising prevalence of chronic illness, the rising prevalence of limb loss, and increasing precision for more accurate joint replacement. The market is fragmented with multiple small-scale and large-scale players, such as Ottobock, Ossur Americas, Touch Bionics Inc., Touch Bionics Limited, HDT Global, SynTouch, Inc., Artificial Limbs & Appliances, and Blatchford Group.

| Report Coverage | Details |

| Market Size by 2034 | USD 4.14 Billion |

| Market Size in 2025 | USD 1.95 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.69% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Extremity, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased precision for more accurate joint replacement

The increased precision for more accurate joint replacement can boost the robotic prosthetics market. The increased joint replacement accuracy may boost the prosthetics industry by enhancing functionality, user pleasure, and clinical results. This will incentivize more people and healthcare providers to use robotic prosthetic systems.

High cost of robotic prosthetics

The high cost of robotic prosthetics may slow down the robotic prosthetics market. Advanced robotic prostheses need expensive materials and technologies, which makes research, development, and production of these devices very expensive. The customers typically find the finished goods to be pricey, and additional expenses like as regular upkeep or replacement parts may increase the entire financial load.

Production of affordable robotic prosthetics

The production of affordable robotic prosthetics can be the opportunity to grow the robotic prosthetics market. The robotic prostheses become more affordable, making them available to a wider range of people, including those who are now unable to purchase high-end prosthetic options. There are more potential users of more reasonably priced solutions since they are more likely to be covered by insurance policies. When expenses are reduced, more people who require prostheses but are discouraged by the existing high cost may accept them.

Government initiatives and non-governmental groups that support people with disabilities are more likely to promote affordable solutions. The demand growth may result in increased manufacturing volumes, which, through economies of scale, may further lower costs.

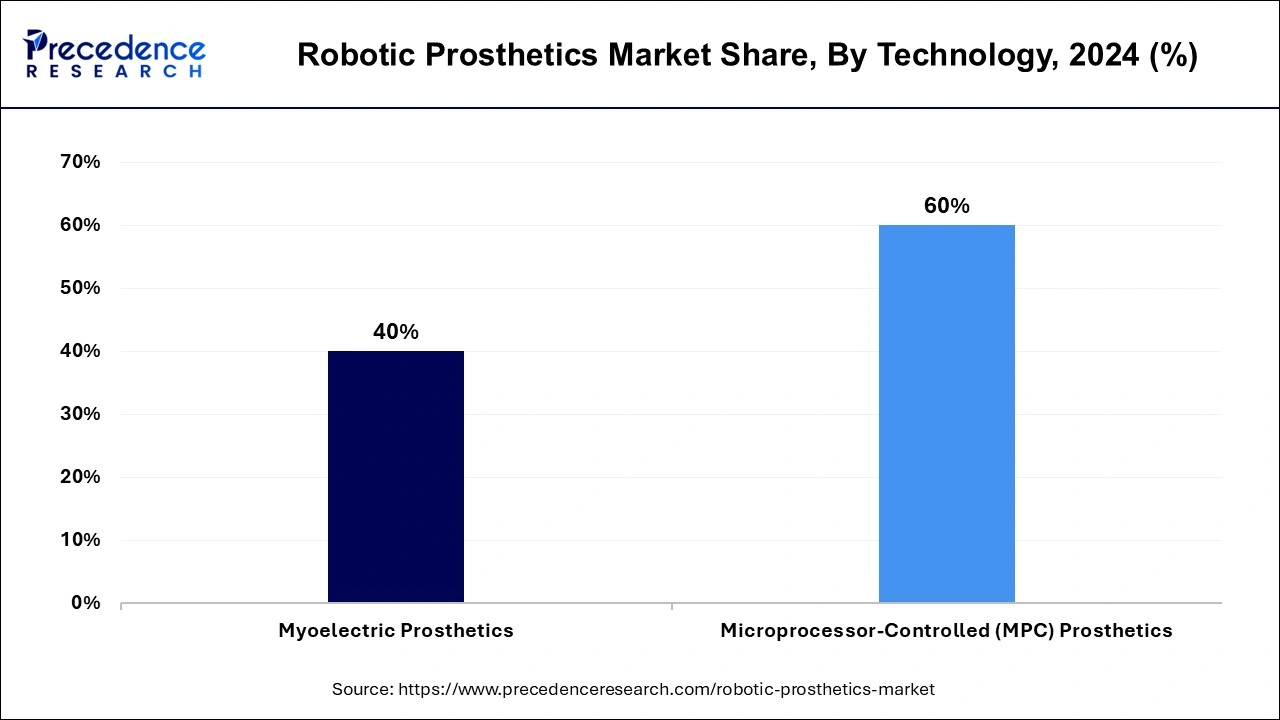

The microprocessor prosthetics segment dominated the robotic prosthetics market in 2024. The microprocessor prostheses use cutting-edge technology to provide more natural mobility and improved activity and terrain adaption. Compared to conventional prostheses, these prosthetics may be adjusted in real time, giving patients more capability and stability.

The microprocessor-controlled prosthesis greatly improves user experience because of their accuracy and responsiveness. These gadgets may adapt to the user's stride and degree of activity automatically, lowering the chance of a fall and boosting confidence and comfort. Users frequently feel more freedom and movement when using microprocessor prostheses. Because these prostheses can adjust to different environments, users may do more tasks that traditional prosthetics would not be able to support as well, such as walking on uneven terrain and climbing stairs.

The myoelectric prosthetics segment is expected to grow at the highest CAGR in the robotic prosthetics market during the forecast period. The myoelectric prostheses provide more natural and accurate control by using electrical impulses from the user's muscles to operate the prosthetic limb. Using this technology instead of a more conventional body-powered prosthesis gives users a more responsive and natural experience.

The innovations in machine learning, artificial intelligence, and sensor technologies have greatly improved the functionality of myoelectric prostheses. These developments increase the prosthetic limbs' precision and responsiveness, increasing user appeal. The myoelectric prostheses allow amputees to do more activities and move about more freely, which significantly improves their quality of life. The users are able to do tasks that call for fine motor abilities, which is especially useful for activities related to everyday life and work.

The lower body prosthetics segment dominated the robotic prosthetics market in 2024. The amputations of the lower limb occur more frequently than those of the upper limb, and they are frequently caused by illnesses including diabetes, peripheral artery disease, and severe trauma. The need for lower body prostheses increases as a result of this increased prevalence. One of the biggest concerns for people who have had lower limb amputations is mobility. Modern lower limb prostheses are in great demand since they greatly increase mobility and freedom, especially robotic ones.

Significant technical advances have been made in lower body prostheses, including bionic legs, powered exoskeletons, and knees and ankles controlled by microprocessors. The prosthetics are becoming more and more popular because of these improvements that increase their comfort and functionality. Compared to earlier versions, modern lower body prostheses offer improved stability, balance, and natural walking patterns.

The upper body prosthetics segment is expected to grow at the highest CAGR in the robotic prosthetics market during the forecast period. The upper body prostheses are essential to rehabilitation because they let patients regain their freedom and carry out everyday tasks. The goal of raising amputees' quality of life is a major factor in this market's expansion. The prosthetic devices for the upper body may now be extremely tailored and individualized thanks to developments in 3D printing and other manufacturing technologies. The users find the prostheses more appealing because of the improved fit, comfort, and usefulness that result from this personalization. Access to upper-body prostheses is increasing due to improvements in healthcare policy, insurance coverage, and financing for prosthetic devices. The growth in the industry is being aided by financial support from both the public and private sectors.

By Technology

By Extremity

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

September 2024

September 2024

March 2025