September 2024

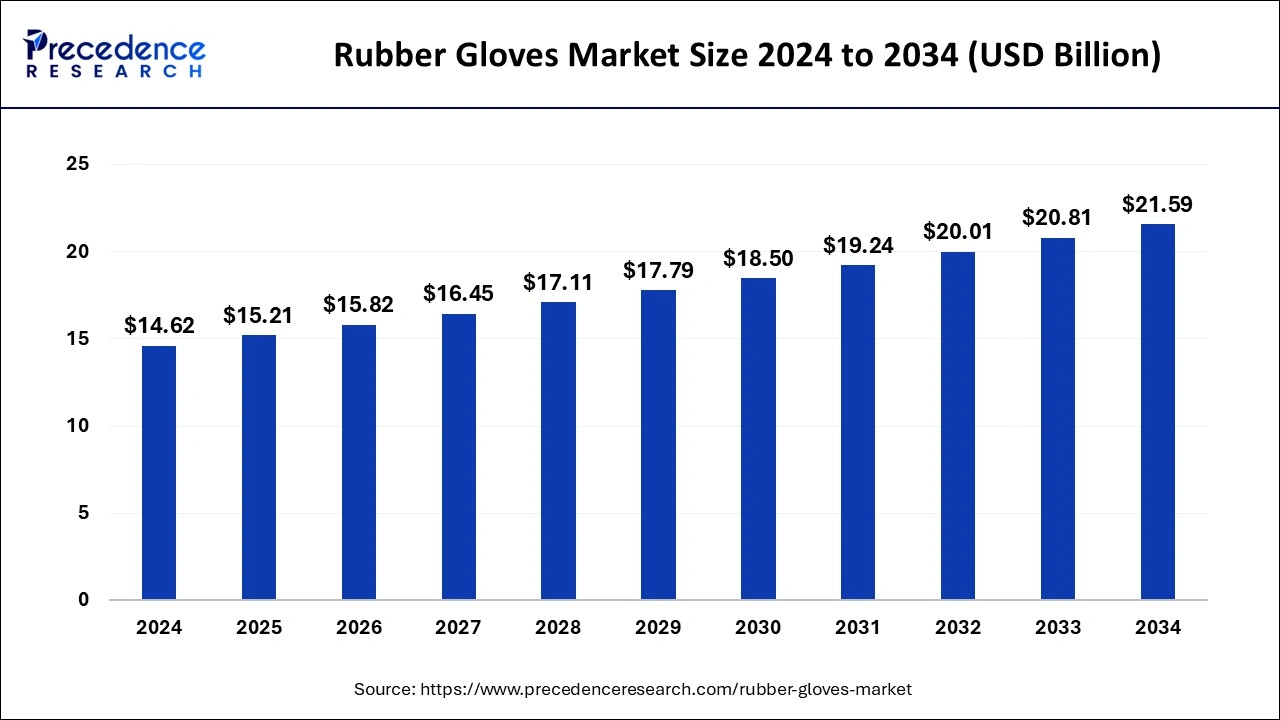

The global rubber gloves market size is calculated at USD 15.21 billion in 2025 and is forecasted to reach around USD 21.59 billion by 2034, accelerating at a CAGR of 3.98% from 2025 to 2034. The Europe rubber gloves market size surpassed USD 5.63 billion in 2025 and is expanding at a CAGR of xx% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global rubber gloves market size was estimated at USD 14.62 billion in 2024 and is predicted to increase from USD 15.21 billion in 2025 to approximately USD 21.59 billion by 2034, expanding at a CAGR of 3.98% from 2025 to 2034. The primary reason behind the growth of the rubber gloves market is a rise in industries and research labs.

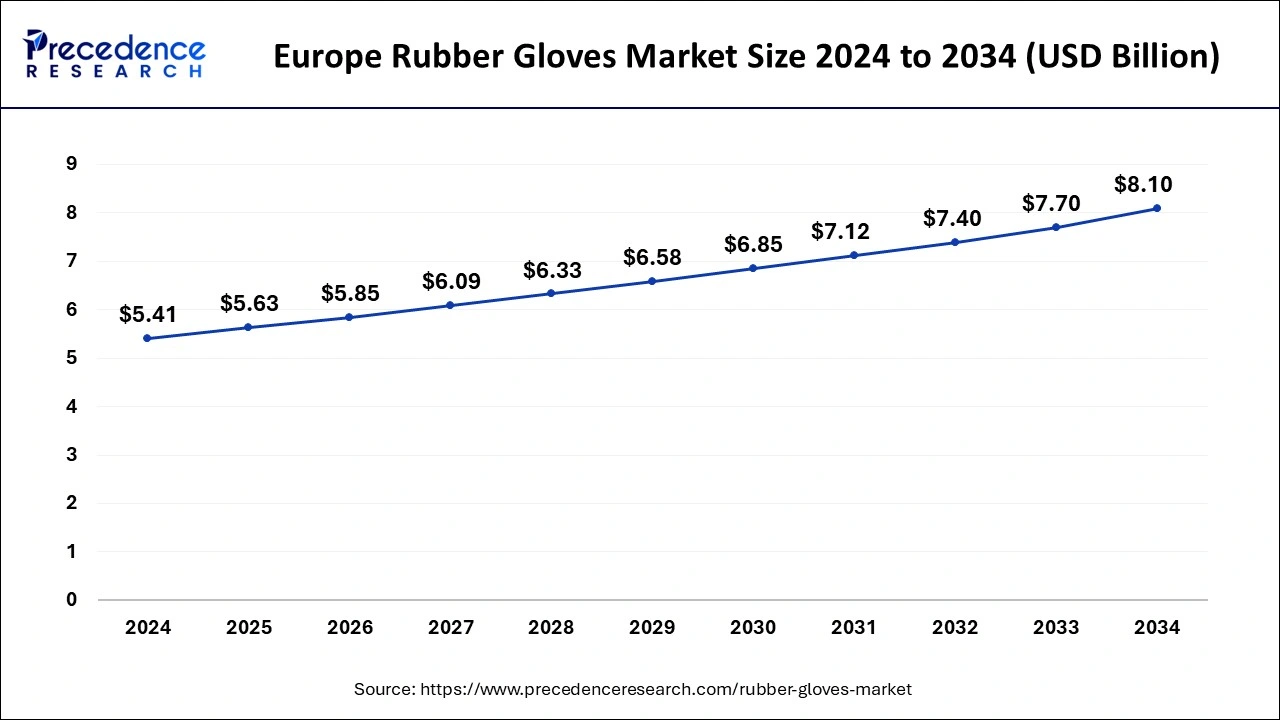

The Europe rubber gloves market size reached USD 5.41 billion in 2024 and is predicted to be worth around USD 8.10 billion by 2034, at a CAGR of 4.12% from 2025 to 2034.

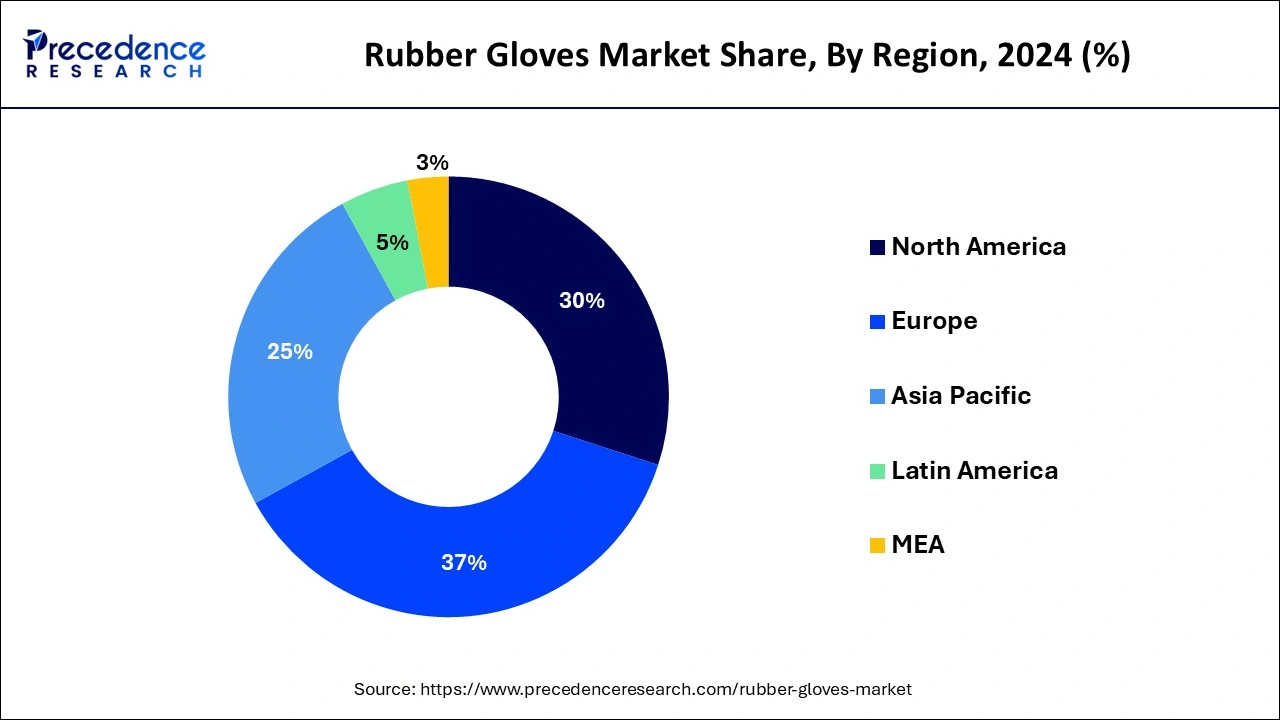

Europe dominated the rubber gloves market in 2024. Europe is shifting towards nitrile glove production, and there is a constant enhancement in material type and manufacturing process. There are several industries, such as food processing, chemicals, and beauty sectors, that need rubber gloves, hence helping to accelerate the market. More emphasis is given to hygiene and safety in these sectors. Powder-free gloves are more popular, and their production takes place in large amounts. The healthcare market is boosting, too, and this is helping the market to grow.

Asia Pacific will show substantial growth in the rubber gloves market during the forecast period. There is rising awareness among people regarding the usage of gloves in different industries. Gloves prevent infection and keep the doctor and patient safe, so they are increasingly used in hospitals. The food industry is also growing in the Asia Pacific, and food processing industries, like the dairy industry, where a sterile environment is extremely important, show high use of rubber gloves.

Rubber gloves are made up of synthetic or natural rubber. These gloves are durable, highly elastic, and waterproof. The primary purpose of such gloves is to ensure safety while handling chemicals in a lab or to provide a sterile environment while handling a bacterial culture. They find their uses in science labs, industries, and even domestic uses, such as washing dishes with hot water and not letting the detergent affect the skin.

The use of rubber gloves in different fields has more or less the same purpose: to provide safety and protection from high temperatures or dangerous chemicals. One will definitely find rubber gloves in a chemical lab. They are tight fit but allow some ventilation for the hands. One might find their hands sweating after a while on wearing rubber gloves, as they only offer ventilation near the wrists; the rest of it is completely nonporous. They protect hands from spillage of harmful detergents or acids.

Rubber gloves are made up of natural or synthetic latex. Synthetic gloves show lesser stretchability and flexibility than natural latex rubber gloves. However, synthetic gloves are helpful for those with latex allergies, and vinyl or nitrile gloves are an excellent choice. Due to the excessive grip and friction that rubber has, it becomes difficult to wear these gloves. Hence, rubber gloves are powdered to make them easy to wear. Usually, natural rubber gloves have this problem to wear because of excess friction.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 3.98% |

| Market Size in 2025 | USD 15.21 Billion |

| Market Size by 2034 | USD 21.59 Billion |

| Largest Market | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Material, By Type, By Product, By Distribution Channel, and By End-use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Expanding healthcare sector

The biggest drivers in the growth of the rubber gloves market are the growing healthcare industries and rising awareness of rubber gloves. Several research institutes have laboratories where extremely sterile environments are to be maintained, such as a lab where bacterial cultures of different strains are set up. Such laboratories are the largest consumers of rubber gloves, as these gloves need to be discarded right after they are used. The food industry is another such industry where rubber gloves are very useful. In some food industries like dairy, the slightest contamination can damage large storage of milk, or one could see an entirely different product forming.

Disposal issues

The biggest restraint in the rubber gloves market is the problem of disposal. Rubber gloves are highly used in industries and chemical labs. Once used, they are discarded. These gloves are made up of synthetic rubber, which is, in a way, plastic. It takes a very long time to decompose and remains in the environment for almost forever. This contributes heavily to pollution. Also, poor disposal of gloves can lead to infection and diseases. So, the disposal of waste has to be proper, and recycling this waste is a challenge, too. Many people have latex or powder allergies, which can result in rashes on the skin. Hence, in some cases, gloves do more harm than good.

Increasing awareness and eco-friendly alternatives

As the occurrence of diseases and contagious conditions increases, the demand for disposable gloves has been increasing exponentially. Especially after the global pandemic, the general public has become more aware of the need for preventative measures. Moreover, the development of eco-friendly alternatives has been able to support this growing demand while simultaneously addressing the concerns of environmental dangers and raw material shortages.

The natural rubber/latex type segment dominated the rubber gloves market in 2024. Natural rubber gloves offer many advantages that make them extremely popular. Being made of natural rubber, they offer some good physical properties like good elasticity and are resistant to tearing. They can offer protection from many dangers and hazards like pathogens and biohazards. They are used in chemical labs, too. These types of gloves are popular because they are comfortable to wear and fit well on the skin. Due to their good fit, they also provide a good sense of touch while being worn. Latex gloves are biodegradable, as they are made up of natural material.

The nitrile segment will be the fastest-growing segment during the forecast period. Some people are allergic to natural latex, and nitrile gloves are a savior for allergic people. Latex allergies can cause skin irritation and cause more harm than safety. Nitrile gloves are made up of synthetic rubber and are good for those with latex allergies. Compared to latex gloves, they have high strength and are durable. Due to their strength, they can be used in places involving sharp objects. They are used in chemical labs because they are highly resistant to chemicals. They offer a good level of comfort and fitting.

The powder-free segment dominated the rubber gloves market. Powder-free gloves do not contain cornstarch. They are skin-friendly and offer a higher strength and versatility. They offer high strength and durability as they are used in tough industries. As no powder is used in these gloves, there is a risk of contamination. They are skin-friendly because some people are allergic to powder. They provide a high grip.

The powdered segment will show substantial demand during the forecast. Wearing gloves can lead to a lot of sweating, and to prevent it, powder is applied to the gloves. This powder is cornstarch. Due to this, the grip improves, and one can wear gloves with ease. These gloves are more affordable and are comfortable on a hot day. Sweating does not affect the performance of these gloves much.

The durable segment dominated the rubber gloves market. Durable gloves, or reusable gloves, are gloves that can be reused. They are made up of thicker and high-quality rubber. They find uses in heavy industries while dealing with extremely high or extremely low-temperature materials. For example, there are some ultra-cold fridges in some laboratories where chemicals, reagents, or samples need to be stored. Removing reagents from such a cold environment can lead to a cold burn. Durable gloves are helpful in this case. These gloves are sold in pairs. Durable gloves are designed for longer use and are made of neoprene, nitrile, or latex.

In the rubber gloves market, the disposable gloves segment will be the fastest-growing segment during the forecast period. Disposable gloves are used in chemical laboratories and industries and are beneficial while handling chemicals. In order to prevent any cross-contamination, these gloves are disposed of regularly, and fresh gloves are always sterile. These gloves don’t come in pairs. Any glove can be worn in any hand, and these gloves come in large packs having 50, 100, or whatever number of gloves. They are made of nitrile or latex and have extremely high flexibility but very low strength compared to durable gloves.

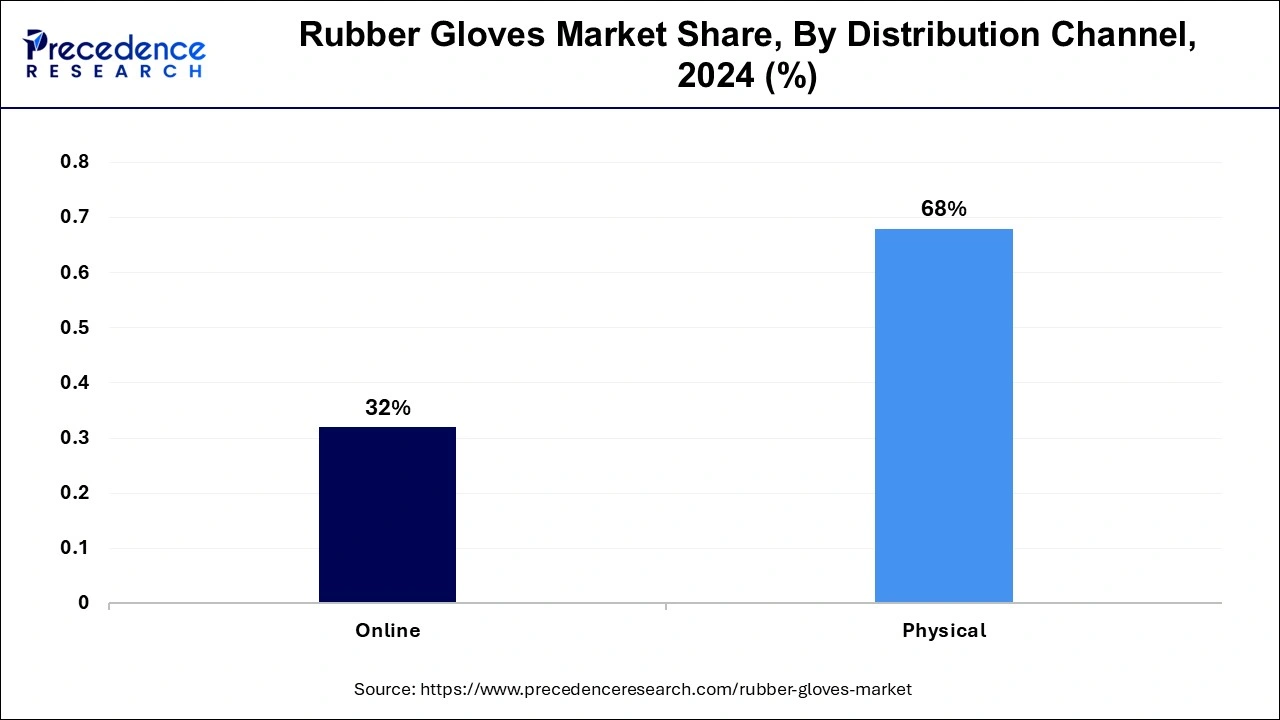

By distribution, the physical distribution channel segment dominated the rubber gloves market in 2024. Rubber gloves are crucial for the medical and chemical industries. No compromise can be made with the quality of the gloves. Physical distribution allows one to check the quality of gloves and provides assurance. One can also check for old stock and poor quality. Also, offline purchasing provides better services to the buyer.

In the rubber gloves market, the online distribution segment will be the fastest-growing segment during the forecast period. This is because of increased digitalization. Online ordering provides the luxury of getting the product to the doorstep. Staff expense is reduced in the case of online distribution, as the products are stored in warehouses. It is easy to sell on online platforms.

The medical and healthcare segment dominated the rubber gloves market in 2024. Medical and healthcare is a growing industry. More research is being done to design high-quality drugs and treatments. Chemical labs and biology labs in the research and development department require a highly sterile environment, and contamination has to be avoided at all costs. Apart from labs, doctors and nurses also use rubber gloves in hospitals while performing surgeries. A slight contamination of the patient’s wounds can exacerbate the condition into an infection and risk a patient’s life.

In the rubber gloves market, the automotive segment will show significant growth during the forecast period. The automotive industry involves the use of oil, grease, or other chemicals. Mechanics working in these industries, when working with these chemicals, need to wear proper gloves so that they don’t have to keep washing their hands before picking a new task. They can simply discard the gloves that they wear.

By Material

By Type

By Product

By Distribution Channel

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

July 2024

July 2024