September 2024

Rubber Processing Chemicals Market (By Product: Anti-degradants, Accelerators, Flame Retardants, Processing aids/Promoters, Others; By Application: Tire and Related Products, Automotive Components, Footwear Products, Industrial Rubber Products, Others; By End Use: Tire, Non-Tire) - Global Industry Analysis, Size, Share, Growth, Trends, Regional Outlook, and Forecast 2023-2034

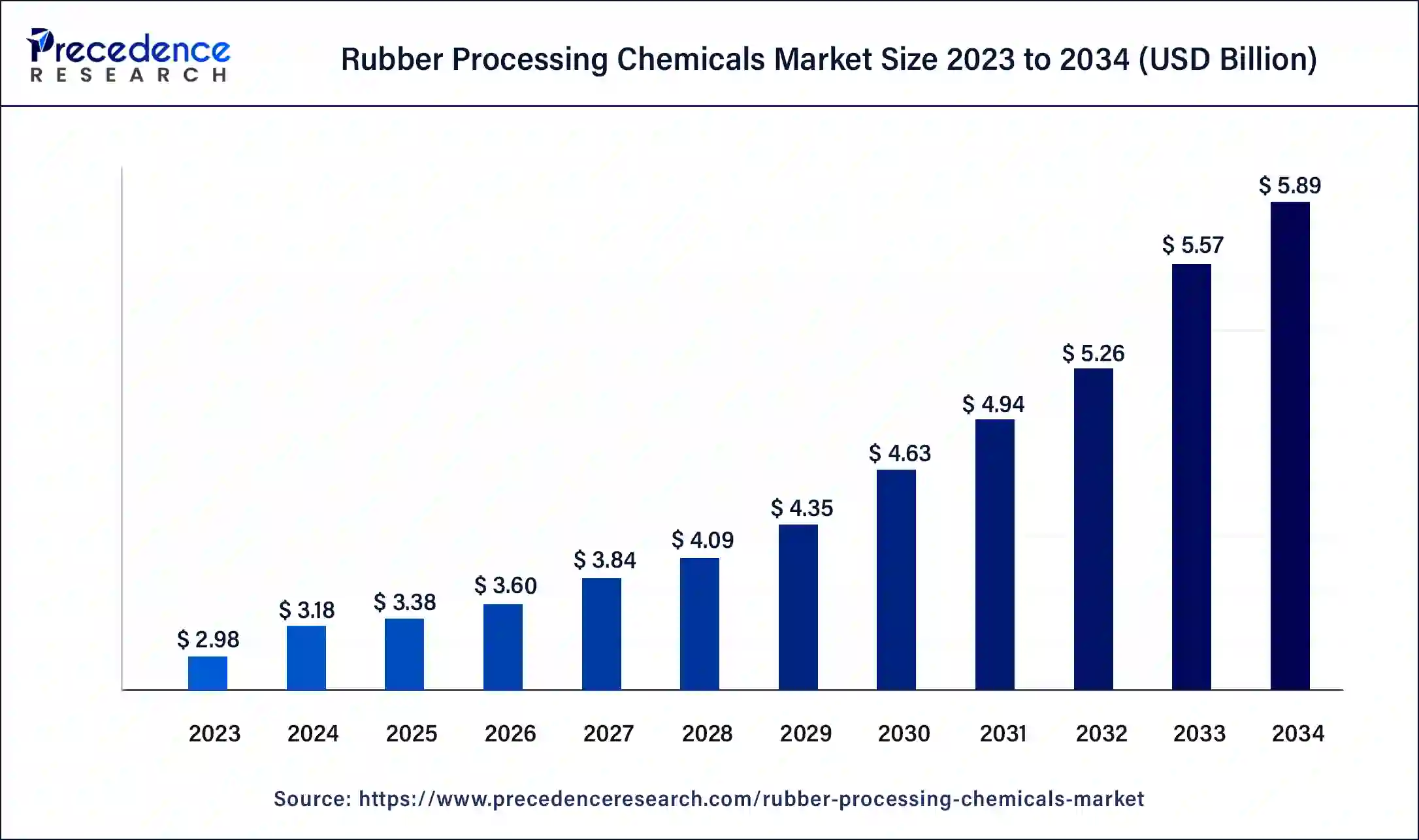

The global rubber processing chemicals market size was USD 2.98 billion in 2023, accounted for USD 3.18 billion in 2024, and is expected to reach around USD 5.89 billion by 2034, expanding at a CAGR of 6.4% from 2024 to 2034.

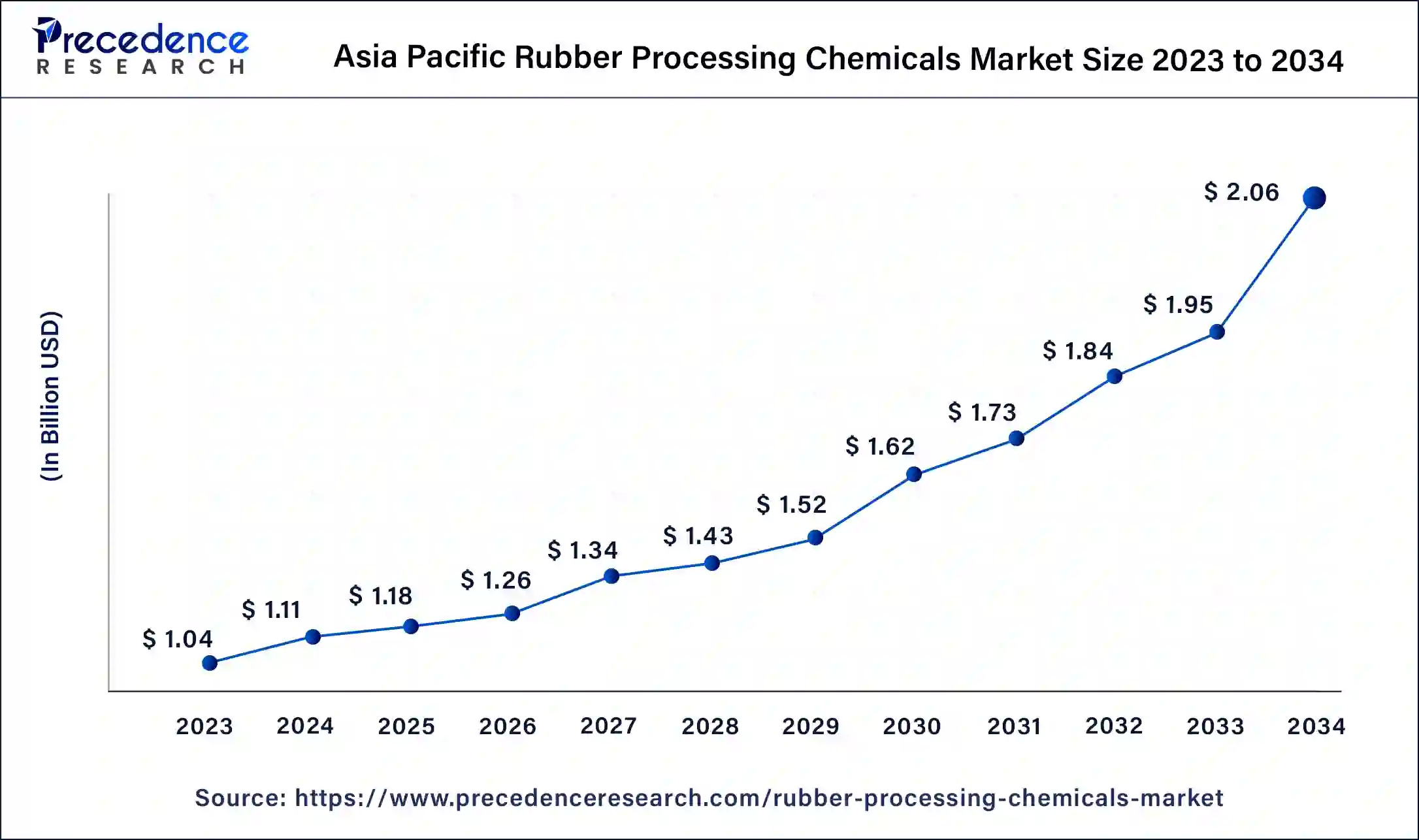

The Asia Pacific rubber processing chemicals market size was estimated at USD 1.04 billion in 2023 and is predicted to be worth around USD 2.06 billion by 2034, at a CAGR of 6.6% from 2024 to 2034.

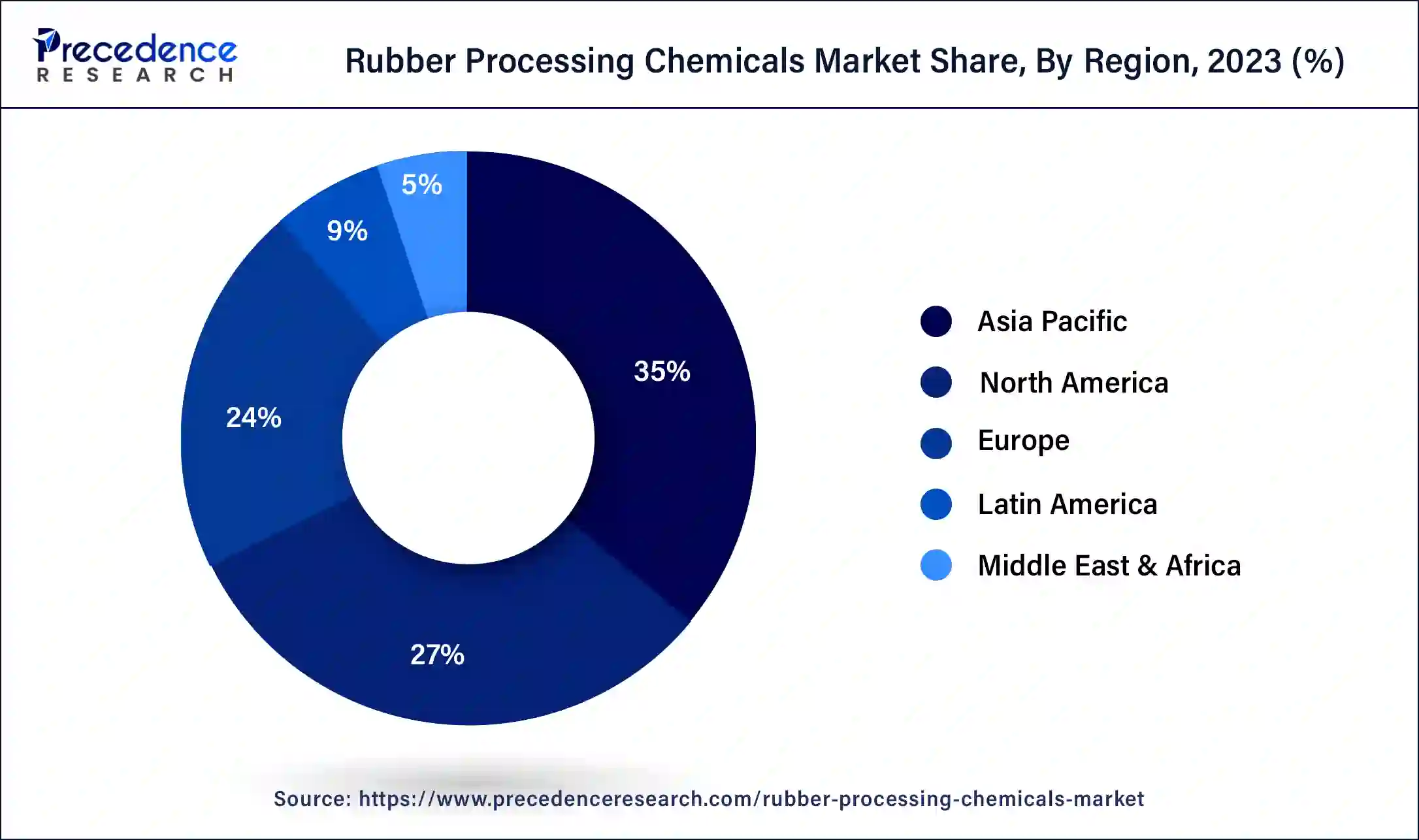

Asia-Pacific has held the largest revenue share 35% in 2023. In the Asia-Pacific region, the rubber processing chemicals market is witnessing substantial growth driven by the thriving automotive and manufacturing sectors. The demand for high-performance rubber components, particularly in countries like China and India, is surging. Additionally, increased environmental regulations are pushing manufacturers to adopt eco-friendly additives and compounds. The region's economic expansion and focus on sustainable solutions are shaping the evolving landscape of the rubber processing chemicals industry in Asia-Pacific.

Europe is estimated to observe the fastest expansion. In Europe, the rubber processing chemicals market is witnessing trends driven by environmental concerns and stringent regulations. The region is increasingly focused on eco-friendly and sustainable rubber processing chemicals, aligning with its commitment to reducing environmental impact. Additionally, the automotive sector's transition towards electric vehicles and greener technologies is shaping the demand for advanced rubber additives that improve tire efficiency and reduce emissions. Customized solutions and partnerships with end-users are also on the rise to meet diverse industry needs.

Moreover, in North America, the rubber processing chemicals market is witnessing several notable trends. There is a growing focus on sustainable and eco-friendly solutions, driven by stringent environmental regulations. The region also sees increasing demand from the automotive industry for high-performance rubber components. Customization and specialized formulations are gaining prominence as manufacturers collaborate closely with end-users. Additionally, advancements in digitalization and automation are enhancing production processes, increasing efficiency, and driving innovation within the market.

| Report Coverage | Details |

| Growth Rate from 2024 to 2034 | CAGR of 6.4% |

| Market Size in 2023 | USD 2.98 Billion |

| Market Size in 2024 | USD 3.18 Billion |

| Market Size by 2034 | USD 5.89 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Product, By Application, and By End Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The demand from the industrial and construction sectors significantly boosts the rubber processing chemicals market. These sectors rely on rubber materials for applications like conveyor belts, hoses, and seals. As industrialization and infrastructure development continue to expand globally, the need for high-quality rubber products escalates, driving the requirement for processing chemicals.

The reliability and durability of rubber components in these sectors are critical, making the role of rubber processing chemicals indispensable in meeting stringent performance and safety standards. Moreover, the rising demand for fuel-efficient, high-performance vehicles in the automotive industry drives the need for advanced rubber components like tires and seals. To meet these demands, the rubber processing chemicals market experiences increased growth as manufacturers seek additives to enhance rubber properties, ensuring safety, performance, and efficiency in vehicles.

Regulatory Compliance complexity hampers market demand in the rubber processing chemicals market by imposing burdensome requirements on manufacturers. Meeting evolving environmental and safety standards, such as REACH and EPA regulations, demands significant investments in research, testing, and documentation. These complexities can increase production costs and hinder product innovation. Environmental impact concerns pose a restraint on the rubber processing chemicals market. Emissions of volatile organic compounds (VOCs) during manufacturing processes contribute to air pollution and environmental degradation. Increasing regulations to curb emissions and reduce the industry's carbon footprint require costly process modifications.

Additionally, heightened consumer awareness of sustainability and eco-friendliness prompts the demand for greener alternatives. Manufacturers must adapt to these environmental pressures to align with regulatory standards and changing consumer preferences, impacting market dynamics. Heightened environmental impact concerns, including emissions like volatile organic compounds (VOCs) during manufacturing, have resulted in heightened scrutiny and regulatory actions. Compliance with these stringent environmental standards often necessitates costly modifications to production processes and the development of environmentally friendly alternatives, impacting the industry's dynamics.

Specialized formulations in the rubber processing chemicals market significantly boost market demand by offering tailored solutions to diverse industries. Customized rubber compounds are designed to meet specific performance, durability, and environmental criteria address unique challenges, creating a strong value proposition. This fosters partnerships with end-users and builds customer loyalty. The ability to provide bespoke solutions not only enhances market competitiveness but also drives increased demand as industries seek high-performance rubber materials precisely suited to their needs. Moreover, supply chain optimization in the rubber processing chemicals market enhances market demand by ensuring a reliable supply of raw materials and timely deliveries. Efficient logistics and reduced production disruptions result in stable product availability, which instills confidence in customers and fosters increased demand for these essential chemicals in the market.

According to the product, the anti-degradants held 35.4% revenue share in 2023. Anti-degradants are a class of rubber processing chemicals designed to protect rubber materials from degradation caused by environmental factors such as heat, oxygen, and UV radiation. In the rubber processing chemicals market, a notable trend is the growing demand for eco-friendly anti-degradants, aligning with sustainability goals. Manufacturers are developing formulations that provide effective protection while minimizing the environmental impact. Additionally, advancements in nanotechnology are enhancing the efficiency of anti-degradants, offering improved performance characteristics in rubber products.

The accelerators segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Accelerators in the rubber processing chemicals market are substances that hasten the vulcanization process, enhancing rubber's physical properties like elasticity and durability. A notable trend in this segment involves the development of eco-friendly accelerators to align with sustainability goals and regulatory compliance. Manufacturers are increasingly focusing on non-nitrosamine accelerators and those with lower environmental impact. This trend reflects the industry's commitment to greener alternatives and addressing environmental concerns in rubber processing.

By application, automotive components is anticipated to hold the largest market share of 28.3% in 2023. Automotive components in the rubber processing chemicals market refer to rubber-based parts used in vehicles, including tires, seals, gaskets, and hoses. A significant trend in this segment is the growing demand for performance-enhancing additives to optimize tire efficiency, fuel economy, and safety. Additionally, the development of eco-friendly rubber compounds aligns with the automotive industry's sustainability goals, fostering innovation in processing chemicals for automotive applications. This trend reflects the industry's commitment to improving both performance and environmental impact.

On the other hand, the industrial rubber products segment is projected to grow at the fastest rate over the projected period. Industrial rubber products, including conveyor belts, hoses, gaskets, and seals, rely on rubber processing chemicals for enhanced durability and performance. A key trend in the rubber processing chemicals market is the increasing demand for these chemicals in the industrial sector. As industries expand, the requirement for high-quality rubber products escalates, prompting the use of advanced processing chemicals. Additionally, there is a growing focus on sustainability, pushing manufacturers to develop eco-friendly additives tailored for industrial applications.

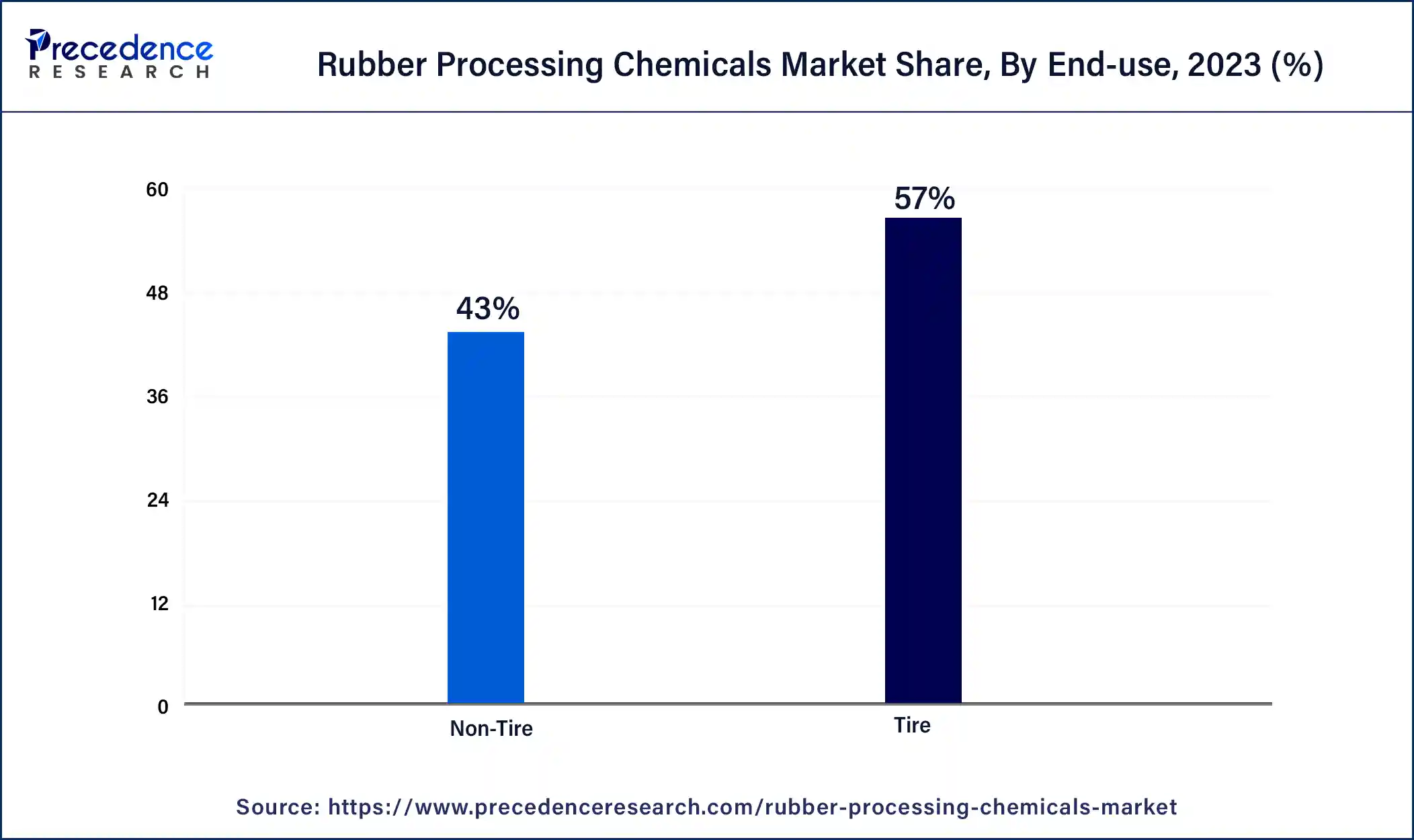

In 2023, the tier segment had the highest market share of 57% on the basis of the installation. Tire is a prominent end-use segment in the rubber processing chemicals market. Rubber processing chemicals play a vital role in enhancing tire performance, durability, and safety. Key trends in this segment include the growing demand for high-performance tires with reduced rolling resistance to improve fuel efficiency. Additionally, eco-friendly tire manufacturing is gaining momentum, driving the development of sustainable rubber processing chemicals to meet both regulatory requirements and consumer preferences for greener products.

The Non-Tier is anticipated to expand at the fastest rate over the projected period. In the rubber processing chemicals market, the "Non-Tire" segment refers to the utilization of rubber processing chemicals in applications other than tire manufacturing. This segment encompasses various industries such as automotive components, industrial goods, footwear, and construction materials. Current trends in the non-tire sector include the rising demand for eco-friendly rubber additives, customization of rubber compounds for specific industrial needs, and the integration of advanced manufacturing technologies to enhance product quality and efficiency in various non-tire applications.

Segments Covered in the Report:

By Product

By Application

By End Use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

January 2025

July 2024

September 2024