February 2025

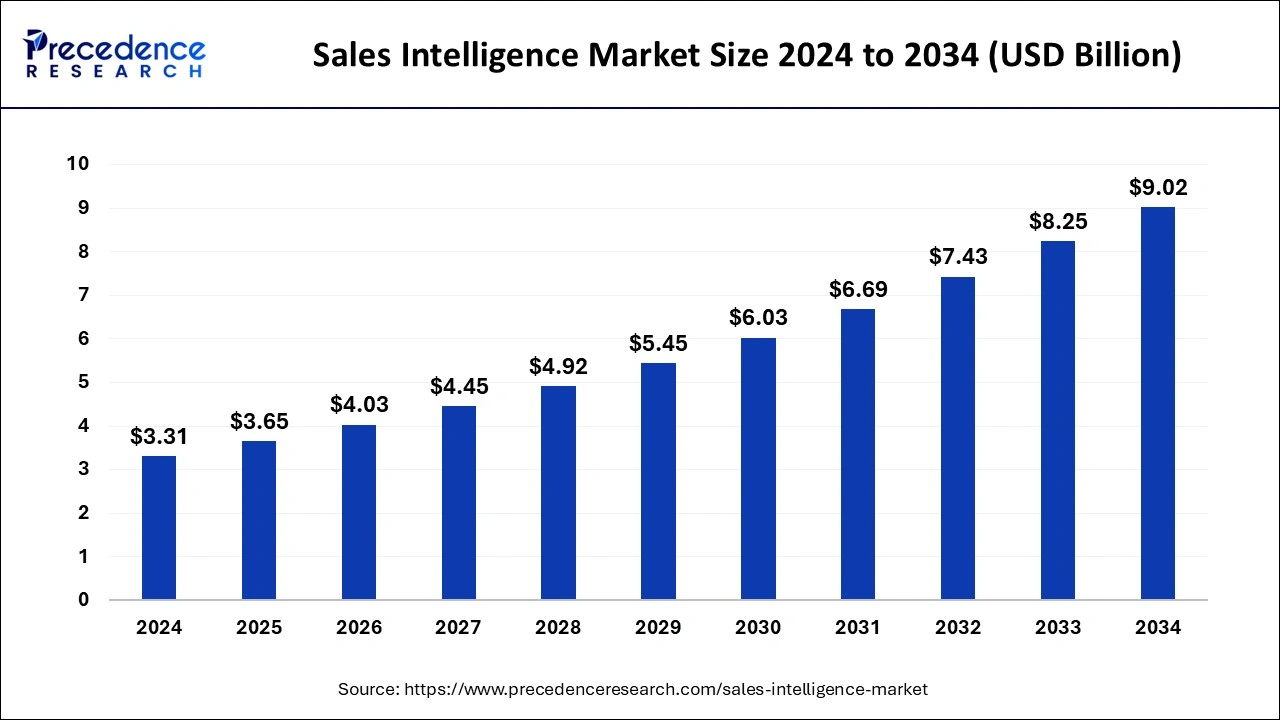

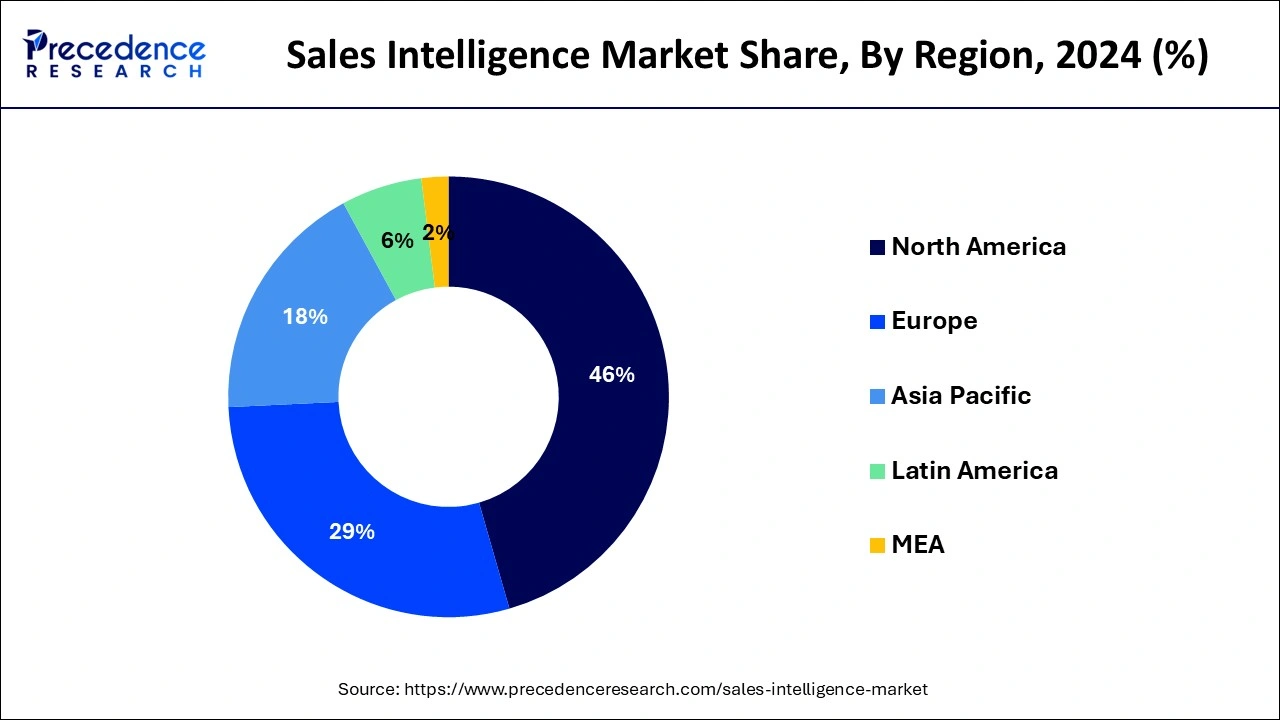

The global sales intelligence market size is calculated at USD 3.65 billion in 2025 and is forecasted to reach around USD 9.02 billion by 2034, accelerating at a CAGR of 10.54% from 2025 to 2034. The North America sales intelligence market size surpassed USD 1.52 billion in 2024 and is expanding at a CAGR of 10.57% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global sales intelligence market size was estimated at USD 3.31 billion in 2024 and is predicted to increase from USD 3.65 billion in 2025 to approximately USD 9.02 billion by 2034, expanding at a CAGR of 10.54% from 2025 to 2034.

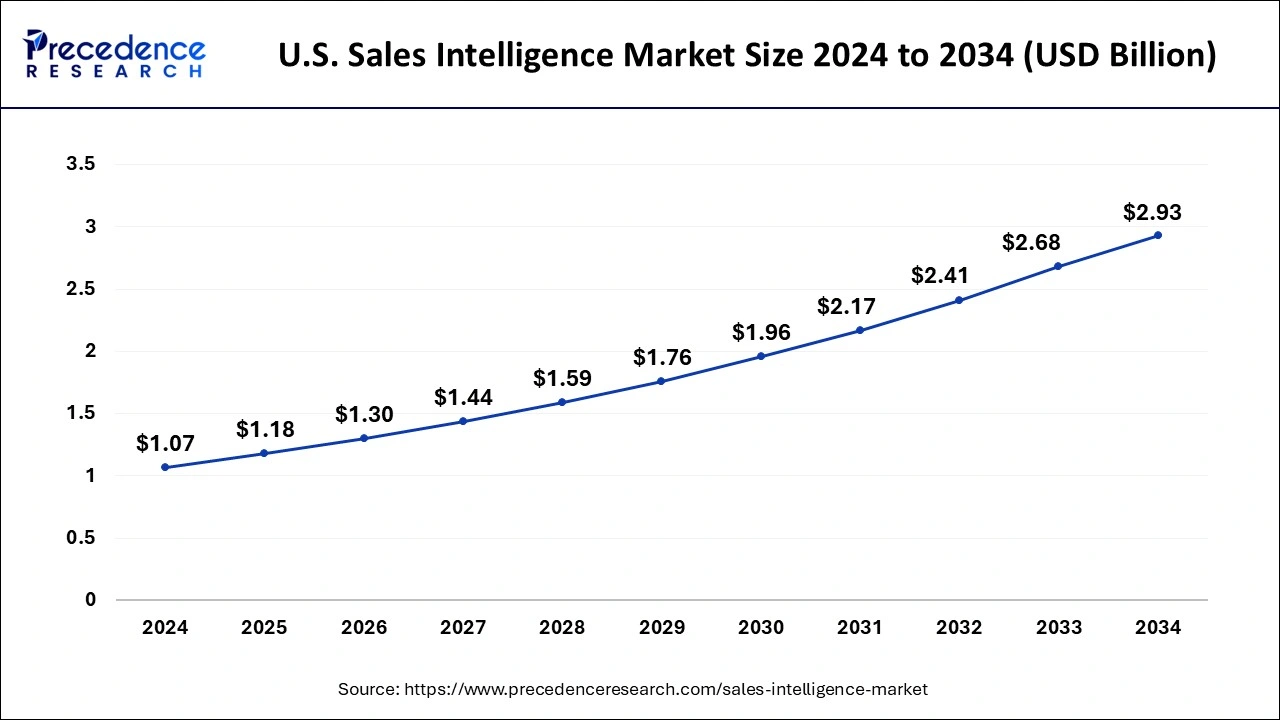

The U.S. sales intelligence market size was valued at USD 1.07 billion in 2024 and is anticipated to reach around USD 2.93 billion by 2034, poised to grow at a CAGR of 10.60% from 2025 to 2034.

North America held the largest share of 46% in the sales intelligence market. This can be attributed to the extensive presence of numerous sales intelligence vendors, including both established tech giants and innovative startups. Companies in this region are actively developing sales intelligence platforms tailored for diverse verticals.

In the retail segment, data plays a pivotal role in understanding and anticipating customer needs. The deployment of sales intelligence in the retail sector, spanning various regions, enables sales teams to gather extensive information from sources such as beacons, wearables, Point of Sale (PoS) terminals, customer relationship management (CRM) systems, and various other databases. Sales intelligence platforms are instrumental in helping retailers solidify their position in sales and trade intelligence, supporting their transformation into intelligent and agile retail enterprises.

Asia Pacific is anticipated to witness the fastest CAGR of 15.2% during the forecast period. This growth is fueled by substantial investments in sales intelligence by FinTech companies and the increasing presence of AI startups. The adoption of sales intelligence solutions in the region is aimed at process automation and boosting sales productivity.

Across different regions, solution providers offer cloud-based sales intelligence tools that empower sales professionals with real-time access to customer information, sales opportunity pipelines, dashboards, embedded reports, activity tracking, and revenue trends.

Moreover, sales intelligence tools incorporate AI, delivering personalized shopping experiences that drive increased engagement, conversion, revenue, and customer loyalty.

The sales intelligence market plays a crucial role in enhancing both the quality and quantity of sales leads, equipping sales teams with the necessary information to capitalize on potential opportunities. The increasing recognition of the significance of sales intelligence among small and medium-scale enterprises (SMEs) is contributing to the growth of the market. As SMEs worldwide continue to expand, there is a growing realization that leveraging sales intelligence can provide a competitive advantage by offering valuable insights into customer behavior, market trends, and competitor activities. This trend is driving the adoption of sales intelligence tools and solutions, creating a favorable market environment. The emphasis on informed decision-making, targeted sales strategies, and improved customer engagement further propels the demand for sales intelligence, positioning it as a valuable asset for businesses navigating a dynamic and competitive marketplace.

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 10.54% |

| Market Size in 2025 | USD 3.65 Billion |

| Market Size by 2034 | USD 9.02 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Offering, By Application, By Deployment Mode, and By Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increasing impact of AI-enabled solutions

Artificial intelligence (AI) has made a significant impact on the sales industry, showcasing its potential over the past decade while promoting the sales intelligence market’s growth. AI-enabled solutions, such as chatbots, have played a crucial role in enhancing customer interactions and related services, particularly in the B2C (Business-to-Consumer) domain. Additionally, in the financial technology (fintech) sector, AI-supported advisor services are being offered to end-use industries, enabling automated investment decisions. Sales intelligence, powered by AI, plays a vital role in providing marketers with precise information about buyers.

It enhances the content mapping and creation process, contributing to more effective marketing strategies. The access to real-time and enriched company data is a valuable asset for salespeople, empowering them to improve their lead generation processes and streamline transactions. The current business landscape, marked by exponentially increasing data volumes, stringent regulations, and low interest rates, is prompting organizations to reconsider and adapt their traditional business strategies. AI and sales intelligence serve as key tools in navigating and thriving in this dynamic environment.

Additionally, sales intelligence solutions play a crucial role in revolutionizing the lead procurement process by ensuring the acquisition of high-quality leads. Leveraging the latest technologies and advanced data enrichment tools, these solutions automate the collection of relevant lead information and facilitate efficient data storage. The gathered data is then utilized to create personalized and precisely targeted content, enhancing lead nurturing efforts.

One significant advantage provided by sales intelligence solutions is the time saved by marketers. Previously spent on manual processes such as segmenting and scoring lead lists, this time can now be redirected towards more strategic and value-added activities. The result is a streamlined workflow that ensures the delivery of only high-quality leads to the sales team. Overall, the integration of sales intelligence solutions optimizes lead management processes and contributes to the overall effectiveness of marketing strategies.

Limit the scope of growth in the long run

The growth of the sales intelligence market may face impediments due to various restraints. A notable hindrance is the lack of technical expertise among users, which could hinder the seamless adoption and utilization of sales intelligence solutions. Additionally, the limited awareness of this technology across industries may constrain its potential for widespread implementation, narrowing down the scope of market growth. Moreover, the global business landscape has experienced disruptions caused by the COVID-19 pandemic, leading to the suspension of business activities. These disruptions can further create obstacles for the market, impacting adoption rates and growth opportunities. Addressing these challenges through targeted awareness campaigns, education programs, and adapting to the evolving business landscape will be essential for the sustained growth of the sales intelligence market.

Growing demand for soundproof transportation

Businesses across diverse industry verticals are recognizing the critical importance of refining customer targeting strategies to unlock the full potential for future revenue growth. To achieve this, organizations are turning to advanced solutions that enhance their customer targeting processes, aiding in the identification of new sales opportunities both at non-customer companies and within existing client accounts. Marketing and sales executives are increasingly adopting such solutions to streamline workflows and conduct more efficient operations.

In the current business landscape, sales executives are seeking comprehensive solutions that can align their data, salesforce, and processes seamlessly. There is a growing demand for content optimization, driven by sales teams across various industries who are in need of clean, automated, and thorough data collection. Technologies like robotic process automation (RPA) are employed to automatically capture the activities performed by sales teams on their work tools. Furthermore, the integration of artificial intelligence and machine learning is on the rise, providing transparency in workflows without the burden of lengthy reviews and potential mismanagement.

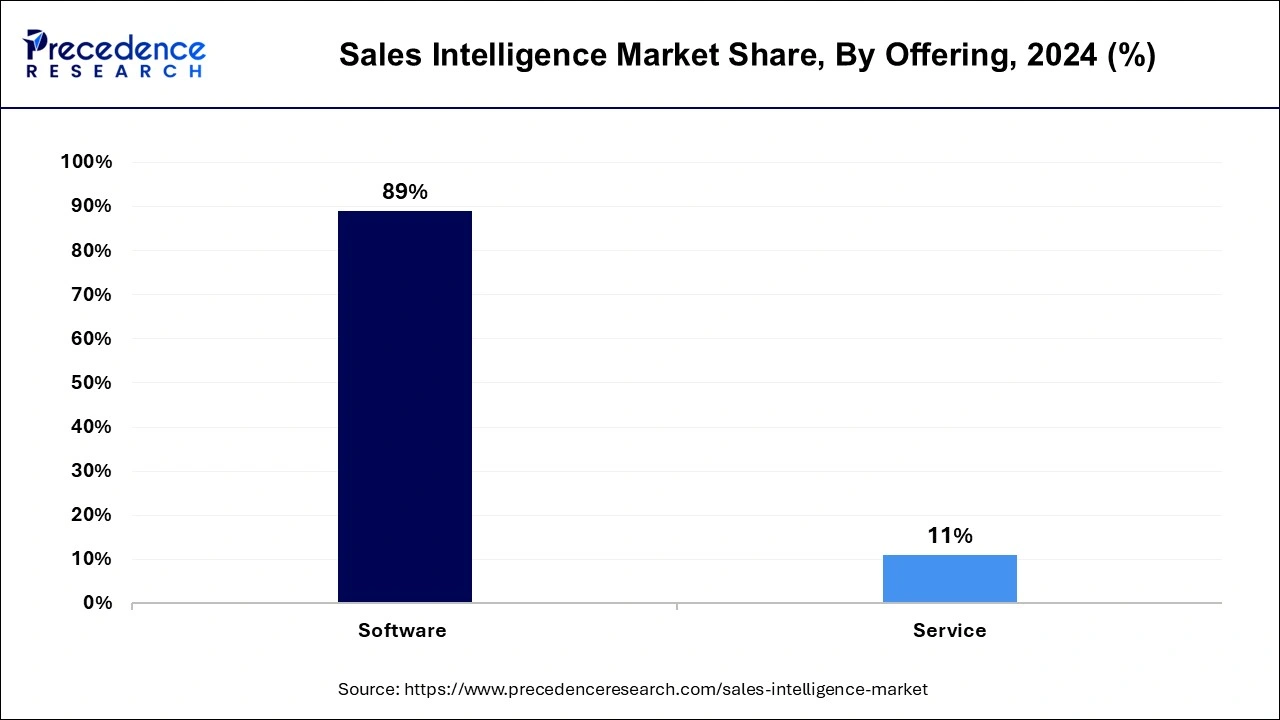

The software offerings segment dominated the sales intelligence market with 89% in 2024. This significant share is attributed to the integration capabilities of sales intelligence software, allowing seamless deployment within existing systems like marketing platforms and Customer Relationship Management (CRM). The preference for these solutions is driven by their ability to offer multiple deployment options and high-quality data enrichment. The widespread adoption of lead-generation software tools further supports the market's growth.

Various companies provide sales intelligence software tailored for diverse applications, including lead management, data management, risk management, and data analytics.

The service offerings segment is projected to witness the fastest CAGR during the forecast period. Cloud-based sales intelligence services, suitable for businesses of all sizes, are continually updated with new data and insights, providing a valuable tool for staying competitive. Additionally, the adoption of AI in sales intelligence services is contributing to substantial growth, automating tasks such as lead generation and qualification. This allows sales professionals to focus on more strategic activities, such as closing deals.

The lead management segment held the largest market share of 64% in 2024 in the sales intelligence market. This dominance is primarily attributed to the rising adoption of Artificial Intelligence (AI) platforms for lead generation and business expansion. Notably, platforms like LinkedIn Sales Navigator, a cloud-based sales intelligence solution from LinkedIn Corporation, are widely used by both large enterprises and Small and Medium Enterprises (SMEs) for lead management. The platform facilitates advanced lead search, recommendations based on saved leads, and provides real-time insights on leads and accounts.

The data management segment is anticipated to witness the second-highest CAGR over the forecast period. The increasing volume and complexity of data generated by enterprises necessitate robust data management solutions. AI-powered platforms such as Traq.ai track conversations and Customer Relationship Management (CRM) activity to generate sales intelligence. These platforms recognize sales objections, highlight risks and opportunities during calls, and transcribe calls to extract significant insights. Additionally, they identify prospecting tendencies over time, providing suggestions for necessary corrections.

Moreover, the analytics and reporting segment is poised for substantial growth, driven by the growing acceptance of sales analytics to enhance decision-making processes and gain visibility into sales activities. The penetration of real-time leaderboards for building competitive intelligence is a significant factor encouraging the adoption of sales intelligence platforms for analytics and reporting applications.

The cloud segment secured the largest market share of 65% in the sales intelligence market in 2024. This dominance is primarily due to the advantages offered by cloud solutions, such as eliminating firewall restrictions that could impede users' access in on-premise solutions. Cloud-based Software as a Service (SaaS) solutions also eliminate maintenance and overhead costs, providing a cost-effective and scalable alternative. Cloud object storage services contribute to virtually unlimited storage capacity, overcoming scalability and storage volume limitations associated with locally-placed hardware.

The on-premise segment is projected to experience a significant CAGR of 12.8% over the forecast period. This growth is attributed to the security and privacy benefits provided by on-premise solutions in the field of sales intelligence. Additionally, on-premise solutions leverage edge analytics, which reduces bandwidth requirements. Integrating these solutions with on-premise deployment ensures higher speed and increased reliability in delivering results. The on-premise deployment model appeals to organizations seeking enhanced control over their data and security measures.

The IT & telecom segment has captured the largest share of 27% in the sales intelligence market in 2024, driven by the growing availability of data and the continuous development of new technologies. The expanding IT & Telecom sector, marked by increased investments and infrastructure expansion, is fueling the demand for sales intelligence solutions. Companies like COSO IT play a significant role in the telecom sector, providing consulting solutions that enhance efficiency, customer engagement, service delivery, business intelligence, data integration, advanced analytics, predictive analysis, and machine learning-driven automation.

Sales intelligence vendors leverage advanced technologies, including artificial intelligence and machine learning, to automate tasks and enhance the accuracy of sales intelligence. The telecom industry benefits from Big Data, optimizing network usage, reducing costs, improving customer satisfaction, and enhancing security by identifying and preventing fraud.

The retail & e-commerce segment is poised to experience the fastest CAGR of 14.7% during the forecast period. This industry's increasing reliance on sales intelligence is crucial for businesses to obtain accurate, up-to-date information about target customers, the market, and competitors. The retail and e-commerce sector, being data-rich, collects extensive customer data. Sales intelligence aids in optimizing this data to enhance marketing and sales strategies, enabling businesses to make informed decisions and stay competitive in the market.

By Offering

By Application

By Deployment Mode

By Vertical

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

February 2025

October 2024

February 2025

March 2025