April 2025

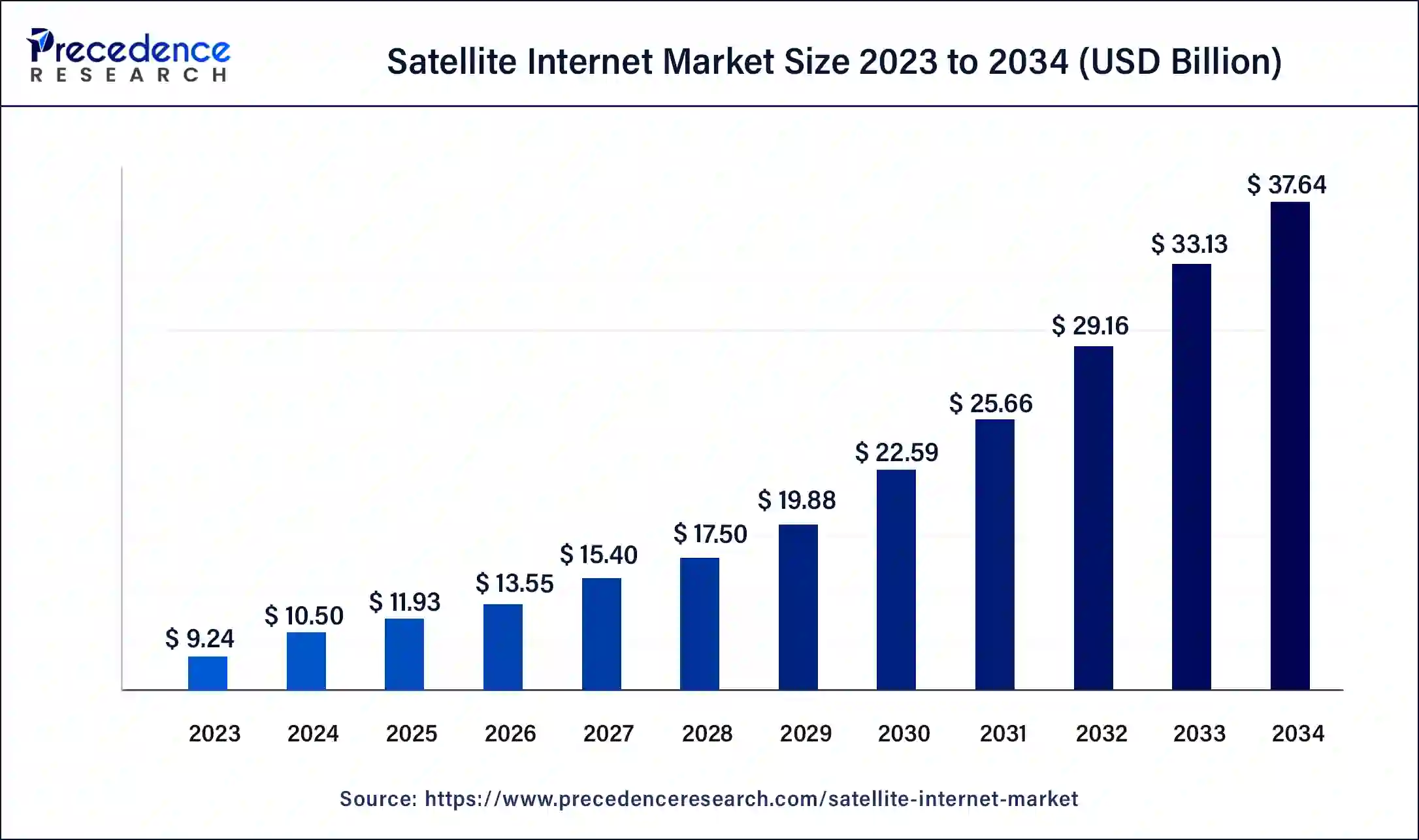

The global satellite internet market size was USD 9.24 billion in 2023, calculated at USD 10.50 billion in 2024 and is anticipated to surpass around USD 37.64 billion by 2034. The market is slated to expand at 13.62% CAGR from 2024 to 2034.

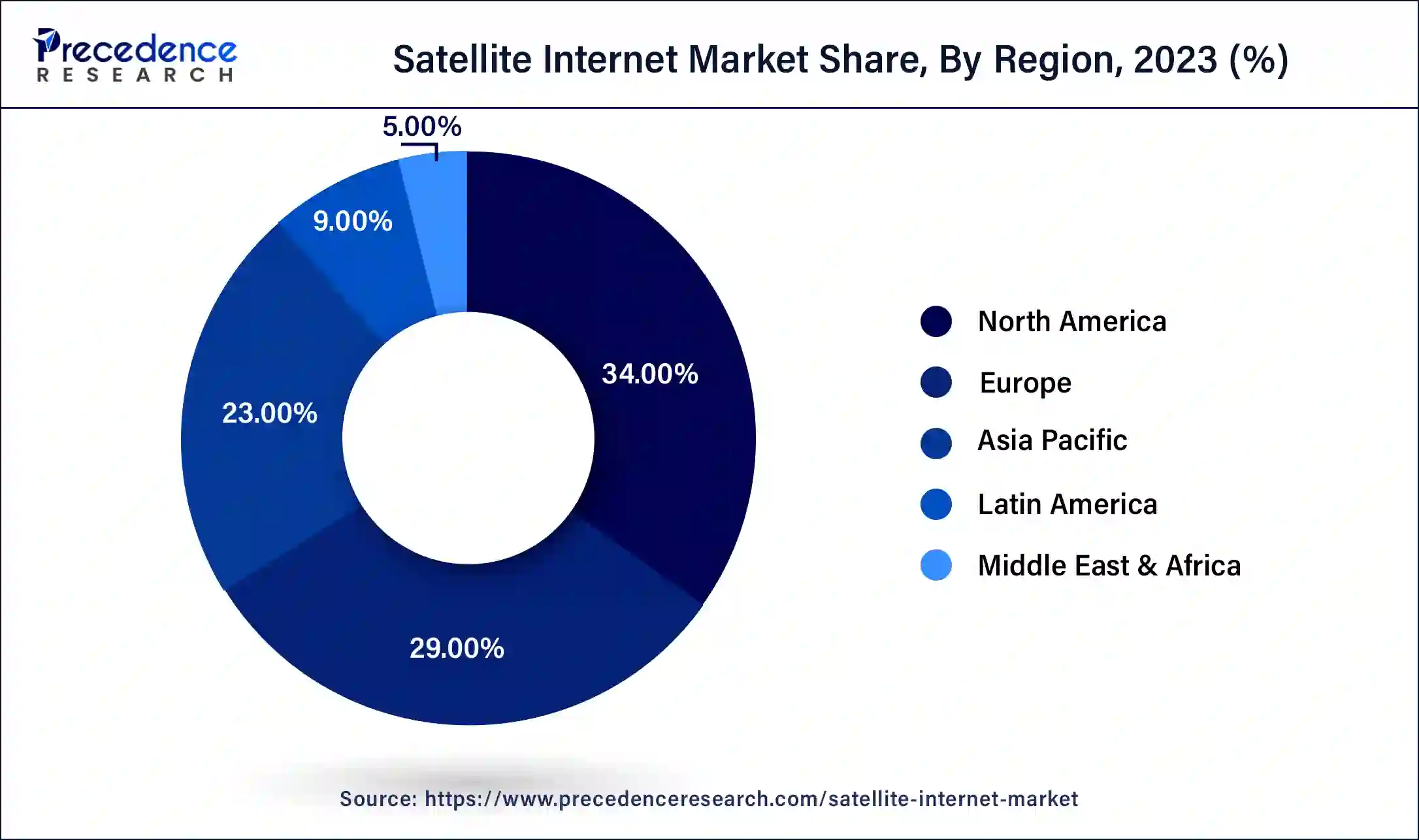

The global satellite internet market size is projected to be worth around USD 37.64 billion by 2034 from USD 9.24 billion in 2023, at a CAGR of 13.62% from 2024 to 2034. The North America satellite internet market size reached USD 3.04 billion in 2023. There is an increasing need for reliable and high-speed data transmission across the world since the internet has pervaded every sector, making it crucial to digitally upgrade and bridge the gap between rural and urban areas to expand globally, propelling the global satellite internet market.

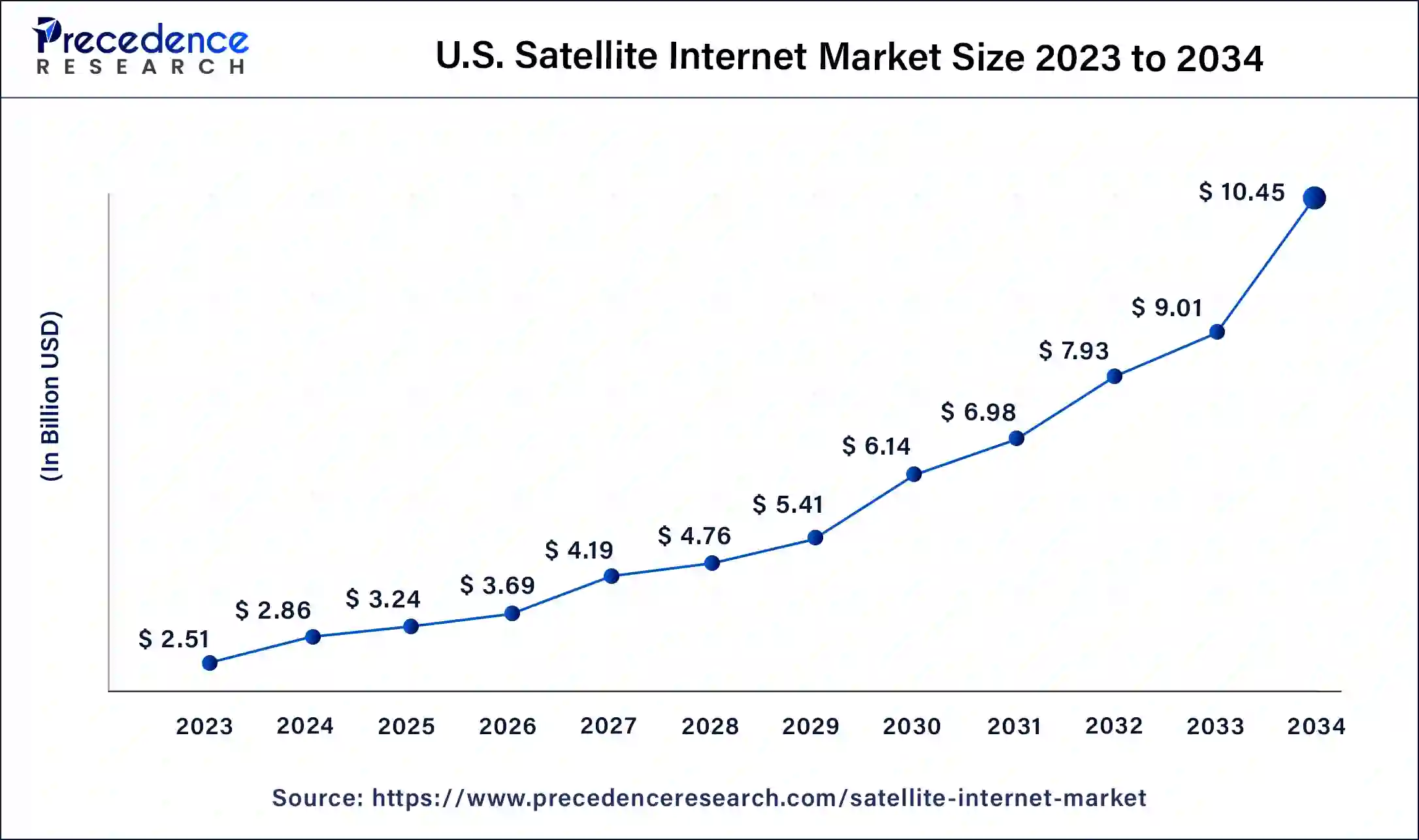

The U.S. satellite internet market size was exhibited at USD 2.51 billion in 2023 and is projected to be worth around USD 10.45 billion by 2034, poised to grow at a CAGR of 13.84% from 2024 to 2034.

North America held the largest share of the satellite internet market in 2023. The region boasts advanced technological infrastructure and significant investments in satellite technology from companies like SpaceX and Viasat. The demand for high-speed internet, particularly in rural and underserved areas, is high, driving the adoption of satellite services.

Additionally, North America has a favorable regulatory environment that supports innovation and the deployment of satellite constellations. Government initiatives aimed at bridging the digital divide also provide financial support and incentives for satellite internet providers. The combination of technological leadership, substantial investments, strong demand, and supportive policies positions North America as a dominant force in the global satellite internet market.

Top Companies for Satellite Internet

| Company name | Starting Plans | Benefits |

| HughesNet | USD 84.99/month |

|

| Viasat | USD 159.99/month |

|

| Starlink | USD 140-500/month |

|

Asia Pacific is observed to witness the fastest rate of expansion during the forecast period. The region has a vast and diverse population, including many remote and underserved areas where traditional broadband infrastructure is lacking or insufficient. Satellite internet provides a viable solution to bridge this digital divide, driving strong demand. Additionally, increasing government initiatives and policies aimed at enhancing digital connectivity and supporting rural development are fostering market growth.

China’s Investment in Internet Satellites: Aims & Projections

Technological advancements and decreasing costs of satellite deployment are making satellite internet more accessible and affordable in the region. Furthermore, the presence of emerging economies with growing internet penetration rates, coupled with rising disposable incomes, enhances the adoption of satellite services. Strategic partnerships and investments by global satellite providers in the Asia Pacific market also contribute to its expansion, positioning the region as a significant growth area for satellite internet services.

The satellite internet market is experiencing robust growth driven by the increasing demand for high-speed internet in remote and underserved regions. Advances in satellite technology, including low Earth orbit (LEO) constellations like SpaceX's Starlink and Amazon's Project Kuiper, significantly enhance connectivity and reduce latency. The market is characterized by a competitive landscape with major players such as HughesNet, Viasat, and emerging entrants focusing on innovation and expanding global reach. A key driver is the growing need for reliable internet for education, telehealth, and remote work, especially post-pandemic. Challenges include high initial deployment costs and competition from terrestrial broadband technologies. However, government initiatives and investments in digital infrastructure are expected to bolster market expansion. The market's future looks promising, with continuous advancements to bridge the digital divide globally.

AI Impact on the Market

AI will revolutionize the satellite internet market by optimizing network performance and enhancing user experience. AI algorithms can predict and manage network congestion, ensuring smoother data transmission and reduced latency. Through predictive maintenance, AI can foresee and address potential satellite issues before they impact service, improving reliability. Additionally, AI-driven analytics can offer valuable insights into user behavior, enabling personalized services and targeted marketing. Autonomous systems powered by AI will facilitate more efficient satellite deployment and management, reducing operational costs. Furthermore, AI can enhance cybersecurity measures, safeguarding against potential threats and ensuring data integrity. AI’s integration into the satellite internet ecosystem will lead to more efficient, reliable, and user-centric services, driving market growth and innovation.

| Report Coverage | Details |

| Market Size by 2034 | USD 37.64 Billion |

| Market Size in 2023 | USD 9.24 Billion |

| Market Size in 2024 | USD 10.50 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 13.62% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Frequency Band, Industry, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Rising inclination toward global connectivity

The major driving factor for the satellite internet market is the rising inclination toward global connectivity, as it offers numerous business opportunities across the globe. A viable solution has been presented by seamless and reliable internet connections around the world, providing internet connections to underserved and remote areas. Satellite technology aids in bridging the gap between the digital world in urban areas and the areas where infrastructure is limited or nearly nonexistent. A traditional internet connection doesn't seem to be a feasible option for industries such as maritime and aviation as they require a high-speed internet connection to operate with time-critical operations within the field.

Therefore, satellite internet connection offers unprecedented and instant network connection, which plays a crucial role in emergency situations and immediate response to disaster management. Features like the ability to enhance internet connections with high quality and improved bandwidth capabilities further fuel the market demand on a global level.

Advancement in LEO satellite technology

Another major driving factor for the satellite internet market is continued advancement in satellite technology, such as development in low earth orbit-LEO satellite constellations, further fuelling the market significantly. One of the interesting facts is that LEO satellites are launched and positioned closer to Earth than conventional GEO-stationary satellites, which aids in excellent low latency and higher data transmission speeds. Renowned enterprises like SpaceX, with its Starlink project, are the frontier for deploying such constellations, targeting to offer unmatched high-speed data transmission via the internet.

Such technological advancements are making satellite internet more reliable plus competitive and, thus, a feasible alternative for traditional settings for broadband services, particularly in areas where infrastructure is lacking. The improved performance and reliability of LEO satellites are attracting a significant amount of consumers, such as residential users, businesses, and governments. In addition, the scalability of such satellite networks allows for rapid expansion and the ability to meet increasing bandwidth demands, further propelling the market growth on a broader scale globally.

Initial expenditure

A major restraint for the satellite internet market is the high initial cost of deployment and infrastructure. Establishing a network of satellites, particularly low Earth orbit (LEO) constellations, involves significant financial investment. This includes the cost of satellite manufacturing, launch expenses, and the development of ground stations and user terminals. Despite advancements in technology and cost-reducing innovations like reusable rockets, the initial expenditure remains substantial.

Furthermore, the high cost can translate to expensive subscription fees for end-users, limiting market penetration, especially in price-sensitive regions. Additionally, regulatory challenges and the need for spectrum allocation can complicate deployment efforts, adding further delays and costs. These financial and regulatory hurdles can inhibit the rapid expansion of satellite internet services, potentially slowing down the market's growth despite the growing demand for global connectivity.

Emerging markets targets for rural areas

One impactful opportunity for the satellite internet market is emerging markets, which aim to provide satellite internet connections in underserved and rural areas. Rural areas have no access to high-speed Internet connections, and they also lack the robust infrastructure needed to support such data transmission via the Internet, which could create a lucrative opportunity for major players to expand their portfolios and strengthen their hold in the satellite Internet market. Since the global demand for reliable and high-speed internet connectivity is growing, satellite internet providers can tap into vast areas, providing essential services like education, healthcare, and economic development.

Governments and international organizations are increasingly prioritizing digital inclusion, creating favorable regulatory environments and funding opportunities for satellite internet projects. This focus on bridging the digital divide presents a substantial growth opportunity for satellite internet providers, enabling them to expand their customer base and establish a strong presence in regions where traditional broadband infrastructure is either inadequate or economically unfeasible.

Technological advancements and cost reductions

The satellite internet market stands to benefit from ongoing technological advancements and cost reductions. Innovations in satellite manufacturing, launch technologies, and ground equipment are driving down costs, making satellite internet more affordable and accessible. For instance, reusable rocket technology, spearheaded by companies like SpaceX, has significantly reduced launch costs.

Additionally, advancements in satellite design and miniaturization allow for the deployment of more efficient and cost-effective satellite constellations. These developments enable providers to offer competitive pricing and improved service quality, attracting a broader range of customers. The continuous evolution of technology ensures that satellite internet can keep pace with increasing data demands and remain a viable alternative to traditional broadband solutions.

The K-band segment registered the largest share of the satellite internet market in 2023. The K-band frequency, which ranges from 18 to 27 GHz, offers several benefits for the satellite internet market. Its higher frequency provides increased bandwidth, allowing for faster data transmission and higher-quality internet services. This results in lower latency and improved performance, which are essential for applications such as streaming and real-time communication. Additionally, K-band frequencies have a smaller beamwidth, enabling more precise targeting and higher capacity in densely populated areas. While it is more susceptible to rain attenuation, advancements in technology are mitigating these issues, making K-band a valuable option for high-speed satellite internet services.

The X-band segment is expected to grow significantly in the satellite internet market during the forecasted years. The X-band frequency, spanning 8 to 12 GHz, offers several benefits for the satellite internet market. It provides robust signal penetration through atmospheric conditions, including clouds and rain, ensuring reliable connectivity. X-band frequencies are less susceptible to interference compared to higher frequency bands, enhancing service stability. Additionally, X-band supports high data rates, making it suitable for both commercial and military applications. Its widespread use in communication satellites and established infrastructure further supports its reliability and effectiveness, contributing to its ongoing relevance in the satellite internet market.

The government & public segment hold the largest share of the satellite internet market in 2023. Governments and the public sector are expanding in the satellite internet market to address critical connectivity needs and bridge the digital divide. By investing in satellite internet infrastructure, they aim to provide reliable, high-speed internet access to remote and underserved areas, enhancing educational, healthcare, and economic opportunities. Government initiatives often include funding programs and partnerships with private companies to accelerate deployment and reduce costs. Additionally, public sector involvement helps ensure equitable access to digital services, supports national security and disaster response capabilities, and fosters technological innovation. This strategic expansion aligns with broader goals of improving digital inclusivity and infrastructure resilience on a national and global scale.

The media & broadcasting segment is anticipated to witness the fastest growth in the satellite internet market during the foreseeable period. The media and broadcasting sector is rapidly growing in the satellite internet market due to increasing demand for high-quality, reliable content delivery. Satellite internet provides essential connectivity for broadcasting live events, streaming services, and content distribution, especially in remote or underserved areas where traditional infrastructure is lacking. It enables media companies to reach a global audience with minimal latency and high-speed transmission. Additionally, the expansion of digital media and the rise of over-the-top (OTT) platforms drive the need for robust and scalable satellite solutions. As media consumption continues to shift towards digital formats and high-definition content, satellite internet offers a crucial solution for seamless and widespread content delivery.

Segments Covered in the Report

By Frequency Band

By Industry

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

July 2024

October 2024

July 2024