January 2025

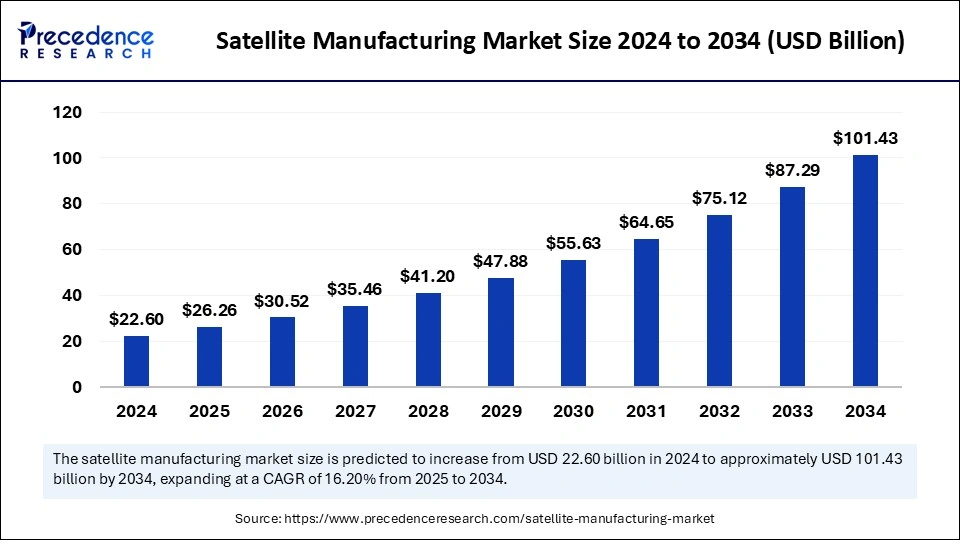

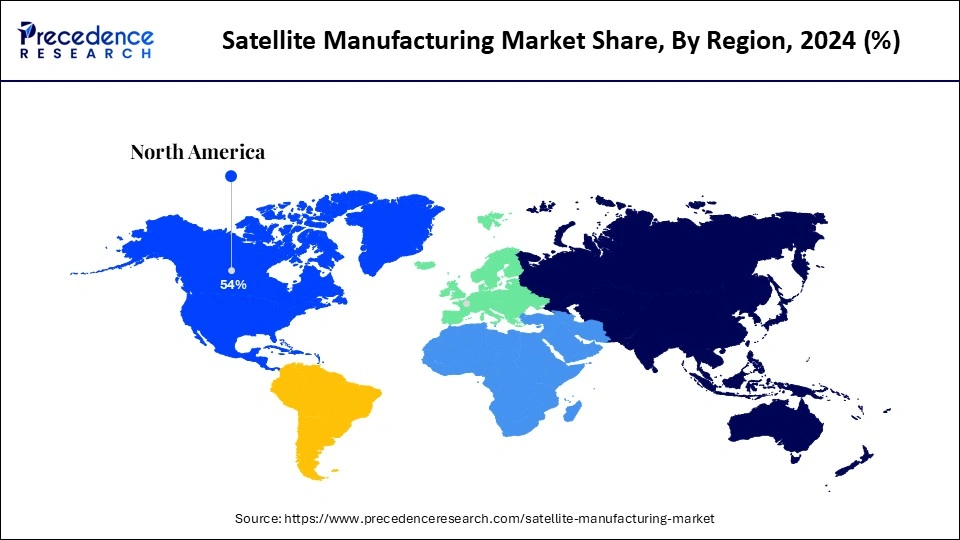

The global satellite manufacturing market size is calculated at USD 26.26 billion in 2025 and is forecasted to reach around USD 101.43 billion by 2034, accelerating at a CAGR of 16.20% from 2025 to 2034. The North America market size surpassed USD 12.20 billion in 2024 and is expanding at a CAGR of 16.31% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global satellite manufacturing market size was estimated at USD 22.60 billion in 2024 and is predicted to increase from USD 26.26 billion in 2025 to approximately USD 101.43 billion by 2034, expanding at a CAGR of 16.20% from 2025 to 2034. The market is expanding due to various factors like increasing demand for LEO satellites for better internet connectivity by various organizations, satellite-based services and data transmission, and usage of satellite data in the defense and earth observation sector, augmenting the growth of the market on a global scale.

Artificial intelligence is entering the new age of information, and the satellite manufacturing industry can also benefit from AI’s evolving nature and compatibility. AI can seamlessly transform gathered data from satellite imagery systems into helpful insights at high-resolution levels. Industry leaders like Airbus, Relativity Space, and Hypergiant are some of the market players leveraging AI technologies in satellite manufacturing. Machine Learning-based orbit prediction algorithms can predict the position of satellites and debris in low-earth orbit more precisely than other techniques.

Convolutional neural networks can further help object detection, classification, and localization algorithms on satellites, which gives them direction to identify and respond to the objects they observe with onboard sensors without permission from the ground station. Moreover, ML algorithms can be used for on-orbit to identify anomaly detection and trigger a response. AI can also help to speed up the manufacturing process of satellites.

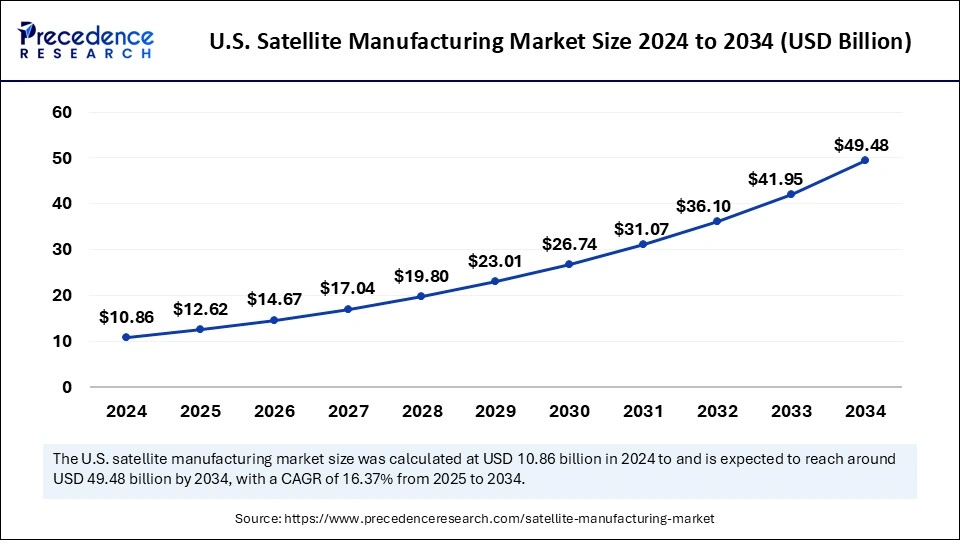

The U.S. satellite manufacturing market size was exhibited at USD 10.86 billion in 2024 and is projected to be worth around USD 49.48 billion by 2034, growing at a CAGR of 16.37% from 2025 to 2034.

North America accounted for the largest market share in 2024, thus dominating the global market. The North American region is dominating due to several factors, such as technological advancement and reliance on the internet for digital transactions, platforms, earth observation for climatic changes through satellite images and real-time data analysis, and growing reliance on satellite-based data for national security.

Government agencies such as NASA and the Department of Defence, along with collaborations between private and public partnerships, drive innovation in satellite technology. Satellite data has become crucial in every sector, such as environment monitoring and emergency response, also helping the market to grow further.

In North America, the satellite manufacturing market is dominated by the leading nation United States, with the largest market share. The market growth is attributed to factors like high demand for commercial satellites in various sectors, strong government backup, and innovation in satellite manufacturing, along with collaborations among private and government institutes. Enterprises like NASA contribute to deep space exploration and thus develop innovative ways to build highly advanced satellite systems.

The Asia Pacific is expected to witness the fastest growth rate during the foreseeable period in the market. The Asia Pacific is expanding in the market due to substantial government investment in satellite manufacturing to enhance its capabilities, growing commercial space exploration and businesses, and increased reliance on satellite-based data that can be applicable to various industries.

Strong support from growing space agencies like ISRO, CNSA, and JAXA fuelling the market growth along with the contribution of leading countries like India, Japan, China, and South Korea. Private space start-ups like PIixxel, Agnikul, and Skyroot Aerospace from India also contribute to the growth of the market by innovating satellite manufacturing.

The satellite manufacturing market in China registered a substantial market share in 2024 and led the Asia Pacific region in the global market. There are certain factors that broadly define the country’s growth, including strong government backup, advancement in the military and space sector, expanding commercial space sector, and growing adoption of small satellite constellations designed for broadband internet services.

The satellite manufacturing market in Japan is expanding at a significant growth rate owing to factors like the manufacturing of high-tech and high-performance satellites for several applications, including earth observation, which plays a crucial role in border security.

By region, the market in Europe is expected to grow at a notable growth rate during the foreseeable period. The region is fostered by to leading agency in Europe, known as the European Space Agency, that plays a critical role in supporting projects like earth observation and helps to expand the horizon of the satellite manufacturing market. The prominent factors that shaped Europe's satellite manufacturing include a growing inclination towards miniaturization, AI-based satellite operations, and reusable technologies. Moreover, increasing commercial investments and collaborations among research institutes and space agencies further augment the region’s growth in the global market.

The satellite manufacturing market encompasses a series of activities: like integration of satellite payload to the rocket, launch assembly system, launching platform, and infrastructure. Satellites have become integral parts of technological advancements as they are carriers of the signals or data from Earth to space and vice-versa. They have tremendous applications in leading sectors like satellite communication, broadcasting, remote sensing technology, earth observation, navigation, and many more, showcasing their hold in the global market.

Frontiers in space exploration like ISRO, NASA, SpaceX, and other private organizations like Skyroot and Pixxel have developed a series of satellites for various applications. According to the U.S. Department of Commerce, small space-based enterprises are heavily reliant on research and development capacity. In the last few years, there has been a growing focus on maximum satellite launches by leading countries and organizations to expand their satellite network and to improve satellite workings, which eventually helps to strengthen their presence in the global market as a leading space firm.

| Report Coverage | Details |

| Market Size by 2034 | USD 101.43 Billion |

| Market Size in 2025 | USD 26.26 Billion |

| Market Size in 2024 | USD 22.6 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Category, Mass, Type of Business, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Significance of satellite data transmission

The major driving factor for the satellite manufacturing market is the significance of satellite data transmission in various fields. Growing demand for advanced connectivity and communication services further augments satellite manufacturing. To achieve this target, leading commercial players in the market, like SpaceX and One Web, are launching a constellation of small satellites to provide internet connectivity globally and support earth imaging and communication systems. Such huge production of small satellites drives the innovation within the manufacturing domain of satellites.

Substantial manufacturing cost

A major restraining factor for the global satellite manufacturing market is the substantial cost needed to build satellites along with their launch system, which needs strong financial support. Satellite manufacturing is a highly demanding business but requires huge costs to build as it is the most sophisticated product that should operate efficiently. The chances of failed attempts to launch satellites may create a huge financial burden on the agencies, which is difficult to retain without an extra backup plan on a financial level. Moreover, the robust infrastructure needed for space launch, transportation, and construction of private spaceports, along with other investments in space exploration, is critically high.

Expansion of satellite programs

A significant opportunity that satellite manufacturing holds is the proliferation of satellite programs by government and private space agencies. The growing investment in satellite manufacturing projects by the government and military sector is further creating lucrative opportunities for the market to expand limitlessly on a global scale. For example, a leading country U.S., has significantly invested in space exploration with a budget of roughly USD 25.5 billion in 2025 to build a massive constellation of low-earth orbit satellites. Similarly, the National Space Agency of Europe is also investing substantially to improve the working characteristics of satellites, increasing the growth of the market on a global scale.

The low earth orbit-LEO segment accounted for the largest market share in 2024, thus dominating the global satellite manufacturing market. The segment is expanding due to factors like growing demand for earth observation along with satellite-based service. Earth observation is required for various sectors, such as environmental monitoring, agriculture monitoring, and telecommunications. This sector needs real-time data analysis for precise decision-making and to plan strategies around it to get maximum benefit from it.

The geostationary orbit-GEO segment is expected to witness the fastest growth rate during the upcoming period. The segment is proliferating due to the growing demand for high-capacity communication systems. GEO satellites are ideal where one area needs to be completely covered and observed continuously for precise updates. Therefore, GEOs are demanding in the market for increasing practices of broadcasting and telecommunication services such as direct-to-home services and demand for high-definition content to further augment the segments' growth.

The medium-sized satellite segment registered the highest market share in 2024, thus dominating the global satellite manufacturing market. The segment growth is attributed to the increasing demand for various monitoring systems and communication systems. Medium-sized satellites are ideal for applications like scientific research, telecommunication services, and earth observation purposes. The major factors that spurred substantial investment in medium-sized satellite technology include increasing connectivity of global internet systems and demand for real-time data analysis and transmission over secure lines.

The nano-satellite segment is anticipated to witness a notable growth rate during the forecast years. The factors positively influencing the growth of the nano-satellite segment are the cost-effectiveness and versatility they provide, which are required for various applications. The nanosatellites can be used mostly for educational purposes, earth observation, and technical analysis. Hence, a factor driving the nanosatellite launches is the inclination of start-ups to deploy nanosatellites for research and commercial purposes.

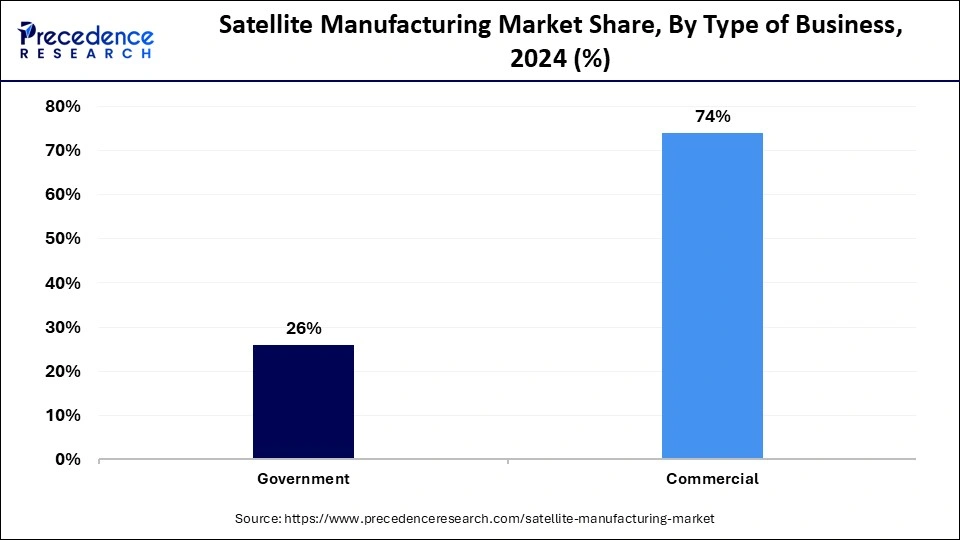

The commercial segment accounted for the largest market share in 2024, thus dominating the global satellite manufacturing market. The commercial segment is growing due to satellite-based services being adopted by various sectors due to the surge of digital technologies and the growing need for high-speed internet access. This can be more helpful in underserved and remote areas where internet access can be possible with service-based satellites.

The government segment is expected to witness a notable growth rate in the foreseeable period. The segment is expanding due to the satellite-based services providing robust security for national security purposes, surveillance, and communication. To enhance satellite systems such as disaster management, environmental monitoring, and reconnaissance, the governments of leading countries are substantially investing in satellite manufacturing. In terms of defense applications, growing concern regarding secure and authentic communication channels plays a significant role.

By Category

By Mass

By Type of Business

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

January 2025

November 2024

February 2025

April 2025