October 2024

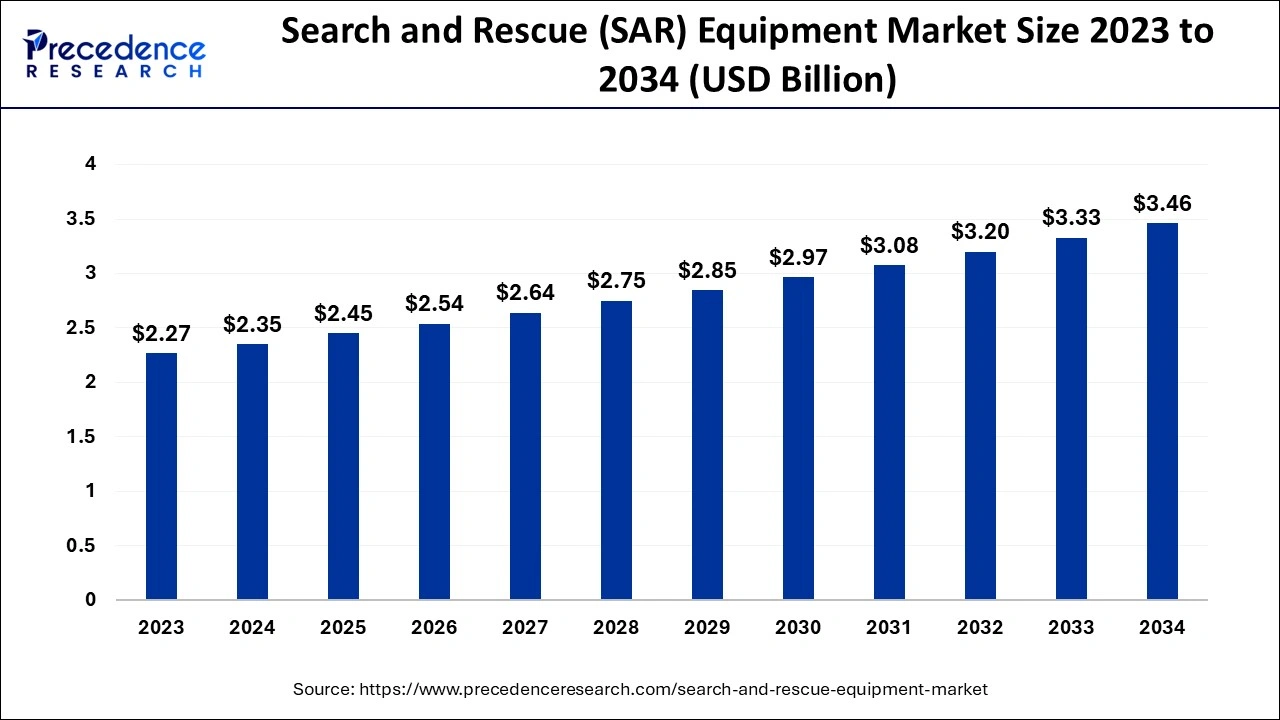

The global search and rescue (SAR) equipment market size accounted for USD 2.35 billion in 2024, grew to USD 2.45 billion in 2025 and is projected to surpass around USD 3.46 billion by 2034, representing a CAGR of 3.92% between 2024 and 2034. The North America search and rescue (SAR) equipment market size is calculated at USD 1.03 billion in 2024 and is expected to grow at a CAGR of 4.00% during the forecast year.

The global search and rescue (SAR) equipment market size is calculated at USD 2.35 billion in 2024 and is predicted to reach around USD 3.46 billion by 2034, expanding at a CAGR of 3.92% from 2024 to 2034. The growth of the search and rescue (SAR) equipment market can be attributed to the rising technological advancements in search and rescue equipment and the increase in emphasis on security and safety.

Artificial intelligence provides various advantages across traditional search and rescue operations. AI is essential for anomaly detection and complex data analysis. AI helps SAR teams allocate resources efficiently and prioritize search areas. In addition, AI is projected to be used to identify real-time data on terrain, conditions, and weather to help optimize risks and search strategies and assess potential risks for search and rescue teams.

Coordination and planning of search can be achieved via artificial intelligence, thereby enhancing the growth of the search and rescue (SAR) equipment market. To deliver basic supplies, assess damage, and locate survivors, AI-generated robots can be tailored in hazardous environments. AI helps drones to reduce the risk of human exposure to danger zones and save time.

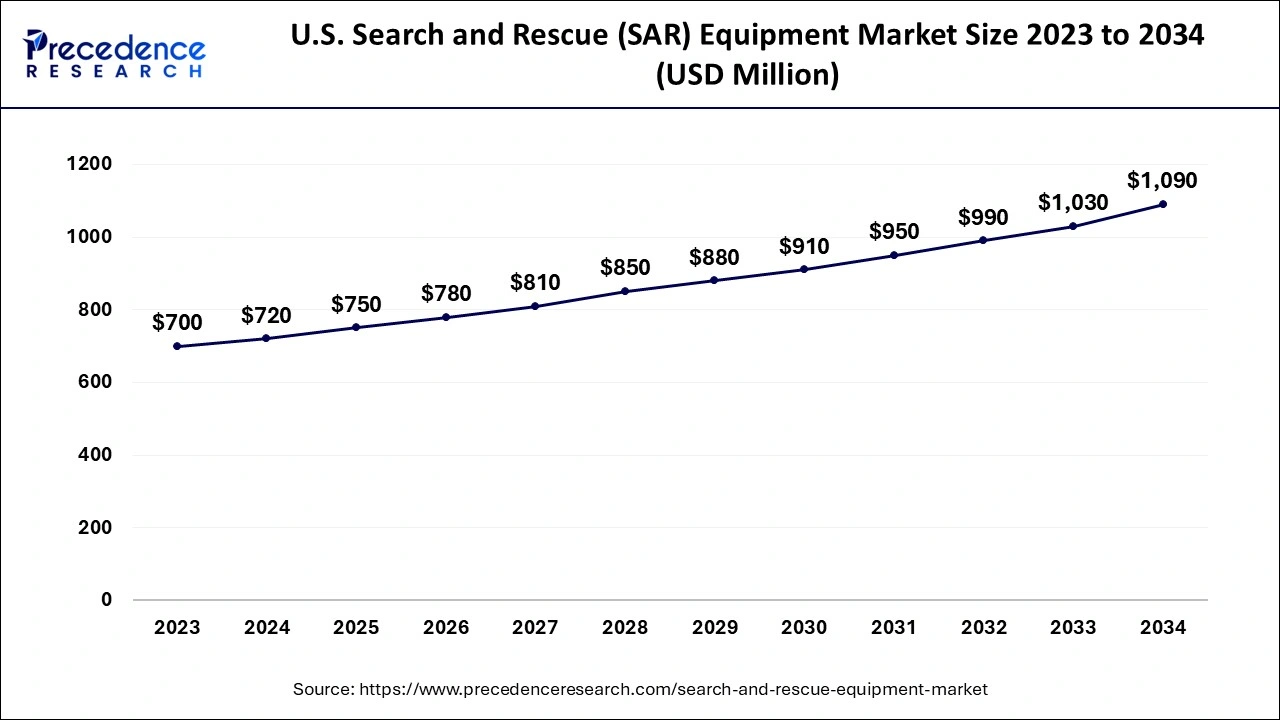

The U.S. search and rescue (SAR) equipment market size is evaluated at USD 720 million in 2024 and is projected to be worth around USD 1,090 million by 2034, growing at a CAGR of 3.92%.

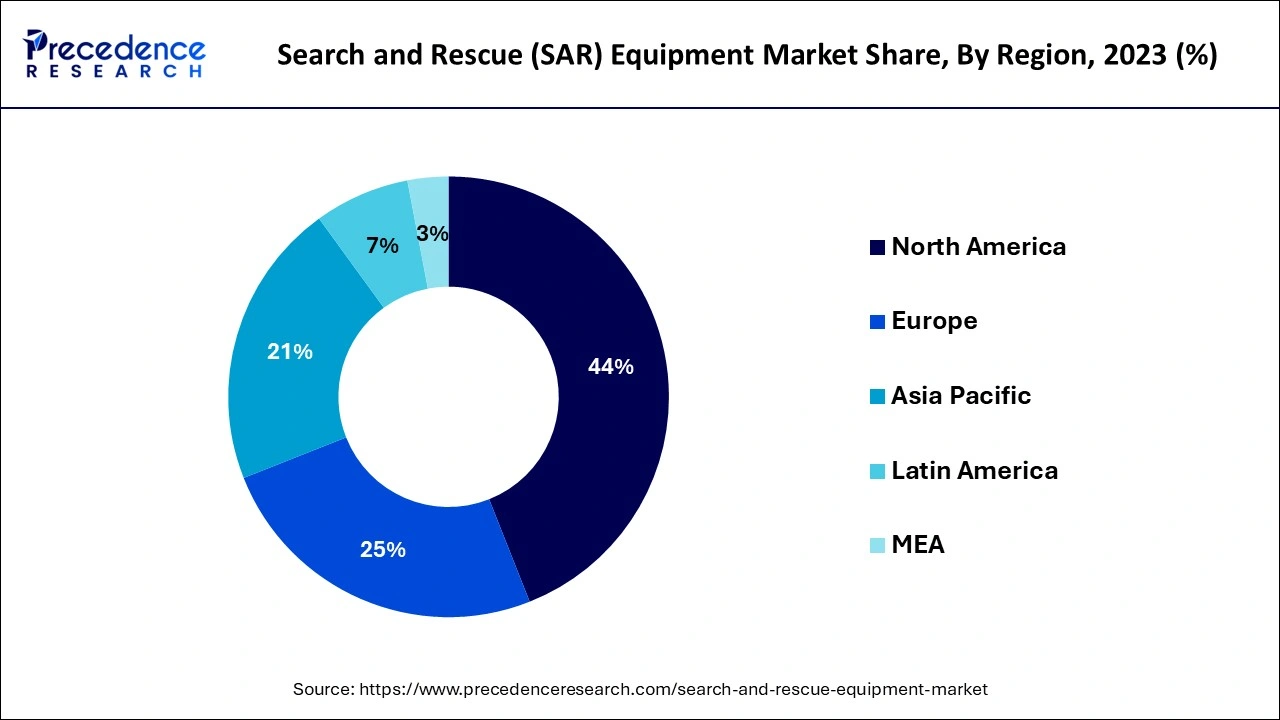

North America dominated the global search and rescue (SAR) equipment market in 2023. The market growth in the region is attributed to the rising significant resources, well-established emergency response systems, and rising advanced technological infrastructure. Various companies in the region are investing significantly in research and development, owing to the adoption of advanced technologies in search and rescue operations. In addition, the countries in the region, such as the U.S. and Canada, are major market contributors.

Asia Pacific is anticipated to grow at the fastest rate in the search and rescue (SAR) equipment market over the projected period. The market growth in the region is driven by the rising commitment to innovation and diverse geographical challenges. Asia Pacific encompasses varied terrains, such as areas prone, vast wilderness, and dense urban areas. Various countries in the region invest in innovative search and rescue technologies, such as efficient communication tools, early warning systems, and advanced drones, to address these challenges.

China, India, Japan, and South Korea are the major countries driving the growth of the market. The search and rescue (SAR) equipment market in China holds the largest share in the region, while India is the fastest-growing market.

The search and rescue (SAR) equipment market deals with specialized equipment, devices, and tools used in search and rescue operations. It encompasses the sale, distribution, and manufacturing of various search and rescue equipment, such as thermal imaging cameras, drones, medical kits, navigation systems, personal protective gear, communication devices, and other related products. In addition, the market is attributed to demand from law enforcement agencies, military forces, search and rescue organizations, and other entities involved in safety operations and emergency response in the world.

In addition, international bodies and governments have identified the presence of effective search and rescue capabilities, and they have conducted strict regulatory standards to ensure interoperability, reliability, and quality of search and rescue equipment. The use of drones adapted to advanced imaging systems is also expected to play an important role in search and rescue operations in the search and rescue (SAR) equipment market. Moreover, machine learning (ML) and artificial intelligence (AI) are expected to improve the effectiveness and efficiency of SAR operations.

| Report Coverage | Details |

| Market Size by 2034 | USD 3.46 Billion |

| Market Size in 2024 | USD 2.35 Billion |

| Market Size in 2025 | USD 2.45 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 3.92% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Equipment, Application, Platform, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Growing demands and application

The search and rescue (SAR) equipment market growth is attributed to various factors, such as the rising demand for portable and versatile rescue equipment, increasing investments in public safety and defense, and rising advancements in search and rescue technology. The increasing prevalence of maritime emergencies and natural disasters is generating a continuous need for advanced search and rescue tools, such as multi-function rescue devices, thermal imaging cameras, and drones. The expansion of offshore industries and maritime activities is enhancing the demand for specialized marine search and rescue equipment.

The adoption of advanced communication systems, machine learning, and artificial intelligence for real-time coordination and predictive analytics is driving market growth and enhancing the effectiveness of search and rescue operations. In addition, government initiatives to improve national disaster response frameworks and modernize search and rescue capabilities are further driving the growth of the search and rescue (SAR) equipment market.

Challenging and rubbed environments

The increasingly challenging and rubbed environments create major challenges in the market. Search and rescue operations are continuously conducted in tough environments such as disaster-stricken locations, extreme weather, or distant wilderness areas. The SAR equipment used must be allowed to prevent these complexes, which necessitates excellent dependability and durability. Creating search and rescue equipment that addresses needs can be technically difficult and expensive. The mass and weight of ruggedized equipment may reduce the effectiveness of search and rescue efforts and hinder response times and mobility. In addition, preventing these environmental limits is a major obstacle for SAR equipment makers.

Rapid advancements and integration of newer technologies

Search and rescue equipment is evolving with the integration of enhanced communication tools, drones, and GPS tracking, while drones provide remote access and aerial reconnaissance to challenging terrains. Enhanced communication equipment enhances the chances of successful missions and ensures better coordination among rescue teams. To reduce the environmental impacts, research and equipment are rapidly being constructed with energy-efficient technologies and environmentally friendly materials. This transition is expected to increase emphasis on environmental conservation and sustainability. In addition, search and rescue equipment is being integrated with real-time information sharing and data analytics, improving coordination during operations and enabling better decision-making.

The communication equipment segment held the largest share of the search and rescue (SAR) equipment market share in 2023. The communication equipment segment is connected to the crucial role it plays in ensuring seamless connectivity between command centers and rescue teams and facilitating response strategies and efficient decision-making. In addition, advanced communication systems significantly enhance the effectiveness of search and rescue operations. Some necessary systems include wearable devices, the Internet of Things (IoT), uncrewed aerial systems, digital radio interoperability, satellite communications, and enhanced visualization systems and data analysis. These communication systems can drastically increase the chance of finding a lost person alive when used properly.

The ground-based segment dominated the search and rescue (SAR) equipment market share in 2023. The ground-based platforms segment caters as central hubs for search and rescue operations. The segment is providing versatility, accessibility, and stability in search and rescue operations. In addition, the ground-based platforms can navigate diverse terrains and are adaptable, which makes them convenient for a broad range of search and rescue missions. The equipment and land vehicles provide the advantage of quick response times, which is vital for time-sensitive search and rescue missions such as missing person searches and disaster relief. In addition, ground-based SAR equipment is cost-effective and accessible for search and rescue operations, particularly in urban and terrestrial areas. Furthermore, there is a rising growth in technological advancement in ground-based SAR equipment and an increasing emphasis on security and safety across the globe.

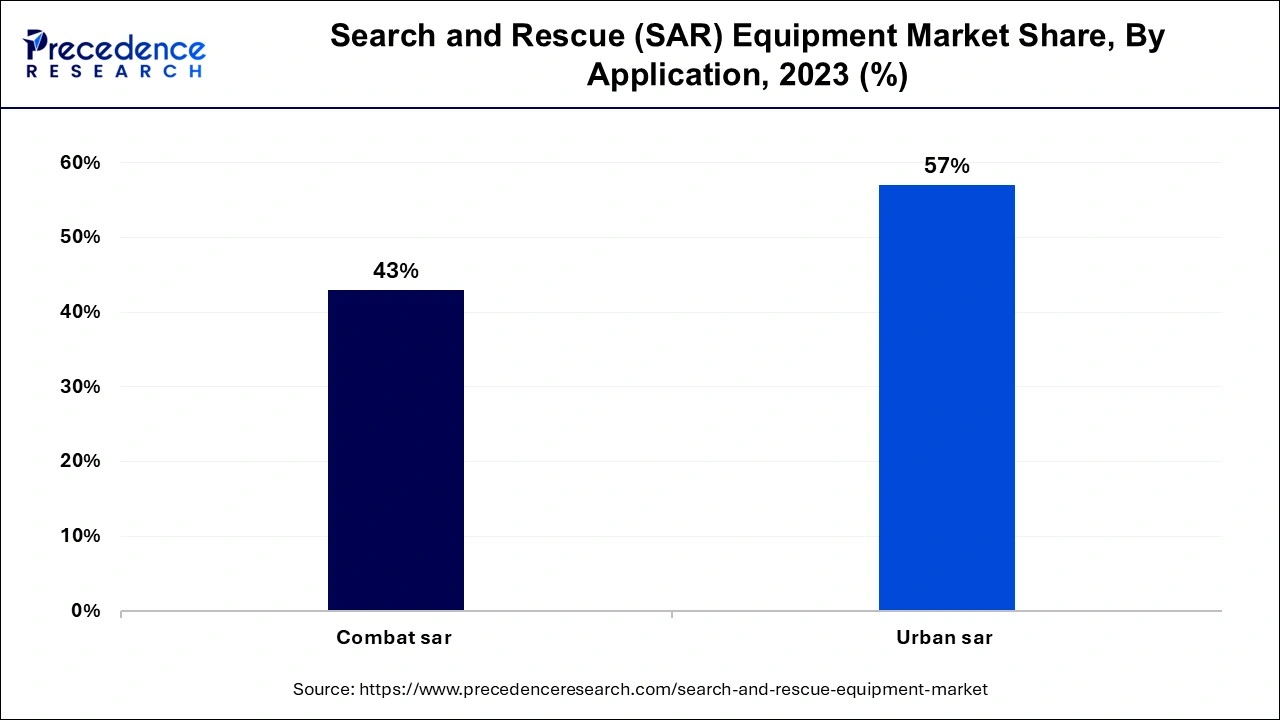

The urban SAR segment dominated the search and rescue (SAR) equipment market in 2023. Based on application types, the market is segmented into urban SAR and Combat SAR. The growth of the urban SAR segment is attributed to the increasing frequency of emergencies, such as structural collapses, accidents, and natural disasters. In addition, various companies provide a wide range of firefighting equipment tailored for natural disasters, building collapse, urban search and rescue (USAR), and more.

By Equipment

By Application

By Platform

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

October 2024

November 2024

March 2025

April 2025