April 2025

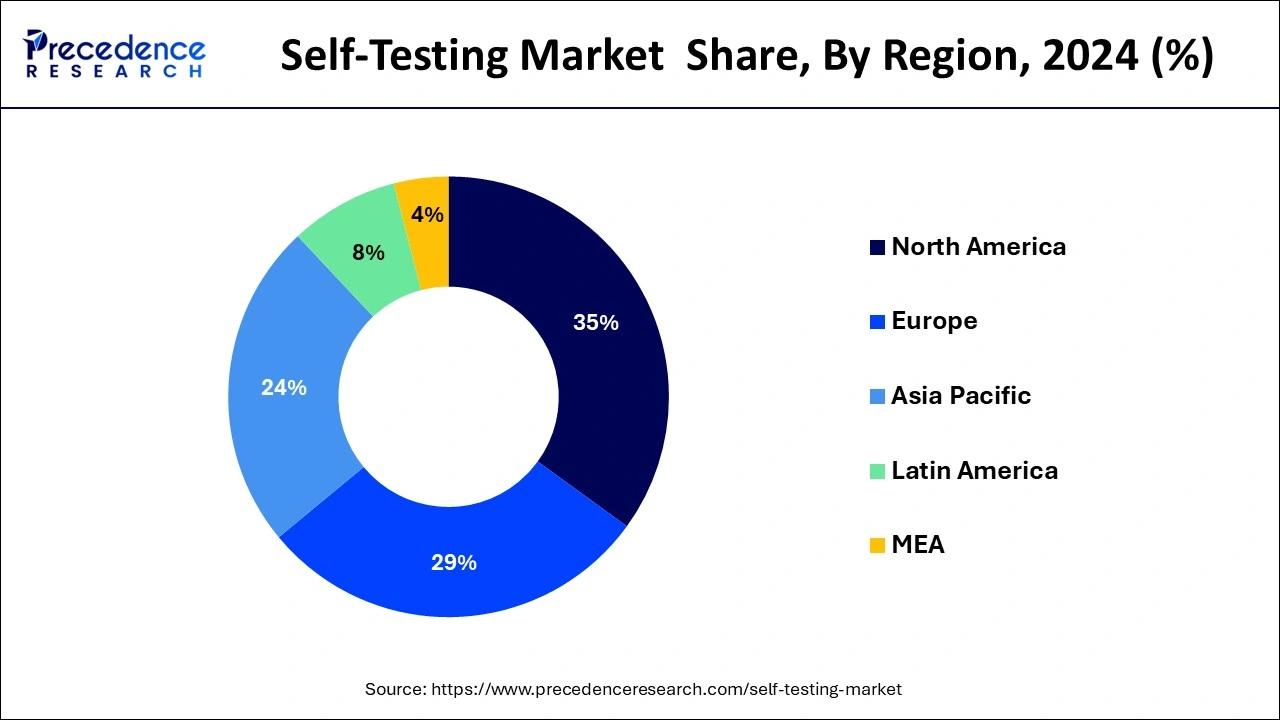

The global self-testing market size is calculated at USD 12.26 billion in 2025 and is forecasted to reach around USD 22.41 billion by 2034, accelerating at a CAGR of 6.95% from 2025 to 2034. The North America self-testing market size surpassed USD 4.01 billion in 2024 and is expanding at a CAGR of 6.98% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global self-testing market size was valued at USD 11.45 billion in 2024 and is anticipated to reach around USD 22.41 billion by 2034, growing at a CAGR of 6.95% from 2025 to 2034. Benefits offered by self-testing include an easy and quick check for various illnesses and infections to help monitor and control health. This helps the growth of the market.

Artificial intelligence (AI) can be used to design and develop novel self-testing kits or equipment. It results in increased accuracy and precision, allowing physicians to make effective clinical decision-making. AI and machine learning (ML) algorithms can identify and quantify potential biomarkers involved in the disease. Disease testing software uses AI to enhance and streamline the testing process. AI and ML can also aid in determining the stage and severity of a disease. They can also predict the involvement of one chronic disorder with the other. AI and the Internet of Things (IoT) can enable the storing and sending of test data to patients and healthcare professionals. This allows patients and healthcare professionals to store vast amounts of data and access it at any time and from any place.

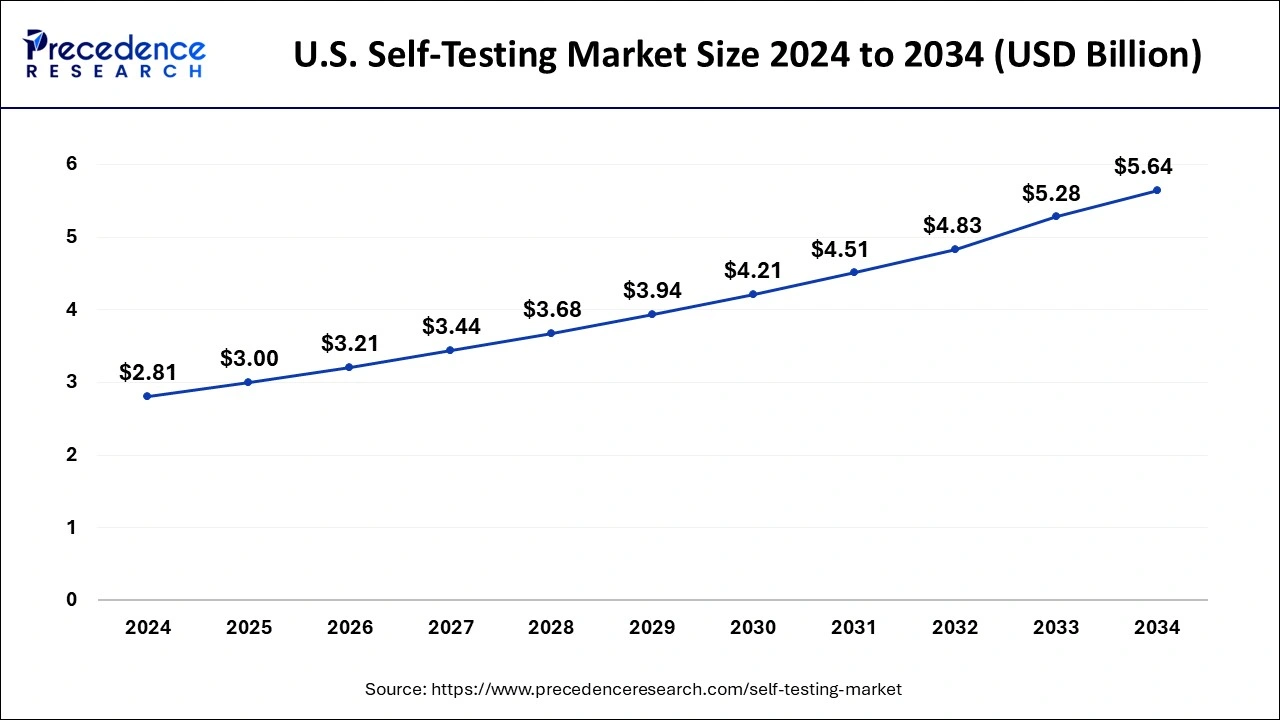

The U.S. self-testing market size was estimated at USD 2.81 billion in 2024 and is predicted to be worth around USD 5.64 billion by 2034 with a CAGR of 7.22% from 2025 to 2034.

North America dominated the self-testing market in 2024. In North America, the increasing number of chronic conditions leads to the need for self-testing, which helps in a quick diagnosis of patients. In the United States, cancer is the leading cause of death, so there is a high demand for self-testing in this region. Favorable government support also contributes to the market. The U.S. government announced an investment of $600 million in 12 COVID home test manufacturers as cases and hospitalizations rise. In Canada, there is a high use of medical self-testing kits that may help to take an active role in improving and monitoring health. The Government of Canada also announced an investment of $17.9 million to increase access to HIV testing. These factors help the growth of the market in the North American region.

Asia Pacific is estimated to host the fastest-growing self-testing market during the forecast period of 2025-2034. Increased healthcare awareness and advanced technologies lead to the demand for home-based clinical laboratory equipment or self-testing equipment, which helps the growth of the market in the region. Rising government initiatives, improving healthcare sectors, and research and development of new therapies for infections factors help the growth of the market. In China, approximately 1.3 million people are estimated to be living with HIV by the end of 2023. In India, the HIV cases were found to be 2.5 million in 2023.

The self-testing market deals with manufacturers that are developing new kits for wellness and prevention strategies, ranging from chronic disorder management and acute infection diagnoses to detecting the potential risk of alignments. It is opening new ways to monitor, diagnose, and address patients and their treatment. The benefits of self-testing include monitoring and controlling your health.

Self-testing offers an effective and simple way to test for various illnesses and infections; it is easy to gain access to the tests that are needed. It also helps to monitor how your health changes over time. It helps to improve metacognitive skills, promotes anatomy, and helps to improve personal growth and mastery. These factors help to the growth of the market.

| Report Coverage | Details |

| Market Size in 2025 | USD 12.26 Billion |

| Market Size by 2034 | USD 22.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.95% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Sample, Application, Distribution Channe, Usage, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Favorable Government Support

The major growth factor of the self-testing market is favorable government support. Several government organizations and official agencies support the development of self-testing kits. These organizations encourage countries to initiate screening and early diagnosis of a disease, promoting the use of self-testing. The World Health Organization (WHO) launched the global health sector strategies (GHSSs) on HIV, viral hepatitis, and sexually transmitted diseases for 2022-2030 to end these diseases by 2030. The U.S. Food and Drug Administration also regulates self-testing kits developed for various diseases. These organizations also provide funding to accelerate the development process of self-testing kits. Additionally, increasing public-private partnerships helps the government achieve the desired goal of eliminating the disease.

Diagnosis-related issues

Patients may misinterpret the test results, which may lead to trying the wrong therapies or medications or delay treatment or diagnosis. Some of the results of the tests may be tricky to interpret. Patients may improperly store the sample or mishandle the sample, which leads to inaccurate results. Patients may not choose the proper testing, which leads to anxiety and unnecessary spending. Disadvantages of self-testing include that without professional guidance, results may lead to unnecessary anxiety or false reassurance. These factors may restrict the growth of the self-testing market.

Research and development

In self-testing, the use of automation offers opportunities to improve tools and frameworks. Advanced technology use in self-testing helps to grow performance. This helps patients to make self-testing more user-friendly and accurate. Investment in the development of self-testing methods helps to the growth of the market. Autonomous testing is a growing technology that uses artificial intelligence (AI) or machine learning (ML) to create and drive software testing without human intervention. In self-testing, smart sensors can be used to perform self-diagnosis by internal signal monitoring for fault evidence. These factors help to the growth of the self-testing market.

The kits segment dominated the self-testing market in 2024. Self-testing kits are allowed for the individual to perform different disease tests in the comfort of their own homes. This is mainly helpful for those who have been in contact with an infected person and are experiencing symptoms. Self-testing kits have numerous benefits, including curating and rapid tests being performed in a short period of time. Self-testing kits cover the spectrum of health conditions ranging from preventive care to infectious diseases and some chronic diseases. These factors help to the growth of the kits product type segment and contribute to the growth of the market.

Type, the testing strips segment is expected to grow significantly in the self-testing market during the forecast period. For testing of urine and saliva, self-testing strips are used, like pH test strips. For blood glucose testing, blood testing strips are used. The benefits of self-testing strips include requiring a small amount of samples. Urine test strips may detect many urological, systematic, and metabolic conditions. These benefits help the growth of the testing strips product type segment and contribute to the growth of the market.

The blood sample segment dominated the self-testing market in 2024. Self-testing of blood samples helps to avoid travel and the loss of time. Blood sample testing helps healthcare professionals or doctors identify many health conditions, including diabetes, cancer, HIV, organ failure, vitamin deficiencies, high cholesterol, anemia, infections, and others. Doctors or healthcare professionals use blood samples to analyze substance behaviors like chemicals, cells, or proteins in the blood. Testing of blood samples has the benefits of self-testing, which is much more accessible and convenient. These factors help to the growth of the blood sample type segment and contribute to the growth of the market.

The urine sample segment is expected to witness the fastest growth in the self-testing market during the forecast period. A urine sample test is used to detect and manage many disorders like diabetes, kidney diseases, liver diseases, urinary stones, and urinary tract infections. Urine sample testing involves checking the concentration, content, and appearance of urine. The urine sample test type is relatively less expensive. These factors help the growth of the urine sample type segment and contribute to the growth of the market.

The allergy test segment dominated the self-testing market in 2024. There are many benefits of allergy testing, including finding accurate treatment solutions, creating a manageable diet, making responsible choices, taking control of the environment, and preventing serious effects, which helps the growth of the segment. Allergy test information can help healthcare professionals develop allergy treatment plans, which include allergy treatment plans, medicines, or allergen avoidance. Allergy tests are highly used to help diagnose allergic conditions like hay fever, also known as allergic rhinitis. Blood samples can be used for the allergy test. Patch testing is commonly used to determine the cause of allergic skin inflammation. These factors help to the growth of the allergy application type segment and contribute to the growth of the market.

The cancer tests segment is expected to witness the fastest growth in the self-testing market during the forecast period. Self-testing cancer test kits help for the detection and screening of cancer in its early or more treatable stage or sometimes before an individual shows any symptoms. By finding changes in the body due to cancer can be prevented by cancer testing. These factors help the growth of the cancer tests application type segment and contribute to the growth of the market.

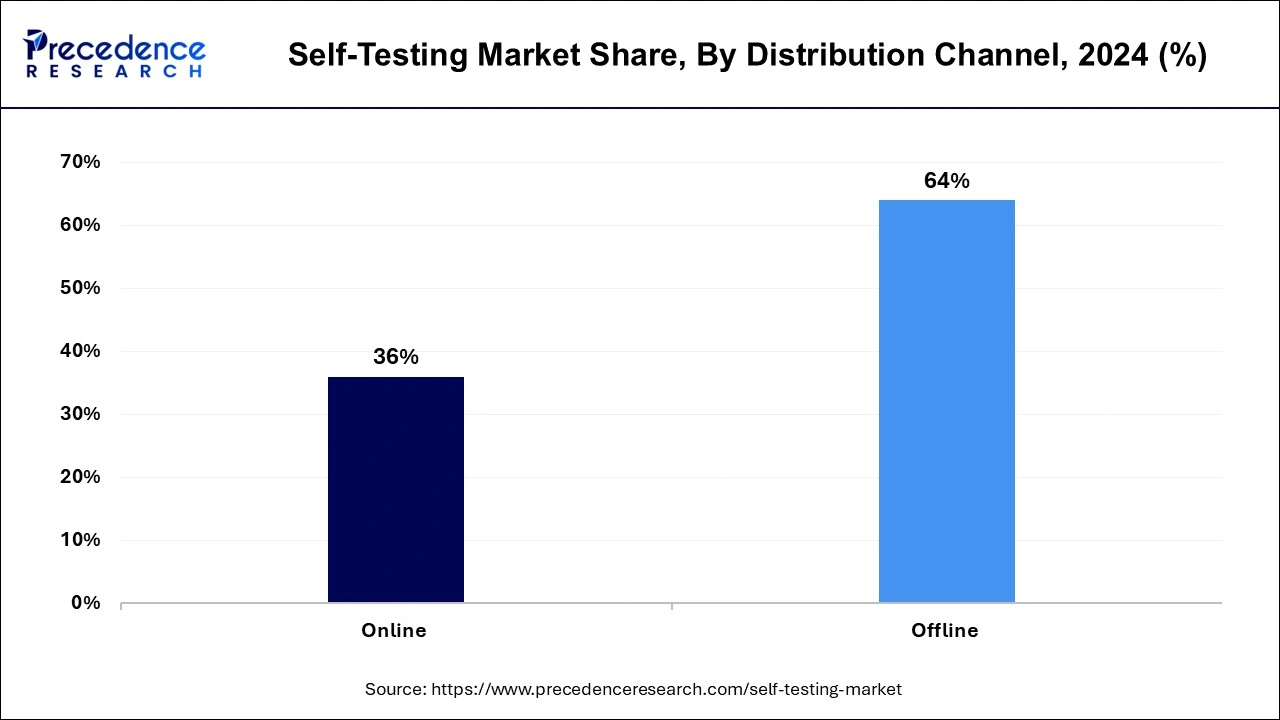

The offline segment dominated the self-testing market in 2024. Offline distribution channels help to leverage retail partnerships, create memorable and engaging customer experiences, build loyalty and trust with customers, and maximize physical presence. For elderly persons, an offline distribution channel is a better option for those who are not active online. In offline distribution channels, customers can get their product home instantly by avoiding the wait for shipping. These factors help to the growth of the offline distribution channel type segment and contribute to the growth of the market.

The online segment will expand rapidly during the forecast period. The online distribution channel has an easier return and delivery system, easy inventory management, greater control, and more customers. It can help to set up the choice of payment modes and can offer many benefits to the buyers. It explores many varieties of products without leaving the comfort zone of their home. It also can compare prices effortlessly and quickly and sometimes may have access to better discounts and deals. These factors help the growth of the online distribution channel type segment and contribute to the growth of the market.

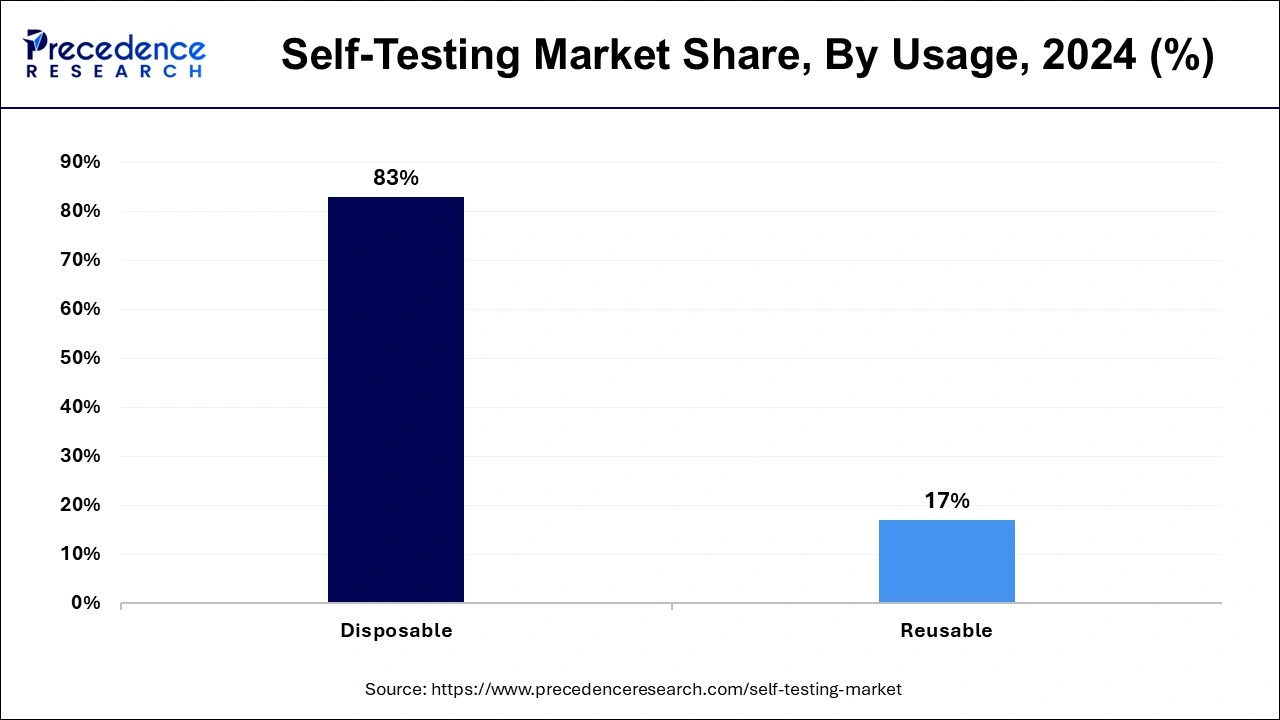

The disposable segment dominated the self-testing market in 2024. Disposable usage type of self-testing has many advantages, including easy disposal, cost-effectiveness, increased convenience, decreased infection rates, and reduced risk of contamination. These factors help to the growth of the disposal usage type segment and contribute to the growth of the market.

The reusable segment will expand rapidly in the self-testing market during the forecast period. The reusable usage type self-testing has advantages, including saving money, helping for environmental sustainability for future generations, helping to reduce greenhouse gas emissions, saving energy, reducing the risk of injury to the staff, and preventing pollution caused by the necessity of new raw material harvesting. These factors help the growth of the reusable usage type segment and contribute to the growth of the market.

By Product

By Sample

By Application

By Distribution Channel

By Usage

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

April 2025

February 2025

December 2024

February 2025