The global serviced apartment market size accounted for USD 126.88 billion in 2024, grew to USD 143.04 billion in 2025 and is projected to surpass around USD 420.89 billion by 2034, representing a healthy CAGR of 12.74% between 2024 and 2034. The North America serviced apartment market size is evaluated at USD 48.21 billion in 2024 and is expected to grow at a CAGR of 12.87% during the forecast year.

The global serviced apartment market size is calculated at USD 126.88 billion in 2024 and is predicted to reach around USD 420.89 billion by 2034, expanding at a healthy CAGR of 12.74% from 2024 to 2034. The rising urbanization and the relocation of the population from rural to urban areas for the education and employment that causing the demand for the home like comforting place that boosts the growth of the market.

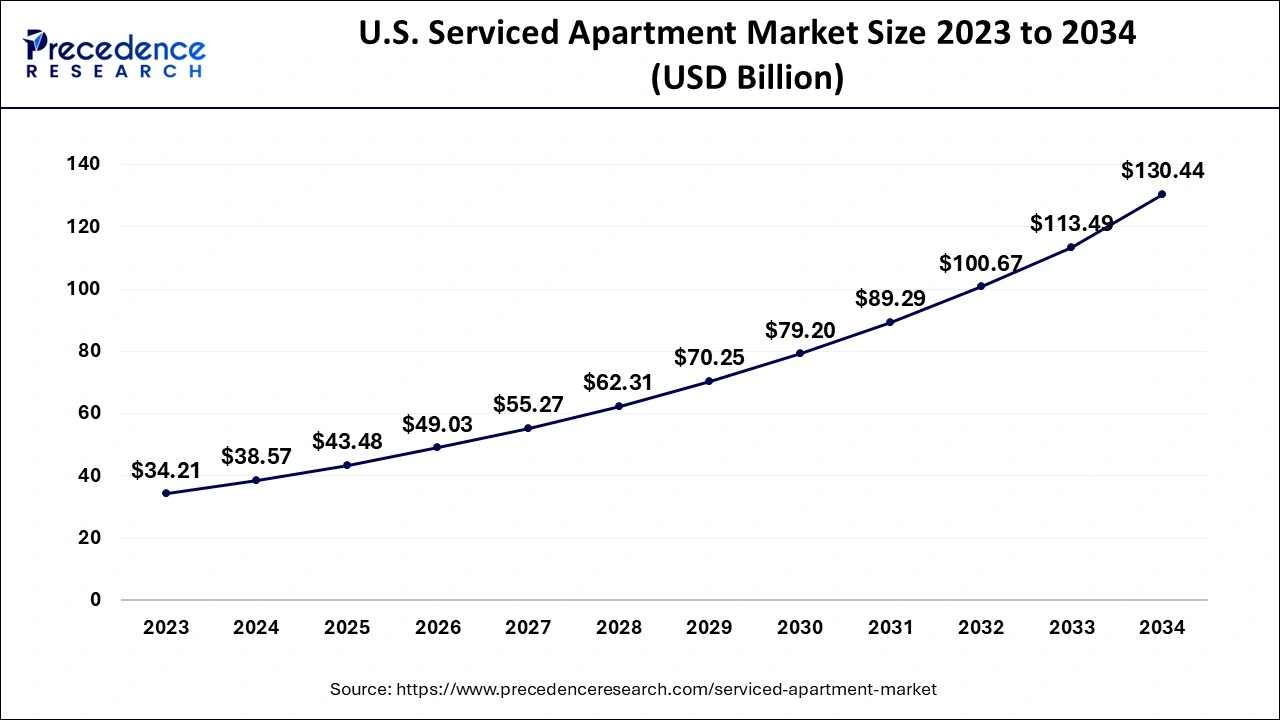

The U.S. serviced apartment market size is exhibited at USD 38.57 billion in 2024 and is anticipated to be worth around USD 130.44 billion by 2034, growing at a CAGR of 12.93% from 2024 to 2034.

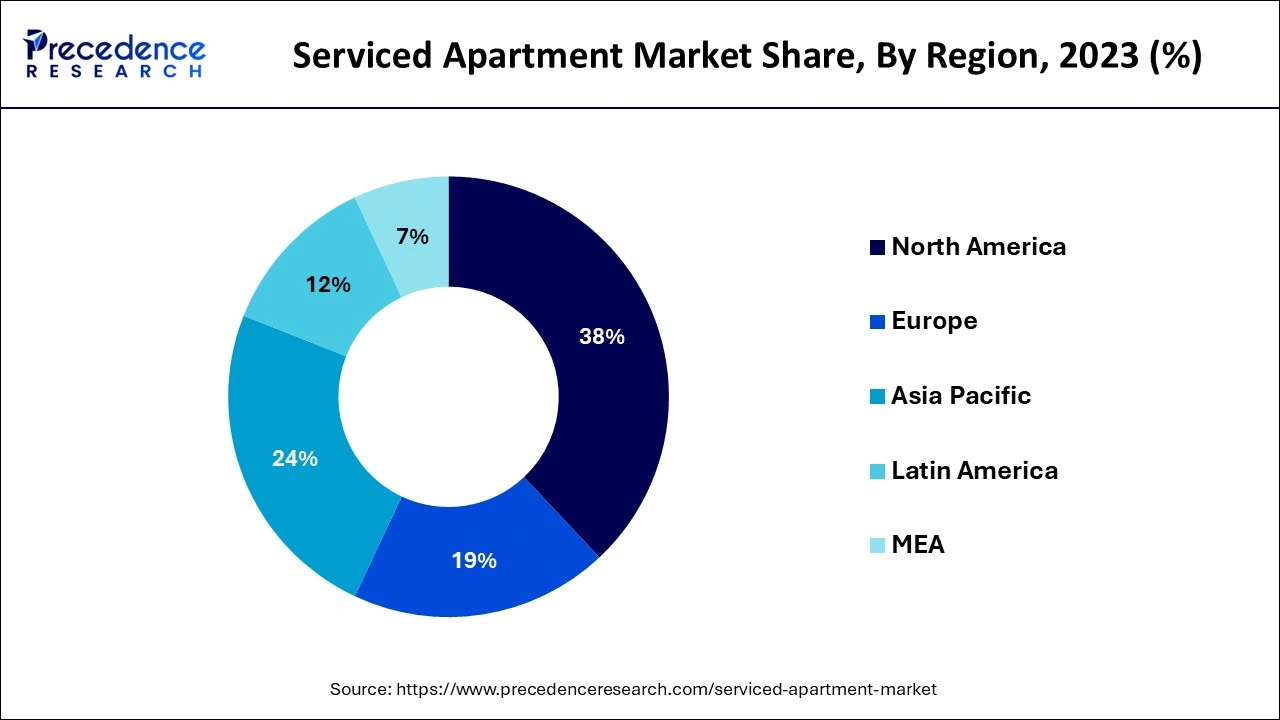

North America dominated the serviced apartment market in 2023. The growth of the market is attributed to the rising hospitality industry and rising industrialization, causing the robust demand for the hospitality and hotel industry for corporate stays and visits that drive the expansion of the serviced apartment market. The higher availability of the leading hospitality players on the expansion of the serviced apartments featuring all the essential amenities with affordability and comfort and the rising relocation from rural to urban areas for work or education is further contributing to the expansion of the market in the region.

Asia Pacific expects the fastest growth in the market during the forecast period. The growth of the market is owing to the rising infrastructural development and the rising relocation to the urban areas for education, better lifestyle, employment, and other reasons that drive the demand for serviced apartments. This apartment provides all the essential amenities to the consumer, along with the hotel's comfort and convenience. The rising economic stability in the population of the regional countries and the surge in lifestyle expenses are contributing to the growth of the serviced apartment market across the region.

The serviced apartments are projects that come under the hospitality industry that provide privacy and comfort, like a home, with the availability of essential amenities and luxuries and the convenience of hotel rooms. They are equipped with a kitchen, living areas, and spacious rooms. They offer a home away from home, a complete comfort of home. The rising urbanization, tourism activities, and relocating culture due to personal or professional reasons are accelerating the growth of the serviced apartment market.

How Can AI Impact the Serviced Apartment Market?

The integration of Artificial Intelligence (AI) into the hospitality industry revolutionizes the entire working operations with better efficiency. Artificial intelligence helps streamline the overall booking process, offers personalized recommendations as per consumer requirements, and recommends popular tourist places, workplaces, shopping centers, and more. It enhances service efficiency and provides personalized guest experiences.

| Report Coverage | Details |

| Market Size by 2034 | USD 420.89 Billion |

| Market Size in 2024 | USD 126.88 Billion |

| Market Size in 2025 | USD 143.04 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 12.74% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Type, End-use, Booking Mode, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Rising migration of the population

The increasing economic growth of several leading countries like the United States, Canada, India, China, Japan, Australia, and others is driving industrialization and urbanization across the countries, which directly accelerates the per capita income of the population. The rising urbanization and the opportunities for better education, employment, lifestyle, and other factors are influencing people to migrate from rural to urban areas, driving the demand for the hospitality industry and boosting the demand for serviced apartments for homely comfort and privacy, which drives the growth of the market.

High cost

The increased cost of maintenance of properties, fluctuation in rental prices of the serviced apartment according to the location, and wholly dependence on the operator’s management are collectively restraining the growth of the serviced apartment market.

Advancements in a serviced apartment

Technological advancements in serviced apartments, such as the integration of technologies, elevate the customer experience and luxuries in the apartment. In advancements such as connectivity and smart home integration, sustainable and eco-friendly practices, flexible and customizable living spaces, health and wellness facilities, localization and cultural immersion experiences, adoption of AI and automation, enhanced security, and data-driven personalization.

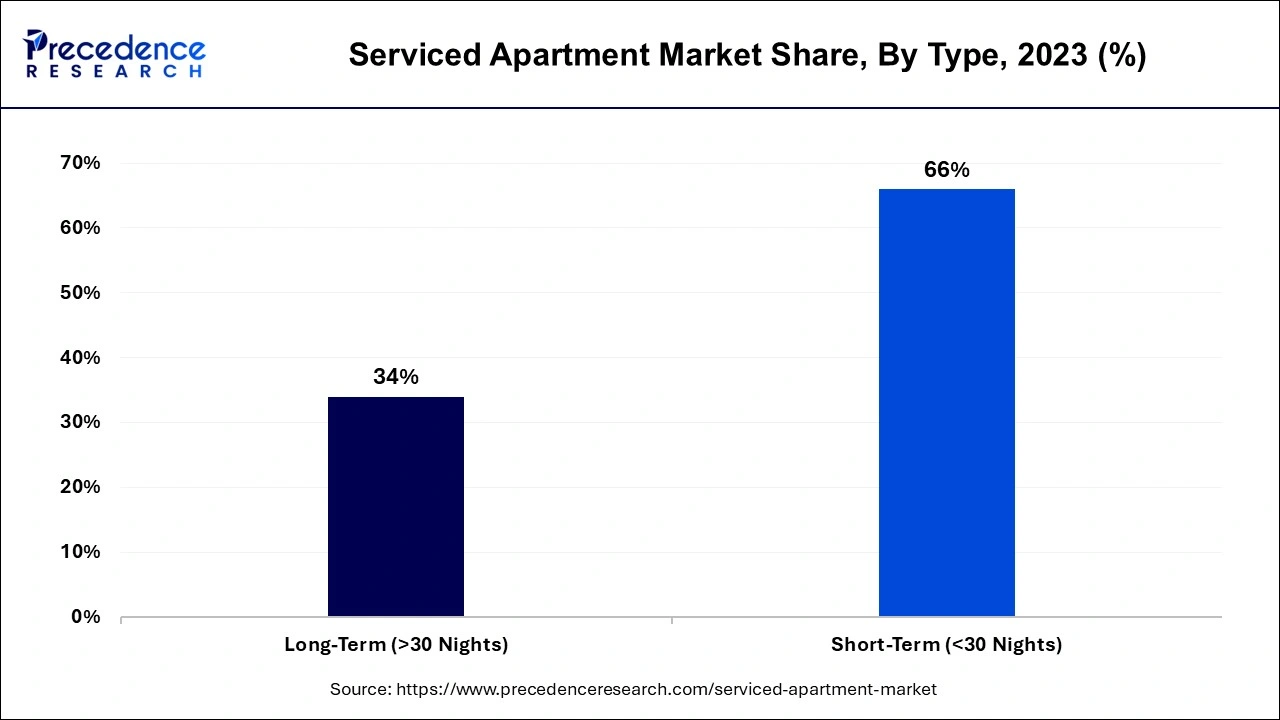

The short-term (<30 nights) segment led the serviced apartment market in 2023. They preference the service apartments for the short term, which is less than 30 nights, for the increased services, flexibility, and cost-effectiveness as compared to the traditional rental apartments. The service apartment provides the comfort and convenience of the hotel rooms and the privacy of home apartments. The short-term service apartment is the ideal choice for business or corporate travelers. This apartment offers home-like comfort; it is known as the best choice for temporary living settings rather than hotel rooms.

The long-term (>30 nights) segment is predicted to witness the fastest growth in the market over the forecast period. The service apartments are the ideal choice for long stays due to their cost efficiency and home comfort. The long-term service apartment offers services and convenience like any other hotel with the space like the normal home apartment with the inclusion of a kitchen, living rooms, bedrooms, and other amenities that enhance the long-term living experience of the consumers.

The corporate/business traveler segment accounted for the largest growth in the serviced apartment market in 2023. The increasing demand for the service apartments by the corporate or the business employees for their business tours. The rising popularity of serviced apartments for corporate employees is due to extended stays and affordable stays within budget. The service apartments offer more privacy and self-contained living spaces. The serviced apartment market is gaining popularity post-pandemic due to the rising adoption of remote working policies, which are extending the stays and collectively driving the growth of the market.

The expats and relocators segment is expected to have the fastest growth in the serviced apartment market during the predicted period. The increasing number of expats and relocators shifting to new countries for work or education is driving the demand for homely comfort with hotel convenience and services. Serviced apartments are equipped with all the home amenities that offer the comfort and daily requirements of the consumers. The serviced apartments provide an efficient solution that helps in enhancing the relocation experience.

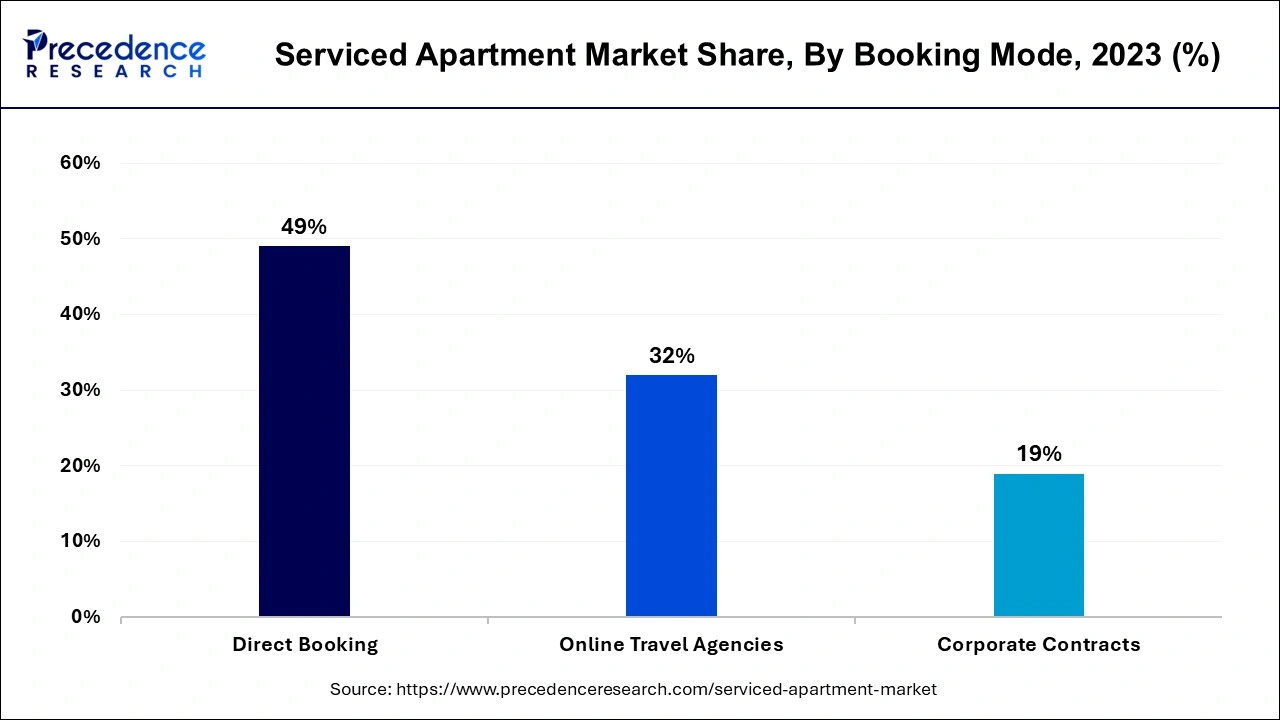

The direct booking segment dominated the market in 2023. Customers highly preferred direct booking of serviced apartments with better prices, which were provided by eliminating intermediary commissions. Direct booking enhanced the customer experience with better customer service, customer data acquisition, and customized service offerings that increased customer retention.

The corporate contracts segment expected significant growth in the serviced apartment market during the predicted period. The booking of serviced apartments by corporate contracts has several benefits, including cost savings, convenience, home base, flexibility in cost, enhanced privacy, and amenities. The booking of serviced apartments offers more cost efficiency to the corporate employees and streamlines the booking and billing process, enhancing efficiency.

By Type

By End-use

By Booking Mode

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client