September 2024

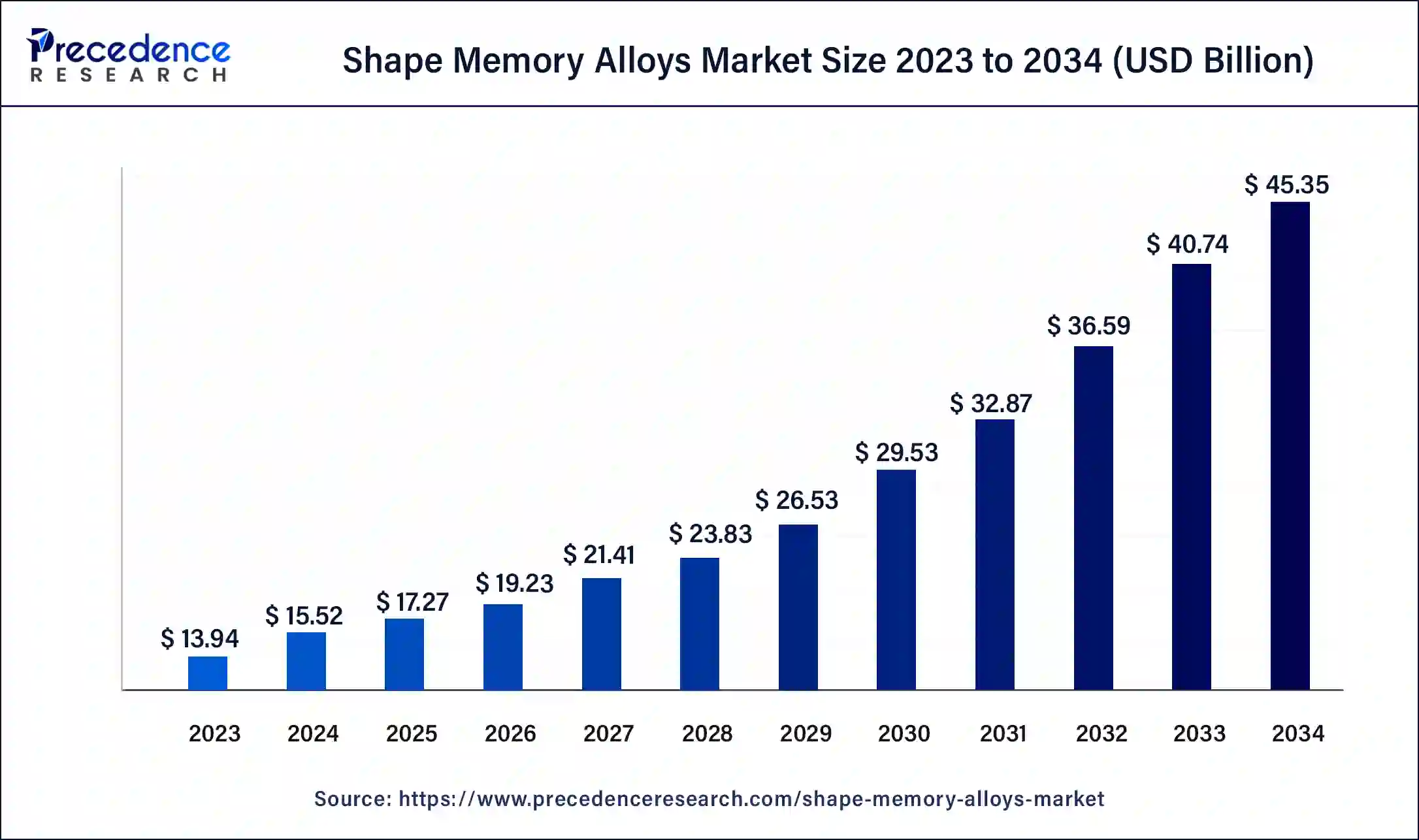

The global shape memory alloys market size was USD 13.94 billion in 2023, calculated at USD 15.52 billion in 2024 and is expected to be worth around USD 45.35 billion by 2034. The market is slated to expand at 11.32% CAGR from 2024 to 2034.

The global shape memory alloys market size is projected to be worth around USD 45.35 billion by 2034 from USD 15.52 billion in 2024, at a CAGR of 11.32% from 2024 to 2034. Increasing investment in healthcare within the biomedical industry is a critical factor in driving the need for the shape memory alloys market.

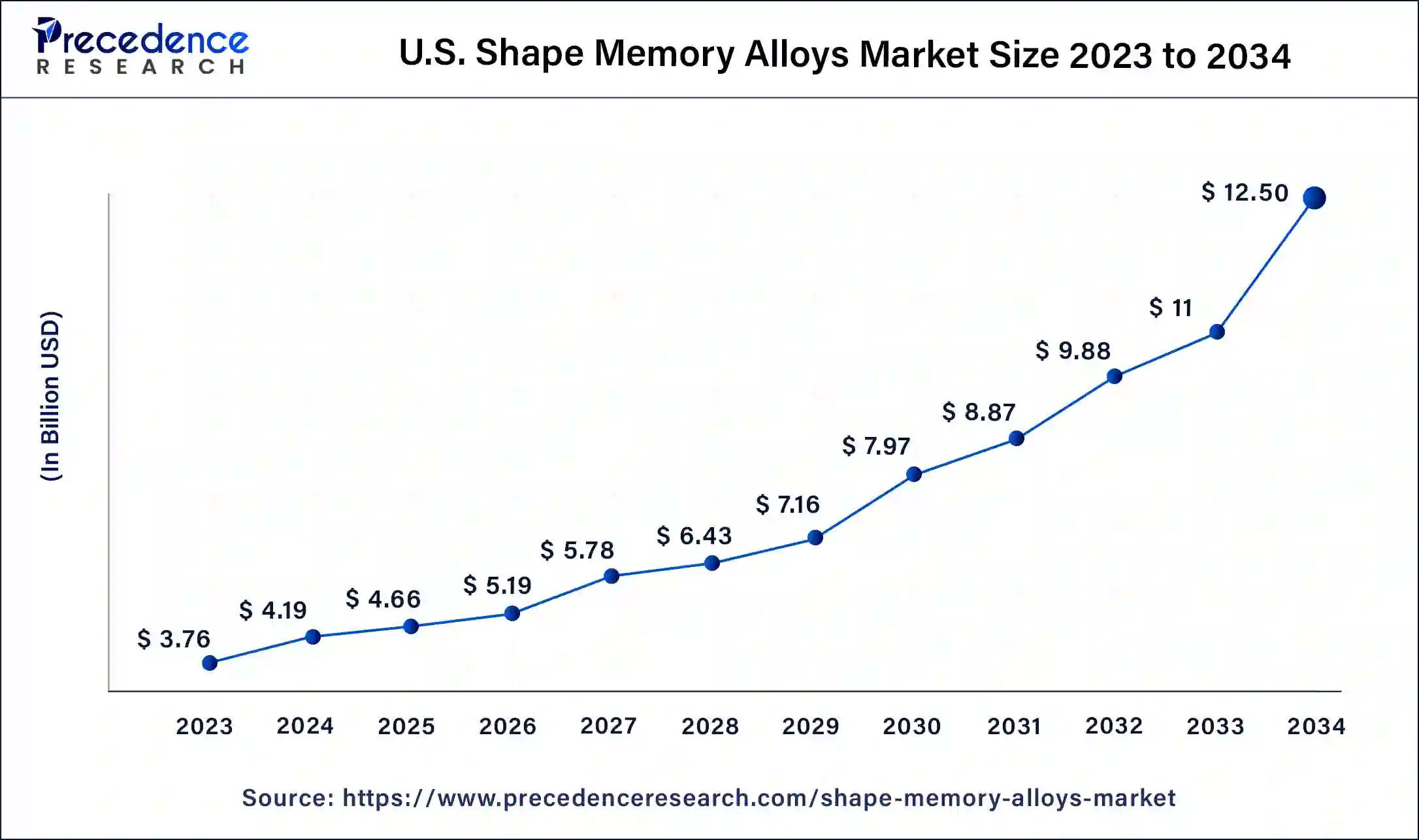

U.S. Shape Memory Alloys Market Size and Growth 2024 to 2034

The U.S. shape memory alloys market size was exhibited at USD 3.76 billion in 2023 and is projected to be worth around USD 12.50 billion by 2034, poised to grow at a CAGR of 11.53% from 2024 to 2034.

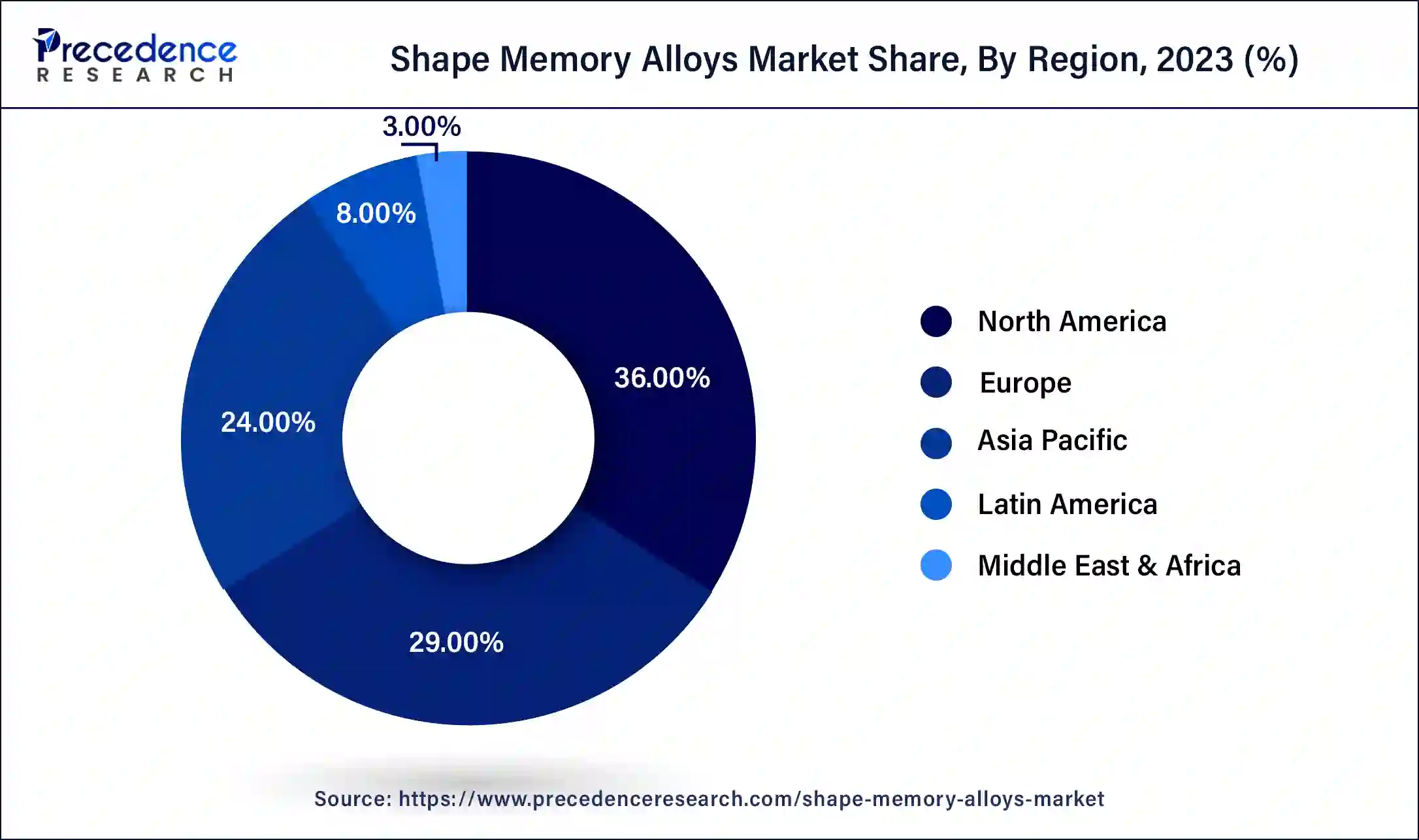

North America dominated the shape memory alloys market in 2023. The region has advanced technological infrastructure and a wide vendor base, which helps it maintain market dominance. Moreover, North America's ability to embrace advanced technologies strengthens its leadership position in the market. North America, particularly the US, led the position due to rising healthcare spending and obesity among most of the population.

Asia Pacific is expected to show the fastest growth in the shape memory alloys market over the forecast period. The growth in the region is driven by growing demand for SMAs in the aerospace, automotive, and healthcare sectors. Furthermore, the region is experiencing a substantial rise in investments in the healthcare sector, which is expected to drive the demand for SMAs in the region soon. China holds a dominant market share in the region because of the availability of low-cost labor, which is the key market driver.

World crude steel production (2023)

| Rank | Countries | Jan-Apr ’23 (mt) |

| 1. | China | 354.4 |

| 2. | India | 43.9 |

| 3. | Japan | 28.9 |

| 4. | The U.S. | 26.1 |

| 5. | Russia | 25.1 |

| 6. | South Korea | 22.4 |

| 7. | Germany | 12.4 |

| 8. | Brazil | 10.6 |

| 9. | Turkey | 10.1 |

| 10. | Iran | 9.7 |

These are metallic alloys that can return their original shape or size in response to external stimuli, such as mechanical stress or temperature changes. These notable properties come from eversible martensitic phase transitions. Shape memory alloy's super elasticity makes them beneficial in several disciplines like aerospace engineering, automotive components medicinal devices, and consumer electronics. These alloys are also utilized in various applications due to their distinctive features. The shape memory alloys market offer dependability, versatility, and adaptation across multidisciplinary sectors.

How is AI changing the Shape Memory Alloys Market?

AI process ensures accuracy control over the actuation, shape memory, and mechanical properties of SMA foils. The use of AI reduces the inconsistencies and errors in the manufacturing processes in the shape memory alloys market. Additionally, an AI-guided approach helps consumers save on production costs without compromising on the function or reliability of the materials. It can minimize waste and improve the resource utilization of sustainable manufacturing methods.

| Report Coverage | Details |

| Market Size by 2034 | USD 45.35 Billion |

| Market Size in 2023 | USD 13.94 Billion |

| Market Size in 2024 | USD 15.52 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 11.32% |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Increased Uses of SMA in Orthodontics

Growing matured populations and developing biomedical inserts globally support interest in the shape memory alloys market. These are generally used in biomedical applications, specifically in clinical inserts, which are inferior in their biocompatibility. Additionally, these composites are used for muscular embeds like clinical staples, hip prostheses, muscular screws and plates, and careful instruments. Orthodontic items are used to adjust and fix the teeth and to close unattractive holes.

Processing complexity can hamper market growth.

Memory alloys are processed utilizing convenient processes to acquire features like form memory effect and super elasticity. Hence, these complexities can make it hard for producers to manage uniformity and quality standards, which can result in key differences in product function and authenticity, which can stagnate the shape memory alloys market growth.

The development of tires

The National Aeronautics and Space Administration (NASA) has created tires that are meant for the rover designed for the Mars mission using alloys. As per information provided by NASA, this tire travels the rugged surface of Mars without any difficulty or damage. Furthermore, NASA mentioned that these tires can undergo deformation up to 30 times before completely breaking. These tires can also be available for commercial use on earth as well. These tires eliminate the adverse effect of inflation over fuel efficiency. Hence, this trend may present the shape memory alloys market opportunities for the future.

The nickel-titanium (Nitinol) alloys segment led the global shape memory alloys market in 2023. The growth of the segment is attributed to the rising investments in research and development activities to create innovative products such as specialty guidewire, wire stents, and micro-coils. Self-expanding stents built from nitinol are utilized to cure peripheral vascular diseases.

The copper-based alloys segment is expected to grow significantly in the shape memory alloys market over the forecast period. This growth can be linked to the rising use of copper-based alloys in actuators, couplings, safety valves, and fluid connectors. This alloy segment includes copper-aluminum and copper-zinc-aluminum (CuZnAl), which is cheap compared to other materials.

The biomedical segment held the largest share of the shape memory alloys market in 2023 by holding the largest market share. The growth of the segment is driven by the rising use of nitinol in biomedical fields. Moreover, the growing global population, along with orthopedic and dental complications and the rising prevalence of cardiovascular diseases, are also expected to fuel market growth soon.

The automotive segment is anticipated to grow at the fastest rate in the shape memory alloys market during the projected period. The growing demand for improved performance, safety, and comfort in vehicles is contributing to the expansion of innovative actuators, sensors, and microcontrollers. Additionally, the increasing adoption of the shape memory effect over traditional actuators like hydraulic and pneumatic systems is propelling the segment's growth.

Segments Covered in the Report

By Product

By End-use

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

September 2024

November 2024

August 2024

July 2024