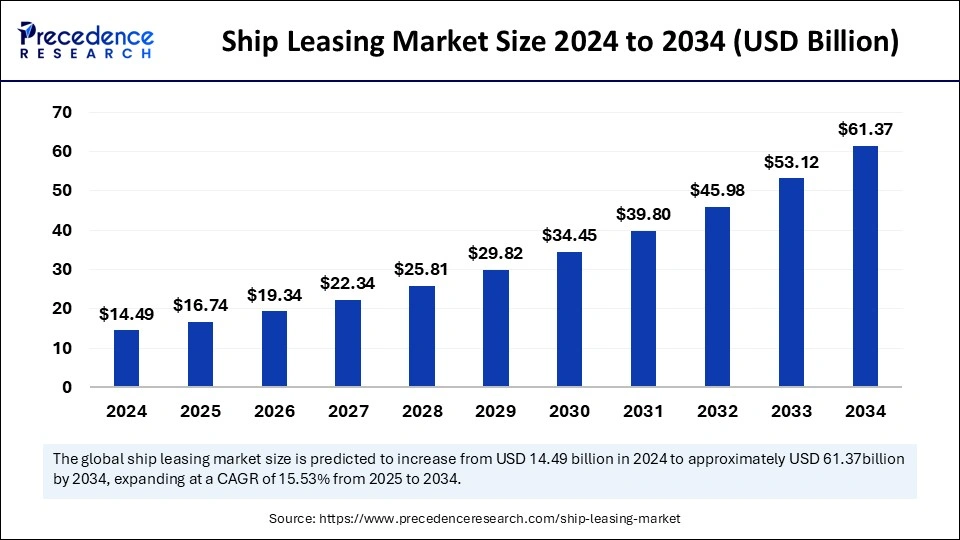

The global ship leasing market size is calculated at USD 16.74 billion in 2025 and is forecasted to reach around USD 61.37 billion by 2034, accelerating at a CAGR of 15.53% from 2025 to 2034. The North America market size surpassed USD 5.65 billion in 2024 and is expanding at a CAGR of 15.68% during the forecast period. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year.

The global ship leasing market size was estimated at USD 14.49 billion in 2024 and is predicted to increase from USD 16.74 billion in 2025 to approximately USD 61.37 billion by 2034, expanding at a CAGR of 15.53% from 2025 to 2034. The global market growth is attributed to the increase in the transportation of heavy cargo and the increasing growth in international trade.

Artificial Intelligence is revolutionizing ship leasing operations through route optimization, autonomous navigation, and predictive maintenance. AI optimizes operational costs, maintenance schedules, and fuel efficiency and enhances forecasting accuracy. AI technologies analyze extensive datasets, such as port congestion, traffic patterns, and weather conditions, to determine the most efficient shipping routes. This process reduces operational costs and fuel consumption. In addition, shipping companies can continuously monitor the health of their vessels by integrating AI with the Internet of Things. AI plays an important role in safety. By automating the reporting and monitoring processes, AI helps ensure compliance with international regulations. Thereby, the adoption of AI technologies into ship leasing is transforming the ship leasing market, making it more innovative, responsive, and efficient.

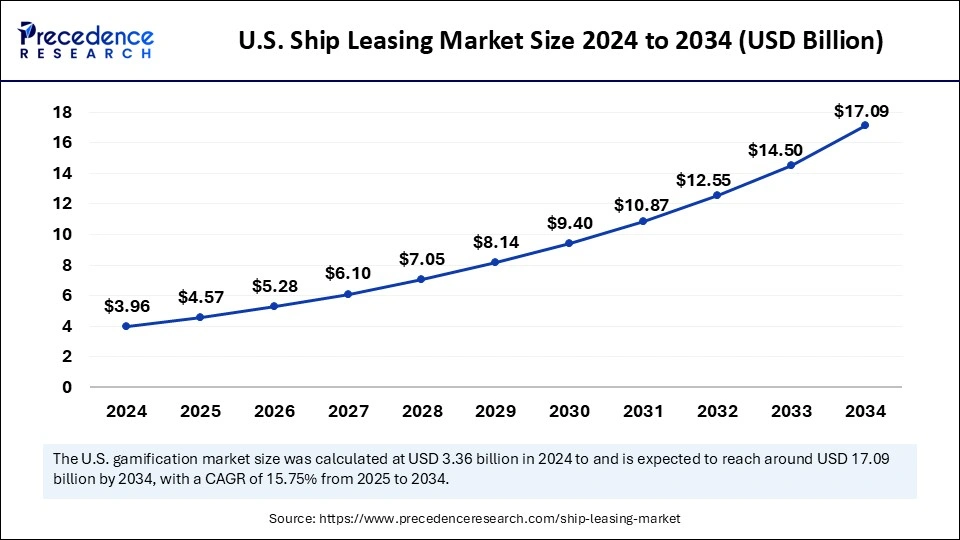

The U.S. ship leasing market size was exhibited at USD 3.96 billion in 2024 and is projected to be worth around USD 17.09 billion by 2034, growing at a CAGR of 15.75% from 2025 to 2034.

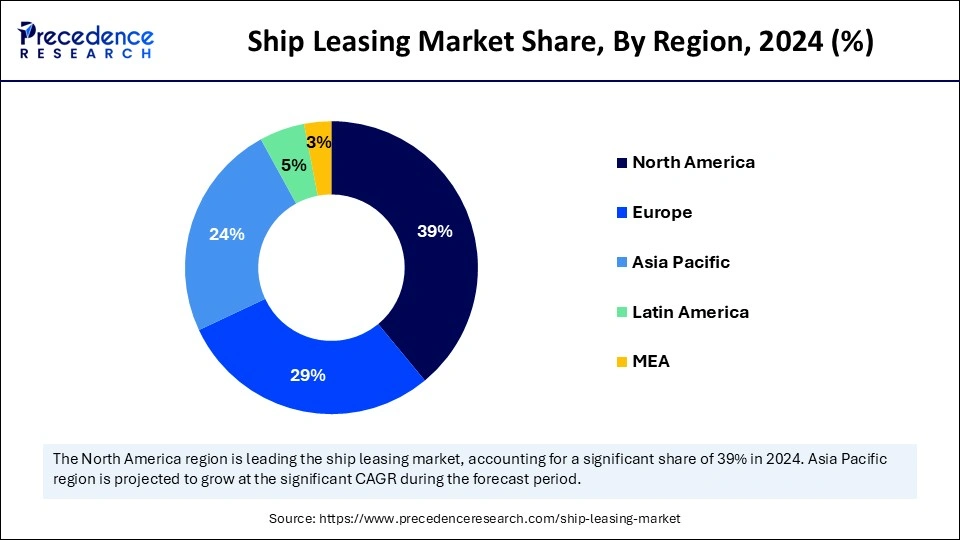

North America dominated the ship leasing market in 2024. The market growth in the region is attributed to the rising robust growth and various advantages such as a well-established shipping network, advanced infrastructure, and strategic location. In addition, the increasing need for environmentally compliant ships, the growing offshore oil and gas exploration, and the rise in maritime trade.

The U.S. dominates the North American market. The market growth in the U.S. is driven by the increasing shift towards more sustainable practices, combined with the need for operational flexibility, the growing emphasis on greener technologies, and the availability of specialized vessels, such as oil tankers.

Asia Pacific is expected to grow at the fastest rate during the forecast period. The ship leasing market growth in the region is attributed to the increasing demand for ships across various industries, increasing shipping activities, and expanding trade routes. In addition, the rising demand for infrastructure development and shipping services is further anticipated to propel the growth of the ship leasing market in the region. China, India, Japan, and South Korea are the fastest-growing countries.

The ship leasing market plays an important role in the international transportation and trade landscape. It includes the practice of leasing ships, primarily to commodities and goods across the globe. This market is becoming an integral part of the global trade infrastructure and has experienced significant growth. Ship leasing provides a cost-effective solution for companies. The market encompasses various types of vessels, such as oil tankers, bulk carriers, and container ships.

The dynamics of the ship leasing market are driven by factors such as environmental regulations, international trade agreements, and the global economic situation and increasing robust growth. In addition, the increasing volume of trade and popular e-commerce platforms and the increasing need for sea-borne transportation services across the globe are expected to enhance market growth during the forecast period. Furthermore, according to market demands, ship leasing allows companies to adjust their fleets, which further enhances operational efficiency.

| Report Coverage | Details |

| Market Size by 2034 | USD 61.37 Billion |

| Market Size in 2025 | USD 16.74 Billion |

| Market Size in 2024 | USD 14.49 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Lease Type, Type, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

The increasing environmental regulations

As operators seek to address sustainability requirements without heavy investment in new eco-friendly vessels, environmental regulations are contributing to the growth of ship leasing. Ship leasing helps operators adhere to regulations such as the IMO’s 2020 sulfur cap and enables them to access compliant ships without upfront costs. In addition, the pressure to manage fleets efficiently is another factor driving the growth of the ship leasing market. Shipping companies need the ability to adjust fleet capacity based on changing demand as global trade grows. Furthermore, modern vessels need ship leasing, and significant investment offers access to advanced ships.

High cost related to regulatory compliance

Due to compliance with strict environmental rules, ship lessees and owners may increase operating costs, such as those pertaining to ballast water management and emissions requirements. In addition, the market may be hindered by the requirement to adapt old vessels and invest in new technology with these regulatory restrictions.

Rising technological advancements

The rising technological advancements, such as digital ship management systems and autonomous vessels, have increased the demand for ship leasing. Ship leasing enables operators to access cutting-edge ships without making significant capital investments. These innovations provide operational efficiency. In addition, emerging markets in various regions are also a major opportunity. As demand for shipping capacity increases with infrastructure development and growing trade, these regions create major opportunities. Without the financial strain of outright purchases, leasing enables companies to expand their fleets.

The financial lease segment dominated the ship leasing market in 2024. The segment growth in the market is attributed to the various benefits associated with financial leases, such as ownership options, fixed payments, easy upgrades, preserved capital, and more. Financial leasing enables businesses to access assets without a large upfront payment. It makes it easier to allocate resources and manage cash flow effectively. The ship leasing sector in the IFSC aims to realize the vision of ‘Ship Acquisition Financing and Leasing.

The full-service lease segment is expected to grow at the fastest rate during the forecast period. The segment growth in the market is driven by the increasing company shift towards all-inclusive solutions to avoid the complexities of managing vessel operations and increasing operational costs. Without the burden of day-to-day management, the demand for this type of lease grew as shipping companies focused on improving operational efficiency. It offers reduced risks and flexibility.

The bareboat charter segment dominated the ship leasing market in 2024. The segment growth in the market is attributed to the increasing versatility and widespread adoption across several industries. The flexibility to customize operations and autonomy of bareboat charters made it an ideal choice for sectors such as cargo transportation, offshore exploration, and shipping. In addition, by providing access to specialized and advanced vessels, bareboat charters delivered financial benefits. These charters served operators aiming to use fuel-efficient or newer ships coupled with advanced technologies such as automated systems and LNG engines. In addition, the strategic significance of bareboat charters and their extensive adoption across diverse maritime applications are further expected to drive segment growth.

The container ships segment dominated the ship leasing market. Container ships allow even business owners and small manufacturers to take advantage of economies of transporting their products to consumers across the globe. Various people understand the process on a detailed level, such as operating fuel consumption, fuel costs, container shortage, port congestion, supply chain, and costs. In addition, segment growth in the market is attributed to the increasing number of large vessels that carry dry cargo. Container ships use containers that are standardized in terms of container ship capacity and size, unlike general cargo ships. Standard-size containers enable each ship to carry a maximum amount of goods and maximize cargo space.

The bulk carriers segment is expected to grow rapidly during the forecast period. Bulk carriers help transport the raw materials and are workhorses of the merchant fleet. Bulk carriers provide the most environmentally friendly method of transporting large volumes of dry cargo long distances.

By Lease Type

By Type

By Application

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client