November 2024

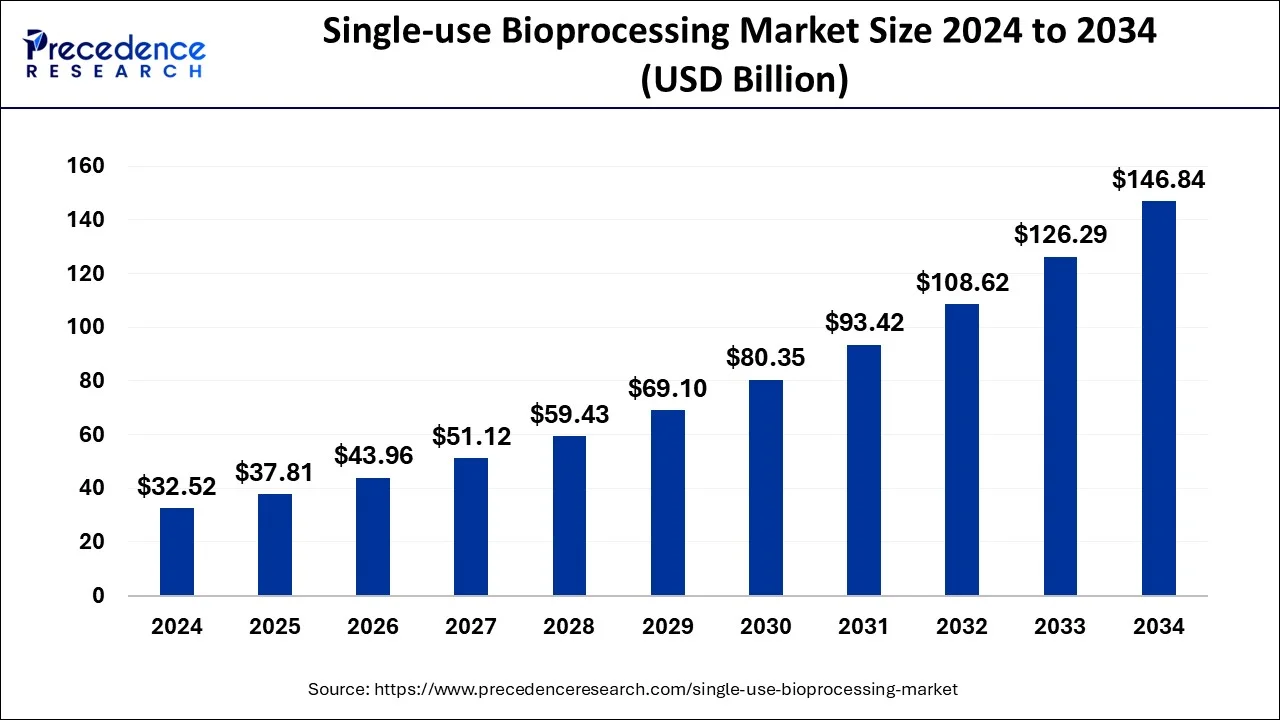

The global single-use bioprocessing market size was accounted for USD 32.52 billion in 2024, grew to USD 37.81 billion in 2025 and is predicted to surpass around USD 146.84 billion by 2034, representing a healthy CAGR of 16.27% between 2025 and 2034. The North America single-use bioprocessing market size was calculated at USD 11.38 billion in 2024 and is expected to grow at a fastest CAGR of 16.44% during the forecast year.

The global single-use bioprocessing market size was estimated at USD 32.52 billion in 2024 and is anticipated to reach around USD 146.84 billion by 2034, expanding at a CAGR of 16.27% from 2025 to 2034.

Artificial intelligence (AI) introduces automation in bioprocessing methods, enhancing process efficiency, optimizing production workflows, and improving overall output. Several key players have incorporated AI and machine learning (ML) in bioprocessing to improve process analytics, process control, product characterization, supply chain management, and factory operations. AI-enabled robots perform numerous tasks during bioprocessing leading to increased productivity and reducing manual errors due to human intervention. AI can also aid in real-time monitoring resulting in timely decision-making and multivariate analysis. AI enables predictive maintenance to detect errors during manufacturing, improving overall process reliability and product quality. Thus, these advanced technologies significantly influence the market dynamics by introducing new efficiencies and capabilities in bioprocessing applications.

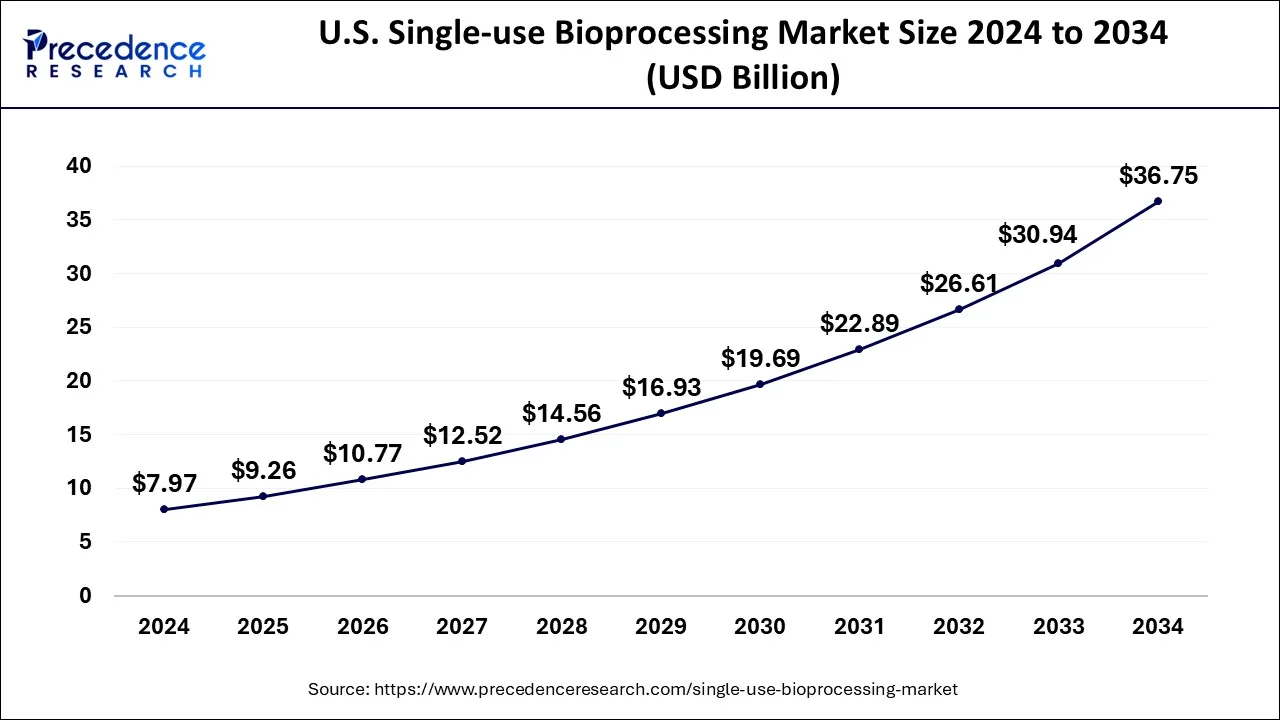

The U.S. single-use bioprocessing market size was evaluated at USD 7.97 billion in 2024 and is predicted to be worth around USD 36.75 billion by 2034, rising at a CAGR of 16.51% from 2025 to 2034.

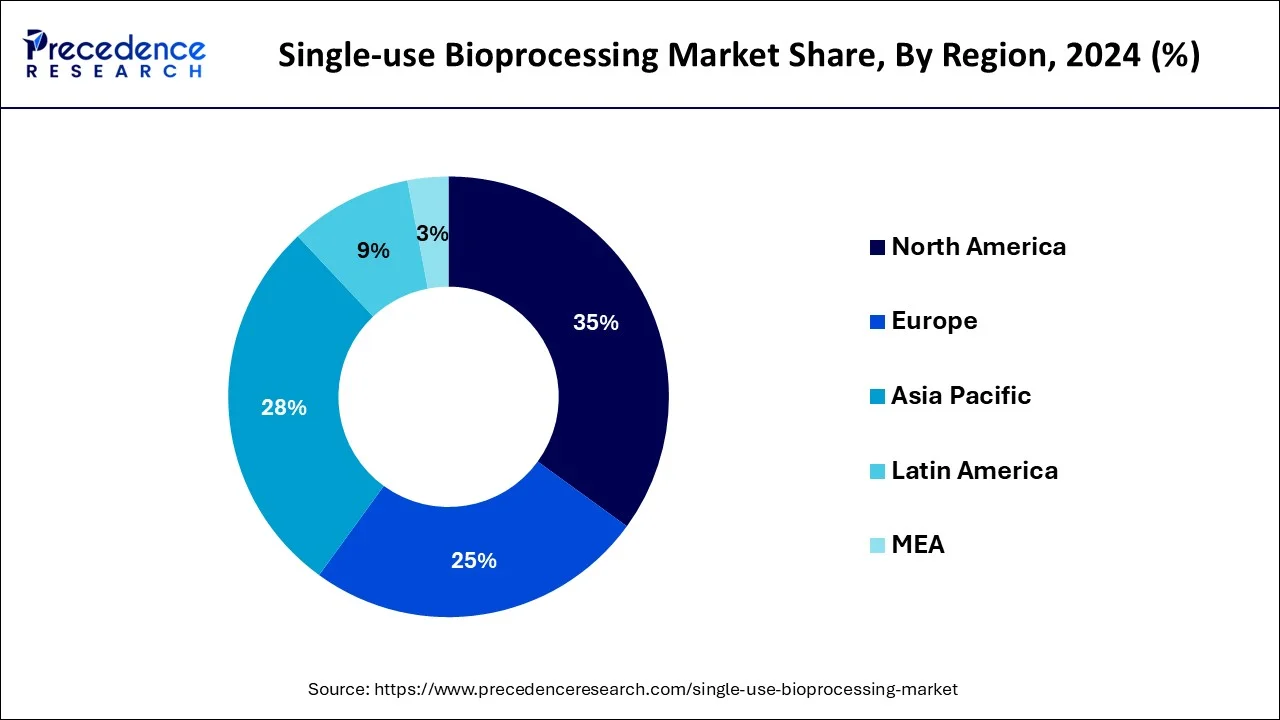

The North America dominated the market with revenue share of 35% in 2024 and is estimated to be the most opportunistic market. This is attributed to the rapid growth and development of biopharmaceutical industry in the region. Moreover, the outbreak of the COVID-19 pandemic stimulated the government to invest heavily in the research and development of the COVID-19 vaccines, diagnostics tests, and drugs. The US government sanctioned over US$ 480 million to Moderna, Inc., for the development of COVID-19 vaccines. The Canada government spent around US$ 160 million in 2020, towards the development of vaccines and drugs for COVID-19 treatment.

The presence of giant players, largescale production units, growing adoption of disposables, increased expenditure in health care, and highly developed healthcare infrastructure are the top factors augmenting the North America single-use bioprocessing market. Moreover, the numerous contract manufacturers and the growing usage of disposables amongst them is exponentially driving the single-use bioprocessing market in the region.

The Asia Pacific has potential growth opportunities owing to the growing biopharmaceutical market in the nations such as China, Japan, and India. Moreover, rising investments by the biotechnology and pharmaceutical companies and the rapid growth of the contract manufacturers may lead to the emergence of Asia Pacific to be the manufacturing hub for the pharmaceuticals. Hence, the region may contribute significantly towards the growth of the single-use bioprocessing market in the forthcoming years.

Bioprocessing is the process of manufacturing products using living organisms, cells, or their components. It is useful in the production of biopharmaceuticals, food, and biofuels. It has numerous applications in the manufacturing of biologics, vaccines, monoclonal antibodies, and biotherapeutics. Single-use bioprocessing refers to vessels, conduits, and consumables that come into contact with process fluids and are then discarded. The traditional bioprocessing method involves using stainless steel equipment, whereas single-use bioprocessing involves using high-performance polymer materials. Some common examples of polymers include polyethylene, polypropylene, polyethersulfone, polytetrafluoroethylene, cellulose acetate, and polyamide. Single-use bioprocessing offers numerous advantages, such as cost reduction, increased productivity, simplified disposal, reduced energy and media consumption, efficient use of time and resources, and minimized risk of cross-contamination.

| Report Coverage | Details |

| Market Size in 2024 | USD 32.52 Billion |

| Market Size in 2025 | USD 37.81 Billion |

| Market Size by 2034 | USD 146.84 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 16.27% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, End User, Application, Workflow, Region |

Growing Demand for Biologics

The growing demand for biological therapeutics due to rising incidences of chronic disorders such as cancer and autoimmune disorders boosts the single-use bioprocessing market. Biologics including vaccines, monoclonal antibodies, and antibodies are a crucial part of the pharmaceutical sector. They can provide targeted treatments for the patients, enhancing the efficacy of drug products. The favorable regulatory policies and rising investments from various organizations increase the demand for biologics. The latest innovations in single-use bioprocessing enable manufacturers to accelerate biological manufacturing processes. The growing research and development activities lead to the development of novel biologics. The post-pandemic era has significantly increased the demand for biologics, resulting in more product approvals. In 2023, the U.S. FDA approved 17 biologics out of a total of 55 new drugs.

Environmental Impact and Leakage

The major challenge of the single-use bioprocessing market is the environmental impact caused due to the use of single-use plastics. The excessive use of plastics increases the carbon footprint which is difficult to recycle. This imposes a negative impact on the environment, hindering market growth. Another major challenge of the market is the leakage of the extractables and leachables from the plastic surface. This is significantly harmful to the patients.

Precision Medicine

The future of the single-use bioprocessing market is promising, owing to the growing preference for personalized medicines. Precision medicine is at the forefront of the drug development and manufacturing sector, which has experienced remarkable growth over the last two decades due to the rise in cell and gene therapy and highly tailored biologics. Since precision medicines are designed for a limited population, they do not require tedious large-scale manufacturing operations. Thus, single-use bioprocessing plays a major role in producing precision medicines. Single-use reactors, membranes, and chromatography systems can reduce time spent on lengthy cleaning processes. After manufacturing a particular therapeutic, the bioprocessing equipment can be discarded, ultimately saving time and costs of manufacturers.

The media bags and containers segment led the global single-use bioprocessing market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. The use of media bags and containers offers low investment, lower wastes emission, and lower operational costs in the biopharmaceutical industry. Moreover, the single-use media bags and containers offers temperature resistance along with durability. Therefore, the extensive use of media bags and containers in the biopharmaceuticals have augmented the segment growth in the recent years.

The biopharmaceutical manufacturers segment led the market in 2024 and the rapid growth of biopharmaceuticals industry is significantly boosting the growth of this segment. Moreover, more than 80% of the biopharmaceutical plants have adopted the single-use bioprocessing systems as this is cheaper, efficient, and reliable.

The extensive and increasing use of single-use or disposables by the contract manufacturers have augmented the segment growth. Furthermore, the increased demand for the single-use bioprocessing systems in various bioprocessing services is expected to foster the market growth in the foreseeable future.

The filtration segment led the global single-use bioprocessing market with remarkable revenue share in 2024 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the increasing adoption of single-use bioprocessing system in filtration owing to its efficient filtration even at large scale. It is used for bioburden reduction, polishing of biomolecules, and for ultrafiltration.

The upstream segment held a major share of the single-use bioprocessing market in 2024. Upstream single-use bioprocessing is the use of single-use technologies in the initial stages of bioprocessing, where cells or microorganisms are cultivated and prepared for further biomanufacturing. Upstream processing involves disposable bioreactors, mixers, containers, tubing, connectors, probes/sensors, and sampling systems. The segment’s growth is attributed to its superior advantages, such as shortened timelines, lowered operational costs, and reduced cleaning needs.

The fermentation segment is predicted to witness significant growth in the market over the forecast period. Single-use fermentation bioprocessing optimizes microbial fermentation, offering flexibility, ease of use, and efficiency. It requires less amount of samples, decreasing validation requirements. It enables rapid scaling of fermentation processes.

The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedand efficient solutions. Moreover, they are also focusing on maintaining competitive pricing.

In February 2020, MabPlex, a contract manufacturing company, launched two new cell culture production lines with 2000-liter disposable bioreactors. The various developmental strategies undertaken by key market players increases competition and contributes significantly towards the development of single-use bioprocessing market.

By Product

By Application

By End User

By Workflow

By Geography

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

November 2024

January 2025

November 2024

November 2024